Based on Hunterbrook Media’s reporting, Hunterbrook Capital is short $PLUG at the time of publication. Positions may change at any time. See full disclosures below.

Plug Power Inc. (NASDAQ: $PLUG) understated the water usage of its hydrogen plants, reporting figures almost eight times lower than actual levels, according to a Hunterbrook Media review of groundwater withdrawal permits, permit applications, and purchase agreements. The revelation could complicate Plug’s development plans in dry areas like Texas, where Plug had hoped to expand but does not appear to have secured sufficient water access.

Asked to explain these discrepancies, Plug did not respond to Hunterbrook’s repeated requests for comment.

These inconsistent statements could threaten Plug’s ability to close its $1.66 billion conditional loan from the Department of Energy, according to lawyers familiar with the loan approval process. The planned facility in Texas is part of Plug’s loan application and adequate access to inputs like water is one of the DOE’s criteria for approving project loans.

The DOE loan is a critical lifeline for Plug, the once high-flying hydrogen player that has seen its market cap plummet from more than $30 billion in 2021 to about $2 billion today as investors soured on hydrogen hype.

The loan has already received scrutiny from a top Senate Republican earlier this year. Now it faces the threat of a Trump administration, whose pick to run the DOE has said he does not believe in climate change or the idea of an energy transition.

In November, Plug added a disclosure to its SEC filing to this effect, writing that “whether and when our DOE loan guarantee will be funded is subject to a number of factors outside of our control, including political administration changes, legislative enactments, administrative actions.”

As Plug awaits the verdict, and amid an ongoing cash crunch, it has quietly walked back promised expansions — and stayed mum on others.

