Hunterbrook Media’s investment affiliate, Hunterbrook Capital, does not have any positions related to this article at the time of publication. Positions may change at any time. Full disclosures below.

American agricultural giant Archer-Daniels-Midland (NYSE: $ADM) has a major stake in two food-processing plants in Xinjiang, China, a region known for state-sponsored forced labor, Hunterbrook Media has found.

In a document posted to the sustainability section of its website earlier this year, the company claimed there was “no identifiable direct or indirect connection between ADM and the region.”

The facilities are owned by a subsidiary of Wilmar International, a Singapore-based conglomerate whose largest single shareholder is ADM.

One of the two facilities is also co-owned by the British food processing and retail company Associated British Foods PLC (LSE: $ABF), the maker of Fleischmann’s Yeast and other well-known products.

Since 2017, the Xinjiang Uyghur Autonomous Region has become the center of the world’s largest state-sponsored detention and forced labor campaign against ethnic and religious minorities since World War II. The Chinese government’s repressive policies have targeted more than one million Uyghur Muslims and other Turkic ethnic groups with family separations, torture, sterilization, and abortion. The U.S. government and other governments have determined that these policies amount to genocide.

While some multinationals have since divested from the region, including ADM’s rival Cargill, In early 2022, Shanxi Changrong Agricultural Science and Technology Co., Ltd. agreed to purchase 100% equity in Cargill Feed (Xinjiang) Co. Ltd., which was then owned by Cargill Investment China Co. Ltd., according to the company’s announcement of the purchase. According to a job posting on a Chinese recruitment website in 2018, Cargill Feed, opened in 2006 and located in Changji, Xinjiang, processed animal feed products. the clothing brand Patagonia, and Apple, ADM and Wilmar appear to be expanding their operations in Xinjiang.

Hunterbrook’s analysis — based on satellite imagery, Chinese corporate data, company disclosures, government documents, and other open-source material — shows ADM and Wilmar’s facilities in Xinjiang have significantly increased their footprints since the government’s systemic abuses in the region intensified in 2017.

ADM and Wilmar have pledged to eliminate the use of forced labor in their supply chains, according to their corporate reports. See ADM’s 2023 Supply Chain Due Diligence report and Wilmar’s 2022 Annual Sustainability Report.

While ADM may not be a household name, the company — with businesses ranging from grain production and oil pressing to storage and transportation — is one of the most important players in the global food supply chain. “Grab a slice of bread in the US, a tortilla in Mexico or a pork dumpling in China,” a recent Bloomberg article said, “and the odds are good that [ADM] or rivals Bunge Global SA, Cargill Inc., or Louis Dreyfus Co. — known as the ABCDs of crop trading — had a hand in it.”

ADM has a history of violating its own policies and the law. Earlier this year, the U.S. Department of Justice launched an investigation into the company’s accounting practices, leading the company to put its chief financial executive on an administrative leave. ADM has since said it is cooperating with the authorities and announced the CFO will resign by the end of September 2024. In the 1990s, ADM pleaded guilty to a price-fixing scheme, incurring what was then the biggest criminal antitrust fine in history, as dramatized in the movie, “The Informant.”

ADM’s presence in Xinjiang may threaten its access to capital from funds that prioritize ESG criteria, Nell Minow, a co-founder of Institutional Shareholder Services, told Hunterbrook. ADM’s top institutional investors include Vanguard Group Inc. and BlackRock Inc., which, according to Bloomberg, have been under pressure since last year, when Congress launched investigations into BlackRock and others for allegedly funding companies engaged in forced labor blacklisted by the U.S. BlackRock told the Financial Times that it “complies with all applicable US government laws” and that it would “‘continue engaging’ with the China committee on the issue.”

ADM’s buyers, including the U.S. government, Bayer AG, and Johnson & Johnson, have explicit policies prohibiting their suppliers from using forced labor.

