Based on Hunterbrook Media’s reporting, Hunterbrook Capital is short $WULF and long $CORZ at the time of publication. Positions may change at any time. See full disclosures below.

For years, two words defined TeraWulf’s brand: “Zero Carbon.”

That message — claiming that TeraWulf was a “zero-carbon” bitcoin miner and “accelerating the transition to a zero-carbon future” — had been plastered all over the company’s homepage, the banner on its X account, its monthly production updates, and even its filings with the SEC. (In its most recent 10-K, TeraWulf wrote: “As of December 31, 2023, 95% of TeraWulf’s mining operations were fueled by zero-carbon energy, reflecting our dedication to sustainability.”)

But TeraWulf Inc. (NASDAQ: $WULF) has been quietly walking back these claims in the months since Hunterbrook Media published an investigation in August revealing that the energy TeraWulf uses at Lake Mariner — its flagship mining facility in upstate New York responsible for over three-quarters of its total energy consumption — cannot be legally claimed as renewable.

The “green” narrative was also part of TeraWulf’s case for why it would receive a major AI data center contract. “All these guys want to be able to be out there saying that they are sensitive to ESG guidelines,” CEO Prager told an interviewer, referring to potential customers for TeraWulf’s data centers.

In reality, The New York Power Authority, which supplies 45% of the energy used at Lake Mariner, told Hunterbrook via email: “None of the power that NYPA provides the firm can be claimed as renewable power.”

The rest of Lake Mariner’s power is sourced to the New York grid — which does not come with any legally recognizable renewable attributes, according to another government body, the New York State Energy Research and Development Authority. NYSERDA told Hunterbrook that the only way TeraWulf could legally substantiate its zero-carbon claims is by purchasing renewable energy credits, but a TeraWulf spokesperson confirmed in August that the company had not done so.

