Hunterbrook Media’s investment affiliate, Hunterbrook Capital, does not have any positions related to this article at the time of publication. Positions may change at any time. Based on Hunterbrook Media’s reporting, Hunterbrook Law is in conversations with firms across the country regarding potential litigation against LGI Homes. If you have dealt with LGI Homes and want to tell us about it, write ideas@hntrbrk.com.

LGI Homes is a publicly traded homebuilder that sells entry-level homes predominantly to current renters. Hunterbrook set out to determine the loan performance of mortgages originated in connection with initial sales from LGI to a purchaser. Homebuyers utilize various lenders to purchase homes from LGI, so we were unable to utilize publicly available loan-level performance data. Instead, we analyzed the frequency of foreclosure-related documents filed on parcels sold by LGI.

Loan Performance in Bexar County, Texas

We started the analysis by reviewing foreclosure filings in a particular subdivision, Luckey Ranch, in Bexar County, Texas. We identified LGI Homes sales out of the Luckey Ranch community by locating the relevant parcels, filtering on sales to individuals (excluding institutional buyers) and matching these parcels to a proprietary set of foreclosure filings that captures 99% of the county records from 2014 to present. We separated these sales into cohorts based on the year in which the home was sold and the purchase mortgage originated. We focused on sale year cohorts between 2014 and 2020 as foreclosures develop over time and the most recent years are not yet representative of actual loan performance.

We then counted Notice of Default, Notice of Sale, Notice of Trustee Sale, and Lis Pendens filings across each cohort and calculated the relevant loan performance by cohort year, (e.g., the performance of mortgages originated in 2014, 2015, etc.) and compared those rates to cohorted mortgage originations across Bexar County, filtered on single-family residential properties with mortgage amounts similar to those at Luckey Ranch (i.e., all mortgage amounts within $50,000 of the average LGI mortgage over the period).

Definitions of Notice of Default, Notice of Sale, Notice of Trustee Sale, and Lis Pendens:

| Code | Recorded Document | Function | Judicial vs. Nonjudicial | Stage (estimated delinquency days) |

| LIS | Lis Pendens | A formal legal notice filed by a lender that indicates a pending lawsuit involving a property | Judicial | Early Stage(> 120 days) |

| NOD | Notice of Default | A formal document filed by a lender to officially inform the public and the borrower that the borrower has failed to meet loan obligations | Nonjudicial | Early Stage(> 90 days) |

| NOS | Notice of Sale | A legal document that informs you that the lender will hold a public auction to sell your property to recover the debt from your missed mortgage payments. | Judicial | Late Stage(>180 days) |

| NTS | Notice of Trustee’s Sale | A legal document in a nonjudicial foreclosure that announces the date, time, and location of a public auction where a property will be sold to recover losses from a defaulted mortgage loan | Nonjudicial | Late Stage(>180 days) |

The analysis showed that LGI loan performance was approximately four times worse than comparable mortgages in the same cohort across Bexar County. We also ran an expanded analysis across the largest 10 counties in Texas, and the LGI loan performance was two times worse than similar loans on single family residential properties.

Percent of Foreclosure Filings Associated with LGI Luckey Ranch homes vs. Bexar County Homes:

| Year | LGI | Bexar County | Multiplier |

| 2014 | 22.00% | 6.51% | 3.38 |

| 2015 | 16.10% | 4.95% | 3.25 |

| 2016 | 9.63% | 3.49% | 2.76 |

| 2017 | 7.59% | 3.04% | 2.50 |

| 2018 | 7.62% | 3.07% | 2.48 |

| 2019 | 8.56% | 2.56% | 3.34 |

| 2020 | 14.02% | 1.30% | 10.78 |

| Cumulative 2014-2020 | 12.22% | 3.56% | 4.07 |

Loan Performance Nationwide

We then expanded the analysis to determine the loan performance of annual cohorts across LGI Homes’ nationwide footprint. We identified all LGI home sales to individual buyers across the relevant time periods. As compared to public company disclosures made by LGI, we have captured 97%-99% of all sales.