China’s intense policing and surveillance of Xinjiang make it nearly impossible to conduct independent, reliable audits for forced labor in factories operating in the province, according to experts on the region. That view underpinned the U.S. Congress decision to ban all imports of goods originating from Xinjiang with the 2021 Uyghur Forced Labor Prevention Act, under the rebuttable presumption that all such products are made with forced labor.

And that presumption is “virtually impossible” to rebut, according to Michael Posner, professor of ethics and finance at the New York University Stern School of Business, since “there’s no access by independent monitors.”

Posner, who served as Assistant Secretary of State for Democracy, Human Rights, and Labor from 2009 to 2013, added: “And remember, the Act passed the House 425-1. I tell you, you probably couldn’t get 425 members of the House to agree on what day of the week it is.”

“This is not a close call,” he added, explaining his view on companies like ADM continuing to operate in Xinjiang. “If this many people are being imprisoned, subjected to forced labor, and you’re doing business in that place, you have to really do some soul-searching and say, ‘Is this the way we want to run our business?’”

ADM maintains “strategic influence” over Wilmar International, rooted in successful partnership in China

ADM’s partnership with Wilmar dates back at least to the 1990s, when the two companies partnered with China’s state-owned COFCO Group to invest in what was then China’s first large-scale comprehensive oil and grain manufacturing complex, according to a 2020 report in the Chinese government-sponsored New Fortune magazine. The joint venture, previously East Ocean Grains Industry Donghai Grain Industry, is now known as COFCO East Ocean Oils & Grains Industries (Zhangjiagang) Co. Ltd.

In 2001, ADM and Wilmar formed a joint venture, Yihai Kerry Arawana Holdings Co. Ltd., to enter China’s nascent soybean crushing industry, taking advantage of further market liberalizations after China’s ascension to the World Trade Organization that year. Initially, the ADM and Wilmar joint venture was called Yihai Group. In 2006, Wilmar purchased Kerry Grains and Oil, the owner of China’s most ubiquitous edible oil brand, Arawana, and merged it with Yihai Grains and Oil to establish Yihai Kerry Arawana Holdings Co. Ltd.

The partnership made strategic sense. ADM, a top global soybean trader and oilseed processor, could supply the raw material and technology to make the products. Wilmar, with its extensive network in China, could market and distribute those goods across the nation.

The joint venture proved to be vastly successful. Over the next several years, Yihai Kerry rapidly expanded its operation, acquiring more than 20 oil-pressing plants, including facilities in Xinjiang, according to a Chinese government publication. Wilmar also owned another subsidiary in Xinjiang, Yihai (Akesu) Oils & Grains Industries, a cottonseed crushing company, but sold it to the Xinjiang Production and Construction Corps — one of the main perpetrators of forced labor abuses in Xinjiang — in 2018, according to Wilmar disclosures. Its operation quickly became one of the largest vegetable oil production and distribution systems in China, cornering half the market.

In fact, the joint venture was so successful that, in the face of mounting criticism in China that foreign investment was threatening the country’s food security, Yihai Kerry’s senior management issued a formal response:

“We are not a company controlled by ADM in the United States at all, but a company invested in China by patriotic overseas Chinese,” referring to Wilmar’s chairman, Kuok Khoon Hong, and his uncle and the company’s key shareholder, Robert Kuok.

In 2006, ADM exchanged its equity in Yihai Kerry for a 16% stake in Wilmar, according to a Chinese government document and media outlets. In tandem with Yihai Kerry’s growing profit in China, ADM steadily increased its stake in Wilmar International.

Over the next decade, it became Wilmar’s largest outside shareholder — a status which ADM has acknowledged in its SEC filings gives it a “significant influence” over Wilmar.

In 2020, ADM sold $500 million worth of shares but assured investors that its stake in Wilmar International would not fall below 20% — the threshold it said was required to maintain its strategic influence over the firm. Senior Vice President Gregory Morris, who is also president of ADM’s largest business unit, the Agricultural Services and Oilseeds division, sits on Wilmar’s board.

