Based on Hunterbrook Media’s reporting, Hunterbrook Capital is short $SOC at the time of publication. Positions may change at any time. See full disclosures below.

READ: Hunterbrook’s bombshell Sable investigation from October 31st.

UPDATE (11/14/25, 5:08 pm): The article now reflects a statement issued by Sable in response to Hunterbrook’s publication.

Sable was running out of money.

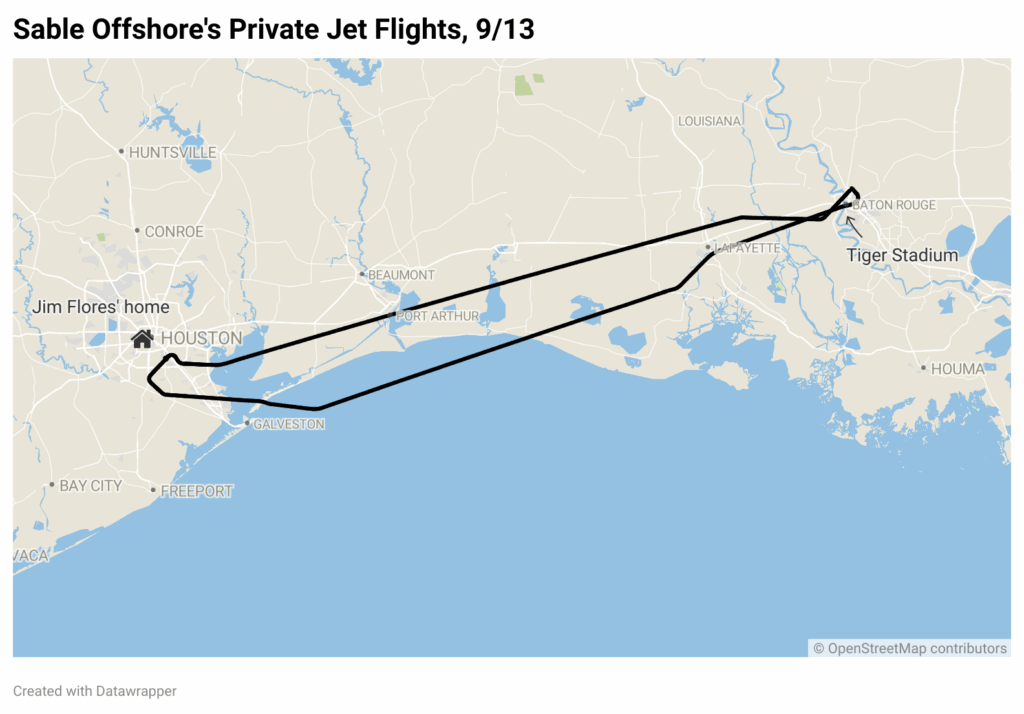

But that didn’t stop the Exxon spinoff from flying its private jet to the home of the CEO’s alma mater just in time for a big college football game.