In this analysis, we produced two different outputs:

First Output : Notice of Default, Lis Pendens, Notice of Sale, and Notice of Trustee Sale filings (all foreclosure documents; >90 days):

| Sale_Year | Properties_Sold* | Foreclosed_Properties** | FCL_Rate_% | Total_FCL_Records | Avg_Years_to_FCL | |

| 0 | 2014 | 936 | 88 | 9.40% | 132 | 4.00 |

| 1 | 2015 | 1954 | 230 | 11.77% | 343 | 3.60 |

| 2 | 2016 | 2735 | 256 | 9.36% | 397 | 3.60 |

| 3 | 2017 | 4389 | 316 | 7.20% | 478 | 3.50 |

| 4 | 2018 | 4592 | 263 | 5.73% | 404 | 3.20 |

| 5 | 2019 | 5372 | 233 | 4.34% | 355 | 3.60 |

| 6 | 2020 | 6462 | 202 | 3.13% | 260 | 3.00 |

| Cumulative 2014-2020 | 26440 | 1588 | 6.01% |

** Total Unique Properties with at least one Foreclosure Record Filed

Second Output : Notice of Sale and Notice of Trustee Sale filings (only late-stage foreclosure documents; >180 days):

| Sale Year | Properties Sold | Foreclosed Properties | FCL Rate % | Total FCL Records | Avg Years to FCL |

| 2014 | 936 | 65 | 6.94% | 98 | 4.1 |

| 2015 | 1,954 | 176 | 9.01% | 248 | 3.6 |

| 2016 | 2,735 | 192 | 7.02% | 297 | 3.6 |

| 2017 | 4,389 | 227 | 5.17% | 350 | 3.6 |

| 2018 | 4,592 | 193 | 4.20% | 289 | 3.5 |

| 2019 | 5,372 | 183 | 3.41% | 288 | 3.6 |

| 2020 | 6,462 | 137 | 3.12% | 212 | 2.6 |

| Cumulative 2014-2020 | 26440 | 1173 | 4.44% |

In the first output, we included all types of foreclosures notices — Notice of Default, Lis Pendens, Notice of Sale, and Notice of Trustee Sale filings — that homeowners typically receive 90 days after initially becoming delinquent on payments. In this output, we found 6.01% of LGI buyers have received some type of foreclosure notice at least once since 2014.

In the second output, we only included Notice of Sale and Notice of Trustee Sale filings — later-stage notices that homeowners typically receive after 180+ days of delinquency. We found 4.44% of all LGI buyers have received at least one of these notices.

