Hunterbrook Media’s investment affiliate, Hunterbrook Capital, does not have any positions related to this article at the time of publication. Positions may change at any time. Full disclosures below.

The eyes of the fashion world are on the runways of New York Fashion Week, but this season’s hottest event is in a Manhattan federal courtroom where style comes to die.

On the docket is the potential $8.5 billion acquisition of Capri Holdings Ltd. (NYSE: $CPRI) — owner of Michael Kors, Versace, and Jimmy Choo — by Tapestry Inc. (NYSE: $TPR), owner of Coach, Kate Spade, and Stuart Weitzman. This spring, the Federal Trade Commission sued to prevent The Avengers of Average American Handbags from forming.

The FTC’s case hinges on establishing that a distinct market exists in between everyday goods and true luxury: the so-called accessible luxury market for handbags. Although there are countless handbag and purse makers worldwide, the agency argues that combining Tapestry and Capri’s iconic but affordable brands would harm lower- and middle-income consumers who want high status without high price tags.

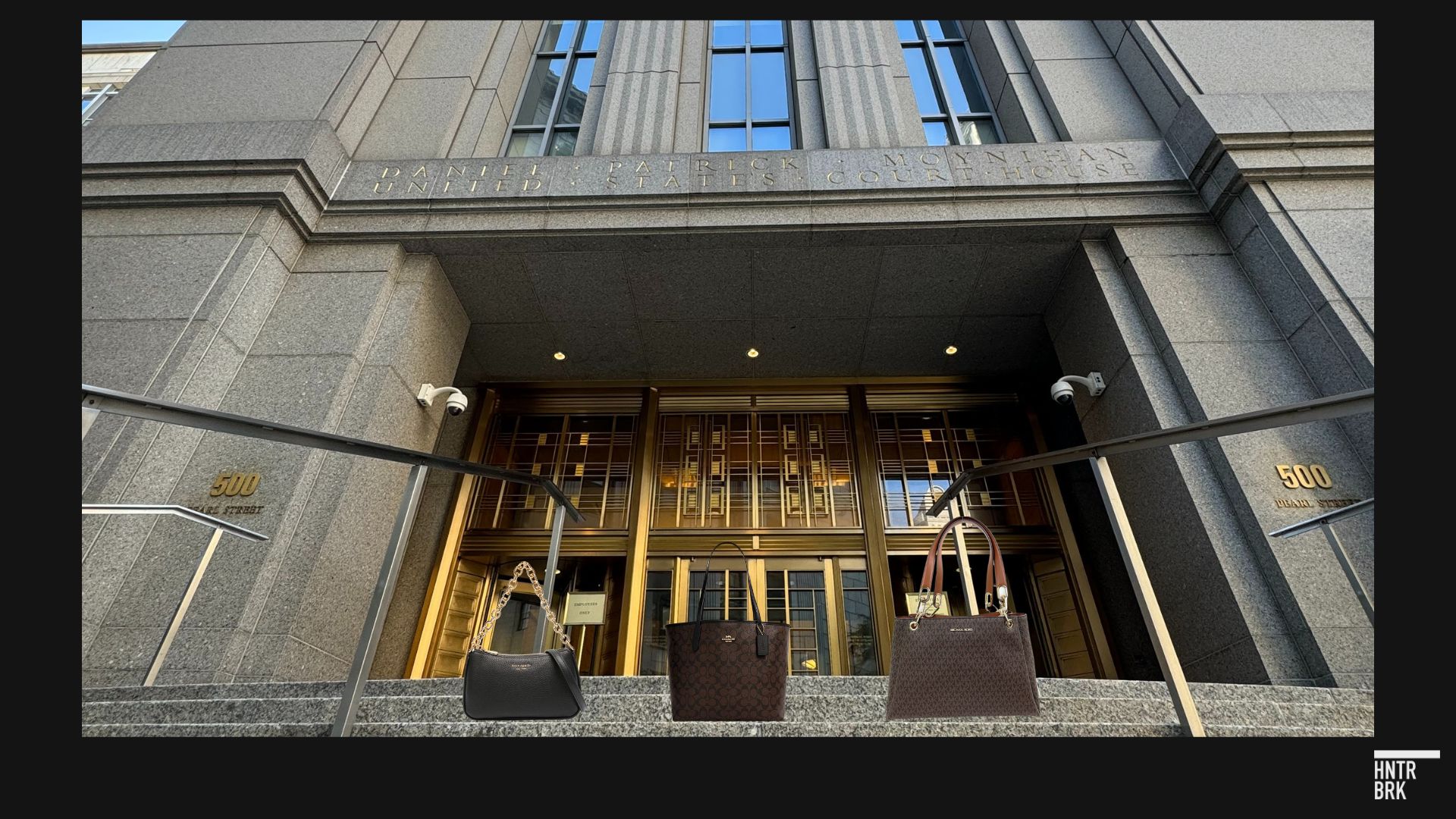

On Monday, the war against the handbag-industrial complex kicked off in Judge Jennifer Rochon’s 20th-floor courtroom at the Daniel Patrick Moynihan United States Courthouse. It was momentarily transformed into a showroom as Tapestry’s lawyers catwalked a half-dozen carts of handbags down the center aisle to aid their case.

Lawrence Buterman, a lawyer for Tapestry, called the FTC’s crusade “completely divorced from reality.”

“Customers are inundated by choices for handbags,” he said, from “Des Moines to Manhattan.”

In an administrative complaint filed in April, the FTC claimed that the acquisition would create an anticompetitive “colossus” in the “‘accessible luxury’” market, a category below brands like Louis Vuitton and Hermes.

The FTC’s decision to target Met Gala brands whose consumers are often associated with Madison Avenue rather than Main Street has drawn ire from some critics of Lina Khan, the progressive chair of the trust-busting agency. But William Kovacic, a former FTC chairperson, told Hunterbrook Media the 5-0 vote to bring the case — from three Democratic and two Republican commissioners — is an indication that the FTC believes it has a strong chance at victory.