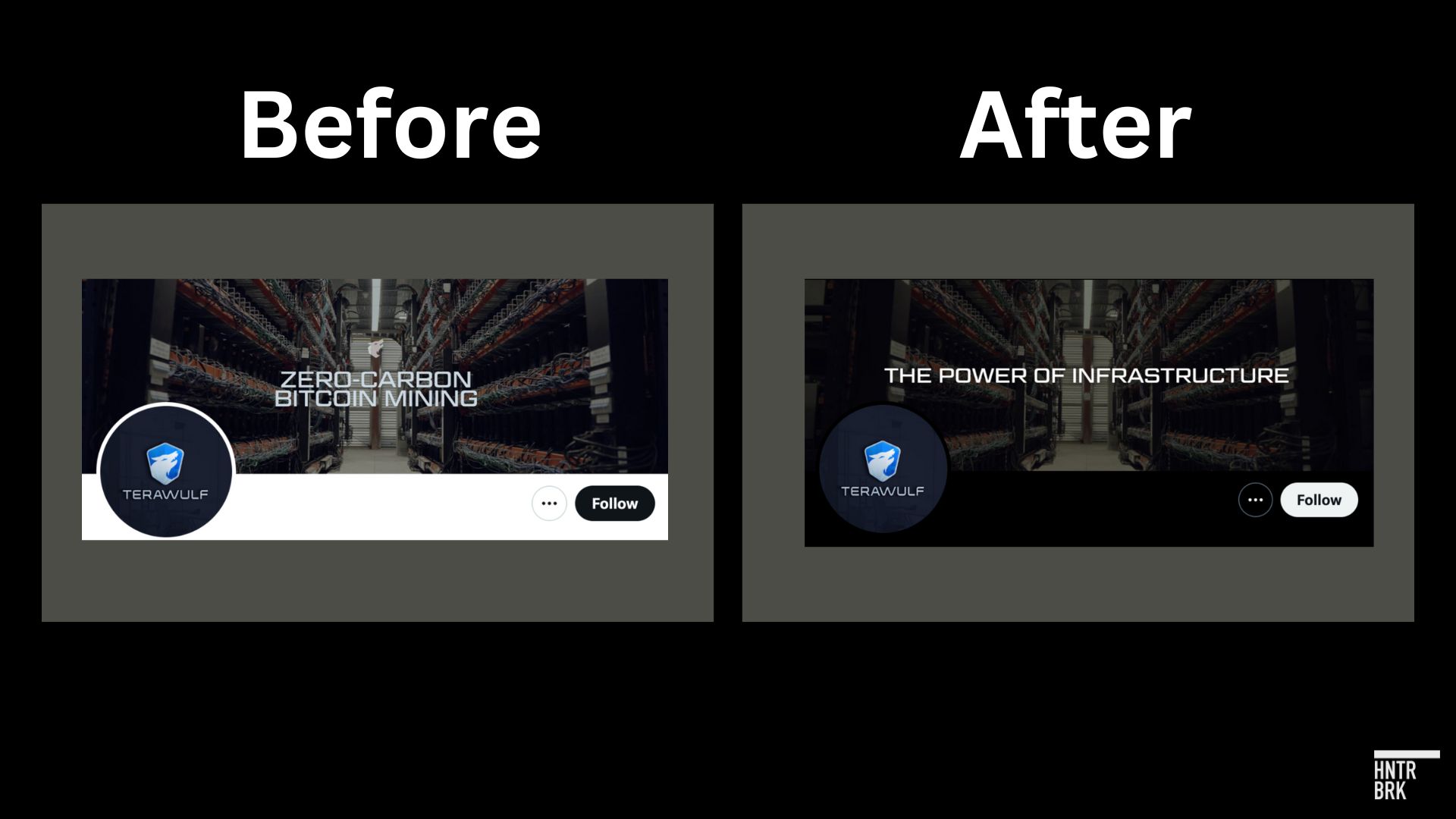

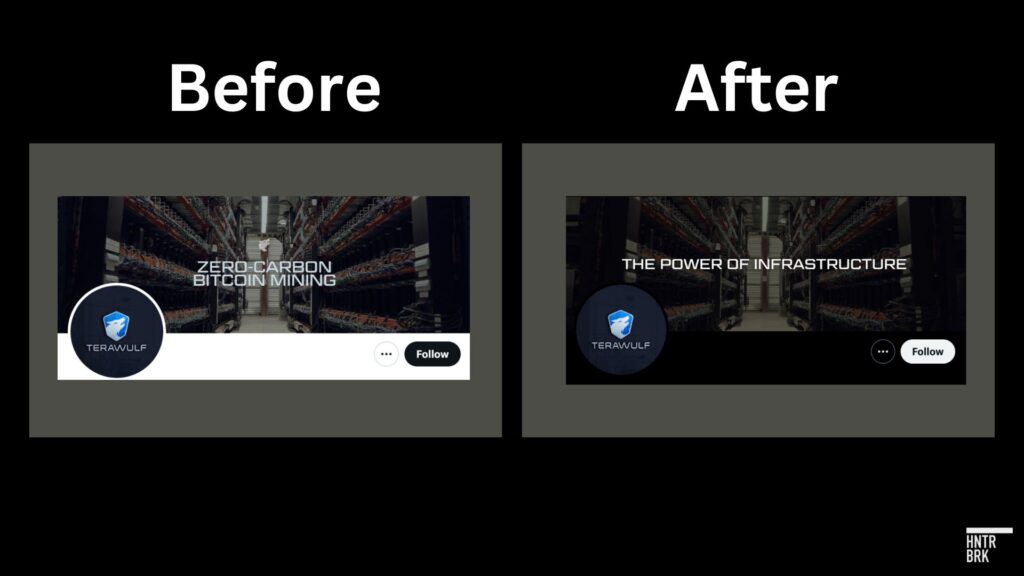

On its homepage, bold letters that once greeted visitors with a description of the company as “accelerating the transition to a zero-carbon future” have been conspicuously replaced with a more neutral message: “The power of infrastructure.”

The company has also replaced the banner on its X social media page with one that no longer includes the zero-carbon messaging.

