Based on Hunterbrook Media’s reporting, Hunterbrook Capital is short $RR and long a basket of comparable securities at the time of publication. Positions may change at any time. See full disclosures below.

Beep, boop, fraud?

Shares of Richtech Robotics ($RR) surged more than 40% on Tuesday after the company announced a “collaboration” with Microsoft through the tech giant’s AI Co-Innovation Labs. On the back of that pump, the following morning, Richtech announced a $38 million dilutive fundraise.

But Microsoft tells Hunterbrook Media that Richtech is just a customer.

“Richtech participated in an AI Co-Innovation Lab engagement, which is a standard customer engagement focused on exploring and prototyping AI solutions using Microsoft technologies,” a Microsoft representative told Hunterbrook. “There is no commercial element in this lab engagement.”

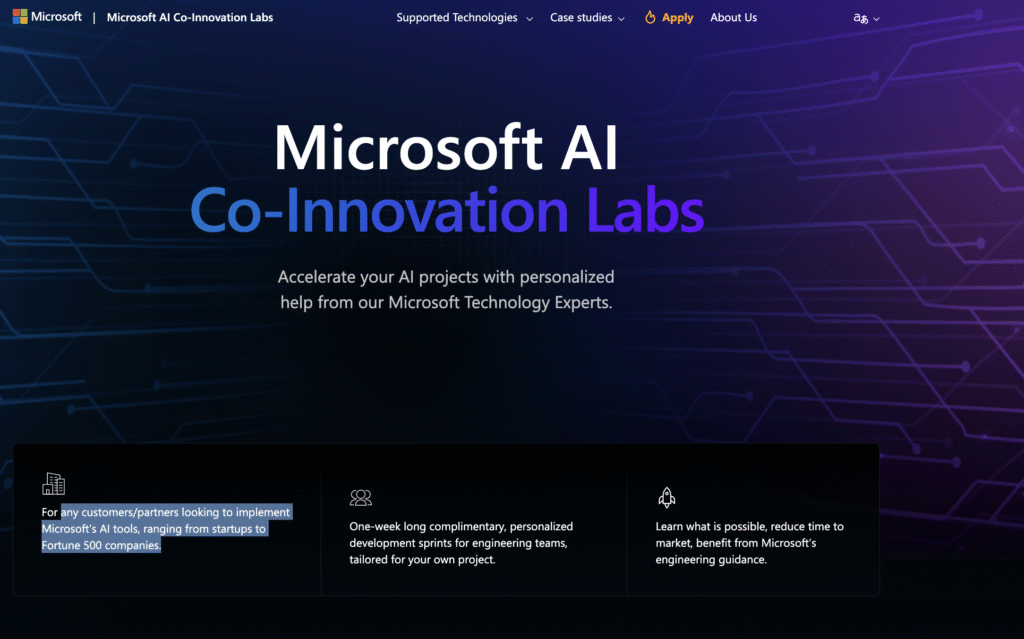

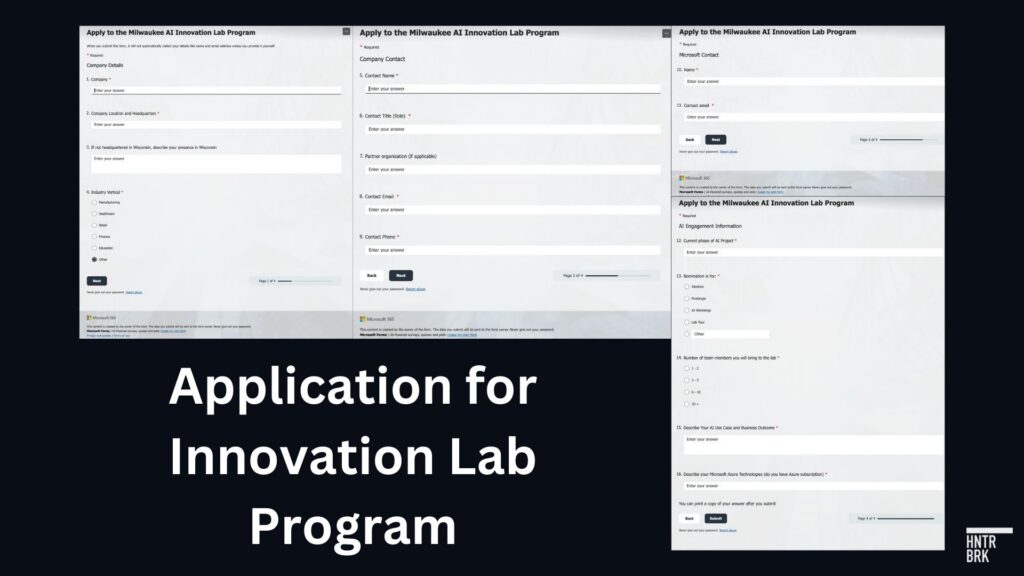

Specifically, Richtech appears to have participated in a program Microsoft describes on its website as being available to “any customers/partners looking to implement Microsoft’s AI tools,” including “startups.” (You can apply right here — and who knows, maybe you, too, can add $370 million in market cap to your name! Expect a response in “3-5 business days.”)

