Based on Hunterbrook Media’s reporting, Hunterbrook Capital is long $PLUG at the time of publication. Positions may change at any time. See full disclosures below.

Plug Power Inc. (NASDAQ: $PLUG) appears to be on the brink of receiving a loan guarantee from the Department of Energy, according to a DOE Loan Programs Office (LPO) page tracked by Hunterbrook Media. When the loan was conditionally approved in May, the DOE said it would be for $1.66 billion.

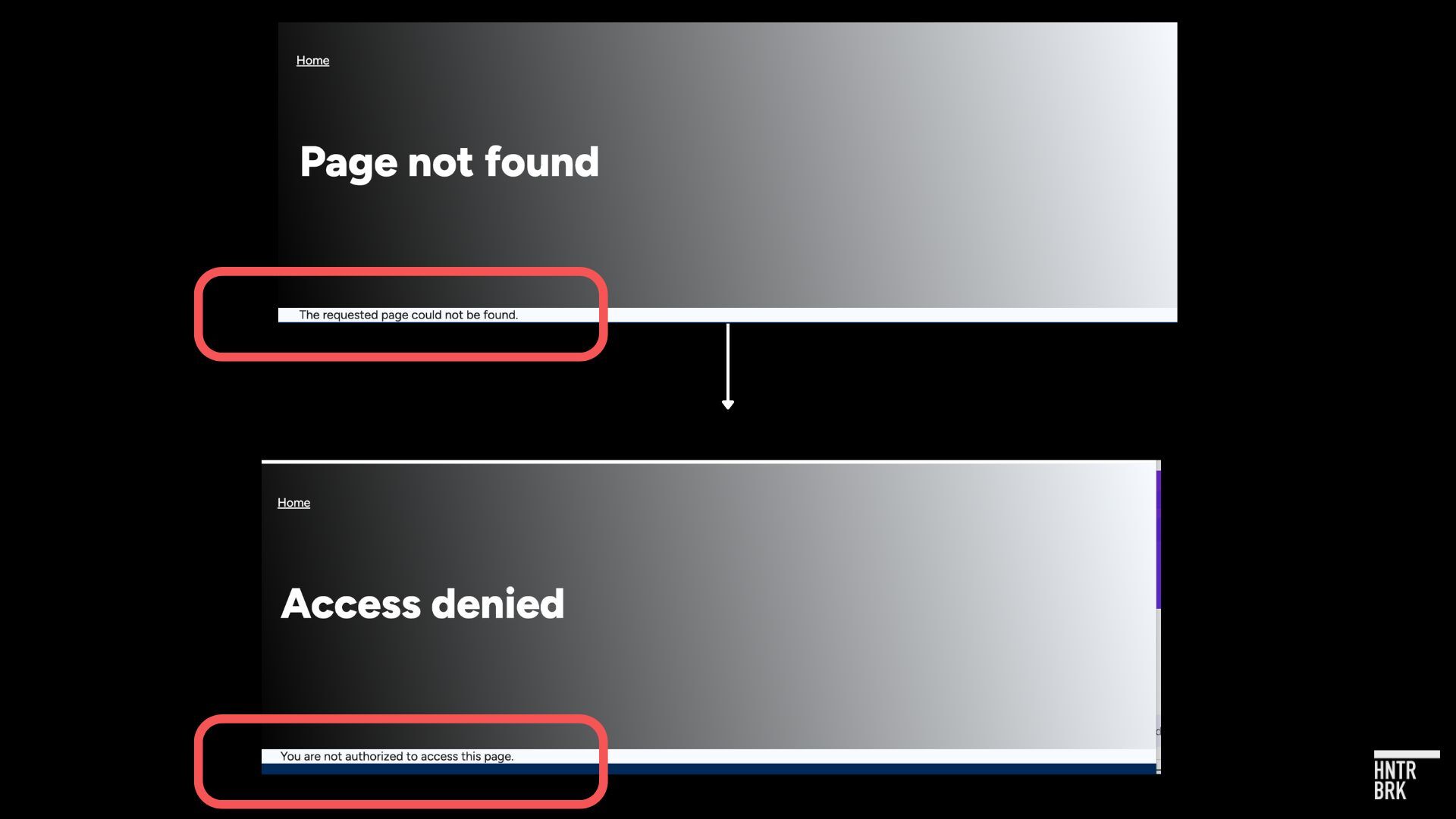

On Friday, the page under a URL that includes Plug’s company name turned from “Page not found” to “Access denied” — indicating that it now exists on the website, but is not public.

The page’s error message also changed, from “The requested page could not be found” to “You are not authorized to access this page.”

This is a pattern that in the past has signaled a loan approval was about to be announced. A project page for Eos Energy Enterprises’ (NASDAQ: $EOSE) $305 million DOE loan guarantee was first indexed on the Internet Archive on December 1 — showing an “Access denied” message. The finalized loan was announced on that same page two days later, on December 3.

Hunterbrook has been pinging the DOE page “https://www.energy.gov/lpo/plug-power” every 15 minutes for more than five weeks. (That’s more than 3,300 pings!)

Hunterbrook has also been pinging similar web pages for eight other companies. This is the first time we have caught a page flipping from “Page not found” to “Access denied.”

At this time, it is unclear whether Plug’s loan will be for the full $1.66 billion originally promised — or if it has changed in some way since being conditionally approved. Asked for comment on the significance of the website update, the DOE did not immediately reply.

Hunterbrook found a series of red flags regarding Plug’s “green” hydrogen projects

Plug is racing to finish the DOE loan approval process before Inauguration Day, fearing the Trump administration may cancel the conditional loan. The loan would be a critical lifeline for the company, which has faced dwindling cash and declining margins: A Hunterbrook analysis of Plug’s public financial documents in December revealed limited resources due to ongoing operating losses and significant investments in working capital and expansion.

