Based on Hunterbrook Media’s reporting, Hunterbrook Capital is long $BIOA at the time of publication. Positions may change at any time. See full disclosures below.

BioAge was growing up.

A next-gen medicine in clinical trials to tackle obesity. Over $283 million in fresh funding from an upsized IPO and parallel financing run by top banks. A new board chair who had been CEO of GlaxoSmithKline. The nomination of a deputy director at the Department of Health and Human Services whose twin passions for life extension and libertarianism seem poised to benefit companies like BioAge founded with a focus on combating aging.

Ahead of its IPO at the end of September, the first line of BioAge’s S-1 filing read: “We are a clinical-stage biopharmaceutical company developing therapeutic product candidates for metabolic diseases, such as obesity, by targeting the biology of human aging.”

$BIOA shares closed regular trading on Friday, December 6, up over 9% at around $20 per share.

Half an hour later, the company announced it halted the key study of its lead candidate. That Phase 2 trial had been testing a pill called azelaprag to treat obesity in combination with Eli Lilly’s tirzepatide, the active ingredient in Mounjaro and Zepbound.

The problem with BioAge’s trial? Liver transaminitis: elevated levels of liver enzymes in the blood, indicating organ damage. Transaminitis is often curable, but drugs causing it are often killed.

$BIOA stock fell over 75% on Monday, December 9, to as low as $4.50, cutting its market cap below $170 million. In the following days it traded below $4.

However, as of September 30, BioAge had reported $334.5 million in cash with about 34.2 million shares outstanding, or almost $10 in cash per share. Based on reported Q3 operating expenses of $24.75 million and the new $20 million committed by Novartis, BioAge will likely end 2024 with roughly $330 million, around $10 per share.

That capital had been intended to fund the company into 2029 with its clinical asset and additional programs. Now with no clinical program and likely staff cuts, the quarterly operating expenses of $20 million for research and development and $4.7 million for general operations should drop significantly, extending the company’s runway even further.

BioAge said it “will evaluate data from patients enrolled to date and share updated plans for azelaprag in Q1 2025,” without confirming there’d be any continued development.

But BioAge was not originally a weight loss company. Per its namesake, the founding premise had been to tackle aging — as well as the diseases associated with it, from metabolomics to inflammation. And it already has its next target.

BioAge’s Second Life: A Therapy for Inflammation, Including the Nervous System

In its press release, BioAge announced: “In parallel to evaluating azelaprag, Company will continue to advance earlier platform-derived programs, including IND submission for CNS penetrant NLRP3 inhibitor anticipated in the second half of 2025.” IND refers to Investigational New Drug status from the FDA, which would enable the program to enter the clinic.