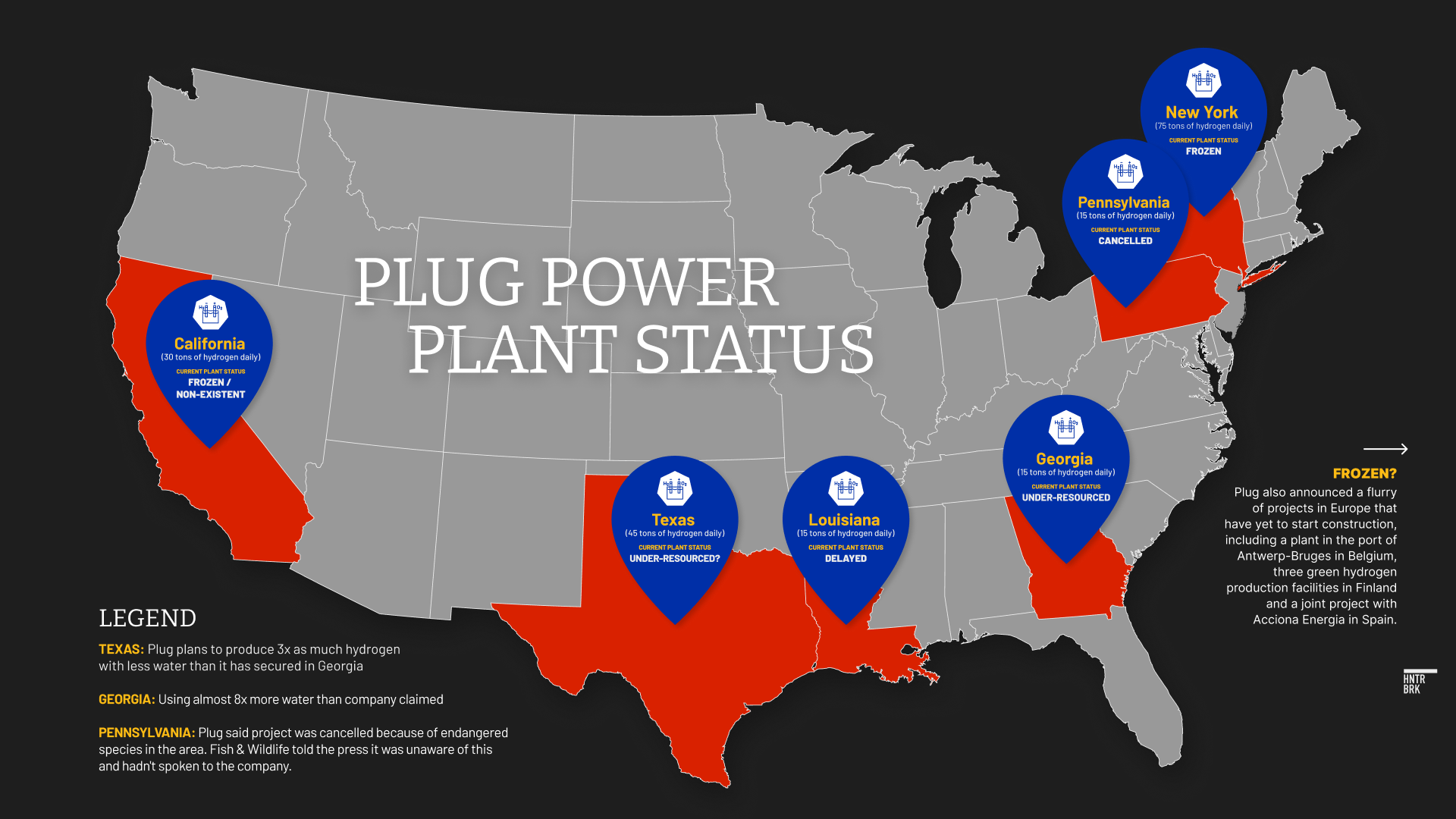

Earlier this year, Plug put its keystone New York project on ice, a Heatmap investigation revealed. The company’s joint venture with Olin Corp. (NYSE: $OLN) in Louisiana, originally scheduled to launch in 2024, has also been delayed. The status of several projects Plug announced in press releases remains unclear, as the company appears not to have mentioned them again.

Last year, Plug said it would produce 500 metric tons of green hydrogen across its facilities per day by the end of 2025. Today, Plug appears to be producing only 25 metric tons, according to Hunterbrook’s analysis. With just one 15-ton-per-day hydrogen plant in Louisiana on pace to come online next year, that will be, at best, less than 10% of the daily production the company had projected.

“It’s been a painful journey,” Plug’s CEO told the Financial Times just before reporting earnings in November, which revealed the company’s accumulated losses since its inception more than a quarter century ago have increased to more than $5 billion.

Plug’s shaky financial footing could present additional difficulties in closing the loan. Experts say long-term viability is a key focus of the Loan Program Office, especially after the 2011 collapse of Solyndra, the federally funded solar panel manufacturer that has become synonymous with failed clean energy ventures.

Hunterbrook’s analysis of Plug’s public financial documents — which will be published in a separate article — revealed limited cash due to ongoing operating losses and significant investments in working capital and expansion. Our examination also uncovered restricted cash which may not be realized; a collapse in equipment profitability following the curtailment of certain sale-leaseback transactions; continued significant losses and declining expected revenue associated with power purchase agreements and fuel deliveries; and a bloated inventory balance with questionable reserve accounting.

Plug has been in regulatory crosshairs as well. In 2023, the SEC charged Plug for failures in financial reporting, accounting, and control that necessitated a multi-year restatement of the company’s prior financial statements. The company agreed to settle these charges, which led to a $1.25 million civil fine.

The SEC’s scrutiny appears to be ongoing. In response to an October Freedom of Information Act request for documents on investigations into Plug, the SEC declined to provide anything — citing FOIA Exemption 7(A), which protects documents collected for “law enforcement purposes” from disclosure.

Later that month, correspondence between the Commission and the company related to Plug’s financial reporting was posted to the SEC’s website — an indication that the company continues to be watched closely.

Plug Underestimated Water Use By At Least a Factor of Seven at Georgia Plant, Threatening Its Expansion Plans Across U.S.

“We’re not playing this game to come in second place.”

Founded in 1997, Plug Power began as a pioneer in fuel cell technology, focusing on replacing traditional batteries in forklifts and other industrial vehicles. Its successes have included partnerships with major companies like Amazon and Walmart, which integrated Plug’s hydrogen fuel cell systems into their logistics operations to improve efficiency and reduce emissions.

But as the global energy transition has accelerated and the narrative around sustainable solutions has progressed, Plug Power has leaned into a more ambitious goal: becoming a leader in the green hydrogen economy.

“We’re not playing this game to come in second place,” CEO Andy Marsh said in a 2023 interview. “We want to be the company that people talk about in 2035 like people talk about Amazon and Google today.”

Green hydrogen — hydrogen gas that is produced using renewable energy sources — offered Plug a pathway to decarbonize hard-to-electrify sectors of the economy like heavy industry and transportation.

To achieve this vision, Plug announced plans to develop a network of hydrogen production facilities across the United States, capable of producing hundreds of tons of liquid hydrogen per day. This shift positioned the company as a key player in the global push for clean energy, but finding the resources necessary to scale green hydrogen production has proved enormously challenging.