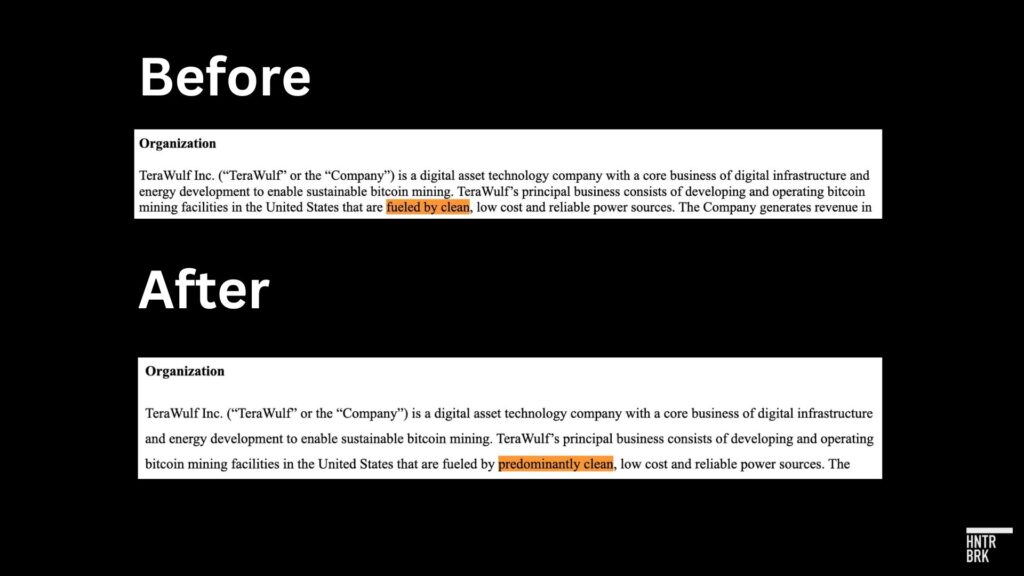

In a recent quarterly 10-Q report filed with the SEC prior to Hunterbrook’s August publication, the company had described its mining facilities as being “fueled by clean, low cost and reliable power sources.” In a subsequent report — submitted eight days after our publication — the company tweaked that language to read: “fueled by predominantly clean, low cost and reliable power sources.” (Emphasis added by Hunterbrook.)

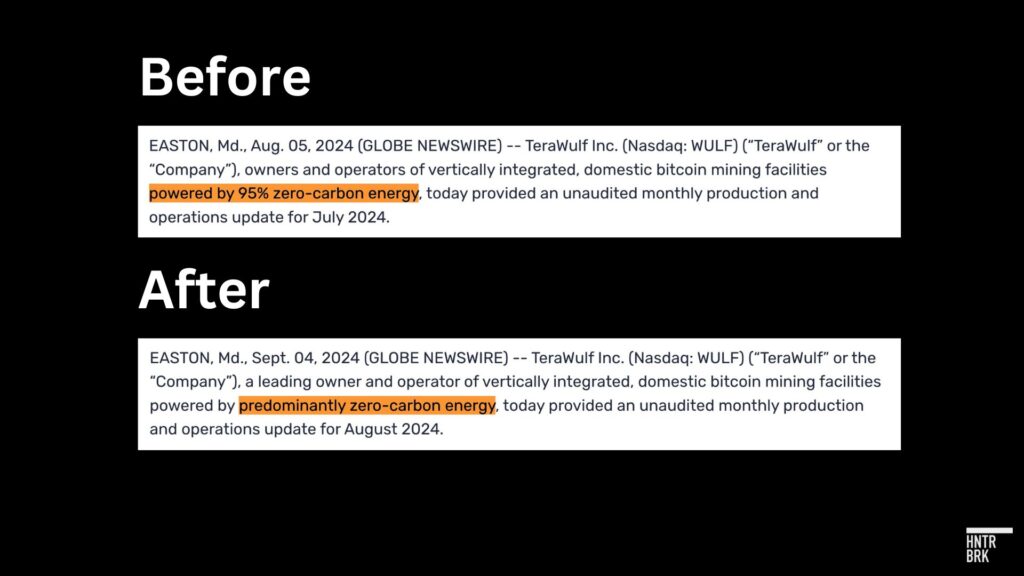

The same change is seen in the company’s monthly production updates before and after our publication:

TeraWulf did not respond to Hunterbrook’s question whether the change in the language is in response to regulatory action or updated legal analysis of the accuracy of the company’s statements.

But Stanley Keller, a corporate and securities lawyer at law firm Locke Lord LLP, told Hunterbrook that “if a company has made claims that turn out not to be correct — if that’s the case, and it’s certainly indicated by moderating their disclosure — it’s somewhat of an invitation for the SEC to look into it and, if appropriate, bring an enforcement action.”