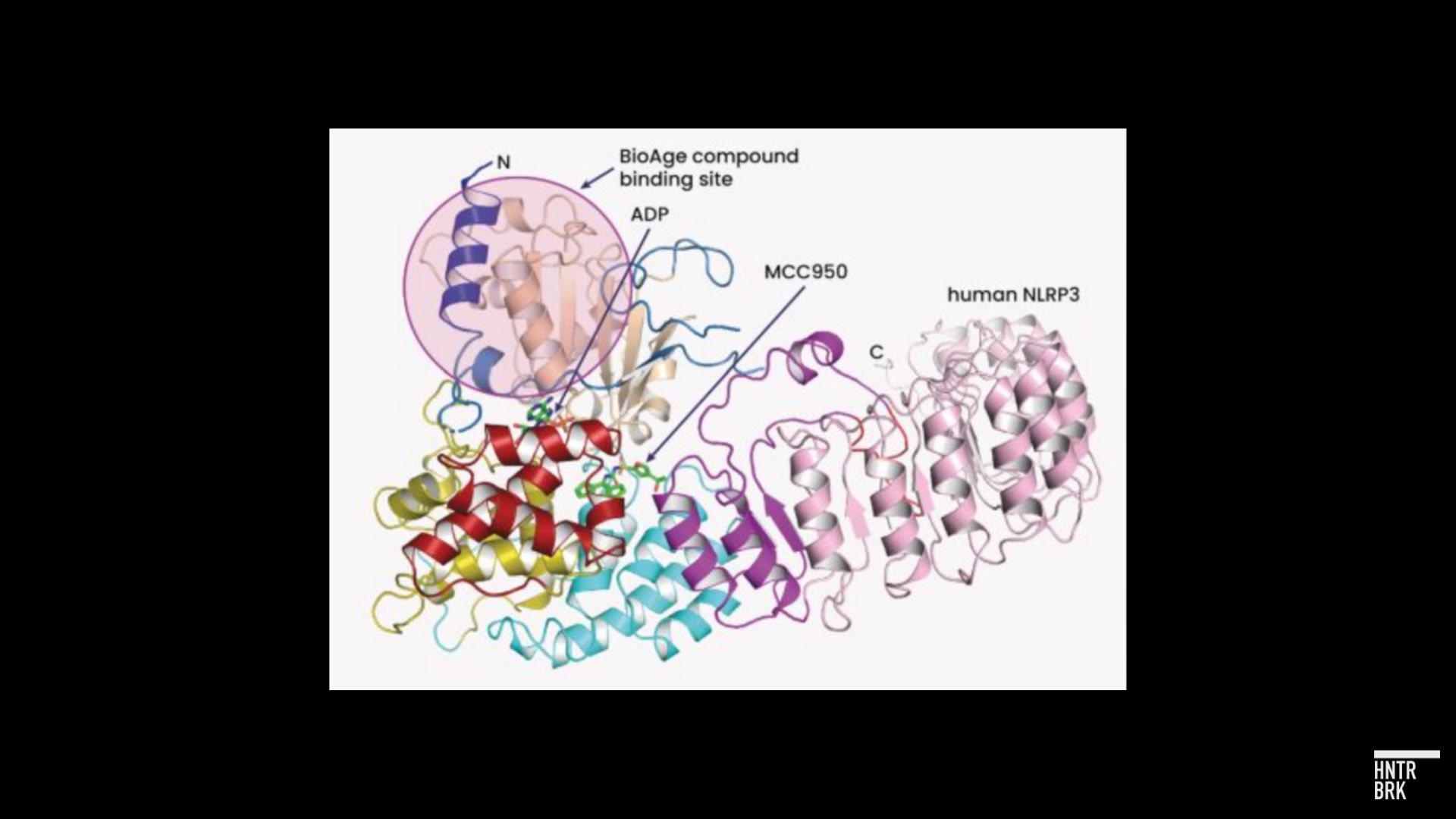

To translate the scientific jargon: NLRP3 is a protein that plays a significant role in immunity. Several companies are developing NLRP3 inhibitors to treat inflammatory disorders. But where BioAge’s program differs from all but a handful of NLRP3 assets is that it can cross the blood-brain barrier to reach the central nervous system: “CNS penetrant.”

BioAge also says its molecule binds NLRP3 in a different way from a molecule called MCC950, which inspired multiple NLRP3 programs developed by other companies.

“Direct competition is currently limited as there are no approved NLRP3 inhibitors or other inflammasome-targeted therapeutics for neuroinflammation. However, we are aware of NLRP3 inhibitor pipeline programs with reported CNS activity,” BioAge wrote in its S-1, referring to other companies that are working toward eventual FDA approval, “including those from NodThera, Ventyx Biosciences, Roche and Ventus Therapeutics.”

NLRP3: Still a Hot Target?

Major drug companies have made NLRP3 a valuable target, though the key tests of clinical effectiveness remain in the future.

In 2019, Novartis acquired the startup IFM Tre for $310 million upfront and up to $1.265 billion in milestones “to Develop First-In-Class NLRP3 Antagonist Portfolio Targeting Innate Immune System.” On December 10, the registry ClinicalTrials.gov updated a Novartis Phase 2 study of NLRP3 inhibition to “Completed,” indicating that results are on the horizon.

In 2022, Novo Nordisk paid Ventus Therapeutics $70 million up front and up to $633 million in milestones and royalties for a preclinical NLRP3 inhibitor that is not CNS penetrant. That program entered Phase 1 clinical trials in May 2024. The prior month, Ventus completed a Phase 1 trial for its CNS-penetrant NLRP3 inhibitor, which it is developing independently from Novo.