Documents: Plug’s Water Demand Far Exceeds Company Statements

The production of green hydrogen relies on a process called electrolysis. This involves using renewable electricity to split water into hydrogen and oxygen. While the technology itself is clean, it is resource-intensive: Each kilogram of hydrogen requires several gallons of water to produce, not just for electrolysis but also for cooling systems and other operational needs. These demands can be particularly challenging in regions facing water scarcity or regulatory scrutiny, including states like Texas and California where Plug plans to operate.

A Hunterbrook Media review of documents and permits revealed that Plug has significantly overstated the water efficiency of its green hydrogen plants, calling into question the overall environmental sustainability and logistical viability of its operations.

Plug estimates on its website that the maximum water usage at its Woodbine, Georgia, facility is 74,300 gallons per day — but in reality, the company appears to consume up to almost an order of magnitude more water.

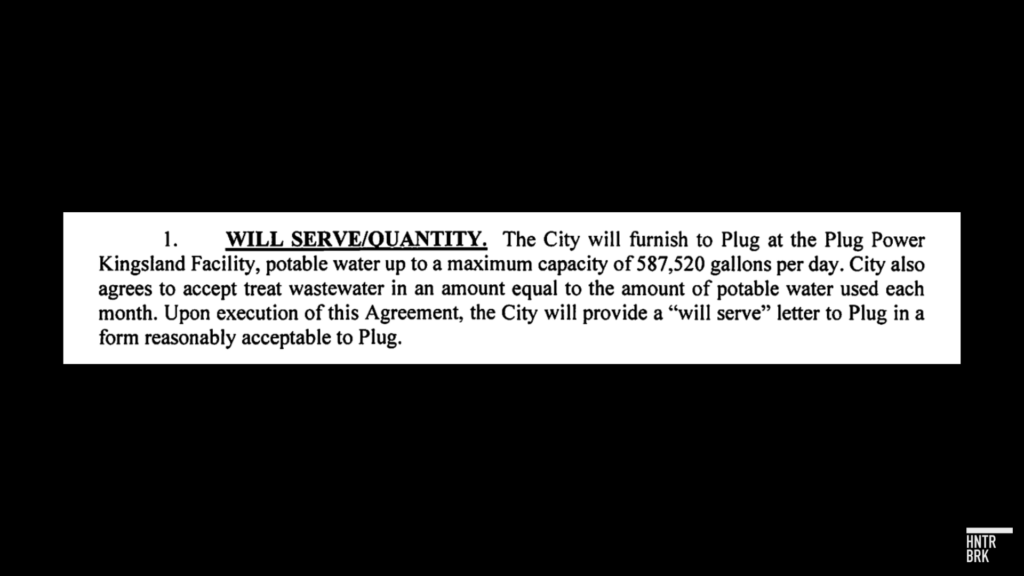

Since June 2023, Plug has had a 10-year water purchase contract for the facility with the city of Kingsland, Georgia, for up to 587,520 gallons daily — almost eight times as much as the daily maximum on its website.

According to Kingsland’s City Manager Lee Spell this water is mainly used for hydrogen production, though some also goes to Plug’s office facilities.

But even that does not appear to have been adequate.