A separate Hunterbrook investigation also found potential major roadblocks to getting the loan approved: Plug may not be able to secure enough water for planned hydrogen plants and may not have a credible plan for paying the loan back.

A review of documents and permits showed that Plug’s plant in Georgia uses at least seven times more water than the company publicly claimed. While Plug’s website says that the facility would use a maximum of 74,300 gallons of water per day, the company already has access to 587,520 gallons daily and stated in a groundwater withdrawal application that it will need up to a million gallons daily to operate the plant. Overall, Plug is aiming to secure a total of up to 1.7 million gallons per day for the Georgia facility.

This threatens Plug’s planned expansion in Texas because the company only secured 500,000 gallons of water per day for hydrogen production at its new plant outside Dallas-Forth Worth, where it aims to produce three times more liquid hydrogen than it does in Georgia. The planned facility in Texas is part of Plug’s loan application, and adequate access to inputs like water is one of the DOE’s criteria for approving project loans.

The DOE in December published a Draft Environmental Assessment for Plug’s Texas project that found that it does not have a significant effect on the human environment and does not require an environmental impact statement, a document that outlines the impact of a proposed project on its surroundings.

The DOE sprints to close loans before the next administration

Since the presidential election, the LPO has been rapidly finalizing loans before the new administration takes office.

In just the past two months, it has announced the finalization of loans to companies ranging from battery manufacturer BlueOval to solar manufacturer Qcells.

The office has also received scrutiny, including via an Inspector General’s report that found inadequate protections from conflicts of interest. The DOE rejected the findings, calling them “both baseless and vastly disproportionate.”

Notably, the Inspector General claimed that the LPO had not only “already closed 15 loans and loan guarantees for over $15 billion since 2021,” but was “currently planning to close an additional $22 billion in loans and loan guarantees for an additional 13 projects before January 20, 2025.”

Included among these, presumably, is Plug Power, which is one of just over a couple dozen recipients of conditional loans.

Plug has repeatedly expressed confidence that it would close the loan before the next administration takes office. In a November research note, an analyst from Jefferies stated that management had “expressed their confidence in closing the DoE loan on or before Jan 20th.”

In an investor call in November, Plug CEO Andy Marsh said: “I think when you look at the DOE loan, we have a clear path with the DOE to close that out before changing administration.”

He told Politico: “There’s nothing like seeing your own coffin to get you moving faster.”

Author

Till Daldrup joined Hunterbrook from The Wall Street Journal, where he focused on open-source investigations and content verification. In 2023, he was part of a team of reporters who won a Gerald Loeb Award for an investigation that revealed how Russia is stealing grain from occupied parts of Ukraine. He has an M.A. in Journalism from New York University and a B.S. in Social Sciences from University of Cologne. He’s also an alum of the Cologne School of Journalism (Kölner Journalistenschule). Till is based in New York.

Editor

Sam Koppelman is a New York Times best-selling author who has written books with former United States Attorney General Eric Holder and former United States Acting Solicitor General Neal Katyal. Sam has published in the New York Times, Washington Post, Boston Globe, Time Magazine, and other outlets — and occasionally volunteers on a fire speech for a good cause. He has a BA in Government from Harvard, where he was named a John Harvard Scholar and wrote op-eds like “Shut Down Harvard Football,” which he tells us were great for his social life. Sam is based in New York.

Hunterbrook Media publishes investigative and global reporting — with no ads or paywalls. When articles do not include Material Non-Public Information (MNPI), or “insider info,” they may be provided to our affiliate Hunterbrook Capital, an investment firm which may take financial positions based on our reporting. Subscribe here. Learn more here.

Please contact ideas@hntrbrk.com to share ideas, talent@hntrbrk.com for work opportunities, and press@hntrbrk.com for media inquiries.

LEGAL DISCLAIMER

© 2025 by Hunterbrook Media LLC. When using this website, you acknowledge and accept that such usage is solely at your own discretion and risk. Hunterbrook Media LLC, along with any associated entities, shall not be held responsible for any direct or indirect damages resulting from the use of information provided in any Hunterbrook publications. It is crucial for you to conduct your own research and seek advice from qualified financial, legal, and tax professionals before making any investment decisions based on information obtained from Hunterbrook Media LLC. The content provided by Hunterbrook Media LLC does not constitute an offer to sell, nor a solicitation of an offer to purchase any securities. Furthermore, no securities shall be offered or sold in any jurisdiction where such activities would be contrary to the local securities laws.

Hunterbrook Media LLC is not a registered investment advisor in the United States or any other jurisdiction. We strive to ensure the accuracy and reliability of the information provided, drawing on sources believed to be trustworthy. Nevertheless, this information is provided "as is" without any guarantee of accuracy, timeliness, completeness, or usefulness for any particular purpose. Hunterbrook Media LLC does not guarantee the results obtained from the use of this information. All information presented are opinions based on our analyses and are subject to change without notice, and there is no commitment from Hunterbrook Media LLC to revise or update any information or opinions contained in any report or publication contained on this website. The above content, including all information and opinions presented, is intended solely for educational and information purposes only. Hunterbrook Media LLC authorizes the redistribution of these materials, in whole or in part, provided that such redistribution is for non-commercial, informational purposes only. Redistribution must include this notice and must not alter the materials. Any commercial use, alteration, or other forms of misuse of these materials are strictly prohibited without the express written approval of Hunterbrook Media LLC. Unauthorized use, alteration, or misuse of these materials may result in legal action to enforce our rights, including but not limited to seeking injunctive relief, damages, and any other remedies available under the law.