“That’s a pretty reliable signal that the board as a whole … thinks this was a good case and that they believe they have some good evidence to back it up,” said Kovacic.

The former chairperson added that one motivation the FTC may have had in bringing the case is the precedent it could set, despite the acquisition’s impact on a more privileged population than, say, the Albertsons-Kroger merger, which the FTC is also currently challenging. “I assume they’re interested in demonstrating that you can define markets in narrower terms, that you can define them in terms of niches that exist within a larger product category,” he said. “I’m assuming that one possible priority is to use this case as a vehicle to do that.”

The FTC has framed its case as being about the welfare of consumers. “This case is about the millions of Americans who will suffer harm — in the form of higher prices, fewer discounts and promotions, and reduced innovation,” the FTC wrote in a filing supporting its motion for a preliminary injunction, arguing that “lower- and middle-income women … comprise the majority of Coach, Kate Spade, and Michael Kors handbag customers.”

A lawyer for Tapestry argued on Monday that consumers will not be harmed by the merger because buying a handbag “is a want, not a must.” But experts say the case will not come down to harm alone. It will also depend upon whether the FTC can clearly define the accessible luxury market and the players that operate in it.

“Even though the economic theory of harm is going to turn on economic expert evidence about how important these two businesses are as constraints on one another, the law is still pretty interested in markets and structural information,” said Daniel Francis, a former deputy director of the FTC Bureau of Competition. “Judges and courts pay a lot of attention to that.”

One lawyer for Tapestry argued on Monday that the accessible luxury category is ill-defined and its subsidiaries have dozens of competitors, from Lululemon and Marc Jacobs to Calvin Klein and Ralph Lauren. He noted that most FTC cases are about a market narrowing from 4 to 3 or 3 to 2 participants, not “244 to 243.”

The FTC has pointed out that Tapestry’s own executives have used a similar term to define the accessible luxury market and have “acknowledged this distinct product segment” in SEC filings. Some internal records from the two companies have yet to be revealed; others were cited by counsel and made visible to the judge, but not to the public.

