Based on Hunterbrook Media’s reporting, Hunterbrook Capital is short $PLUG at the time of publication. Positions may change at any time. See full disclosures below.

It’s not just the water.

Plug Power’s financials are a mess, according to Hunterbrook Media’s analysis.

The company’s survival now appears to hinge on a $1.66 billion lifeline from the Department of Energy — funding meant to complete the hydrogen production plants critical to its future. But our reporting suggests a more fundamental question looms over the DOE’s decision: Will there be enough of Plug Power left to pay the DOE back — or will the company default and become the next Solyndra?

In Part I of Hunterbrook’s investigation, we revealed how Plug significantly understated its water requirements to investors and the public. Now, a deep dive into the company’s financial statements exposes: dwindling cash reserves despite massive shareholder dilution, collapsing margins on core products, unprofitable fuel deliveries, and accounting practices that raise serious questions about whether the company has truly fixed its reporting problems.

The evidence points to a company not just struggling with execution, but potentially masking the true extent of its difficulties through aggressive accounting choices. Even if Plug secures the DOE loan, our analysis suggests it may only delay an increasingly inevitable reckoning with reality.

Sign Up

Breaking News & Investigations.

Right to Your Inbox.

No Paywalls.

No Ads.

Massive Share Dilution Fails to Solve Deepening Cash Crisis

In its third-quarter 2023 filings, Plug delivered sobering news to investors: The company no longer had enough capital to fund its operations for the next 12 months. This wasn’t just a routine disclosure — it was a formal “going concern” warning that laid bare the severity of Plug’s financial distress.

The company’s response was dramatic. In an effort to stay afloat, Plug issued 268 million new shares across two financing rounds — diluting existing shareholders by 43% since the start of 2023. These sales brought in $793 million in gross proceeds. Yet by the end of Q3 2024, Plug’s unrestricted cash had dwindled to just $93.9 million.

The reason for this rapid cash depletion becomes clear in the numbers: Operating activities burned through $597.4 million, while investments consumed another $358.5 million during this period. These investments included:

- $253.1 million in capital expenditures

- $64.4 million for non-consolidated entities

- $41.5 million for equipment related to power purchase agreements and fuel delivery

Even after this cash crunch, Plug continued seeking more funding. Post-Q3, the company:

- Reloaded its at-the-market equity offering program, allowing up to $1.0 billion in additional share sales through February 2025

- Issued a $200 million convertible debenture, netting $190 million

Management has suggested monetizing its substantial inventory, which stood at $885.8 million at Q3’s end, as another potential source of cash. But this solution has two major problems: First, Plug is currently losing money on every piece of equipment it sells, making any inventory liquidation costly; second, if Plug sells off its inventory to raise cash now, it would need to spend that cash to rebuild inventory levels just to keep operating — essentially solving nothing.

The outlook remains grim. Even sell-side analysts project continuing EBITDA losses of:

- $734.7 million in 2024

- $339.3 million in 2025

- $122.6 million in 2026

These projections assume Plug can successfully scale its hydrogen production plants to reduce costs — an assumption that appears increasingly optimistic given the company’s operational challenges.

So even after its aggressive capital raising efforts, Plug faces a daunting reality: Its persistent cash burn and uncertain future cash flows cast serious doubt on its long-term viability, whether or not it secures the DOE loan.

Partially-Built Plants Put Nearly $1 Billion at Risk Without DOE Loan

In a desperate move to preserve cash, Plug has slashed its capital expenditures by 47.7% compared to last year.