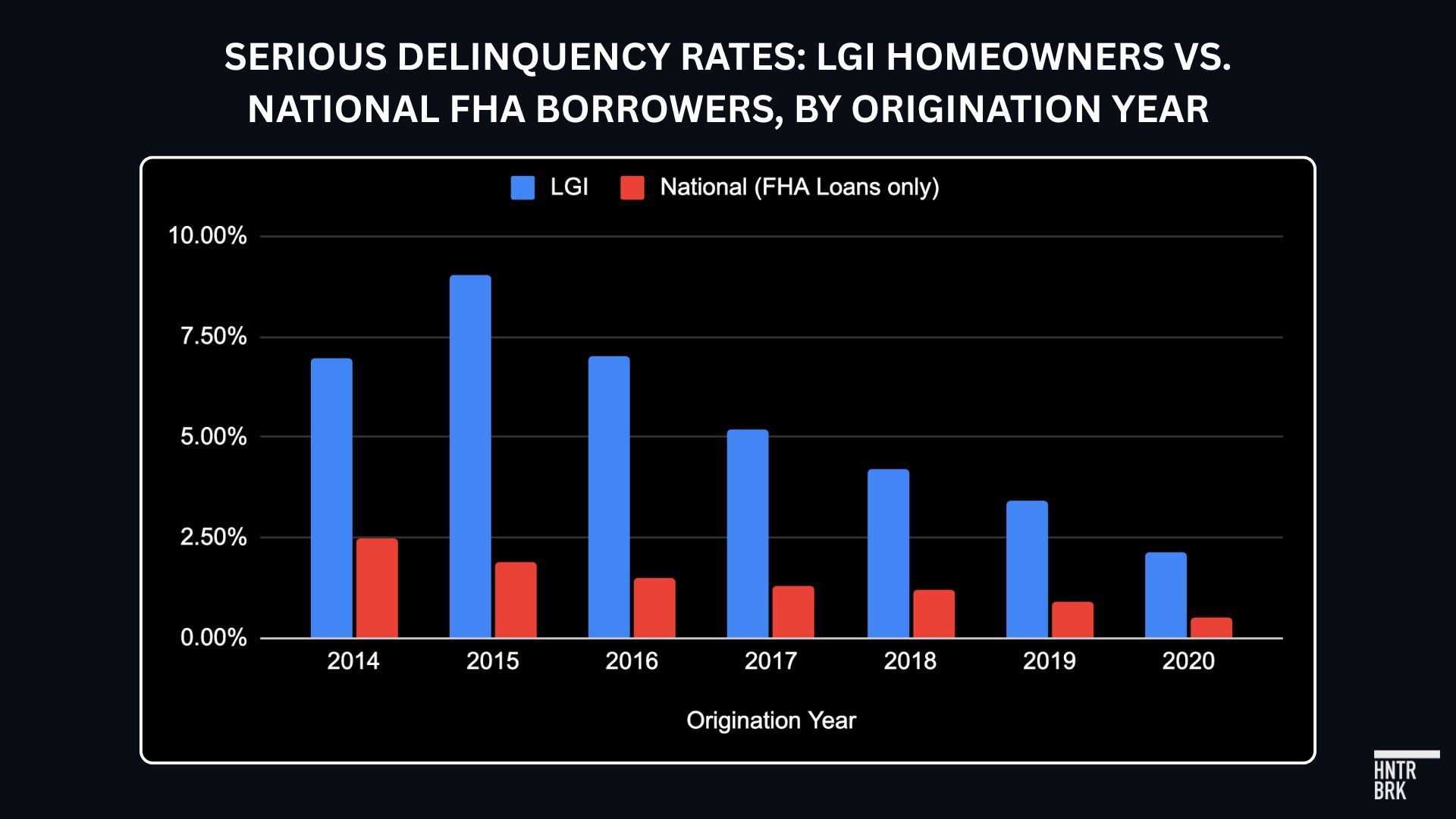

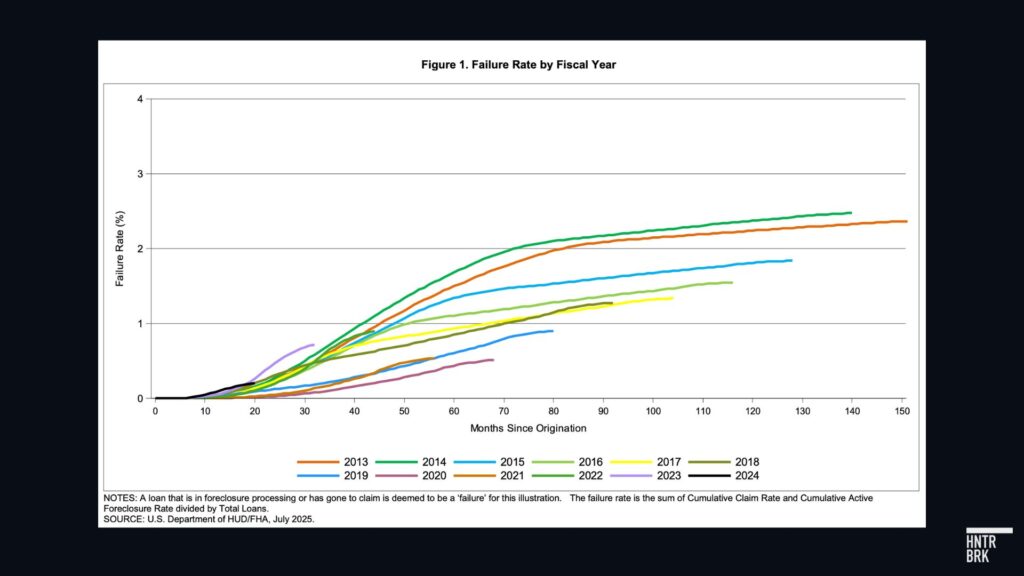

Benchmarks

We reviewed publicly available industry and government sources for loan performance data cohorted by year originated. We identified the Failure Rate of FHA Loans by Fiscal Year published by the FHA as the best benchmark for comparison. (FHA loans are federally backed loans intended to help borrowers with lower credit scores or a smaller down payment. LGI markets to borrowers who are eligible for FHA loans as well as other types of loans; FHA loans generally perform worse — i.e., are associated with higher foreclosure rates — than conventional or VA loans, making this a conservative comparison.)

The FHA study defines Failure Rate as the sum of Cumulative Claim Rate and Cumulative Active Foreclosure Rate divided by total loans in a given cohort. Cumulative Claim Rate is defined as the rate of foreclosures, short sales, deeds-in-lieu of foreclosure, or other actions resulting in the payment of a claim on its insurance over the life of a given book of insured loans. Active Foreclosure Rate is defined as the number of loans currently in the foreclosure process. The foreclosure records Hunterbrook reviewed did not indicate how many cases were settled before the lender carried out the foreclosure.