ADM and Wilmar are two of the largest agribusinesses in the world. ADM, with 41,000 employees, has a market cap of about $30 billion. Wilmar, with 100,000 employees, has a market cap of about $15 billion.

The ties between the two companies go well beyond shareholder equity. ADM and Wilmar also share a deeply integrated supply and logistics chain, including a global shipping partnership. They are among each other’s largest suppliers and buyers. They operate a joint venture in Europe that markets their oil and fat products in the region.

“We’ll get married one day,” Kuok Khoon Hong, the chairman of Wilmar, told the Financial Times in 2014, suggesting a potential merger. “But unless conditions for marriage are good, we’ll just work closely with each other.”

Satellite imagery shows ADM and Wilmar expanded operations in Xinjiang

ADM and Wilmar operate two facilities in Xinjiang, which have expanded significantly since China’s detention and forced labor policies intensified in 2017, Hunterbrook found.

One of the facilities, Yihai Changji Cereal and Oil Industry Co. Ltd., Chinese name: 益海(昌吉)粮油工业有限公司 is located on the outskirts of Xinjiang’s capital Ürümqi, in a city called Changji. The facility, opened in 2005, is among Yihai Kerry’s biggest oilseed processing factories in China. It produces several popular Chinese vegetable oil brands including Arawana, which can be found at online delivery stores in the U.S.

A 2020 article in New Fortune said the Changji factory’s products include soybean oils produced for the French multinational Carrefour (PA: $CA) chain, although Hunterbrook could not independently verify this.

The Changji factory is also the largest vegetable oil processing facility in northwestern China, according to a profile of the plant found on an official Chinese corporate registry database. The data is from Tianyancha, a Chinese business data search firm, which was leaked and posted on public forums in 2023. It contains 118 million profiles for Chinese registered companies. Analysts have compared this data against verified records and consulted with subject matter experts, and assess the data to be credible.

“Experts from ADM are responsible for … providing technology, while Wilmar handles the financial arrangements,” the profile reads.

The second Xinjiang facility is located about 300 miles further west, in the city of Cocodala near China’s border with Kazakhstan. The facility, AB Mauri Yihai Kerry (Cocodala) Food Co. Ltd., Chinese name: 益海嘉里英联马利(可克达拉)食品有限公司 produces yeast and other baking ingredients, according to a Chinese corporate credit information provider. Wilmar acquired it just four years ago and co-owns it with AB Mauri China, a subsidiary of the British food processing and retail giant, Associated British Foods. According to its 2023 Annual Report, ABF also has a 25% stake in another joint venture, Qingdao Xinghua Cereal Oil and Foodstuff Co. Ltd., in Cocodala, Xinjiang.

Trade data from the corporate data provider Sayari shows that between 2022 and 2024, the factory exported products to Asia, Africa, and Latin America. According to China’s General Administration of Customs, the facility exported yeast products to the U.S. at least once in 2020, before Congress imposed its ban via the Uyghur Forced Labor Prevention Act, which was passed in 2021 with bipartisan support.

