Based on Hunterbrook Media’s reporting, Hunterbrook Capital is short $RH at the time of publication. Positions may change at any time. See full disclosures below.

One definition of home may be where you spend Thanksgiving, and Gary Friedman — the coiffed, bronze, truculent CEO of Restoration Hardware — celebrated in the penthouse of the chic West Village hotel owned by his furniture company.

That is according to a server at the restaurant downstairs, which, even critics must admit, is the ne plus ultra, the platonic ideal, the crème de la crème (fraîche with kaluga and chives) of department store eats — the kind of spot where the truffle fries are $20 but the people-watching is priceless.

The hotel rooms are similarly extravagant: The cheapest costs $2,200 per evening; the suites start at $3,700; and the penthouse, outfitted with a fireplace and a chef, will set you back $15,000.

But for Friedman, the penthouse is apparently free — despite the fact that RH bought the building for $57.7 million. And while it’s listed on RH’s website, it’s unclear if anyone else has access to the 2,600-square-foot residence, which one glowing profile referred to as Friedman’s “personal penthouse,” even though he doesn’t disclose paying RH for his use of it. It’s hard to prove a negative, but Friedman discloses reimbursements to the company for use of the plane and yacht. The fact that he does not do the same for the penthouse seems to imply he doesn’t, in fact, pay for it.

Some might say he has earned it. When Friedman took over Restoration Hardware in 2001, he rescued the company, transforming a sleepy furniture brand on the brink of bankruptcy into an empire defined by caviar, champagne, and cloud couches. This metamorphosis followed Friedman’s own ascent, from stock clerk at the Gap to the boardrooms of Pottery Barn and Williams Sonoma.

But the penthouse is not an aberration. It’s just one minor example of RH’s profligate leadership draining the company of resources under the banner of brand-building — bringing the company to the brink of a liquidity crisis.

In recent months, Hunterbrook has visited RH locations across continents; analyzed its distribution centers in person and through satellite imagery; spoken to expert analysts and accountants; and eaten, really, just a ton of overpriced (though, frankly, quite delicious) salads.

The takeaway has been clear: RH has a brand that matters, an increasingly rare asset at a time dominated by the social media platforms Friedman’s company eschews. But the business isn’t working — with its cash position declining even amid a wave of discounts and deals.

And now, RH appears to be one housing downturn away from what could be a cataclysmic collapse.

Sign Up

Breaking News & Investigations.

Right to Your Inbox.

No Paywalls.

No Ads.

The Anatomy of a Liquidity Crunch

RH Buys Stock; Gary Sells Stock

In the fall of 2021, RH announced it would borrow $2 billion at what seemed like an attractive interest rate — just about 3% at the time. The following spring, the company borrowed another $500 million at 3.76%, with Friedman telling investors this money would provide “optionality” as RH positioned itself as a “global luxury brand.”

Ultimately, RH used about 90% of this borrowed money — around $2.3 billion — to buy back RH’s stock as it began to fall from its pandemic highs.

But while RH was spending billions in borrowed money buying its own stock, Friedman himself was cashing out — selling more than $740 million of his personal shares at or around the same time.

“The company has never had more than $500 million of GAAP free cash flow. He sold almost a billion,” said Matt McClintock, an analyst who has covered RH for almost a decade. This is true on a fiscal year basis — at one point, RH did crack this amount in the trailing 12-month number. “He took two of the best years in company history out of the company.”

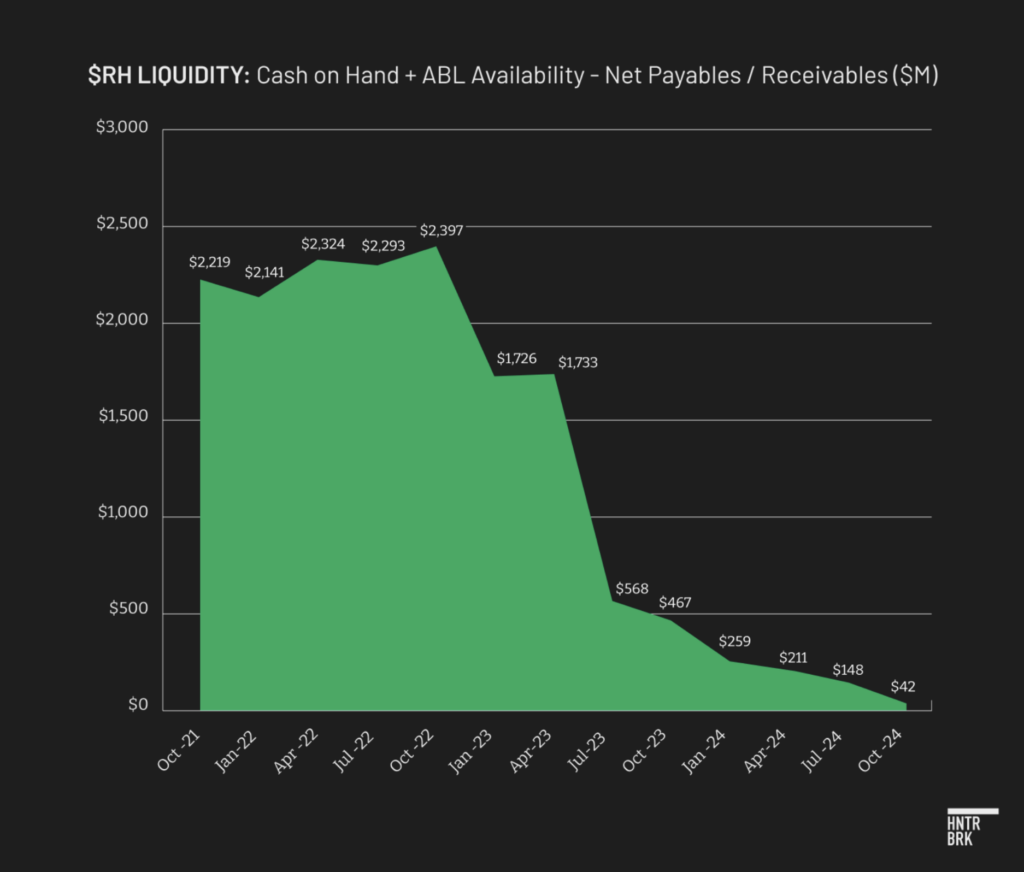

Cash Position Plummets from $2.1 billion to $42 million

For Friedman personally, this was a major liquidity event. For RH’s balance sheet, which suddenly included billions in debt amid a cooling housing market and burgeoning inflation, it was a mess.

Those 3% loans weren’t secured at a fixed rate. So as the Fed aggressively hiked rates to fight inflation, RH’s annual interest payments ballooned from $81 million to $211 million. $81 million is calculated using rates at loan origination point assuming LIBOR/SOFR floors. $211 million is the trailing 12-month interest expense through 2024-11-02.

The outcome of increased interest expense and large-scale stock buybacks: Cash and cash equivalents plummeted from $2.1 billion to a mere $421 million in just over a year — as what started as a move to increase optionality has left the company dangerously exposed, burning through cash just to service its debt.

And now, RH has only $42 million in cash resources available — the lowest it has had in years, leaving the company in a position where if it doesn’t quickly turn profitable, it may need to either raise more debt, further levering the balance sheet, or dilute existing shareholders by issuing a convertible bond or selling recently purchased shares.