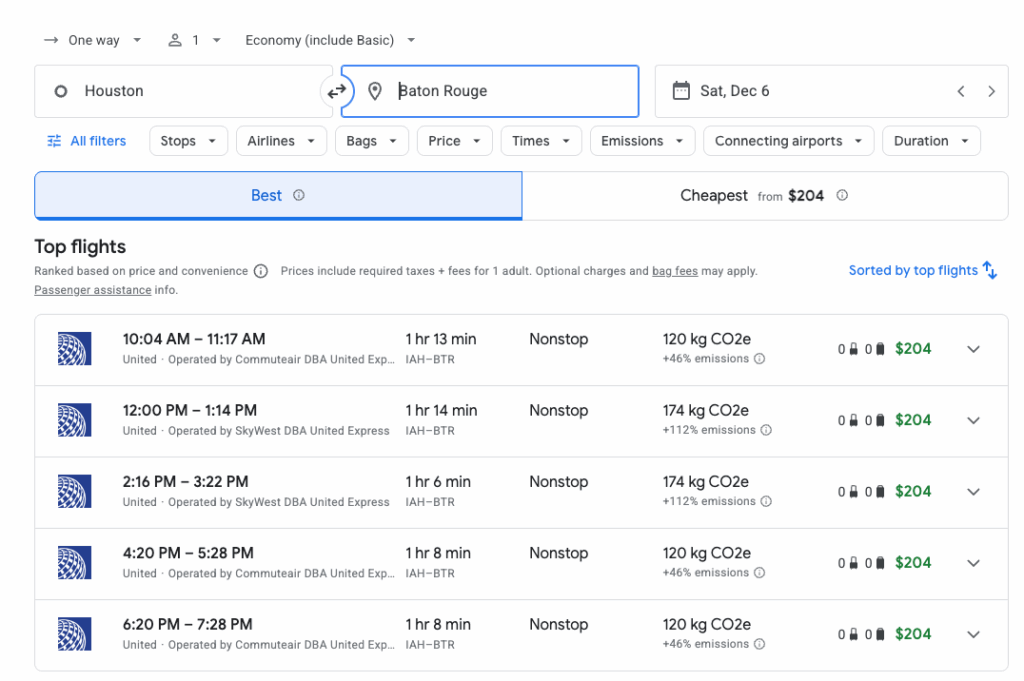

On September 13, the company had only weeks of cash remaining, according to its most recent SEC filing. That afternoon, the private jet took off from Sable’s base in Houston, Texas, and landed in Baton Rouge, Louisiana, at 5:22 PM CST. The LSU game kickoff was scheduled for 6:30 PM.

At about 9:45 p.m., the Citation flew back to Houston, where Sable’s CEO Jim Flores lives.

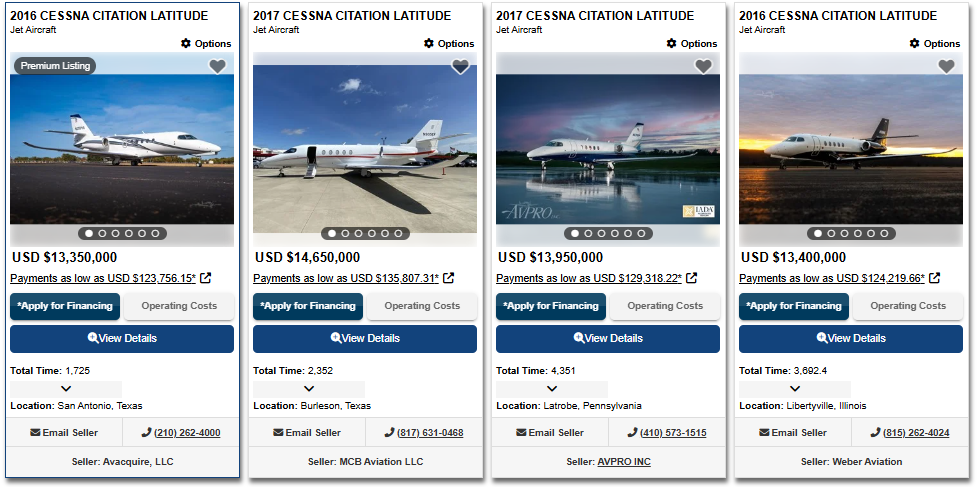

Sable purchased the Cessna Citation Latitude in 2024 from Sable Aviation, an entity belonging to Flores, a graduate of Louisiana State University who endowed the school’s MBA program.

Instead of cash, Flores received 600,000 shares of $SOC — worth $15.2 million at around $25 per share — in exchange for the “transportation assets and related equipment.”

Asked whether Sable or Flores paid for the flight to Baton Rouge, the company did not reply to Hunterbrook. While Sable “owns and operates” the jet, it does permit the CEO access “for personal reasons.”