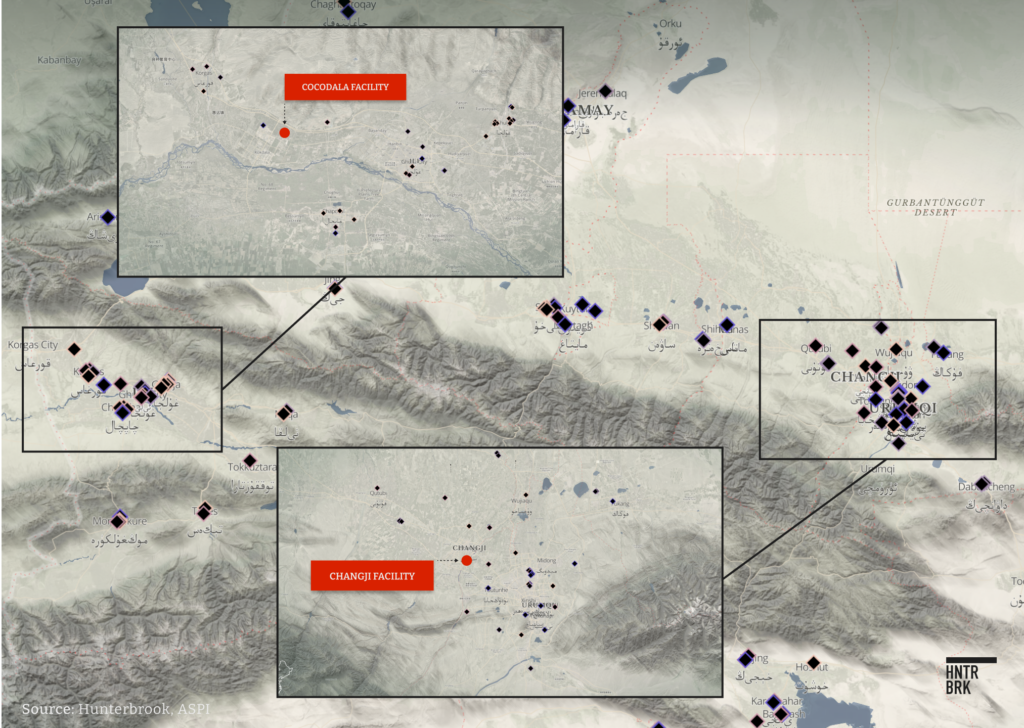

While the Chinese government has blocked access to the region for journalists and researchers, the Australian Strategic Policy Institute, a strategic and military policy think tank, has used satellite imagery and open-source information to map hundreds of suspected detention centers (so-called re-education centers), internment camps, and prisons built or significantly expanded across the region since 2017.

Hunterbrook mapped the coordinates of ADM and Wilmar’s factories alongside these detention camps. It appears 30 of these detention facilities were located within approximately 25 miles of the Cocodala factory, and 34 were located within approximately 30 miles of the Changji factory. Hunterbrook overlaid the location of the two Xinjiang factories on the ASPI map and calculated the distance between the factories and the detention centers, prisons, and re-education centers on the ASPI map.

Hunterbrook’s analysis of satellite images shows that the Changji processing plant grew significantly between 2019 and 2023. Hunterbrook used Google Earth Pro to compare historical satellite images of the ADM and Wilmar facilities in Changji (43.955, 87.187) and Cocodala (43.944, 81.049). Chinese corporate registry data describes the Changji facility address as “Sangong Town, Changji City, Changji Prefecture, Xinjiang (west side of Changji City Railway Station).” The description matches the location of the facility labeled “Yihai (Changji) Grain and Oil Industrial Co., Ltd. (益海(昌吉)粮油工业有限公司)” on Baidu map, a Chinese mapping platform. Chinese corporate data site Qichamao provides the Cocodala factory address as “No. 1, Renmin East Road, 66th Regiment, Kekedala City, Xinjiang (新疆维吾尔自治区 可克达拉市 人民东路).” This matches a location labeled “Xinjiang Mali Food Co., Ltd (新疆可克达拉市六十六团人民东路1号)” — a previous name of the Cocodala factory before it was changed in 2022 — on Baidu map. The factory added several new structures to the site, including cylindrical structures similar to ones used for food storage. The additions also include a new square-shaped edifice that appears to be one of the largest buildings in the facility.

The Cocodala facility has also expanded since Yihai Kerry entered the joint venture with ABF in 2020. Satellite imagery of the facility shows new construction of a cylinder-shaped building, possibly a storage tank.

Hunterbrook also analyzed light pollution data from the area collected by NASA and publicly available through the website lightpollutionmap.com. The data shows light pollution activity increased around both facilities after 2017 — another indicator of heightened human activity around the factories since the forced labor campaign began.