Morningstar analyst David Swartz told Hunterbrook that Coach, Kate Spade, and Michael Kors would have healthy competition in the mid-tier market. “These are not brands that sell a lot of handbags in the four-digit category,” he noted. “There are direct competitors like Tory Burch … and Telfar, which has been a growth story in recent years.”

The case involves complex statistical models that courts use to measure the concentration of markets — like diversion ratios and the Herfindahl-Hirschman Index — but one reason it has captivated so many is that it also implicates an age-old question: What even is luxury? And can it be accessible?

Coco Chanel, the French designer behind the eponymous brand, is purported to have stated that “Luxury is a necessity that begins where necessity ends.”

Devorah Ezagui, the influencer and stylist behind the Class of Palm Beach Instagram account, which tracks ritzy getups on the getaway island, described luxury as “more like a feeling” in an interview with Hunterbrook.

“It’s definitely exclusive. It’s higher quality than just anything else,” she said about the term. “When you wear it, it’s prestigious.”

During its opening statement, the FTC described accessible luxury as “handbags made with high craftsmanship sold at affordable prices,” largely above the mass market category of less than $100 and below the so-called true luxury category of greater than $1,000. A lawyer for Tapestry countered on Monday that at least in one category analysis, the majority of Michael Kors and Kate Spade handbags ultimately fall outside that band, claiming an average price of $92 per bag.

But pinpointing which “exclusive” and “prestigious” labels fit into a doesn’t-hurt-the-wallet market is challenging, according to interviews with top shoppers. Melissa Polo Landau, a New York City-based stylist, told Hunterbrook that Coach occupies its own lane distinct from Kate Spade and Michael Kors. “It’s like the beginning of the luxury market,” she said about Coach.

Ezagui, meanwhile, said Kate Spade and Coach are on equal footing in the luxury market. She said sightings of the Michael Kors brand, however, have dipped on the island of Palm Beach, whose residents include some of the world’s wealthiest people. “You don’t really see people wearing Michael Kors, not in Palm Beach,” she said. “Maybe, like, West Palm Beach.”

Jean Shafiroff, a socialite who bops between point-one-percent locales like Palm Beach, the Hamptons, and Manhattan, said she is a fan of Michael Kors products. “I remember buying some of Michael Kors’ big bags. I was traveling to places like Cambodia, China, and they were really perfect,” she told Hunterbrook. “I think there’s a tremendous market for that mid-market.”

The FTC declined to comment on the case to Hunterbrook. In a statement, a Tapestry spokesperson said “the evidence will show that Tapestry’s acquisition of Capri is a pro-competitive deal that will benefit consumers.”

Investors seem torn on the deal’s chances. A couple of days into the trial, Capri traded up to around $39, still well below the $57 per share Tapestry committed to pay in the acquisition, suggesting a strong possibility in Wall Street’s eyes that the government could prevail.

But some investors have a different view. Paul Cerro, the chief investment officer of investment fund Cedar Grove Capital Management, who told Hunterbrook Media he has bet on Capri’s stock, called the FTC’s case “baseless.”

“It’s not even throwing wet spaghetti at a wall to see what sticks. It’s not even wet,” he said of the FTC’s argument. “They’re just throwing dry spaghetti at a wall and hoping it’s going to stick.”

The FTC has argued that the tie-up would make it harder for new fashion labels to emerge. Cerro said that the fashion industry has low barriers to entry and many competitors could emerge.

“Another brand could pop up tomorrow. That’s how easy it is,” he said, contrasting this acquisition to the recently blocked JetBlue-Spirit Airlines deal. “It’s not like you have to start leasing new aircraft and find airport gates and stuff. I could manufacture a handbag tomorrow.”

Other investors are more concerned Judge Rochon could side with her fellow President Biden appointee Lina Khan. But because she only began serving in 2022; has not yet ruled on an antitrust case; and spent her last decade as General Counsel for the Girl Scouts of the USA, Wall Street has resorted to reading horoscopes and shaking Magic 8 Balls between CNBC segments.

In private practice, Judge Rochon represented ALZA Corporation in a commercial antitrust trial — back in the early 2000s, when she was an associate at a New York law firm.