“This setup left little room for RH to navigate prolonged economic challenges,” wrote Mike Kytka, an investor who runs Substack MoneyFlow Research and told Hunterbrook he was once long RH stock but removed his position amid the cash crunch. “I’ve never doubted the business or Gary Friedman. I think he’s an awesome CEO,” he said, but thought Friedman had done “too much of a levered buyback leading to a challenging liquidity situation.”

“I don’t want a donut,” he added.

The Mysterious “Demand” Metric and Growth Story That Have Helped RH To Defy Gravity

An outlier from its peers

Last month, RH reported earnings that might have sent another company’s stock plummeting — missing expectations on revenues, profit, margins, EBITDA, earnings per share, customer deposits, cash flow, and just about every other metric.

Sales per square foot is also at its lowest level in 10 years. This is true even accepting the sales-per-square-foot numbers RH reports to the SEC. Those numbers, however, diverge significantly from the square footage numbers RH posts on its website, which could mean the reality is even worse than the company is admitting.

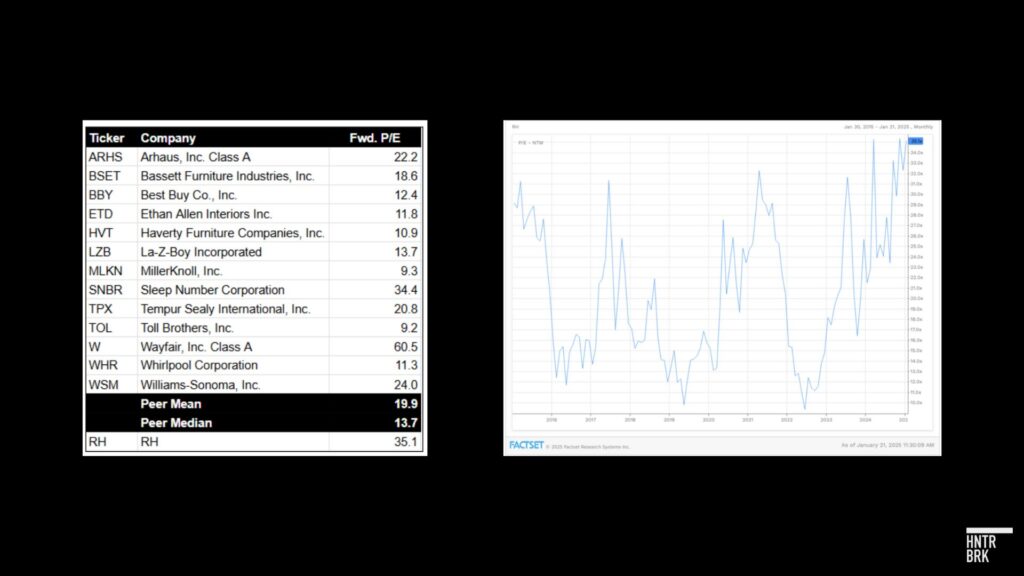

But despite all of these numbers — and the company’s cash position — RH stock nonetheless spiked by as much as 18% in the day after reporting. And in the weeks since, the company has continued to trade at a multiple more than double its peers and at a record relative to its own historic valuation.

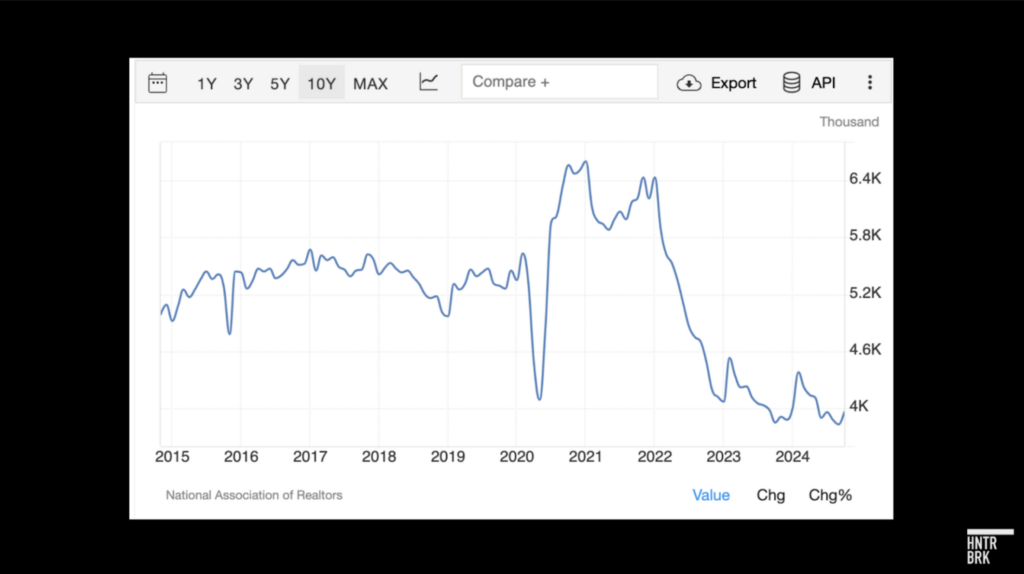

It’s an especially impressive feat considering that the housing market — and, consequently, the furniture market — has cooled significantly amid high mortgage rates, which are at levels that haven’t been seen since at least 2008. (The adage: “How goes the housing industry, so goes the furniture industry.”)

This dynamic has been followed by downward revisions in the earnings projections of other rate-sensitive sectors, including homebuilders and mortgage originators. Luxury builder Toll Brothers, for instance — which, like RH, caters to a higher-income customer base, though not quite as high as RH’s — has seen its stock fall around 20% since November.

But RH? It’s trading at levels not seen since early 2022 — and has outperformed its peers.

That is the magic of Gary Friedman.

A consummate pitchman, Friedman always seems to find the right message for the moment. “Gary changes his language every quarter,” said McClintock, who also called the CEO a “genius” who is “a master of creating physical environments to elevate products that might not be any better than other retailers.”

It’s a habit that has gotten Friedman in trouble in the past: In 2019, RH settled a lawsuit brought against it as well as Friedman and then-CFO Karen Boone for $50 million after the company had to walk back numerous hyperbolic claims Friedman had made about the company’s preparedness to launch its new “game-changing” RH Modern line, as well as the line’s performance after launch.

After these revelations, RH stock cratered — but the experience didn’t stop Friedman from hyping future growth.

The new narrative

On December 12, 2024, during a roughly two-hour earnings call, Friedman told a grand new story — weaving a narrative that placed RH in a dialectic with Pablo Picasso, Steve Jobs, and other creative leaders who are “comfortable making others uncomfortable.” His point was that RH is no longer a furniture store. It’s a “platform for taste.”

And even if it hasn’t been a particularly profitable platform recently, it will be soon, Friedman asserted. RH claimed it will produce 18% to 20% revenue growth in the fourth quarter, during the same three months when most of its peers are estimating significant declines.