The private jet is one of Sable’s only assets beyond its troubled oil and gas project. And the September flight — while the company was burning through its final weeks of cash — captures how Sable was operating before reality set in.

Sable’s latest 10-Q filing reveals the company had $41.6 million in cash on September 30 against $39.7 million in monthly burn, barely a month of runway around the time of that flight to Baton Rouge. By the time Sable closed its $250 million financing on November 12, the company likely had only single-digit millions remaining. Without the raise, Sable may not have survived November.

But the new money only buys time, and not much of it. At Sable’s current reduced $25 million monthly burn, the $250 million raise provides roughly 10 months of runway. And it’s unclear whether the $25 million number includes the mounting pile of liabilities Sable disclosed in its recent 10Q, obligations that will burn through cash.

NOTE: After publication, Sable Offshore halted trading of $SOC and released a statement addressing certain facts reported in this article. Sable also stated that it “believes it has the liquidity required to pursue its objectives, including a comprehensive debt refinancing in the first quarter of 2026.” Read the full statement here.

Payments To Exxon:

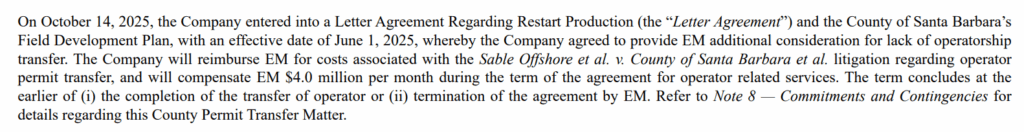

Under an October 14 agreement disclosed November 13, Sable must pay Exxon $4 million per month until Exxon transfers its operating permit to Sable. The agreement is effective as of June 1, apparently meaning Sable already owes Exxon $24 million for June through November.

And that permit transfer just became far less likely. On November 4, Santa Barbara County’s Board of Supervisors voted 4-1 against allowing Exxon to transfer the critical pipeline permit to Sable. A prior supporter of the project changed his vote, citing Hunterbrook’s October 31 investigation.

“The final straw for me was a Hunterbrook article, which was as disturbing as anything I’ve read,” said Supervisor Steve Lavagnino, citing Hunterbrook’s investigation into the company’s selective disclosures to certain investors. “I have many friends in the oil industry and I will continue to support efforts to access our natural resources, but it has to be done responsibly by operators who put safety above profits.”

“Sable’s management actions have reeked of desperation, and with desperation comes poor decisionmaking,” said Lavagnino. “There is something wrong with the strategy of Sable’s leadership.”

Without the permit transfer, Sable keeps paying Exxon $4 million per month indefinitely: $48 million per year bleeding from an already cash-strapped company. Sable must also fund Exxon’s litigation expenses as the oil giant fights Santa Barbara County in court.

Bonding:

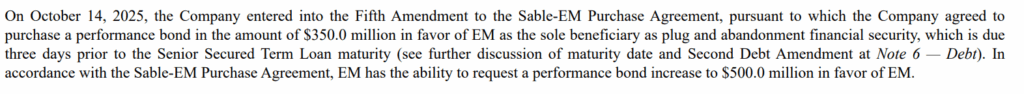

The Exxon arrangement includes another new disclosure: Sable must now post a $350 million bond — which could potentially become a $500 million bond at Exxon’s request.