(Disclosure: the author previously led a 2021 investment into Ventus and served as an observer on the board of directors, but no longer has a financial interest related to the company).

Most recently, in September 2024, Sanofi invested $27 million in similarly-named Ventyx Biosciences, which expects Phase 2 data in 2025 from parallel NLRP3 trials against Parkinson’s and obesity. Sanofi received “exclusive right of first negotiation” for the drug. Sanofi’s corporate investment arm, Sanofi Ventures, is an investor in NodThera, which is also pursuing Phase 2 trials of an NLRP3 inhibitor in Parkinson’s disease and obesity.

“I believe that NLRP3 is among the greatest immunology targets of our time,” said Dr. Marcelo Bigal, CEO of Ventus, in an interview with Hunterbrook. He enumerated a few of the many conditions NLRP3 companies are pursuing: obesity, Parkinson’s, metabolic diseases, pericarditis, epilepsy, a rare disease called CAPS, and even Alzheimer’s.

Many of these trials, he pointed out, are expected to announce data in the near future. “The catalysts to me are real and there are plenty in the next year,” he said.

BioAge wrote in its press release: “We intend to submit an IND for an NLRP3 inhibitor to the FDA in the second half of 2025 and, if cleared, initiate a Phase 1 trial in the first half of 2026 to evaluate safety, tolerability, pharmacokinetics and pharmacodynamics in healthy volunteers.”

“Not knowing details, the timelines seem realistic,” said Bigal, who believes there is an opportunity for BioAge. “It is crowded, but if they are ready to develop NLRP3, they will take advantage of several catalysts.”

A biotech analyst at Jefferies wrote in a December 9 research note after speaking with BioAge management that the company “will now be focused on NLRP3 program with IND in 2H25/Ph1 in 2H26 but potentially accelerate.”

With around a half-dozen CNS-penetrant NLRP3 programs, it will be years before the winners are clear. But even during development, an NLRP3 program can be worth hundreds of millions, given the enormous size of many immune disease markets and the precedent deal-making.

It will also be months before BioAge’s largest investors could leave, due to a standard 180-day lockup from the IPO at the end of September, meaning that they can’t sell shares until around the end of the first quarter of 2024.

“We are backed by a strong set of healthcare-specific investors, including our 5% or greater stockholders, a16z Bio + Health, Khosla Ventures, Sofinnova Investments, Longitude Capital, RA Capital, Cormorant Asset Management, Kaiser Permanente,” Disclosure: The author was previously a venture partner at RA Capital but was not directly involved with BioAge and does not have a financial interest in RA Capital. A co-founder of RA Capital is a personal investor in Hunterbrook. BioAge had written in its S-1. Page 7: https://www.sec.gov/Archives/edgar/data/1709941/000119312524212046/d835745ds1.htm Its board includes directors from a16z, Sofinnova, and Longitude.

That lockup may prove beneficial, as biotech companies that trade below cash after a clinical trial failure can regain meaningful value.

A few of these firms were also invested in Aerovate Therapeutics (NASDAQ: $AVTE), whose lead drug failed in June, with an over 90% stock drop. After trading below cash, the stock rose on anticipation that skeleton crew leadership could either return cash to shareholders, acquire an asset, or find an accretive reverse merger. On October 31, Aerovate merged with Jade Biosciences, with $AVTE now up over 80% since June.

Ventyx (NASDAQ: $VTYX) also traded below cash after falling over 90% following the failure of its original lead program for another immunology target. The company cut staff and the stock then ran up over 300% within months, ahead of Ventyx’s first clinical data for its new lead NLRP3 program (but has since declined significantly).

Perhaps the biggest difference between the fall of BioAge compared to Aerovate or Ventyx is how soon it blew up after an IPO. This may cast a shadow over its potential next chapter, as BioAge lost significant trust from the market — by the Monday after the trial discontinuation, at least one shareholder litigation firm was already seeking plaintiffs.