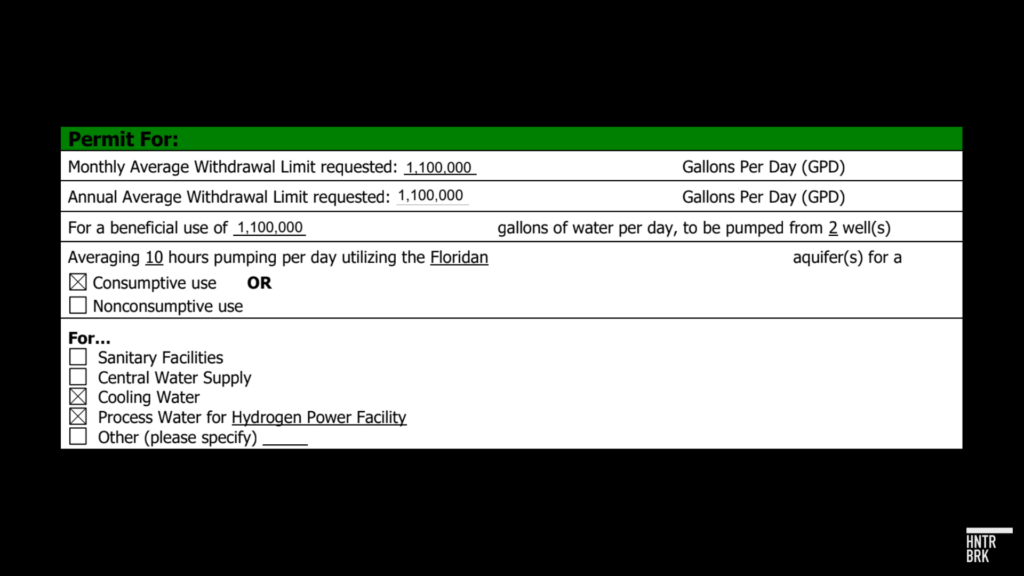

In November 2023, the company applied for a groundwater permit to withdraw up to an average of 1.1 million gallons per day for the Woodbine green hydrogen plant. Plug applied for “consumptive use,” meaning that the water is not returned to a water system, but is “evaporated, transpired, incorporated into products or crops, consumed by humans or livestock, or otherwise not available for immediate use,” according to the U.S. Geological Survey. Plug plans to drill two new wells to access the water.

In justifying its application for the new groundwater permit, Plug explicitly said that the amount of water Kingsland is able to provide is not sufficient for its plant. To meet its needs, the company said the city would have had to drill a new well and ask the Georgia Environmental Protection Division for a daily increase of 1 million gallons to Kingsland’s existing groundwater withdrawal permit.

With the new groundwater withdrawal permit and the existing water purchase contract combined, Plug could access up to almost 1.7 million gallons of water per day for its plant in Georgia. The company has said that the facility could be upgraded and its daily output of 15 metric tons of liquid hydrogen could be doubled to 30 metric tons. Assuming its estimate for water usage would double proportionate to output, that would mean Plug’s current estimate is 148,600 gallons maximum — which would still be just a tenth as much as what the company is asking to withdraw in total.

Archived versions of Plug’s webpage show that the company added the 74,300 gallons per day number after July 10, when it had already applied for the new permit.

A website version from July said that the facility Plug planned to build in New York with an output of 75 metric tons of liquid hydrogen daily (five times more than the Woodbine plant produces) would need 254,000 gallons of water per day (240,000 gallons for production and 14,000 gallons for cooling) — substantially less than Plug applied for in Georgia.

When asked about the discrepancy between the plant’s water usage it stated publicly and the water need it lists in its permit application, the company did not respond.

Plug also shared significantly lower water usage numbers with investors. In a 2023 presentation, the company stated that its electrolyzers use between 0.25 and 0.31 gallons of water per kilowatt-hour (kWh) of energy produced. But the actual number is likely more than three times higher, according to Hunterbrook’s calculations.

Based on the Georgia plant’s total daily water supply of at least 587,520 gallons — which Plug said doesn’t meet its needs — and the company’s disclosed ratio of water used for electrolysis versus cooling, Hunterbrook calculated that approximately 499,000 gallons are consumed daily for electrolysis alone. With the plant producing 15,000 kilograms of hydrogen per day — equaling about 499,500 kWh of energy — this equates to one gallon per kWh for electrolyzers. That’s more than 300% higher than Plug’s reported range, when using the company’s — potentially unrealistic — allocation of 85% of total water needs towards electrolysis, leaving only 15% for cooling needs. (The company has been inconsistent on this ratio: Plug representatives in a council meeting with the city of Graham, Texas, said that about 75% of water at the facility is used for cooling, a much higher percentage than the numbers it shared for the Georgia plant.)

Plug Power’s 2023 ESG report shows that its water consumption has jumped drastically, even before the Woodbine plant came online early this year, from about 21 million gallons in 2022 to 212 million in 2023. The company offered no explanation for this massive jump, beyond acknowledging that the way it has measured its water usage leaves room for improvement and may not be accurate.

The ESG report states: “Plug’s water metering efforts are ongoing, and the company plans to improve its measurement capabilities in the future by adding more meters and enhancing its ability to capture data. These efforts will allow the company to more accurately track its water usage and identify opportunities for conservation and efficiency improvements.”

Looking Ahead: Plug’s Water Consumption Threatens Expansion Plans

If the water usage Plug Power estimated for its plants is wrong, its expansion plans across the U.S. may be in jeopardy. This includes a green hydrogen plant Plug wants to build near Graham, Texas, in 2025.

The Graham plant is set to produce 45 metric tons of liquid hydrogen per day — three times as much as the Georgia plant. Curiously, despite the significantly higher output, and the fact that Graham’s summers tend to be notably hotter than Woodbine’s,

July is the hottest month for Woodbine — with an average high temperature of 91.3 degrees Fahrenheit. August is the hottest month for Graham — with an average high temperature of 96.1 degrees Fahrenheit.