Company documents may show support for forced labor policies

The Chinese government uses phrases such as “employment transfers” and “poverty alleviation” to refer to the systemic detention, relocation, and exploitation of ethnic and religious minorities in Xinjiang, according to academics and the U.S. Government. See Shifting Gears, the Center for Advanced Defense Studies, June 30, 2022; Forced Labor in the Uighur Region: The Evidence, Sheffield Hallam University, April 2023; Forced Labor in the Xinjiang Uyghur Autonomous Region, the Jamestown Foundation, February 14, 2024. Wilmar subsidiary Yihai Kerry’s financial reports and Chinese government documents echo this language.

In its 2023 semi-annual statement, under a section titled “Social Responsibility,” Yihai Kerry said, “the company complies with the national rural revitalization policy … to help poverty alleviation and promote rural revitalization.” It specifically cited its Changji facility as an example of its compliance with these policies, stating “since 2016 … Changji has carried out rapeseed contract farming in Xinjiang, stimulating farmers’ enthusiasm for planting and creating high-quality rapeseed raw material.”

The U.S. Forced Labor Enforcement Task Force, responsible for overseeing bans on imports linked to forced labor, has banned companies that participate “in business practices that target members of persecuted groups, including Uyghur minorities in the PRC.” This includes participation in “government-sponsored poverty alleviation,” according to a statement by the U.S. Department of Homeland Security.

“You have a definite forced labor risk in a place like Changji. There’s no doubt about it,” said Adrian Zenz, an expert on Xinjiang whose work has been cited at the United Nations. “It does have its own ethnic minority regions and it does have a lot of industrial and commercial activity. And you would also have labor transfers going to Changji, bringing Uyghurs from the south to Changji besides the ones … who already live in the region.”

“It’s not possible to not be implicated in the policies that govern the region,” said Zenz. “You empower the government, you help them finance the police state.”