But now valued at around half of its cash, can $BIOA stock stage a similar comeback?

Referring to the BioAge selloff, Alex Zhavoronkov, CEO of anti-aging company Insilico Medicine, wrote on X on December 10: “I think that this is completely unfair and unjustified.” He has also served as a director of the Biogerontology Research Foundation, a think tank focused on aging research, and authored a book on aging.

“They have 300+mil in cash so the current price is half that. And NLRP3 is another aging+disease target,” he added.

The following day, Zhavoronkov announced that Insilico had just nominated its own NLRP3 inhibitor to enter IND-enabling studies, which Insilico claimed is CNS-penetrant.

“NLRP3 is a super promising target,” Zhavoronkov wrote in the announcement.

Then, a week later on December 18, BioAge announced its partnership with Novartis to treat diseases related to aging. The deal does not appear to include any rights to BioAge’s NLRP3 program. Instead, it focuses on using BioAge’s research platform to develop new programs.

BioAge pitched this platform in its S-1: “To develop new insights into the biological drivers of aging, we have generated proprietary longitudinal human datasets based on exclusive access to a unique resource: serial biobanked human samples coupled with health records and functional measurements collected for up to 50 years, capturing individual aging trajectories measured over several decades.”

BioAge says that it then measures “thousands of biologically relevant molecules” and applies “computational tools to the resulting data to extract potential drivers of a long and healthy lifespan.” In BioAge’s press release, a scientific executive at Novartis highlighted the application of this “human longevity data” as a foundation of the partnership, which could yield “up to $530M in future long-term research, development, and commercial milestones” for BioAge, in addition to the $20 million in upfront payments and research funding to treat diseases related to aging.

Could an Immortality-Seeking HHS Appointee Enable BioAge To Pursue Its Original Anti-Aging Aspirations?

“You can tell a lot about an era by listening to what people whine about. If we invest wisely in life extension technologies, in forty years, we’ll all be able to annoy our friends with complaints like: immortality almost never works.”

That quip was from a 2014 keynote by Jim O’Neill, the libertarian and longevity devotee who is also President-elect Trump’s nominee to be the next deputy secretary of the Department of Health and Human Services.

His audience?

The SENS Research Foundation, a nonprofit established to fight aging. O’Neill served on the board of directors for over a decade starting in 2010 and as CEO from 2019 to 2021, according to his LinkedIn page, where he led “a team of scientists … with the goal of curing such age-related diseases as heart disease, cancer, and Alzheimer’s disease.”

The mission of the nonprofit mirrors that of BioAge. But aging itself isn’t yet an “indication” for which the FDA approves medicines that can then be marketed and prescribed. So, instead of treating aging directly, BioAge focused on aging-related diseases, as shown in its S-1 filing:

Now, with an aging-related lead program and the aging-focused Novartis partnership, BioAge may be able to more directly focus on its original aspiration. HHS — through the FDA — could classify aging as an indication for which drugs can be approved.

O’Neill might also advocate for the FDA to incentivize the development of anti-aging medicines and reduce barriers for products that have proven safe but not yet proven effective.

“Let people start using them, at their own risk, but not much risk of safety,” argued Jim O’Neill in the 2014 keynote, suggesting that the FDA should leave the assessment of effectiveness to the free market. “Let’s prove efficacy after they’ve been legalized.”

The audience applauded.

For decades, O’Neill has advocated for anti-aging therapies, regenerative medicine, and a libertarian approach to healthcare. During his time on the board of the Seasteading Institute, which aims to build libertarian communities aboard floating ocean enclaves, he proposed at a Seasteading conference in 2009 that people should be allowed to sell their organs, according to STAT News. The official video of his talk was deleted but separately reposted.

In 2016, Trump reportedly considered O’Neill for FDA commissioner, but selected Dr. Scott Gottlieb, a venture partner from New Enterprise Associates, as well as board director at the pharmaceutical giant Pfizer and genome sequencing company Illumina.

O’Neill worked at HHS for almost six years earlier in his career. He first joined in 2002, ultimately becoming an advisor to the HHS Secretary as Principal Associate Deputy Secretary before leaving in 2008.