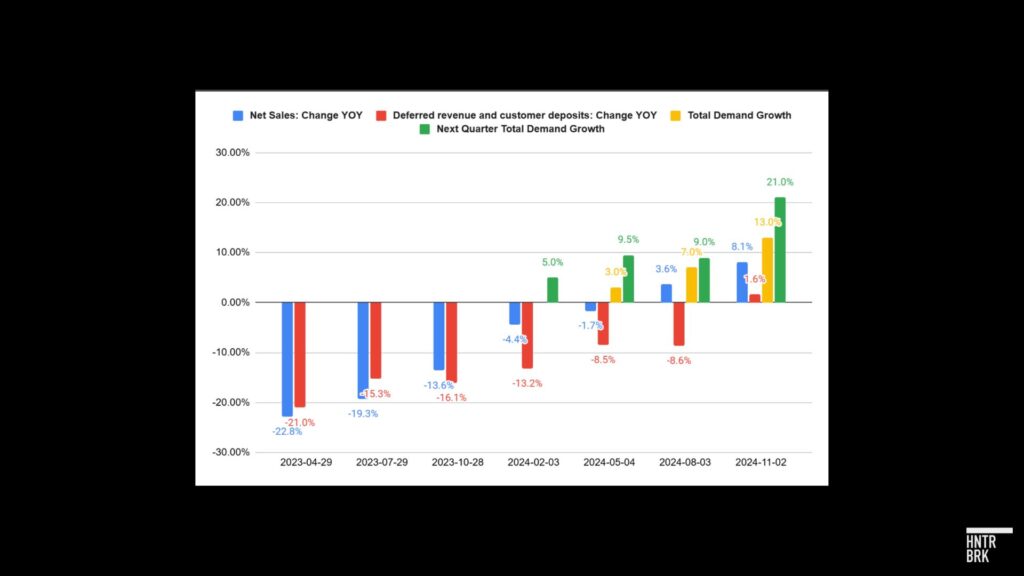

The key to Friedman’s narrative isn’t solely standard metrics like revenue or earnings per share. It’s also another metric, one he introduced just a few years ago, called “demand.”

Demand purportedly measures “the dollar value of orders placed” — the goal being to better capture imminent revenue that hasn’t yet been officially recognized but will be in future quarters. The sell side has gobbled it up, with demand factoring into the way analysts write about the company’s trajectory. Financial publications and observers have picked it up, too — with headlines like: “RH: Demand Growth is Accelerating”; “Demand Remains Brisk”; “Demand Is Accelerating.”

But it’s unclear exactly how this demand is calculated. And curiously, RH’s growth in this custom demand metric has not tracked the company’s growth in deposits (aka deferred revenue), a standard GAAP metric, even though the two should, in theory, look similar. (You’d really think a surge in the “dollar value of orders placed” would lead to a surge in deposits — if not during the same quarter, then at least during the following ones.)

The reality, however, is that year-over-year deposits have declined in recent years — with only marginal growth in the most recently reported quarter.

Asked about this discrepancy, RH did not respond.

Why It Doesn’t Seem Like Inventory Can Save the Day — Without Extreme Discounts

RH does have one potential lifeline: almost a billion dollars worth of inventory. But the data suggests this resource may be more of a burden than a buoy.

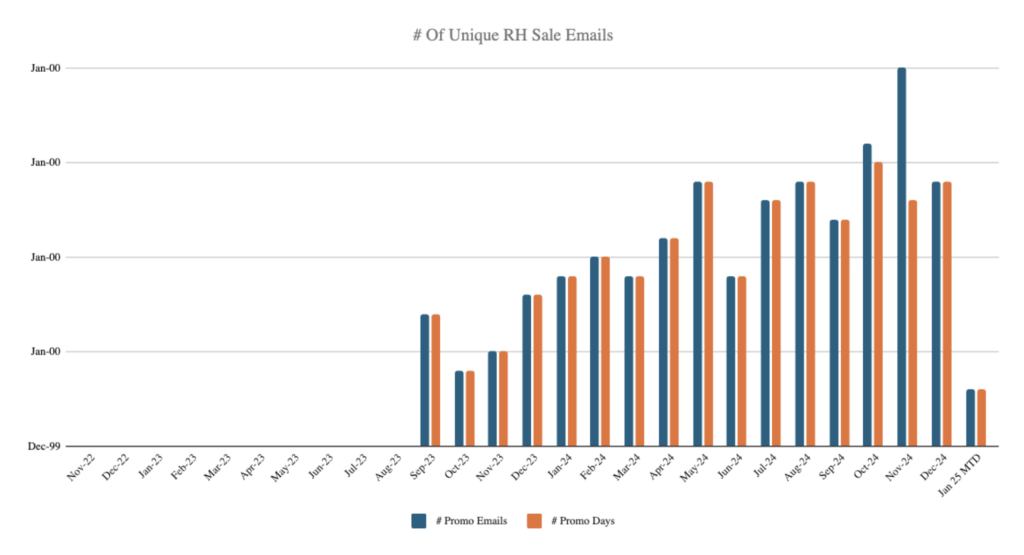

As RH has unleashed an aggressive discounting campaign, which accelerated over the course of the last year, and embraced what it calls “disruptive pricing,” inventory levels are actually increasing — not decreasing — indicating the company may be struggling to move product even at reduced prices.

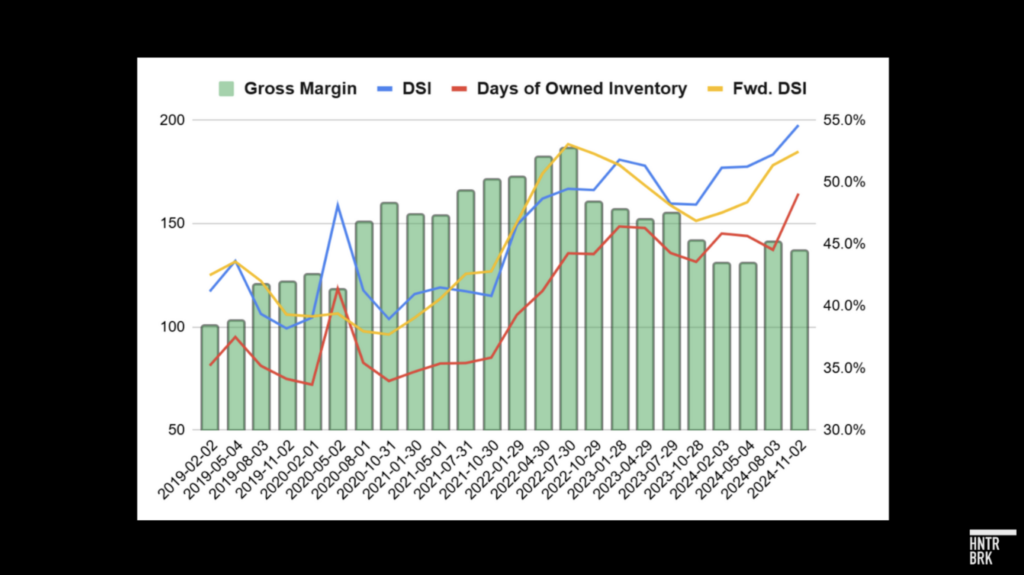

The numbers tell the story: Inventory has skyrocketed to a record 198 days, representing a year-over-year increase of 38 days. Future (or, “forward”) inventory sits at an all-time high of 185 days, while days of owned inventory has climbed to a record 165 days.

All this despite consistently disappointing gross margin numbers, which according to Goldman Sachs have “come in below consensus” in seven of the last eight quarters, leading their analysts to issue a sell rating on the stock. (Other analysts have issued the company a buy rating.)