He said he had not looked into specifics about TeraWulf but mentioned the SEC has been interested in greenwashing, citing a recent action against Keurig Dr. Pepper. In the September 10 enforcement action, the SEC charged Keurig Dr Pepper with making inaccurate statements regarding the recyclability of its K-Cup single use beverage pods. To settle the SEC’s charges, Keurig agreed to pay a $1.5 million civil penalty.

And it’s unclear whether adding the word “predominantly” improves the accuracy of TeraWulf’s claims at all, especially since TeraWulf has just sold its minority stake in Nautilus Cryptomine — the only operation that TeraWulf could legitimately claim as zero-carbon.

Nautilus, which had been responsible for 26% of TeraWulf’s total energy use, had sourced its power from an adjacent nuclear plant owned by TeraWulf’s joint venture partner Talen Energy Corp. (NASDAQ: $TLN).

TeraWulf Claims Sale of Stake in Nautilus, Home to “Arguably the Lowest Cost Power in the Sector,” Was Strategic — But Questions Remain On Whether It Was Purely Voluntary

TeraWulf described the sale of its 25% stake in Nautilus to Talen Energy — valued at “approximately $92 million, resulting in a 3.4x return on investment” — as a strategic move that will “help fuel expansion of HPC/AI and bitcoin mining at the Company’s wholly-owned Lake Mariner facility.”

Prior to the sale, however, TeraWulf had touted the Nautilus facility as having a “long-term, zero-carbon power supply” at an “unmatched power cost of just 2 cents per kilowatt hour.” And TeraWulf still had more than three years left to enjoy that low-cost power under the five-year contract with Talen Energy, “with two successive three-year renewal options.”

“Cost of power is arguably the most important metric when considering the success of a miner,” cofounder and Chief Financial Officer Nazar Khan had said in March. “TeraWulf is positioned exceptionally favorably … averaging around 3.5 cents across our two sites.”

Without Nautilus, TeraWulf’s energy cost becomes an unexceptional 4.8 cents per kilowatt hour — closer to the industry average of 5 cents/kWh — according to Hunterbrook’s analysis of TeraWulf’s monthly production and operations reports from January to September this year. While Terawaulf did not disclose the power cost by facility, the power cost for Lake Mariner can be solved with the following equation, based on its monthly published average power costs and assuming the 2 cents power cost at Nautilus as claimed by TeraWulf: 0.042 = [(0.02*50) + (x*195)] / 245. Solving for x, the power cost at Lake Mariner is approximately 4.76 cents per kWh. The average power cost for both sites from January and September was 4.2 cents/kWh.

The transaction also appears oddly timed, considering the company had just earlier this year exercised its option to double the capacity to 100 megawatts at the Nautilus site, expected to come online in 2025 and bring “significant benefits for TeraWulf.”

And Talen — more so than TeraWulf — had seemed interested in ending the contract. In the August 5 publication, Hunterbrook noted that Talen had already sold the larger data center campus on which Nautilus is located to Amazon Web Services for $650 million in March. The article mentioned that Talen was looking to sell its share of Nautilus as well, according to a Reuters report in the same month.

Hunterbrook also reported that Talen’s filings state that the terms of its lease with TeraWulf allow it to terminate that lease at any time, without TeraWulf’s consent, and that Talen had already transferred the lease to an AWS affiliate — at least raising the possibility that AWS exercised its right to terminate the lease as part of its larger plan for the data center.

Neither AWS nor Talen responded to Hunterbrook’s email asking if TeraWulf’s lease was terminated.

But in a press release following the deal, a Talen executive said: “The transaction allows Talen the ability to reset a legacy below-market Power Purchase Agreement … in order to maximize the value per megawatt for our Susquehanna nuclear generation facility.’”