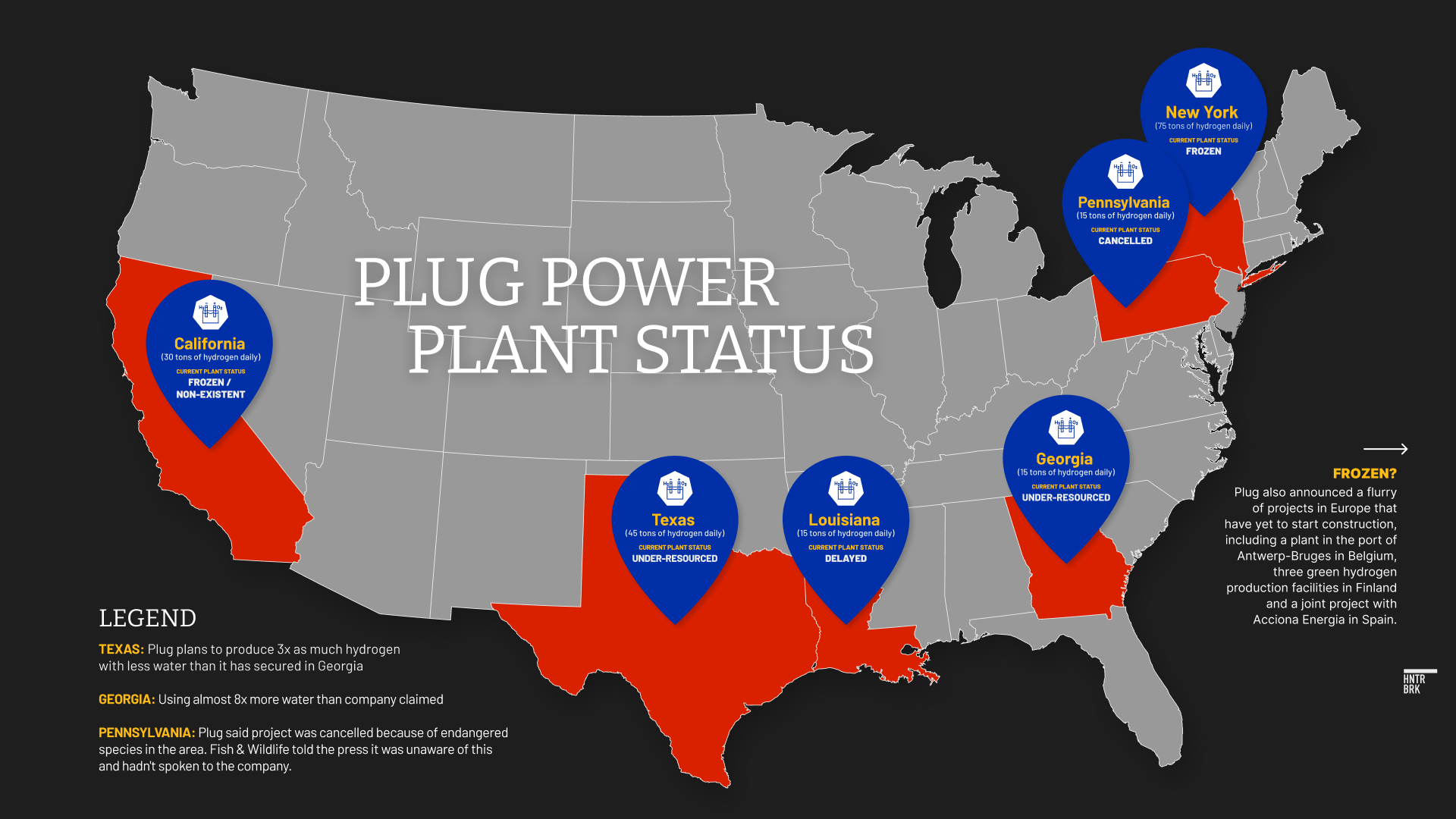

The timing isn’t ideal: The company sits at a critical juncture with three partially completed hydrogen production plants, having already sunk $930.5 million into these facilities. These plants aren’t just expansion projects — they seem to be essential to Plug’s business, designed to reduce production costs and stem the company’s operational losses.

This is where the proposed $1.66 billion DOE loan becomes make-or-break.

If approved, the loan would cover up to 80% of the remaining construction costs. Plug might even satisfy the DOE’s 20% equity requirement using the property and equipment it’s already invested, avoiding any additional cash drain. With this support, Plug would at least have some capital to complete these plants and focus on achieving the economies of scale needed for profitability.

But if the DOE loan falls through, the consequences could be severe.

Plug would likely need to raise more money by issuing new shares, further diluting existing shareholders who have already seen their ownership stake shrink by 43% this year alone. Even worse, the company might have to pause or abandon these critical projects entirely — potentially forcing Plug to write off much of the $930.5 million already invested. Without these plants operational, the company appears to have no clear path to profitability.

Why Plug’s $906 Million in “Restricted Cash” May Never Be Accessible

At first glance, Plug’s balance sheet shows a promising number: $906.3 million in restricted cash, with $216.8 million of it classified as available within the year. Management has even highlighted that about $50 million of this cash becomes unrestricted each quarter, leading some investors to view it as a potential safety net.