Plug appears to anticipate that the Texas facility will use far less water.

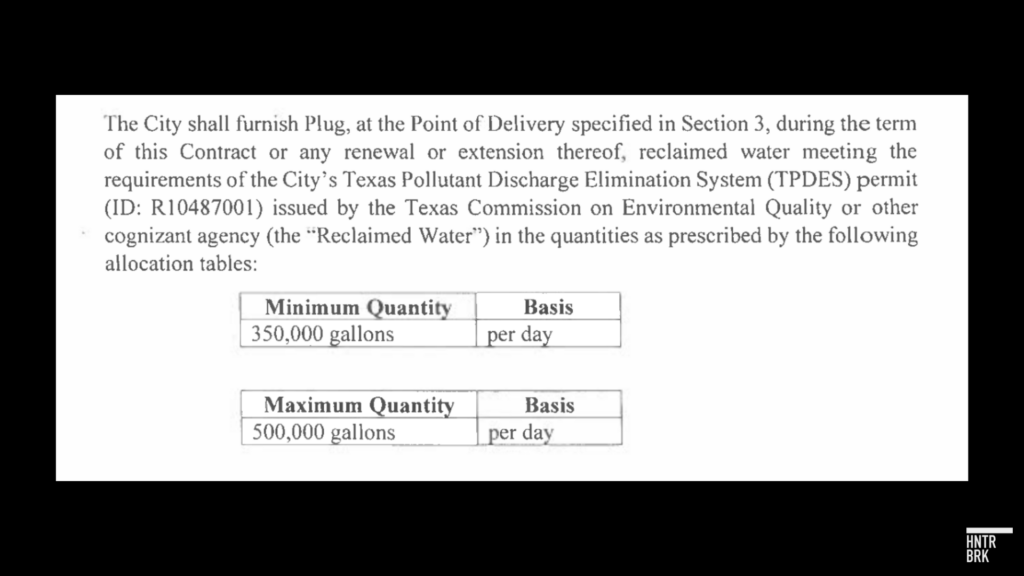

According to a water purchase agreement reviewed by Hunterbrook Media, Plug will buy a maximum of 500,000 gallons of water per day from Graham’s wastewater treatment plant, less than a third of the amount of water it purchases and applied for in Georgia.

According to Graham’s City Manager Eric Garretty, Plug also has a separate agreement with Fort Belknap Water Supply Co, a private company, to supply potable water for its office facilities at the plant. This water could technically be tapped for hydrogen production, but Garretty said that is not the purpose of the agreement, and that the water would cost multiple times more than that the water Plug receives from the city for hydrogen production.

The city says its wastewater treatment plant currently discharges about 600,000 gallons of water per day, leaving only 100,000 additional gallons Plug could tap on top of its current agreement with the city. Should the Texas plant need significantly more water than originally planned, as Plug’s facility in Georgia did, the company would have to find other water sources to keep its plant running. And it’s unclear if Graham would be willing to make further concessions to the company.

According to Eric Garretty, Graham’s City Manager, Plug could potentially secure additional water supply from a nearby lake. But getting access would depend on water availability and approval from the city. “The potential would exist to draw raw water from Lake Graham, but this circumstance would naturally be conditioned upon the availability of raw water capacity, conclusion of an agreement [with the city] to supply water from this source, and the construction of the infrastructure necessary to treat and distribute this raw water for production purposes,” Garretty wrote in an email to Hunterbrook.

Just three months after entering the project development agreement for the new plant with Plug Power in October 2023, council meeting minutes from January show that the city was already considering abandoning the deal and was consulting with an attorney. A video message posted on Facebook by Mayor Alex Heartfield in December 2023 also shows that the city immediately had second thoughts about its contract with Plug. “I know there’s been a lot of community questions and concerns about the Plug Power project, and rightfully so. I’ll tell you that city council is equally as concerned,” Heartfield says in the video. According to Garretty, the city was worried about whether it would be reimbursed on time by Plug for the waterline and pump station it is building for the new hydrogen plant. The company and the city subsequently agreed on a payment schedule to resolve the issue.

The project has been moving along: The city of Graham anticipates that testing of the new water line from its wastewater treatment plant to Plug’s new facility can begin April or May 2025. Plug says it is aiming to finish construction of the plant by late 2025.

Plug Has Only Reached 5% of Its 500-Ton Daily Production Goal So Far

Plug’s expansion to California may face similar obstacles. The company plans to build a facility producing 30 metric tons of liquid hydrogen per day — double the output of the Woodbine plant — near the city of Mendota, an area prone to droughts.