But that was a long time ago — and more recently, her nomination to the bench was championed by Democratic Senator Kirsten Gillibrand. And when the Judiciary Committee pried for information about her family members, she didn’t share much more than the fact that one of her brothers-in-law has been involved with the progressive judicial advocacy group the Alliance for Justice and another is a police officer in Michigan.

Wall Street’s uncertainty may explain why the courthouse was packed on Monday morning — with crowds spilling into multiple overflow rooms — from which investors listened to arguments in-person.

In the first overflow room on the 20th floor, a man in the front row yawned repeatedly. Behind him, in two more rows of men, another man — in the archetypal fleece vest of a “finance bro” — was listening intently.

Across the room, there appeared to be more such vests than handbags: only about a quarter of the audience were women, a ratio seemingly mirrored in the video cast of the main courtroom. Another audience member with a tan, leather-looking handbag shared, “It’s just Kitayama, it’s not —” and gestured at the video-cast of the better-known brands rolled into the main courtroom.

In the first overflow courtroom, the audio cut out minutes into the FTC’s opening statement. The audience groaned. Several rushed to the second overflow room, on the 23rd floor.

“It’s not ready,” said the security guard outside.

In the elevator back down three floors, a man who said he worked at Susquehanna, a quantitative trading firm, remarked: “What a shitshow.”

It was a sentiment mirrored by Tapestry’s lawyer — as he emphasized, twice, that the majority of Michael Kors and Kate Spade bags do not fall in the FTC’s purported accessible luxury price range and highlighted what he saw as contradictions in the government’s argument.

“As a result, your honor,” he summarized, “it’s a mess.”

Author

Andrew Zucker is a freelance journalist whose writing has appeared in The New York Times, The Financial Times, The Washington Post, and Vanity Fair, among other publications.

Hunterbrook Media publishes investigative and global reporting — with no ads or paywalls. When articles do not include Material Non-Public Information (MNPI), or “insider info,” they may be provided to our affiliate Hunterbrook Capital, an investment firm which may take financial positions based on our reporting. Subscribe here. Learn more here.

Please contact ideas@hntrbrk.com to share ideas, talent@hntrbrk.com for work opportunities, and press@hntrbrk.com for media inquiries.

LEGAL DISCLAIMER

© 2026 by Hunterbrook Media LLC. When using this website, you acknowledge and accept that such usage is solely at your own discretion and risk. Hunterbrook Media LLC, along with any associated entities, shall not be held responsible for any direct or indirect damages resulting from the use of information provided in any Hunterbrook publications. It is crucial for you to conduct your own research and seek advice from qualified financial, legal, and tax professionals before making any investment decisions based on information obtained from Hunterbrook Media LLC. The content provided by Hunterbrook Media LLC does not constitute an offer to sell, nor a solicitation of an offer to purchase any securities. Furthermore, no securities shall be offered or sold in any jurisdiction where such activities would be contrary to the local securities laws.

Hunterbrook Media LLC is not a registered investment advisor in the United States or any other jurisdiction. We strive to ensure the accuracy and reliability of the information provided, drawing on sources believed to be trustworthy. Nevertheless, this information is provided "as is" without any guarantee of accuracy, timeliness, completeness, or usefulness for any particular purpose. Hunterbrook Media LLC does not guarantee the results obtained from the use of this information. All information presented are opinions based on our analyses and are subject to change without notice, and there is no commitment from Hunterbrook Media LLC to revise or update any information or opinions contained in any report or publication contained on this website. The above content, including all information and opinions presented, is intended solely for educational and information purposes only. Hunterbrook Media LLC authorizes the redistribution of these materials, in whole or in part, provided that such redistribution is for non-commercial, informational purposes only. Redistribution must include this notice and must not alter the materials. Any commercial use, alteration, or other forms of misuse of these materials are strictly prohibited without the express written approval of Hunterbrook Media LLC. Unauthorized use, alteration, or misuse of these materials may result in legal action to enforce our rights, including but not limited to seeking injunctive relief, damages, and any other remedies available under the law.