In its statement after publication, Sable clarified that it had disclosed the existence of this bond: Regarding Hunterbrook’s statement that ‘[t]he Exxon arrangement includes another new disclosure: Sable must now post a $350 million bond…’ This is incorrect. The report quotes a section from Sable’s recently filed Q3 10-Q where the Company disclosed an extension to its bonding obligation for its plugging and abandonment obligations to ExxonMobil following the cessation of production from the Company’s Santa Ynez Unit. The extension is detailed in Sable’s Fifth Amendment to its Purchase and Sale Agreement (“PSA”) with Exxon Mobil Corporation (“Exxon”). The $350 million bonding obligation (referred to in the PSA as the P&A Financial Security) is an obligation that arises from the original PSA with Exxon Mobil dated November 1, 2022 as first disclosed by Sable on its Form 8-K dated February 14, 2024 (and which was previously disclosed by its predecessor on November 10, 2022) and in multiple filings since, including the Company’s 2024 Annual Report filed on March 17, 2025. The bonding relates to Sable’s obligation to plug and abandon wells at the end of the Santa Ynez Unit’s end of life. The PSA originally required Sable to post the PSA bond 150 days following the resumption of production from the wells on the SYU Unit (which resumed production on May 15, 2025). In the 5th Amendment to the PSA, dated effective October 14, 2025, the P&A Financial Security obligation was extended from effectively October 2025 to a date that is three business days following the ExxonMobil Senior Secured Term Loan Maturity Date, which, following the extension of same, will be the earlier of March 31, 2027 or 90 days after first sales of Hydrocarbons (as defined in the Senior Secured Term Loan). As noted, under certain circumstances after the bonding is in place ExxonMobil has the ability to seek an increase in the bonding amount to $500 million.”

CalGEM:

Exxon isn’t Sable’s only counterparty tightening the screws. The 10-Q revealed that in May, California’s Division of Oil, Gas, and Geothermal Resources now required the company to post a $31.9 million bond, and might impose civil penalties of $50,000 per day if Sable did not comply. Sable disputes the agency’s right to impose these requirements.

If the agency were to impose $50,000 daily fines, that would amount to around $18 million per year.

CCC:

Then there’s the $18 million fine Sable owes the California Coastal Commission for violating state orders to stop work on its pipeline. The company “does not believe this penalty is lawful,” according to the 10-Q, and has refused to pay. The debate is playing out in the courts, where Sable has repeatedly faced setbacks against the CCC.

Billions Needed:

All together, this indicates Sable faces significant disclosed liabilities beyond its $163 million in accounts payable and accrued liabilities and its over $900 million owed to Exxon, debt accruing 15% interest and due March 31, 2027. By that deadline, Sable will owe Exxon about $1.1 billion.

This is all before Sable spends a dollar on its actual business: restarting oil and gas production.

That restart is the reason Sable exists — and according to the leaked audio Hunterbrook obtained of CEO Jim Flores briefing select investors in October, it could be expensive: Achieving commercial production may cost $2.3 billion.

Sable needs to move fast. A Floating Production Storage and Offloading vessel alone costs approximately $450 million, and Sable would need to purchase or lease one soon to have any hope of meeting its end-of-2026 production target, itself an optimistic timeline that appears to assume smooth approvals from multiple hostile regulators.

Sable has told investors it is hoping to circumvent California and receive a greenlight from the federal government. The Department of the Interior confirmed to Hunterbrook that it “continues to work closely with Sable on next steps” for its offshore project. The U.S. Coast Guard, which would need to approve Sable’s plans as well, did not respond to a request for comment.

Sable indicated it may also pursue federal financing.

A former Department of Energy official familiar with the loan process told Hunterbrook that’s unlikely. They also noted the federal loan would likely need to be senior secured and could not be used to pay other lenders like Exxon.

“It doesn’t sound like the kind of thing the office would go for. I don’t see why they would do it,” they told Hunterbrook. “What’s the possible policy goal associated with it? Exxon takes over the asset, it’ll still exist as an asset, it’ll flow if it flows. From a policy standpoint, taking out Exxon’s debt doesn’t help anyone.”

In response to a Washington Post article on the Trump administration’s plans to open federal waters to drilling, Gov. Gavin Newsom’s office posted, “This plan is dead on arrival.”

The Santa Barbara County Air Pollution Control District told Hunterbrook it “does not have a permit application or know any details about Sable’s proposed Offshore Storage and Treatment (OS&T) project beyond what’s been shared in news articles.” Sable appears to need APCD air permit approval for its offshore project.