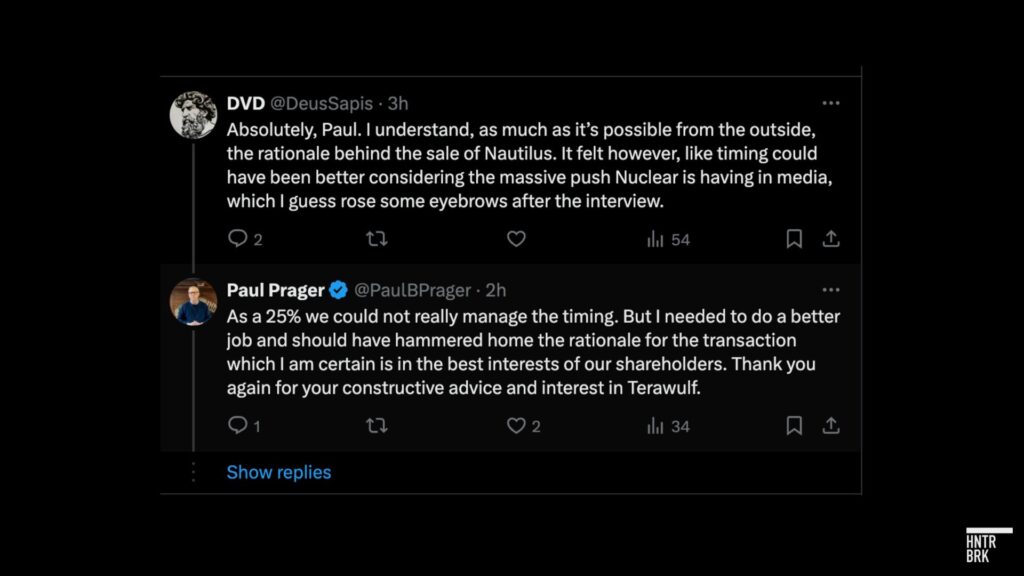

And TeraWulf’s CEO himself seems to have let it slip that the sale wasn’t voluntary — veering off the company’s script framing it positively. In a response to a comment on X about the inopportune timing of the sale, Paul Prager wrote, “As a 25% we could not really manage the timing.”

Author

Jenny Ahn joined Hunterbrook after serving many years as a senior analyst in the US government. She is a seasoned geopolitical expert with a particular focus on the Asia-Pacific and has diverse overseas experience. She has an MA in International Affairs from Yale and a BS in International Relations from Stanford. Jenny is based in Virginia.

Editor

Sam Koppelman is a New York Times best-selling author who has written books with former United States Attorney General Eric Holder and former United States Acting Solicitor General Neal Katyal. Sam has published in the New York Times, Washington Post, Boston Globe, Time Magazine, and other outlets.

Hunterbrook Media publishes investigative and global reporting — with no ads or paywalls. When articles do not include Material Non-Public Information (MNPI), or “insider info,” they may be provided to our affiliate Hunterbrook Capital, an investment firm which may take financial positions based on our reporting. Subscribe here. Learn more here.

Please contact ideas@hntrbrk.com to share ideas, talent@hntrbrk.com for work opportunities, and press@hntrbrk.com for media inquiries.

LEGAL DISCLAIMER

© 2026 by Hunterbrook Media LLC. When using this website, you acknowledge and accept that such usage is solely at your own discretion and risk. Hunterbrook Media LLC, along with any associated entities, shall not be held responsible for any direct or indirect damages resulting from the use of information provided in any Hunterbrook publications. It is crucial for you to conduct your own research and seek advice from qualified financial, legal, and tax professionals before making any investment decisions based on information obtained from Hunterbrook Media LLC. The content provided by Hunterbrook Media LLC does not constitute an offer to sell, nor a solicitation of an offer to purchase any securities. Furthermore, no securities shall be offered or sold in any jurisdiction where such activities would be contrary to the local securities laws.

Hunterbrook Media LLC is not a registered investment advisor in the United States or any other jurisdiction. We strive to ensure the accuracy and reliability of the information provided, drawing on sources believed to be trustworthy. Nevertheless, this information is provided "as is" without any guarantee of accuracy, timeliness, completeness, or usefulness for any particular purpose. Hunterbrook Media LLC does not guarantee the results obtained from the use of this information. All information presented are opinions based on our analyses and are subject to change without notice, and there is no commitment from Hunterbrook Media LLC to revise or update any information or opinions contained in any report or publication contained on this website. The above content, including all information and opinions presented, is intended solely for educational and information purposes only. Hunterbrook Media LLC authorizes the redistribution of these materials, in whole or in part, provided that such redistribution is for non-commercial, informational purposes only. Redistribution must include this notice and must not alter the materials. Any commercial use, alteration, or other forms of misuse of these materials are strictly prohibited without the express written approval of Hunterbrook Media LLC. Unauthorized use, alteration, or misuse of these materials may result in legal action to enforce our rights, including but not limited to seeking injunctive relief, damages, and any other remedies available under the law.