This strikes a very different tone from Richtech’s press release, which cited a “close collaboration” between Richtech and Microsoft.

“By working closely with the Microsoft AI Co-Innovation Labs, our teams were able to jointly develop and deploy intelligent capabilities that strengthen reliability, enhance customer interactions, and support scalable automation across physical environments,” said Wayne Huang, founder and CEO of Richtech Robotics.

The market, at least, seemed to think this implied a meaningful relationship between the two companies — the day of the announcement, $RR saw its steepest daily percentage increase in market cap in over a year. But based on Microsoft’s statement to Hunterbrook, no material partnership appears to exist.

And to the extent Richtech actually achieved anything with this press release, its signature accomplishment appears to have been convincing the market that an ordinary, complimentary customer training session amounted to some kind of partnership. (Sherwood News, owned by Robinhood: “Richtech Robotics soars after announcing partnership with Microsoft.” Benzinga: “Richtech Robotics Stock Surges On Microsoft AI Partnership.” And so on.)

In reality, Microsoft’s AI Co-Innovation Labs are described on the company’s website as offering “one-week long complimentary, personalized development sprints for engineering teams.” In other words, the “collaboration” Richtech announced appears to be participation in a free prototyping program available to Microsoft customers — not a commercial partnership.

In response to a request for comment, Richtech directed Hunterbrook to its delayed 10-K, filed over a week prior to this press release, in which the company disclosed that it had entered a “non-commercial technology collaboration” with Microsoft. When Hunterbrook followed up to ask why Richtech didn’t specify the relationship was “non-commercial” in its press release, the company did not reply.

Richtech has been under scrutiny for months.

In September 2025, short seller Capybara Research published a report labeling Richtech a “China Hustle” and opining that it was “riddled with fraud” and “uninvestable.” The report alleged a range of misconduct including insider self-dealing, ties to individuals under active DOJ prosecution and SEC investigation, fabricated enterprise partnerships, and claims that the company simply rebrands off-the-shelf Chinese robots and resells them at massive markups. Capybara also cited a lawsuit from a former partner alleging Richtech’s robots were “defective and could not operate as promised.”

Richtech did not publicly respond to the report.

Missed SEC Deadline Raises Questions

The Microsoft announcement came just one week after Richtech finally filed its delayed 10-K with the SEC on January 20, 2026, even missing its extended deadline.

Richtech’s fiscal year ended September 30, 2025. As a smaller reporting company, it had until December 29 to file its annual report. Instead, the company filed an NT 10-K (notification of late filing), claiming “additional time is needed to finalize the financial statements.” That extension seemingly granted Richtech until January 13 to file. The deadline came and went with no filing.

Failing to file timely reports, as required by Nasdaq Listing Rule 5250(c)(1), triggers an automatic deficiency notice. Once Nasdaq’s Listings Qualifications Department issues that notice — which may already have happened behind closed doors — Richtech has just four business days to publicly disclose its deficiency notice via an 8-K filing.

A review of Richtech’s SEC filings shows no such 8-K was filed between the January 13 deadline and the January 20 10-K filing. Did Richtech receive a deficiency notice and fail to disclose it? Richtech did not answer this question in its reply to Hunterbrook’s request for comment.

The Morning After: Richtech Raises $38.7 Million in Private Offering — Taking Advantage of Stock Pump for Liquidity

Even without the fraud allegations, Richtech’s numbers are bleak.

The 10-K filing included Richtech’s financial figures, which reveal a cash-burning machine. Fiscal year 2025 revenue totaled $5.045 million, with a net loss of $15.754 million — nearly double the prior year’s $8.14 million loss. After the Microsoft announcement, the company now has a market capitalization of more than $1 billion.

Without substantial revenue, to fund its operations, Richtech has repeatedly diluted shareholders by raising money through the issuance of new shares. But missing its 10-K filing deadline limited its options to secure more cash.

To use the Form S-3 process — the streamlined registration that enables fundraising approaches like shelf offerings and ATM programs — companies must have filed all required SEC reports on time for the preceding 12 months. SEC Rule 12b-25 allows a 15-day grace period for late filers, during which the filing is “deemed” timely. Richtech missed that deadline. The 10-K officially became delinquent, and barring some departure from standard policy, the company should have lost S-3 eligibility.