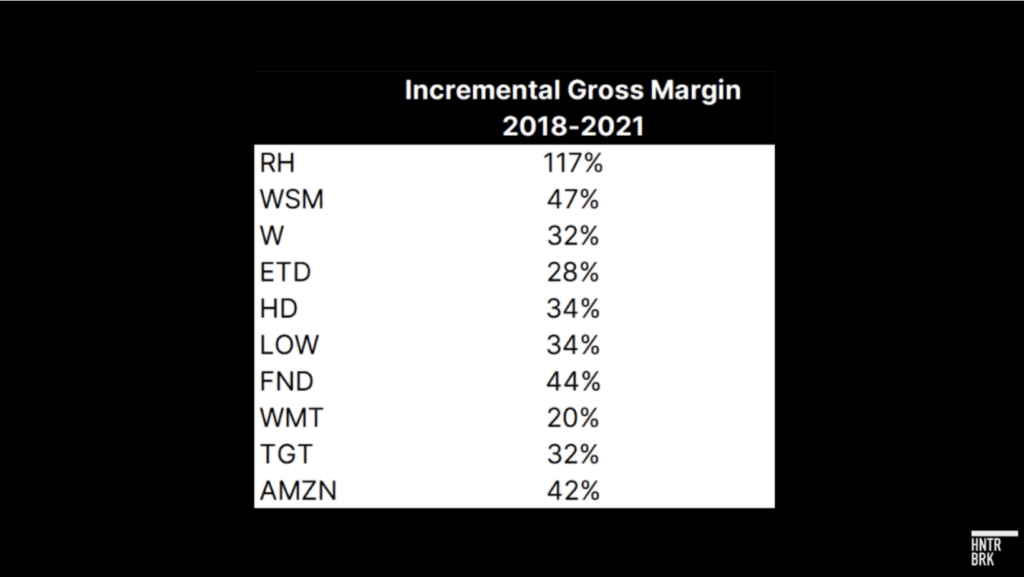

The gross margin miss in the most recent quarter was the biggest in a decade — after a stretch from 2018 through 2021 when RH inexplicably posted numbers that looked more like Apple than Arhaus. (If any readers can understand the accounting that made these gross margins possible, please reach out to ideas@hntrbrk.com.)

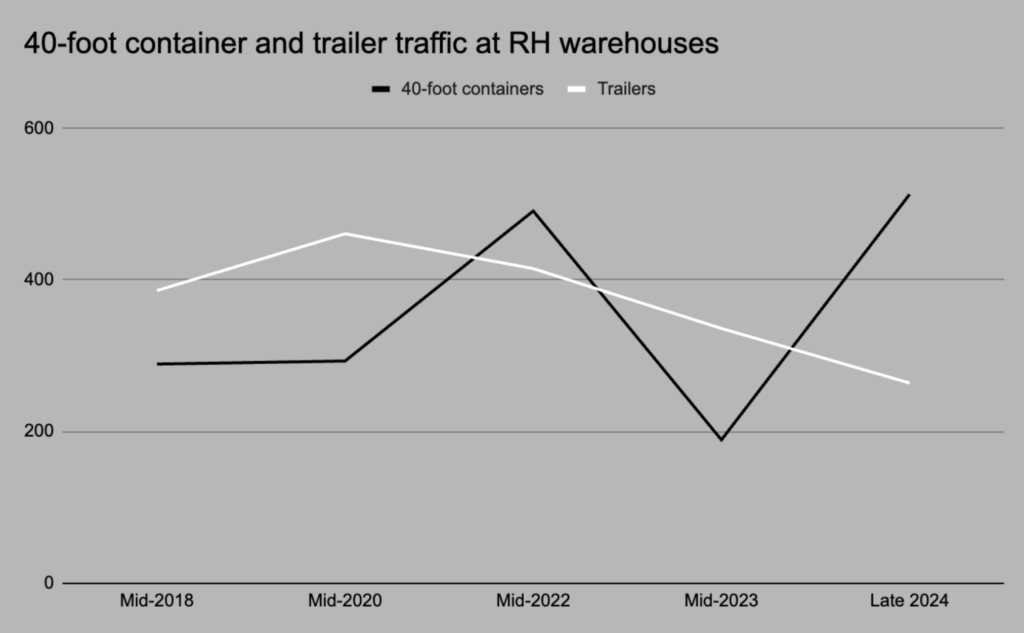

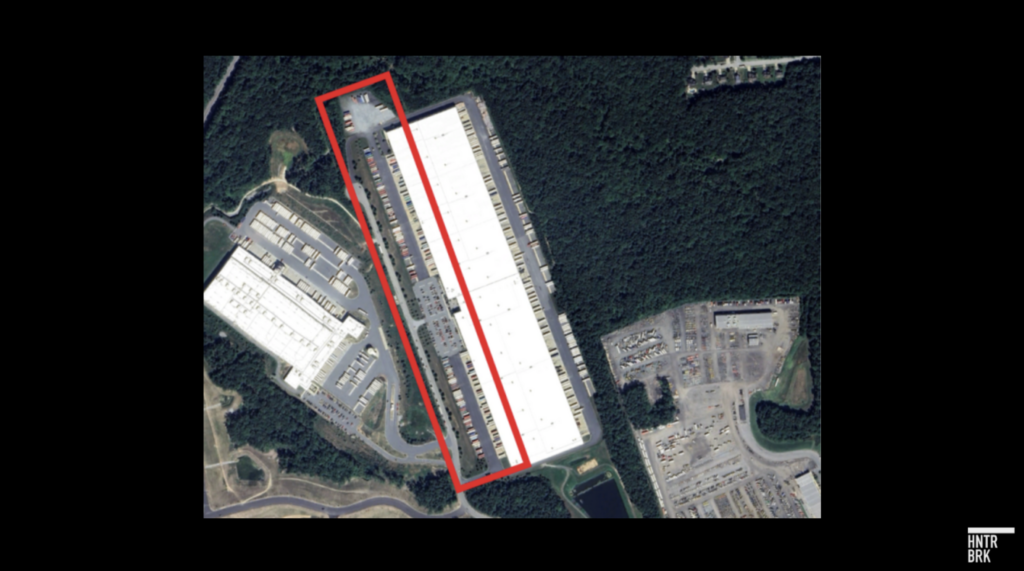

The prodigious stockpile of inventory can be seen from space. Hunterbrook collected satellite imagery of five RH warehouses across the United States — analyzing the presence of 40-foot containers, used to import product from outside the country, and 53-foot box trailers, used to bring RH furniture to galleries and customers.

Overall, while the number of 53-foot trailers that transport goods to their final destination on the outbound side decreased, on average, the number of 40-foot ocean shipping containers on inbound docks at warehouses increased significantly in the past year.

In September 2024, for instance, more than 260 containers were sitting outside the Patterson, Calif., warehouse, while only 70 were visible in June 2023 — raising the possibility that the warehouse, itself, is full.

This apparent inventory buildup presents RH with an unpalatable choice: Either take even more aggressive markdowns to move product and generate cash — potentially damaging its luxury brand positioning — or maintain pricing while watching its critical cash reserves dwindle further due to sluggish sales.

Comments during the December earnings call suggest the company might be leaning toward the former strategy. As Friedman explained, it is “a better time to invest in disruptive pricing and disable competitors than it is to harvest the business and take lower sales.” (Friedman also said an analyst was “correct” in their suggestion that RH “exiting China” may be a contributor to surging inventory.)