In order to most closely match the FHA’s Failure Rate, which does not capture cases that might have been resolved outside of foreclosure and therefore wouldn’t result in an FHA claim, we utilized Output 2 of our data, counting only late stage foreclosure documents (i.e., Notice of Sale and Notice of Trustee Sale). All of these loans were at least 180 days behind.

Foreclosure Rate of LGI Homes vs FHA Borrowers:

| Annual Cohort | LGI Homes Output 2 (late stage): NOS, NTS | FHA Benchmark: Failure Rate by Fiscal Year | Multiplier |

| 2014 | 6.9% | 2.5% | 2.8 |

| 2015 | 9.0% | 1.9% | 4.7 |

| 2016 | 7.0% | 1.5% | 4.7 |

| 2017 | 5.2% | 1.3% | 4.0 |

| 2018 | 4.2% | 1.2% | 3.5 |

| 2019 | 3.4% | 0.9% | 3.8 |

| 2020 | 2.1% | 0.5% | 4.2 |

| Cumulative 2014-2020 | 5.40% | 1.40% | 3.96 |

Based on this analysis, we conclude that mortgages originated in connection with the purchase of a new home from LGI Homes 2014-2020 performed on average four times worse than FHA loans across the same time span. We limited our comparison to loans originated between 2014 and 2020. Foreclosures typically take three to four years to materialize, meaning post-2020 cohorts have not yet had enough time for us to meaningfully evaluate their performance. This window ensures a stable, apples-to-apples comparison with national FHA foreclosure rates.

Author

Matthew Termine is a lawyer with nearly five years of experience leading the legal team at a mortgage technology company. In 2017, Matt was credited by the Wall Street Journal, among others, for identifying suspicious mortgage loan transactions that led to several successful criminal prosecutions, including that of a prominent political operative and the chief executive officer of a federally chartered bank. He is a graduate of Trinity College and Fordham University School of Law. He grew up in Old Saybrook, Connecticut and now lives in Brooklyn with his wife and two sons.

Hunterbrook Media publishes investigative and global reporting — with no ads or paywalls. When articles do not include Material Non-Public Information (MNPI), or “insider info,” they may be provided to our affiliate Hunterbrook Capital, an investment firm which may take financial positions based on our reporting. Subscribe here. Learn more here.

Please contact ideas@hntrbrk.com to share ideas, talent@hntrbrk.com for work opportunities, and press@hntrbrk.com for media inquiries.

LEGAL DISCLAIMER

© 2025 by Hunterbrook Media LLC. When using this website, you acknowledge and accept that such usage is solely at your own discretion and risk. Hunterbrook Media LLC, along with any associated entities, shall not be held responsible for any direct or indirect damages resulting from the use of information provided in any Hunterbrook publications. It is crucial for you to conduct your own research and seek advice from qualified financial, legal, and tax professionals before making any investment decisions based on information obtained from Hunterbrook Media LLC. The content provided by Hunterbrook Media LLC does not constitute an offer to sell, nor a solicitation of an offer to purchase any securities. Furthermore, no securities shall be offered or sold in any jurisdiction where such activities would be contrary to the local securities laws.

Hunterbrook Media LLC is not a registered investment advisor in the United States or any other jurisdiction. We strive to ensure the accuracy and reliability of the information provided, drawing on sources believed to be trustworthy. Nevertheless, this information is provided "as is" without any guarantee of accuracy, timeliness, completeness, or usefulness for any particular purpose. Hunterbrook Media LLC does not guarantee the results obtained from the use of this information. All information presented are opinions based on our analyses and are subject to change without notice, and there is no commitment from Hunterbrook Media LLC to revise or update any information or opinions contained in any report or publication contained on this website. The above content, including all information and opinions presented, is intended solely for educational and information purposes only. Hunterbrook Media LLC authorizes the redistribution of these materials, in whole or in part, provided that such redistribution is for non-commercial, informational purposes only. Redistribution must include this notice and must not alter the materials. Any commercial use, alteration, or other forms of misuse of these materials are strictly prohibited without the express written approval of Hunterbrook Media LLC. Unauthorized use, alteration, or misuse of these materials may result in legal action to enforce our rights, including but not limited to seeking injunctive relief, damages, and any other remedies available under the law.