If each nominee is confirmed, O’Neill would lead U.S. health care policy alongside HHS Secretary Robert F. Kennedy Jr., FDA Commissioner Dr. Marty Makary, NIH chief Dr. Jay Bhattacharya, CMS chief Dr. Mehmet Oz, and CDC director Dr. David Weldon. STAT News reported that if RFK Jr.’s confirmation is drawn out, O’Neill could serve as acting secretary, which may amplify any potential benefit to anti-aging endeavors.

In a response to a request for comment by Hunterbrook, BioAge declined to say whether BioAge would like the FDA to classify aging as an indication for drug development. It also declined to say whether there were signs of elevated liver enzymes prior to October; and whether it had been contacted about exploring a reverse merger, dissolving and returning cash to shareholders, or acquiring additional assets.

Author

Nathaniel Horwitz is CEO of Hunterbrook and sometimes moonlights as a reporter. He was previously a venture partner at the healthcare investment firm RA Capital, where he co-founded, invested in, and served as a director on the board of companies ranging from AI-designed medicines for cancer to cell therapies for autoimmune diseases. He has a BA in Molecular Biology from Harvard. He has published in The Washington Post, The Boston Globe, The Daily Beast, The Atlantic, The Harvard Crimson, The New York Times, and The Australian Financial Review. His first job out of high school was reporting for his local paper.

Editor

Sam Koppelman is a New York Times best-selling author who has written books with former United States Attorney General Eric Holder and former United States Acting Solicitor General Neal Katyal. Sam has published in the New York Times, Washington Post, Boston Globe, Time Magazine, and other outlets — and occasionally volunteers on a fire speech for a good cause. He has a BA in Government from Harvard, where he was named a John Harvard Scholar and wrote op-eds like “Shut Down Harvard Football,” which he tells us were great for his social life.

Hunterbrook Media publishes investigative and global reporting — with no ads or paywalls. When articles do not include Material Non-Public Information (MNPI), or “insider info,” they may be provided to our affiliate Hunterbrook Capital, an investment firm which may take financial positions based on our reporting. Subscribe here. Learn more here.

Please contact ideas@hntrbrk.com to share ideas, talent@hntrbrk.com for work opportunities, and press@hntrbrk.com for media inquiries.

LEGAL DISCLAIMER

© 2025 by Hunterbrook Media LLC. When using this website, you acknowledge and accept that such usage is solely at your own discretion and risk. Hunterbrook Media LLC, along with any associated entities, shall not be held responsible for any direct or indirect damages resulting from the use of information provided in any Hunterbrook publications. It is crucial for you to conduct your own research and seek advice from qualified financial, legal, and tax professionals before making any investment decisions based on information obtained from Hunterbrook Media LLC. The content provided by Hunterbrook Media LLC does not constitute an offer to sell, nor a solicitation of an offer to purchase any securities. Furthermore, no securities shall be offered or sold in any jurisdiction where such activities would be contrary to the local securities laws.

Hunterbrook Media LLC is not a registered investment advisor in the United States or any other jurisdiction. We strive to ensure the accuracy and reliability of the information provided, drawing on sources believed to be trustworthy. Nevertheless, this information is provided "as is" without any guarantee of accuracy, timeliness, completeness, or usefulness for any particular purpose. Hunterbrook Media LLC does not guarantee the results obtained from the use of this information. All information presented are opinions based on our analyses and are subject to change without notice, and there is no commitment from Hunterbrook Media LLC to revise or update any information or opinions contained in any report or publication contained on this website. The above content, including all information and opinions presented, is intended solely for educational and information purposes only. Hunterbrook Media LLC authorizes the redistribution of these materials, in whole or in part, provided that such redistribution is for non-commercial, informational purposes only. Redistribution must include this notice and must not alter the materials. Any commercial use, alteration, or other forms of misuse of these materials are strictly prohibited without the express written approval of Hunterbrook Media LLC. Unauthorized use, alteration, or misuse of these materials may result in legal action to enforce our rights, including but not limited to seeking injunctive relief, damages, and any other remedies available under the law.