But a closer look reveals why this cash won’t rescue Plug from its liquidity crisis. The vast majority — $784.3 million — is tied up in sale-leaseback agreements, a financing mechanism where Plug sells its equipment to financial institutions and then leases it back to serve customers. While these arrangements provided quick cash when they were signed, they came with a heavy price: Plug now owes $936.2 million in combined liabilities from operating leases, sale-of-future-revenue obligations, and sale-leaseback financing — more than its entire restricted cash balance.

This means the $50 million in restricted cash released each quarter isn’t actually available to fund operations or development. Instead, this money is already spoken for — it’s needed to make payments on these financing arrangements. Far from being a lifeline, Plug’s restricted cash represents yet another financial obligation that needs to be serviced.

Plug Loses Money on Each Sale of Equipment

A closer look at Plug’s equipment sales tells a devastating story about the company’s core business. Just three years ago, in 2021, Plug appeared healthy — reporting a robust 21.8% gross margin on $392.8 million in equipment revenue. The following year still looked solid, with a 16.3% margin on increased revenue of $558.9 million.

Then came a dramatic shift. In late 2023, Plug moved away from sale-leaseback transactions (where they sold equipment to financial institutions and leased it back) to selling equipment directly to customers. The results were staggering: For the first nine months of 2024, equipment sales collapsed by 53.6% year-over-year, and gross margins plummeted to negative 64.5% — meaning Plug now loses nearly 65 cents on every dollar of equipment sales. This represents a serious deterioration from the already concerning negative 9.6% margin in the same period of 2023.

This raises a troubling question: Were Plug’s earlier profits real, or did the sale-leaseback accounting merely mask the true economics of their business? The stark reversal suggests Plug may have been losing money on equipment sales all along, with complex financing arrangements obscuring this fundamental weakness from investors.

Even Plug’s “Improvements” Show a Business Losing Money at Every Turn

At first glance, Plug’s latest numbers might seem to show progress in its power purchase agreements and fuel delivery business. But that obscures just how dire the situation really is.

Take fuel deliveries: While revenue grew 53.8% year-over-year to $29.8 million in Q3, Plug still lost an astounding 86 cents on every dollar of sales. Yes, that’s technically an “improvement” from losing $2.04 per dollar a year earlier, but it hardly suggests a path to profitability.

The power purchase agreement business tells a similar story. Revenue inched up 2.0% to $20.5 million, but Plug lost $1.53 for every dollar of revenue — only slightly better than last year’s $1.84 loss per dollar. While management points to lower fuel costs and better contract terms, these “gains” still leave both segments hemorrhaging money.

Future revenue projections are declining sharply:

- PPA revenue revised 14.6% lower — with an estimated $375.1 million to be recognized over next 5-10 years)

- Fuel delivery revenue revised 14.6% lower to 16.6% — with an estimated $82.7 million to be recognized over next 5-10 years

In other words, Plug’s core businesses aren’t just deeply unprofitable — they’re shrinking. These aren’t the numbers of a company working through growing pains. They’re the signs of a fundamentally broken business model.

Massive Inventory Write-Downs May Signal Worse to Come

For years, Plug hardly wrote down any inventory — just $2.0 million in 2022 and $2.2 million in 2021. Then something changed. In 2023, Plug suddenly set aside $93.7 million for inventory losses — a staggering 45-fold increase.

By the end of 2023, these inventory reserves reached $85.2 million, acknowledging that 8% of their total inventory and 27% of their finished goods were worth less than stated on their books. The reserves continued climbing to $117.7 million in early 2024 before settling at $89.5 million in Q3.

The SEC noticed this shift and started asking questions. In particular, they wondered why only $14.0 million of 2023’s massive $93.7 million reserve had actually been used. Plug’s response? Their inventory just takes a long time to sell.

But in correspondence with the SEC dated September 11, 2024, Plug revealed: As they ramped up production in late 2023, they discovered they were locked into sales contracts that would lose money, and there was nothing they could do about it. In other words, Plug didn’t realize until after they’d built the products that they’d be selling them at a loss.

The future looks even more concerning. Plug’s inventory levels remain stubbornly high — they’re sitting on 117 days worth of finished goods. While that’s down from a staggering 165 days in Q1 and 160 days in Q2, it’s still well above last year’s 90 days and far beyond their historical norm of 21 days or less.

Given that Plug loses money on every sale and is carrying record levels of inventory, a crucial question emerges: Has the company fully acknowledged how much their inventory has truly declined in value?

If not, future write-downs could further damage both their bottom line and their credibility with investors.

A Six-Year History of Accounting Problems Raises Fresh Concerns

Plug wants investors to believe it has finally fixed its accounting problems. History suggests otherwise.