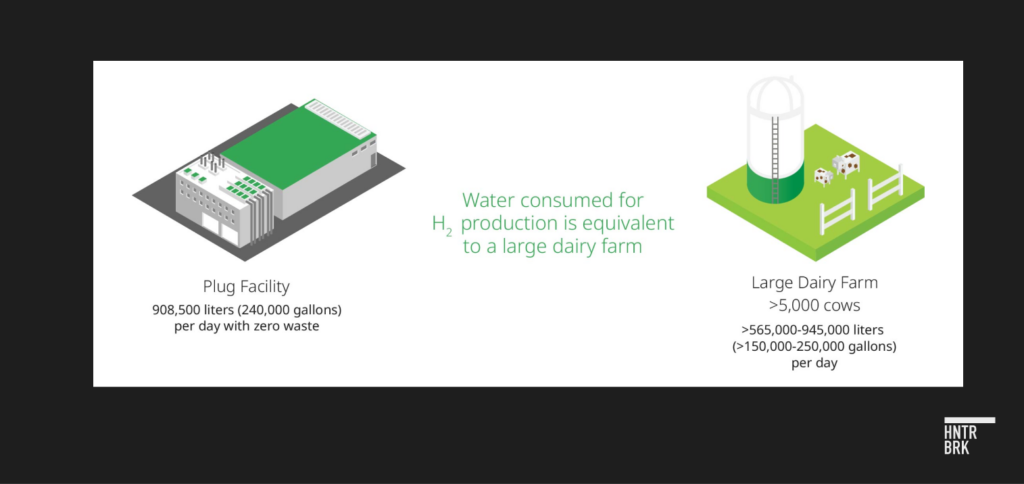

To alleviate any concerns about the hydrogen plant’s water usage, the company said it would build a tertiary wastewater treatment plant, pay for it in full, and transfer ownership to the city. The treatment plant would produce about 1.2 million gallons of water daily, 120,000 gallons of which will be used at Plug’s new plant. That’s considerably less than its other facilities’ use per ton of hydrogen produced.

One reason could be the different cooling system: The company said in a workshop session with the California Energy Commission that it will use dry cooling for the Mendota plant, which doesn’t use any water. The facility originally was supposed to break ground in early 2023 and complete commissioning in early 2024, but construction hasn’t started yet.

Several of Plug’s other construction projects are also behind schedule or have been put on hold: A plant in Louisiana, a joint venture with Olin Corporation, was supposed to come online in late 2024 but is now scheduled to be finished in early 2025.

Construction of a 75-ton-per-day plant in New York is paused, according to a Heatmap report. And an agreement Plug announced in 2022 with New Fortress Energy — a company that has faced significant hardship since Hunterbrook broke the story of its delayed Fast LNG facility — to build a 50-ton green hydrogen plant near Beaumont, Texas, apparently fell through. Green hydrogen tech startup Electric Hydrogen will provide the plant’s electrolyzers instead. Plug has not directly shared this update with investors, according to Hunterbrook’s review of the company’s filings.

Plug over the past three years also announced a flurry of projects in Europe that have yet to start construction, including a plant in the port of Antwerp-Bruges in Belgium, three green hydrogen production facilities in Finland and a joint project with Acciona Energia in Spain.

In 2022, Plug canceled plans to build a new plant in Pennsylvania. According to a local news report, the company said it had discovered that the proposed construction area was home to endangered species, citing conversations with the U.S. Fish and Wildlife Service. The agency told Lancaster Online that it doesn’t have any record of conversations with Plug, that it is unaware of any federally listed species in the area, and suggested that Plug may have spoken to state wildlife officials instead.

The only two Plug hydrogen production facilities online as of now are its plants in Tennessee and Georgia, producing a combined 25 metric tons of liquid hydrogen per day — only 5% of the 500 daily metric tons Plug wants to reach by the end of 2025.

And questions surrounding the Georgia facility persist — beyond water use.

Plug, for instance, is already pricing in federal green hydrogen tax credits included in the Inflation Reduction Act in financial filings for its Georgia facility — even though these credits may never materialize. Hydrogen companies are still waiting on guidance from the Treasury on which types of hydrogen production qualify for the new tax credit — under the rules that are expected to be finalized before the end of the year. Yesterday, Reuters broke the news that the Biden administration will allegedly be delayed in a similar initiative: finalizing its clean fuel tax credit guidance.