But so far, that strategy of discounting doesn’t seem to be solving the fundamental problem.

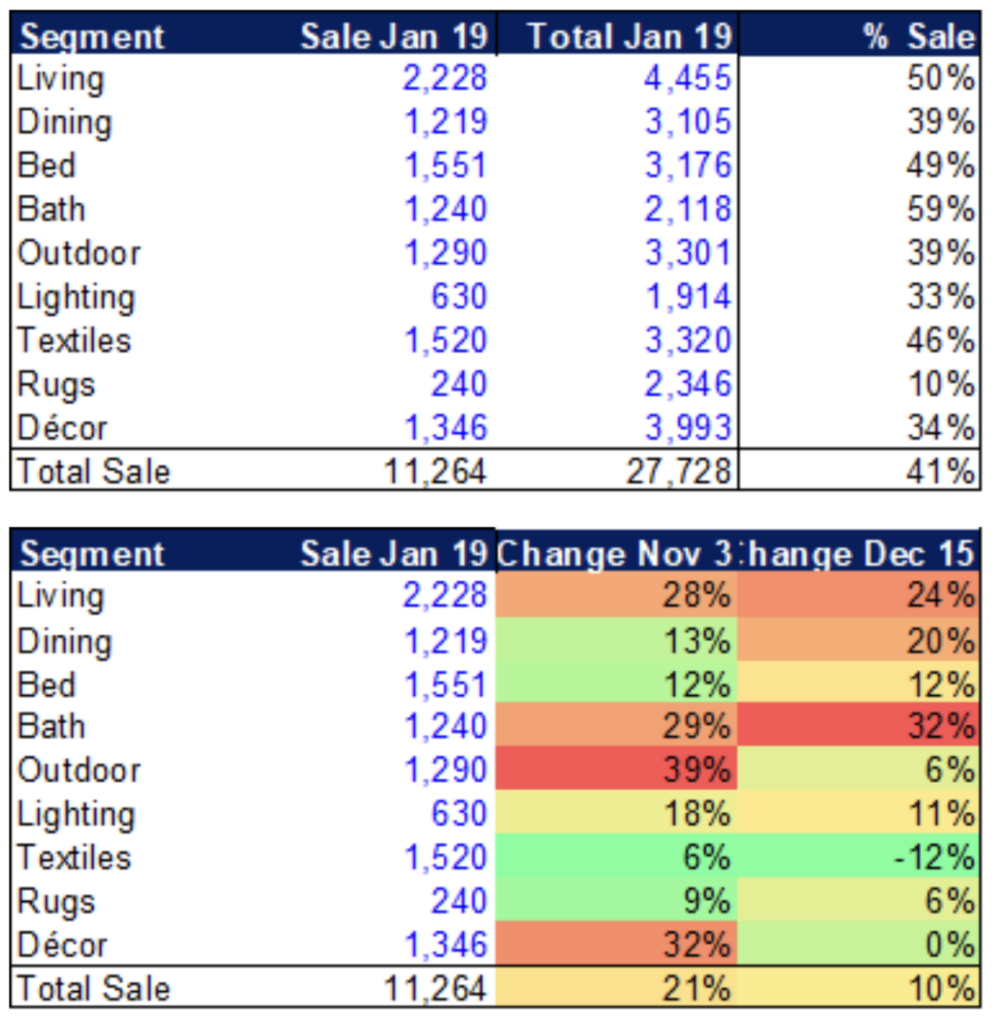

A data analysis from Richard Wang, a student and investor betting against RH stock who reached out to Hunterbrook, found that these discounts included not just backlogged inventory, but also some of the company’s newest offerings. “I believe this paints a clear picture of how the new product refresh has failed,” he wrote. “Out of surveyed categories, more than half are discounted” by over 40%, he said, with the exception of the outdoors category.

Between October, when Wang sent that write-up to Hunterbrook, and January 19, the company increased the total number of SKUs on sale by 21%, according to the analysis. And that number could very well grow, Wang said — since even with these steep discounts, inventory levels continue to rise.

Of course, discounts are just one of the ways RH can plow through inventory. Another is expansion — and RH does not appear to be slowing down on that front.

RH opened two new galleries in the United States in December: RH Newport Beach and RH Montecito. And RH has continued its international expansion as well — with two stores in Germany and one in England, among others in Canada and Belgium, with Paris and London set to open in 2025, and a store in Milan launching as well.

Whether RH can find a reliable customer base internationally, however, remains an open question.

Empty Showrooms, Impairments, and Other Signs of a Failed European Expansion

When a Hunterbrook reporter arrived at Restoration Hardware’s 73-acre estate, Aynhoe Park, about two hours outside of London, he was greeted by three valets. It was among the most social interactions of the day — as the gallery was a ghost town, inhabited, over the course of the visit, by more deer than customers.

(In fairness, Aynhoe is known for having an absolutely massive quantity of deer.)

A receptionist said it was usually much busier. A valet said it was not — and that, when people do visit, it’s “more for the food” than the furniture. Overall, the consensus among staff seemed to be that about 100 people per day walk through the doors.

The atmosphere was a far cry from RH England’s star-studded opening, where the likes of Idris Elba and Ellen DeGeneres could be seen hobnobbing. Hopes were sky-high, with Friedman having estimated that the store would bring in between $40 million and $250 million in sales in its first year and sharing that the press it had received was “multiple times higher than any gallery we’ve ever opened because it’s something nobody has seen before.”

In reality, RH England appears to have brought in significantly less in its first year — with one UK filing indicating the real number may have been under $10 million. Friedman nonetheless reflected on the performance of RH England as “kind of where we thought we’d be.”

The operation is on pace to fall short of the low end of its first-year estimates in its second year, too, with Friedman writing in December that it would generate an estimated $31 million plus $7 million in online demand.

But if Friedman was disappointed by these numbers, he didn’t show it, writing in the investor letter: “If an RH Gallery in the English Countryside, with an estimated population of 100,000 in a 10 mile radius almost 2 hours outside of London, can generate $38 million of demand in its second year, what can an RH Gallery in the center of Mayfair, the most exclusive district of London, a global city with a population of 9.7 million, do in its second year?”

“We believe exponentially more,” he answered.

Taken literally, that would indicate $380 million in annual demand in London alone, a big number under any circumstances, but especially after what happened with RH in Germany, where RH’s experience opening stores in large European cities so far tells a different story.

A year ago, Friedman cited two existing stores in Germany — RH Düsseldorf and RH Munich — as examples of what RH England could become. “You go to Germany, we look really good,” he said at the time, noting that “RH England just doesn’t have the traffic of the locations that we have in Germany.”

But this year, RH disclosed that it was taking an impairment on its German operation, indicating it had not been a success — and the company would not extend its leases in the country.

The impairment tied to the German locations, just a year after opening them, came at a steep cost: $18.6 million, including $13 million related to lease right-of-use assets and $5.6 million tied to property and equipment.

Friedman disclosed on the December earnings call that some of these costs include moving “the product from Europe back to America,” after realizing the items being sold in the German stores were a bad fit for the European market.

“The very first three stores RH opened internationally outside North America are abject failures,” said McClintock.

This, experts who spoke to Hunterbrook say, is unsurprising. Across Europe, the average household income is significantly less that of the United States — and the average home across the continent is about half the square footage of its U.S. counterpart. As Wang put it, RH products in Europe are a “literal poor product-market fit.”