In the meantime, at least one of Sable’s biggest investors may be losing faith in the project.

Pilgrim Jumping Ship?

Hedge fund Pilgrim Global once owned $350 million of Sable — and registered with the SEC as owning over 10% of the company as its largest outside investor.

That registration also meant Pilgrim needed to publicly disclose every time it bought or sold shares, because the actions of big investors close to companies are often material to regular investors.

For months, Pilgrim filed each trade of $SOC for all investors to see, leaving it with over 10 million shares as of October 15.

Then, around the end of trading on November 6, came an exceptionally unusual event.

Pilgrim filed amendments claiming it was never actually meant to register as a 10% holder at all. The apparent rationale: Pilgrim said it could use an exemption because it isn’t the beneficial owner of the shares.

Pilgrim said its previous SEC filings “should not have been filed” — a striking statement given Sable represented 47% of all Pilgrim’s reported investments in U.S. equities. Pilgrim has also been involved with Sable since before the company went public through a Special Purpose Acquisition Company, or SPAC.

These forms have significant implications: Pilgrim now claims it is exempt from rules that would otherwise require it to disclose whenever it traded $SOC.

“The requirements are really for transparency purposes. Who’s buying? Who’s selling?” explained Tracy Davis, a securities attorney who worked in SEC enforcement.

“Maybe they sold knowing they were going to file and wanted to dump their shares before that became known,” Davis theorized. “It could be because you looked into them and they needed to clean up the filings. It could be they hired someone new who said: why are you all even filing these if you’re not required to?”

A former Sable investor put it more bluntly, calling Pilgrim’s SEC filing “the weirdest Form 4 I’ve ever seen.”

“I don’t even know what to make of that at all, except for I don’t think they file something like that if they’re still holding all the stock,” he added.

At its peak, Pilgrim’s stake was worth about $350 million, when Sable briefly traded as high as $35 per share. Today, if Pilgrim still owned that position, it’d be worth less than $60 million.

Pilgrim’s last disclosed transaction was October 15. Anything since then? Now hidden from regular investors.

How rare are Pilgrim’s amended filings?

In the past decade, Hunterbrook was able to find only a handful of other investors who sought to retroactively void their status as registered major holders.

“Did they suddenly finally find religion? Is this a legal position they’re suddenly starting to take?” asked a partner at McDermott Will & Schulte LLP, one of the top firms representing hedge funds.

The attorney speculated that Pilgrim may “want to sell, but they think drawing attention to the sales is a lot worse than drawing attention to the filing.”

For investors deciding whether Sable will survive, knowing what the company’s largest outside investor is doing could be crucial information.

Instead, regular investors are flying blind.

Pilgrim repeatedly declined to comment on how the errors happened, why they only just discovered its mistakes, and whether Pilgrim has been trading $SOC while other investors watch the value of their shares evaporate.

After publication, in its statement, Sable stated that “Pilgrim continues to have substantial ownership in Sable consistent with its regulatory filings.” It added that “was a significant participant in Sable’s recent sale of common equity in a private placement to institutional investors.”

Participants in that private placement — the company’s $250 million raise that closed on November 12 — may also be able to sell at their own pace. Sable appeared to disclose in its latest 10-Q that these investors do not have lockups associated with their shares.

That potential selling pressure may make it harder for Sable to raise additional capital from the equity markets, despite needing the cash.

Of course, there is another way Sable could bring in some much needed funds: selling the jet, the acquisition of which is now looking like quite a good deal.

Those 600,000 Sable shares exchanged for the Citation are now worth about $4 million. Same model Citations from that period are priced between $13.5 million and $14.5 million, according to an online private jet brokerage.

It may not be a terrible option to secure an extra few weeks of burn. There are plenty of commercial flights between Houston and Baton Rouge on Saturdays.