Plug’s Georgia facility is powered by an energy mix that also includes fossil fuels through a local grid, according to The Atlanta Journal-Constitution. Because the company buys renewable energy credits, the hydrogen produced can be called “green.” Whether the Treasury will agree with that definition in its tax credit rules is unclear.

DOE Lifeline in Limbo as Trump Administration Threatens to Slash Loan Program Office

In May, the Department of Energy announced a more than $1.6 billion conditional loan guarantee to Plug. The loan is supposed to help the company build up to six green liquid hydrogen production facilities across the country. The new facility in Texas is part of Plug’s loan application and if the company cannot guarantee sufficient raw material for the plant, including water access, the DOE may decide to not move forward with the deal, according to lawyers familiar with the loan approval process.

The loan is critical for Plug. After first being listed in public markets in 1999, and then seeing its market cap soar in 2021, Plug’s stock has crashed in recent years.

At the time the DOE loan was announced, Plug was worth less than $3 billion.

But this new lifeline could be canceled after President-elect Trump takes office, as the DOE’s Loan Program Office is in limbo and the new administration’s stance on green hydrogen remains unclear.

Since its founding in 2005, the LPO has devoted billions to funding innovative clean energy technologies, and with success: In 2010, Tesla secured a $465 million loan, which helped the company transition from producing only the luxury Roadster to developing mass-market EVs. One major setback for the LPO was the bankruptcy of Solyndra, a solar panel manufacturer that received a $535 million loan guarantee in 2009 but filed for bankruptcy in 2011.

The Biden administration revitalized the LPO in 2022 with the Inflation Reduction Act, which significantly increased the office’s lending authority from about $44 billion to $412 billion. This led to more than two dozen loan guarantees for green energy companies — including Plug’s.

But the DOE’s loan commitment is not guaranteed, even if Plug fulfills all terms and conditions that are attached to it. And unless the loan closes entirely by January 20, 2025, the new Trump administration could cancel it. (Conditional loans expire after two years — and during Trump’s first term, the LPO was, in large part, dormant.)

While not commenting specifically on Plug, Trump vowed in a speech before the Economic Club of New York in September to “rescind all unspent dollars” from the Inflation Reduction Act, which would presumably include the DOE loan to Plug if it is not finalized by the inauguration.

Oil executive Chris Wright, Trump’s pick for energy secretary, has been highly critical of green energy policies. “There is no climate crisis, and we’re not in the midst of an energy transition either,” Wright said in a video uploaded to LinkedIn last year.

On a recent earnings call, Plug CEO Andy Marsh expressed confidence that the loan will close before Republicans take over the White House: “I think when you look at the DOE loan, we have a clear path with the DOE to close that out before changing administration,” Marsh said, telling Politico: “There’s nothing like seeing your own coffin to get you moving faster.”

In its latest quarterly report, however, Plug appeared to acknowledge that there is uncertainty by adding a new risk disclosure, which states: “Whether and when our DOE loan guarantee will be funded is subject to a number of factors outside of our control, including political administration changes, legislative enactments, administrative actions.” The company also noted that it may not be able to satisfy all “technical, legal, environmental or financial conditions” attached to the DOE loan.

Since the beginning of 2022, 31 companies have received conditional loan commitments — and 13 have been finalized, an average of 240 days after the initial offer. Eighteen conditional loans, including five announced before Plug’s, have yet to close. Plug has been waiting for 204 days.

Given that almost 50 days remain until Inauguration Day, and the LPO has been able to close loans in as little as 43 days, it is possible that Plug will be able to finalize its loan before then.

But Plug’s loan commitment may be especially tricky to get over the finish line. Sen. John Barrasso, a member of the Senate Committee on Energy and Natural Resources, in June asked the DOE’s inspector general to investigate the department’s conditional commitment to Plug Power because of potential “conflicts of interest” between the LPO and its director, Jigar Shah.

According to Barrasso, Shah co-founded a company that lent money to Plug Power, which Plug repaid ahead of schedule as it started pursuing a DOE loan. Barrasso also questioned the DOE’s decision to lend to Plug Power because of the company’s dire financial condition, pointing to its losses of $1.4 billion in 2023.

“The company has not turned a profit since its incorporation 20 years ago,” Barrasso wrote.

To close the loan, the DOE must be convinced that Plug’s green hydrogen projects could break the pattern Barrasso identified, according to conversations with lawyers familiar with the loan approval process.

In Part II of our investigation, Hunterbrook advisor and Certified Fraud Examiner Nick Gibbons dives into whether that is possible.