And so far, the point seems to be true: In RH’s filings, the company says the revenues it has generated across its international locations — Canada, the United Kingdom, Germany, Belgium, and Spain — have not been “material in any fiscal period.”

You wouldn’t know about these struggles from talking to the staff at RH England, several of whom — almost as though they were reading from a script — independently shared their enthusiasm about the European expansion, citing the planned openings in Paris, London, and Milan.

And in the meantime, they noted, it’s not as though RH England has been a total failure. It has been, if nothing else, a very pleasant remote work spot for senior leadership, who find it “nice,” according to one of the staffers.

When Friedman visits, one said, he arrives right in the car park where Hunterbrook was greeted by valets — in a helicopter.

As Cash Plummets, RH Buys Yacht, Plane, Penthouse That CEO Uses for Himself

Since 2019, RH has acquired two private jets (“RH One” and “RH Two”) and a 130-foot yacht (naturally, “RH Three”).

All three are technically available for charter on the company’s website, but — like the penthouse — Friedman frequently enjoys them himself.

Hunterbrook has identified several trips Friedman has taken in the past four years, including to luxurious locales like the French Riviera and the Greek island Mykonos, as well as multiple trips to Aspen. Based on a review of social media posts from Friedman’s family and friends, as well as location data tied to the jets and yacht, these appear to be private vacations making use of company assets.

The vibe across all the content: cacio e pepe, crab legs, and convertibles.

Unlike his use of the penthouse, at least some of this activity is disclosed in RH’s financial filings. In 2023, for instance, Friedman paid the company $302,000 for personal use of the yacht and $447,000 for the planes.

That revenue, of course, comes nowhere near the estimated hundred million (or more) RH committed to the three assets Estimated based on the following: RH1 is registered under tail number N711RH, which according to FAA records is a Gulfstream G650ER manufactured in 2020, which can list in excess of $65 million new. Additionally, a RH loan disclosure makes reference to “Permitted Jet Transactions not to exceed $65 million.” The aircraft is owned by Bank of Utah Trustee, suggesting the asset is under a lease agreement. RH2 (N721RH), a Gulfstream G550, was first manufactured in 2003, with its tail number later registered in 2016 and directly owned by RH. Various sources estimate pricing in excess of $12 million at the time RH bought it. RH3, an RMK Marine yacht, was listed for sale at 12.75 million euros as of 2019-05-15 (about $14.3 million), and RH acquired the yacht in 2019. These prices do not include costs associated with refurbishing and retrofitting. — which do not seem to have brought in any meaningful additional cash, despite the company claiming the planes and yacht were purchased with the goal of renting them out to customers.

(You can still charter the yacht here, but after mentioning the yacht in every quarterly earnings call from the first quarter of 2020 through the first quarter of 2024, in the last two quarters, Friedman hasn’t brought it up.)

And based on the number of trips Friedman has taken, it does not appear he is paying close to the $250,000 per round trip cross-country flight that consumers are allegedly charged to fly in RH’s type of aircraft.

Flight data and social media posts suggest that Friedman and his family members in 2023 used the jets for three separate trips from Napa to Aspen, which would cost approximately $500,000 — more than Friedman paid RH for his company jet use the entire year — if booked through Solairus Aviation, which handles jet charters for RH. The planes were also used for two trips to Ibiza in the lead-up to Friedman’s wedding there that year, as well as a November excursion to San José del Cabo, Mexico.

Delays Continue at Nine-Figure Aspen Expansion

Europe isn’t the only place where RH has struggled to realize its grand ambitions. It’s also happened here at home, in Aspen, where the company has attempted to build an entire lifestyle industrial complex. In the December earnings call, Friedman called it a “one-of-a-kind opportunity” on which he predicted an “outstanding return.”

Hunterbrook reviewed public records, investor communications, local media coverage, drone footage, videos, and photos to piece together the narrative behind RH’s Aspen “ecosystem” — a term the company uses to describe its real estate developments in the mountain town. And the reality did not fully match the story Friedman is weaving. (In 2023, Air Mail dove deep into the fraying relationship between RH and Aspen locals.)

At the heart of this saga are three key properties: the historic Crystal Palace, the former Bidwell building, and the Boomerang Lodge. These projects illustrate the tension between RH’s aspiration to redefine luxury and the stark realities of construction delays, regulatory hurdles, and financial strain.

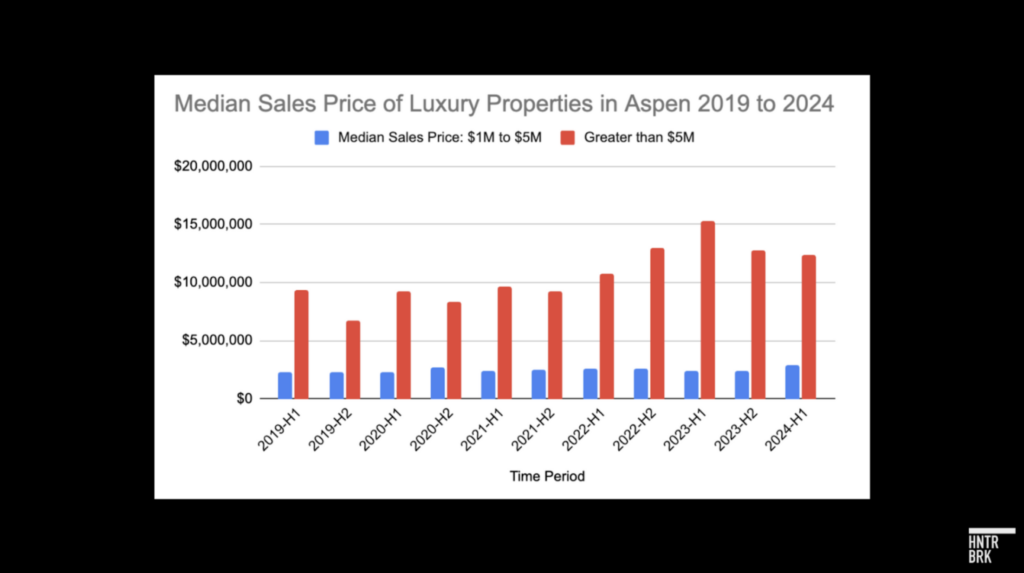

Friedman has stated that he’s not worried about the slow construction headway RH is making, saying that its real estate assets in Aspen have already doubled or tripled in value. Hunterbrook Media’s proprietary real estate database found evidence to the contrary — with median prices since RH’s purchase remaining relatively flat for $1 million to $5 million properties and appreciating only 30% in the $5-million-plus category.

And Hunterbrook found limited progress on the Aspen facilities since Air Mail’s report.

The Crystal Palace: Luxury on a Fragile Foundation

Located at 300-312 East Hyman Ave., the Crystal Palace project aims to transform a 130-year-old dinner theater into an RH Guesthouse, complete with 20 luxury guest rooms, an RH Bath House & Spa, and rooftop dining. But the project, which was originally supposed to open in 2022, has faced delays since its inception in 2019.

The primary challenge stems from the building’s structural instability, including a wall with lead paint and compromised integrity. Reports from experts hired by the project developer noted, “It is our opinion that the existing wall is structurally unstable and should be removed and rebuilt with existing brick.” These findings have fueled debates with Aspen’s Historic Preservation Commission over how to proceed without compromising the site’s historical essence.