Authors

Sam Koppelman is a New York Times best-selling author who has written books with former United States Attorney General Eric Holder and former United States Acting Solicitor General Neal Katyal. Sam has published in the New York Times, Washington Post, Boston Globe, Time Magazine, and other outlets — and occasionally volunteers on a fire speech for a good cause. He has a BA in Government from Harvard, where he was named a John Harvard Scholar (taking much easier classes than Dhruv!) and wrote op-eds like “Shut Down Harvard Football,” which he tells us were great for his social life. Sam is based in New York.

Blake Spendley joined Hunterbrook from the Center for Naval Analyses (CNA), where he led investigations as a Research Specialist for the Marine Corps and US Navy. He built and owns the leading open-source intelligence (OSINT) account on X/Twitter, called @OSINTTechnical (over 1 million followers), which also distributes Hunterbrook Media reporting. His OSINT research has been published in Bloomberg, the Wall Street Journal, and The Economist, among other top business outlets. He has a BA in Political Science from USC.

Till Daldrup joined Hunterbrook from The Wall Street Journal, where he focused on open-source investigations and content verification. In 2023, he was part of a team of reporters who won a Gerald Loeb Award for an investigation that revealed how Russia is stealing grain from occupied parts of Ukraine. He has an M.A. in Journalism from New York University and a B.S. in Social Sciences from University of Cologne. He’s also an alum of the Cologne School of Journalism (Kölner Journalistenschule). Till is based in New York.

Editor

Wendy Nardi joined Hunterbrook after working as a developmental and copy editor for academic publishers, government agencies, Fortune 500 companies, and international scholars. She has been a researcher and writer for documentary series and a regular contributor to The Boston Globe. Her other publications range from magazine features to fiction in literary journals. She has an MA in Philosophy from Columbia University and a BA in English from the University of Virginia.

Hunterbrook Media publishes investigative and global reporting — with no ads or paywalls. When articles do not include Material Non-Public Information (MNPI), or “insider info,” they may be provided to our affiliate Hunterbrook Capital, an investment firm which may take financial positions based on our reporting. Subscribe here. Learn more here.

Please email ideas@hntrbrk.com to share ideas, talent@hntrbrk.com for work, or press@hntrbrk.com for media inquiries.

LEGAL DISCLAIMER

© 2025 by Hunterbrook Media LLC. When using this website, you acknowledge and accept that such usage is solely at your own discretion and risk. Hunterbrook Media LLC, along with any associated entities, shall not be held responsible for any direct or indirect damages resulting from the use of information provided in any Hunterbrook publications. It is crucial for you to conduct your own research and seek advice from qualified financial, legal, and tax professionals before making any investment decisions based on information obtained from Hunterbrook Media LLC. The content provided by Hunterbrook Media LLC does not constitute an offer to sell, nor a solicitation of an offer to purchase any securities. Furthermore, no securities shall be offered or sold in any jurisdiction where such activities would be contrary to the local securities laws.

Hunterbrook Media LLC is not a registered investment advisor in the United States or any other jurisdiction. We strive to ensure the accuracy and reliability of the information provided, drawing on sources believed to be trustworthy. Nevertheless, this information is provided "as is" without any guarantee of accuracy, timeliness, completeness, or usefulness for any particular purpose. Hunterbrook Media LLC does not guarantee the results obtained from the use of this information. All information presented are opinions based on our analyses and are subject to change without notice, and there is no commitment from Hunterbrook Media LLC to revise or update any information or opinions contained in any report or publication contained on this website. The above content, including all information and opinions presented, is intended solely for educational and information purposes only. Hunterbrook Media LLC authorizes the redistribution of these materials, in whole or in part, provided that such redistribution is for non-commercial, informational purposes only. Redistribution must include this notice and must not alter the materials. Any commercial use, alteration, or other forms of misuse of these materials are strictly prohibited without the express written approval of Hunterbrook Media LLC. Unauthorized use, alteration, or misuse of these materials may result in legal action to enforce our rights, including but not limited to seeking injunctive relief, damages, and any other remedies available under the law.