That means Richtech cannot tap its shelf registration or ATM program until it has 12 consecutive months of timely filings — so the earliest it could regain eligibility is January 2027. For a company burning over $20 million a year on $5 million in revenue, losing easy access to capital markets may be an existential problem.

So Richtech found another way to raise money.

On Wednesday morning — one day after the Microsoft announcement sent shares soaring — Richtech announced a $38.7 million private placement, selling millions of shares to an institutional investor “priced at the market under Nasdaq rules.” Unlike ATM offerings, private placements under Regulation D don’t require S-3 eligibility.

The timing could be problematic. Under Nasdaq rules, the “Minimum Price” for a private placement is the lower of the closing price or trailing five-day average immediately preceding the signing of the binding agreement. We don’t yet know when the agreement was signed — that will be disclosed in the 8-K filing.

If the deal was signed after Monday’s 44% surge, part of the pump would be baked into the Minimum Price calculation, allowing the company to raise capital at a higher price than would have been possible days earlier, while the investor would still be able to buy Richtech stock meaningfully below market price.

But if the deal was signed before the Microsoft announcement, it’s even more striking: The institutional investor locked in shares at a price based on the pre-pump stock, and then the very next day, a “collaboration” announcement sent the stock soaring — meaning the institution is now sitting on immediate paper gains while retail investors bought in at the top.

The playbook, in other words, seems to be: Miss your 10-K deadline, limiting your ability to fundraise; announce a “close collaboration” that in reality appears to be a one-week program open to just about anybody; watch the stock surge 44%; then disclose a private placement the next morning, allowing institutional investors to buy shares at a cheaper price than retail.

We may never know what Richtech learned about software engineering at the Microsoft Innovation Lab. But what seems clear is these guys could teach a course of their own on financial engineering.

Author

Sam Koppelman is a New York Times best-selling author who has written books with former United States Attorney General Eric Holder and former United States Acting Solicitor General Neal Katyal. Sam has published in the New York Times, Washington Post, Boston Globe, Time Magazine, and other outlets — and occasionally volunteers on a fire speech for a good cause. He has a BA in Government from Harvard, where he was named a John Harvard Scholar and wrote op-eds like “Shut Down Harvard Football,” which he tells us were great for his social life. Sam is based in New York City.

Editor

Wendy Nardi joined Hunterbrook after working as a developmental and copy editor for academic publishers, government agencies, Fortune 500 companies, and international scholars. She has been a researcher and writer for documentary series and a regular contributor to The Boston Globe. Her other publications range from magazine features to fiction in literary journals. She has an MA in Philosophy from Columbia University and a BA in English from the University of Virginia.

Hunterbrook Media publishes investigative and global reporting — with no ads or paywalls. When articles do not include Material Non-Public Information (MNPI), or “insider info,” they may be provided to our affiliate Hunterbrook Capital, an investment firm which may take financial positions based on our reporting. Subscribe here. Learn more here.

Please email ideas@hntrbrk.com to share ideas, talent@hntrbrk.com for work, or press@hntrbrk.com for media inquiries.

LEGAL DISCLAIMER

© 2026 by Hunterbrook Media LLC. When using this website, you acknowledge and accept that such usage is solely at your own discretion and risk. Hunterbrook Media LLC, along with any associated entities, shall not be held responsible for any direct or indirect damages resulting from the use of information provided in any Hunterbrook publications. It is crucial for you to conduct your own research and seek advice from qualified financial, legal, and tax professionals before making any investment decisions based on information obtained from Hunterbrook Media LLC. The content provided by Hunterbrook Media LLC does not constitute an offer to sell, nor a solicitation of an offer to purchase any securities. Furthermore, no securities shall be offered or sold in any jurisdiction where such activities would be contrary to the local securities laws.

Hunterbrook Media LLC is not a registered investment advisor in the United States or any other jurisdiction. We strive to ensure the accuracy and reliability of the information provided, drawing on sources believed to be trustworthy. Nevertheless, this information is provided "as is" without any guarantee of accuracy, timeliness, completeness, or usefulness for any particular purpose. Hunterbrook Media LLC does not guarantee the results obtained from the use of this information. All information presented are opinions based on our analyses and are subject to change without notice, and there is no commitment from Hunterbrook Media LLC to revise or update any information or opinions contained in any report or publication contained on this website. The above content, including all information and opinions presented, is intended solely for educational and information purposes only. Hunterbrook Media LLC authorizes the redistribution of these materials, in whole or in part, provided that such redistribution is for non-commercial, informational purposes only. Redistribution must include this notice and must not alter the materials. Any commercial use, alteration, or other forms of misuse of these materials are strictly prohibited without the express written approval of Hunterbrook Media LLC. Unauthorized use, alteration, or misuse of these materials may result in legal action to enforce our rights, including but not limited to seeking injunctive relief, damages, and any other remedies available under the law.