As of October 2024, minimal progress had been made. City officials confirmed to Aspen Daily News that RH has maintained active permits by making incremental updates but has yet to finalize tenant improvement plans.

The Bidwell Building: Slow Progress on RH’s Mountain House

An incomplete shell is all that’s been built of an RH Gallery called the Mountain House. It occupies the site of the former Bidwell building, torn down in 2020. The project sits on a prime corner at 434 East Cooper Ave. Planned as a three-story luxury experience featuring retail space and fine dining, the site is currently the only RH project in Aspen that is making visible progress.

In 2021, a stop-work order halted construction after developer Mark Hunt failed to pay encroachment fees — a dispute he later dismissed as a city “mistake.” The slow progress also stems from RH and Hunt seeking multiple amendments to the original construction plan, triggering extensive reviews by Aspen’s planning and historic preservation teams.

Despite the setbacks, Friedman remains bullish: “It’s on the best corner in Aspen … We’ve got a great restaurant and hospitality experience. So that’s on track for next year,” he said on an earnings call in June, 2024.

The Boomerang Lodge: From Dereliction to Aspiration

Perhaps the most challenging project is the former Boomerang Lodge at 500 West Hopkins Ave., slated to become an RH Residences development. Once a mid-century modern gem, the site is now an eyesore, fenced off and neglected for years.

The city of Aspen reached an agreement with developer Hunt, RH’s partner on the property, in early 2024 to address the property’s decay. In exchange for avoiding demolition-by-neglect actions, RH and its partners committed to meeting repair deadlines starting in January. Yet progress has been slow, with Friedman citing market uncertainty and high interest rates as reasons for delaying the project’s timeline.

To this point, RH does not appear to have written off or taken an impairment on any of its Aspen expenses — despite the project being years behind schedule and still not open.

It wouldn’t even be close to the first time a once-promising project wound up being written down. In 2017, RH took impairments on RH Contemporary Art, RH Kitchen, and the Waterworks reporting unit, which specializes in luxury bathroom goods, prompting correspondence with the SEC.

RH Is Closer To Bankruptcy Than Almost All Its Peers, According to Key Statistic

The mounting cash problems aren’t just catching the attention of analysts — they’re lighting up one of Wall Street’s most trusted financial distress indicators.

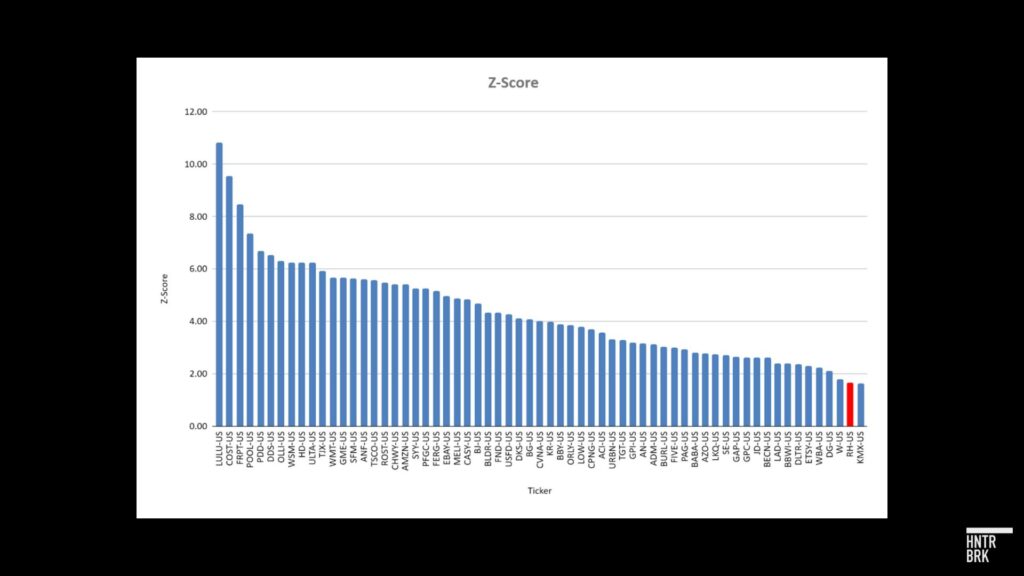

In 1968, New York University Professor Emeritus Edward Altman, then an assistant professor of finance, published what would become a cornerstone of financial analysis: a formula that combined five key financial ratios to predict bankruptcy risk. The original z-score formula combines five key financial ratios, each weighted differently: Z-score = 1.2X₁ + 1.4X₂ + 3.3X₃ + 0.6X₄ + 1.0X₅ where: X₁ = Working capital/Total assets; X₂ = Retained earnings/Total assets; X₃ = Earnings before interest and taxes /Total assets; X₄ = Market value equity/Book value of total debt; X₅ = Sales/Total assets.

The “z-score,” as it became known, proved remarkably prescient, maintaining its predictive power across different market cycles and becoming a standard tool for financial professionals assessing company health.

According to FactSet data, RH has the second-lowest Altman z-score among major U.S. retailers with market capitalizations above $5 billion, coming in at just 1.65.

The score, which weighs factors like working capital, retained earnings, operating income, and market value against total assets and liabilities, places RH squarely in what analysts consider the “distress zone” — territory reserved for companies showing significant financial stress. Any score below 1.81 traditionally signals elevated bankruptcy risk, while scores above 2.99 indicate financial health.

The lower score does not necessarily mean bankruptcy is on the horizon. The z-score is an imperfect metric — and if the housing market recovers, RH could see significant growth. But it does indicate that, in the face of an economic downturn, or a continued housing slump, RH could be in a precarious position.

The Questionable Guide, Or, Why Jim Cramer Might Not Be Right About Gary Friedman

On CNBC, several days after RH reported earnings, Jim Cramer defended Friedman from accusations that his guidance had been too rose-tinted.

“A lot of people feel like he was too bullish in his projections. That’s nonsense. The guy has been spot on in his projections. Probably one of the most accurate CEOs about what is going to happen,” said Cramer, before adding: “Very interesting short squeeze.”

But a review of RH’s past earnings reports shows that, to the contrary, Friedman has not been “one of the most accurate CEOs.”

The company has missed its GAAP EPS estimates in 15 of the last 20 quarters. RH’s free cash flow projections, meanwhile — a statistic the company doesn’t expressly predict but that the sell side derives based on company commentary — have missed in almost every quarter since July of 2021, with a cumulative shortfall versus estimates of $1.4 billion. (The company’s adjusted EPS has only fared a bit better — and the impact of impairments like those related to Waterworks, RH Contemporary Art, and its German stores makes it a difficult metric to track.)

And then, there is the false optimism that led to the $50 million shareholder settlement.

Documents from the lawsuit revealed the company was alleged to have sold product that had never been built and that it had never intended to make.

On Glassdoor, more recent employees shared similar alleged stories, though Hunterbrook could not verify them due to the anonymity of the platform. “Cult environment, fake, stressful, CEO does not care about his employees and only cares about getting richer and making a name for himself,” reads one, calling out “false promises to deliver product by certain dates knowing that product has not even been approved for production.”

But while Cramer is wrong about the accuracy of Friedman’s projections, RH’s stock price — with Friedman at the helm — has proven resilient in the face of consistent misses. And if past is prologue, RH may be able to miss projections yet again and find a way to nonetheless keep its stock price afloat.