Authors

Till Daldrup joined Hunterbrook from The Wall Street Journal, where he focused on open-source investigations and content verification. In 2023, he was part of a team of reporters who won a Gerald Loeb Award for an investigation that revealed how Russia is stealing grain from occupied parts of Ukraine. He has an M.A. in Journalism from New York University and a B.S. in Social Sciences from University of Cologne. He’s also an alum of the Cologne School of Journalism (Kölner Journalistenschule). Till is based in New York.

Sam Koppelman is a New York Times best-selling author who has written books with former United States Attorney General Eric Holder and former United States Acting Solicitor General Neal Katyal. Sam has published in the New York Times, Washington Post, Boston Globe, Time Magazine, and other outlets — and occasionally volunteers on a fire speech for a good cause. He has a BA in Government from Harvard, where he was named a John Harvard Scholar and wrote op-eds like “Shut Down Harvard Football,” which he tells us were great for his social life. Sam is based in New York.

Daniel Sherwood contributed reporting. Sherwood joined Hunterbrook from The Capitol Forum, a premium subscription financial publication, where he was an Editor & Senior Correspondent, writing and managing market-moving investigative reports and building the Upstream database. Prior to The Capitol Forum, Daniel has experience conducting undercover investigations into fossil fuel companies and other research. He also served as an Honors Law Clerk in the Criminal Enforcement Division of the EPA. He has a JD from Michigan State University. Daniel is based in Michigan.

Nick Gibbons, a Hunterbrook Media advisor, also contributed reporting. His experience includes a blend of qualitative and quantitative investment roles at Two Sigma, Norges Bank Investment Management, and Citadel. He began his career in forensic accounting at independent equities research provider Gradient Analytics. He is an Adjunct Assistant Professor of Accounting at NYU Stern School of Business, a Certified Fraud Examiner (CFE), and Master Analyst in Financial Forensics (MAFF). Nick is based in New York.

Editor

Jim Impoco is the award-winning former editor-in-chief of Newsweek who returned the publication to print in 2014. Before that, he was executive editor at Thomson Reuters Digital, Sunday Business Editor at The New York Times, and Assistant Managing Editor at Fortune. Jim, who started his journalism career as a Tokyo-based reporter for The Associated Press and U.S. News & World Report, has a Master’s in Chinese and Japanese History from the University of California at Berkeley.

Hunterbrook Media publishes investigative and global reporting — with no ads or paywalls. When articles do not include Material Non-Public Information (MNPI), or “insider info,” they may be provided to our affiliate Hunterbrook Capital, an investment firm which may take financial positions based on our reporting. Subscribe here. Learn more here.

Please contact ideas@hntrbrk.com to share ideas, talent@hntrbrk.com for work opportunities, and press@hntrbrk.com for media inquiries.

LEGAL DISCLAIMER

© 2025 by Hunterbrook Media LLC. When using this website, you acknowledge and accept that such usage is solely at your own discretion and risk. Hunterbrook Media LLC, along with any associated entities, shall not be held responsible for any direct or indirect damages resulting from the use of information provided in any Hunterbrook publications. It is crucial for you to conduct your own research and seek advice from qualified financial, legal, and tax professionals before making any investment decisions based on information obtained from Hunterbrook Media LLC. The content provided by Hunterbrook Media LLC does not constitute an offer to sell, nor a solicitation of an offer to purchase any securities. Furthermore, no securities shall be offered or sold in any jurisdiction where such activities would be contrary to the local securities laws.

Hunterbrook Media LLC is not a registered investment advisor in the United States or any other jurisdiction. We strive to ensure the accuracy and reliability of the information provided, drawing on sources believed to be trustworthy. Nevertheless, this information is provided "as is" without any guarantee of accuracy, timeliness, completeness, or usefulness for any particular purpose. Hunterbrook Media LLC does not guarantee the results obtained from the use of this information. All information presented are opinions based on our analyses and are subject to change without notice, and there is no commitment from Hunterbrook Media LLC to revise or update any information or opinions contained in any report or publication contained on this website. The above content, including all information and opinions presented, is intended solely for educational and information purposes only. Hunterbrook Media LLC authorizes the redistribution of these materials, in whole or in part, provided that such redistribution is for non-commercial, informational purposes only. Redistribution must include this notice and must not alter the materials. Any commercial use, alteration, or other forms of misuse of these materials are strictly prohibited without the express written approval of Hunterbrook Media LLC. Unauthorized use, alteration, or misuse of these materials may result in legal action to enforce our rights, including but not limited to seeking injunctive relief, damages, and any other remedies available under the law.