For six straight years — from 2018 through 2023 — Plug admitted to “material weaknesses” in its accounting, essentially acknowledging it couldn’t reliably report its own financial results. These weren’t minor issues: The company had to completely rewrite its financial statements for 2018 through 2020 after discovering significant errors in how it accounted for sale-leaseback transactions, misclassified costs, and calculated maintenance contract losses.

When Plug claimed to have fixed these problems in its 2022 annual report, the SEC disagreed. The result? In August 2023, Plug paid a $1.25 million fine and made a high-stakes promise: Fix all accounting weaknesses by mid-2024 or face an additional $5.0 million penalty.

Yet just months later, in its 2023 annual report, Plug disclosed two new material weaknesses — this time in how it accounts for inventory reserves and asset impairments. Then, remarkably, by mid-2024, Plug claimed these problems were solved too, after just two quarters.

Given Plug’s track record of prematurely declaring victory over its accounting problems, combined with ongoing questions about its inventory accounting and reserves, there’s significant reason to doubt these issues are truly resolved.

With the SEC already watching closely, the discovery of any new material weaknesses in 2024 could have serious consequences.

AUTHOR

Nick Gibbons is a seasoned forensic accounting expert and investment researcher. His experience includes a blend of qualitative and quantitative investment roles at Two Sigma, Norges Bank Investment Management, and Citadel. He began his career in forensic accounting at independent equities research provider Gradient Analytics. He additionally has a background in graduate level education having previously served as Adjunct Professor of Finance and Accounting at Thunderbird School of Global Management and currently as Adjunct Assistant Professor of Accounting at NYU Stern School of Business. He is a Certified Fraud Examiner (CFE) and Master Analyst in Financial Forensics (MAFF). Nick is based in New York.

EDITOR

Sam Koppelman is a New York Times best-selling author who has written books with former United States Attorney General Eric Holder and former United States Acting Solicitor General Neal Katyal. Sam has published in the New York Times, Washington Post, Boston Globe, Time Magazine, and other outlets — and occasionally volunteers on a fire speech for a good cause. He has a BA in Government from Harvard, where he was named a John Harvard Scholar and wrote op-eds like “Shut Down Harvard Football,” which he tells us were great for his social life. Sam is based in New York.

Hunterbrook Media publishes investigative and global reporting — with no ads or paywalls. When articles do not include Material Non-Public Information (MNPI), or “insider info,” they may be provided to our affiliate Hunterbrook Capital, an investment firm which may take financial positions based on our reporting. Subscribe here. Learn more here.

Please contact ideas@hntrbrk.com to share ideas, talent@hntrbrk.com for work opportunities, and press@hntrbrk.com for media inquiries.

LEGAL DISCLAIMER

© 2026 by Hunterbrook Media LLC. When using this website, you acknowledge and accept that such usage is solely at your own discretion and risk. Hunterbrook Media LLC, along with any associated entities, shall not be held responsible for any direct or indirect damages resulting from the use of information provided in any Hunterbrook publications. It is crucial for you to conduct your own research and seek advice from qualified financial, legal, and tax professionals before making any investment decisions based on information obtained from Hunterbrook Media LLC. The content provided by Hunterbrook Media LLC does not constitute an offer to sell, nor a solicitation of an offer to purchase any securities. Furthermore, no securities shall be offered or sold in any jurisdiction where such activities would be contrary to the local securities laws.

Hunterbrook Media LLC is not a registered investment advisor in the United States or any other jurisdiction. We strive to ensure the accuracy and reliability of the information provided, drawing on sources believed to be trustworthy. Nevertheless, this information is provided "as is" without any guarantee of accuracy, timeliness, completeness, or usefulness for any particular purpose. Hunterbrook Media LLC does not guarantee the results obtained from the use of this information. All information presented are opinions based on our analyses and are subject to change without notice, and there is no commitment from Hunterbrook Media LLC to revise or update any information or opinions contained in any report or publication contained on this website. The above content, including all information and opinions presented, is intended solely for educational and information purposes only. Hunterbrook Media LLC authorizes the redistribution of these materials, in whole or in part, provided that such redistribution is for non-commercial, informational purposes only. Redistribution must include this notice and must not alter the materials. Any commercial use, alteration, or other forms of misuse of these materials are strictly prohibited without the express written approval of Hunterbrook Media LLC. Unauthorized use, alteration, or misuse of these materials may result in legal action to enforce our rights, including but not limited to seeking injunctive relief, damages, and any other remedies available under the law.