But what distinguishes this moment from some others in the recent past is that RH is running out of cash, leaving the company with very few options.

The first option is making money — turning free cash flow positive before running out of resources — perhaps by going through inventory at a faster pace, even if that means steepening discounts and diluting the brand. The existing home sales market could also, suddenly, recover, leading to a new wave of interest in furniture.

But on his December 12, 2024, earnings call, Friedman stated that while “demand” had continued to soar in November and December, he did not expect the company to turn free cash flow positive until 2025. Some analysts have projected that the inflection point could come in the fourth quarter of 2024 financials — perhaps after conversations with the company. But either way, RH would need to post several consecutive profitable quarters to regain a solid cash position.

The second option is raising money. A stock issuance would be a difficult needle to thread, considering RH’s recent multibillion-dollar stock buyback. But the company could issue a convertible note, as it did in both 2018 and 2019. If RH were to do so again successfully in early 2025, the company would bolster its cash reserves, but that would come with significant dilution for existing stockholders.

RH could also, technically, sell some of those shares it bought back in 2022 — a possibility that would have a similarly dilutive impact. Friedman did not exactly rule that out on his most recent earnings call.

The company’s debt, he explained, wasn’t like normal debt. “We think about it more as a currency swap,” he said with Saylorian flair, arguing that he “exchanged one currency, debt, for what we believe is an exponentially more valuable currency: our stock.”

“We can turn our stock into cash tomorrow,” he added.

The third possible outcome here is what Friedman did before when the company faced an existential threat to its continued operation. The stock price had plummeted to under $3 per share. Cash reserves were running low. The financial crisis was emerging. And Friedman, with the help of outside investors, bought the company and took it private at a discount.

There is currently no indication that Friedman would take RH private — especially while its stock continues to trade near recent highs. And it’s unclear where he would source adequate outside capital at RH’s current valuation.

But if things were to go downhill — if a recession were to hit or the housing market were to continue its descent or if cloud couches went out of vogue — RH could be left with limited options.

One of which might be to buy back the company, which, for Friedman, might not be all bad.

“He’d have amazing assets,” quipped McClintock.

“Two jets. A boat. A mansion in every major city.”

That plus a bottomless supply of $20 truffle fries.

Authors

Till Daldrup joined Hunterbrook from The Wall Street Journal, where he focused on open-source investigations and content verification. In 2023, he was part of a team of reporters who won a Gerald Loeb Award for an investigation that revealed how Russia is stealing grain from occupied parts of Ukraine. He has an M.A. in Journalism from New York University and a B.S. in Social Sciences from University of Cologne. He’s also an alum of the Cologne School of Journalism (Kölner Journalistenschule). Till is based in New York.

Blake Spendley joined Hunterbrook from the Center for Naval Analyses (CNA), where he led investigations as a Research Specialist for the Marine Corps and US Navy. He built and owns the leading open-source intelligence (OSINT) account on X/Twitter, called @OSINTTechnical (>925K followers), which now distributes Hunterbrook Media content. His OSINT research has been published in Bloomberg, the Wall Street Journal, and The Economist, among other top business outlets. He has a BA in Political Science from USC.

Nick Gibbons is a seasoned forensic accounting expert and investment researcher. His experience includes a blend of qualitative and quantitative investment roles at Two Sigma, Norges Bank Investment Management, and Citadel. He began his career in forensic accounting at independent equities research provider Gradient Analytics. He additionally has a background in graduate level education having previously served as Adjunct Professor of Finance and Accounting at Thunderbird School of Global Management and currently as Adjunct Assistant Professor of Accounting at NYU Stern School of Business. He is a Certified Fraud Examiner (CFE) and Master Analyst in Financial Forensics (MAFF).

Sam Koppelman is a New York Times best-selling author who has written books with former United States Attorney General Eric Holder and former United States Acting Solicitor General Neal Katyal. Sam has published in the New York Times, Washington Post, Boston Globe, Time Magazine, and other outlets — and occasionally volunteers on a fire speech for a good cause. He has a BA in Government from Harvard, where he was named a John Harvard Scholar and wrote op-eds like “Shut Down Harvard Football,” which he tells us were great for his social life. Sam is based in New York.

Matthew Termine is a lawyer with nearly five years of experience leading the legal team at a mortgage technology company. In 2017, Matt was credited by the Wall Street Journal, among others, for identifying suspicious mortgage loan transactions that led to several successful criminal prosecutions, including that of a prominent political operative and the chief executive officer of a federally chartered bank. He is a graduate of Trinity College and Fordham University School of Law. He grew up in Old Saybrook, Connecticut and now lives in Brooklyn with his wife and two sons.

Nicholas Hampson, the award-winning British documentarian, contributed reporting from Europe.

Editor

Jim Impoco is the award-winning former editor-in-chief of Newsweek who returned the publication to print in 2014. Before that, he was executive editor at Thomson Reuters Digital, Sunday Business Editor at The New York Times, and Assistant Managing Editor at Fortune. Jim, who started his journalism career as a Tokyo-based reporter for The Associated Press and U.S. News & World Report, has a Master’s in Chinese and Japanese History from the University of California at Berkeley.

Hunterbrook Media publishes investigative and global reporting — with no ads or paywalls. When articles do not include Material Non-Public Information (MNPI), or “insider info,” they may be provided to our affiliate Hunterbrook Capital, an investment firm which may take financial positions based on our reporting. Subscribe here. Learn more here.

Please contact ideas@hntrbrk.com to share ideas, talent@hntrbrk.com for work opportunities, and press@hntrbrk.com for media inquiries.

LEGAL DISCLAIMER

© 2025 by Hunterbrook Media LLC. When using this website, you acknowledge and accept that such usage is solely at your own discretion and risk. Hunterbrook Media LLC, along with any associated entities, shall not be held responsible for any direct or indirect damages resulting from the use of information provided in any Hunterbrook publications. It is crucial for you to conduct your own research and seek advice from qualified financial, legal, and tax professionals before making any investment decisions based on information obtained from Hunterbrook Media LLC. The content provided by Hunterbrook Media LLC does not constitute an offer to sell, nor a solicitation of an offer to purchase any securities. Furthermore, no securities shall be offered or sold in any jurisdiction where such activities would be contrary to the local securities laws.

Hunterbrook Media LLC is not a registered investment advisor in the United States or any other jurisdiction. We strive to ensure the accuracy and reliability of the information provided, drawing on sources believed to be trustworthy. Nevertheless, this information is provided "as is" without any guarantee of accuracy, timeliness, completeness, or usefulness for any particular purpose. Hunterbrook Media LLC does not guarantee the results obtained from the use of this information. All information presented are opinions based on our analyses and are subject to change without notice, and there is no commitment from Hunterbrook Media LLC to revise or update any information or opinions contained in any report or publication contained on this website. The above content, including all information and opinions presented, is intended solely for educational and information purposes only. Hunterbrook Media LLC authorizes the redistribution of these materials, in whole or in part, provided that such redistribution is for non-commercial, informational purposes only. Redistribution must include this notice and must not alter the materials. Any commercial use, alteration, or other forms of misuse of these materials are strictly prohibited without the express written approval of Hunterbrook Media LLC. Unauthorized use, alteration, or misuse of these materials may result in legal action to enforce our rights, including but not limited to seeking injunctive relief, damages, and any other remedies available under the law.