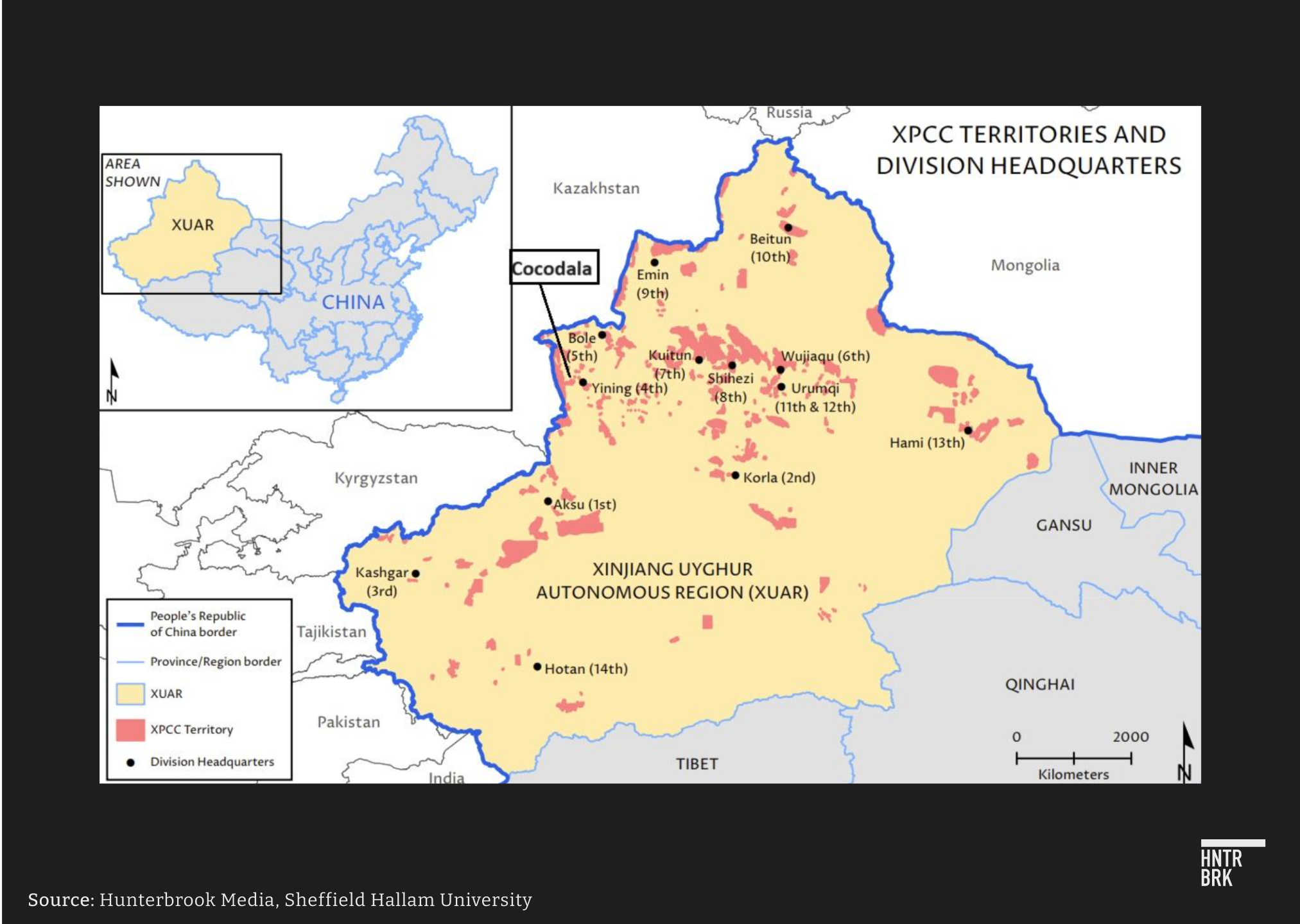

Further exposing the Cocodala facility to state-imposed forced labor policies is the fact that Cocodala City, Variations of the English transliteration of Cocodala (可克达拉市) include Kokdala and Kekedala. where the facility is located, is administered by the Xinjiang Production and Construction Corps, a paramilitary organization allegedly responsible for implementing many of the Chinese government’s atrocities against Uyghurs, including torture and forced relocation. The XPCC is responsible for governing Cocodala City and providing various social, education, and administrative services there. The division commander is the city’s mayor, and other government positions are held by XPCC officials. In 2020, the U.S. Department of the Treasury sanctioned the XPCC for what it called “serious human rights abuse against ethnic minorities in Xinjiang.” Before Wilmar’s investment, the Cocodala factory was run as a joint venture between ABF and the Fourth Division of the XPCC, according to Sayari and descriptions of the company in a Chinese recruitment website.

In response to Hunterbrook’s email requesting comment, an ABF spokesperson said, The full response from ABF is available here. “We share the concerns of the international community concerning allegations of human rights abuses in the XUAR.” The statement continued, “AB Mauri has thorough and extensive knowledge of this factory. … Management teams make regular visits to this factory. At no time during the course of any visits has any evidence of, or allegations of, forced labour come to light. We do not operate in any areas where we are not confident of our ability to comply with the law.” The spokesperson also said ABF internal audit teams visited the site, but did not provide dates and did not address Hunterbrook’s question on whether ABF agreed with the assessment by many experts that independent audits are virtually impossible in the region.

ADM responded to Hunterbrook’s request for comment by saying that it “actively works to protect human rights in our operations and supply chains,” without specifically addressing Hunterbrook’s questions on the Xinjiang facilities.

A recent policy document from Huocheng County, where Cocodala City is located, further indicates Yihai Kerry may be complicit in the county’s forced labor policies. The document, Huocheng County’s 14th Five-Year Plan and Vision for 2035, lays out a strategy for transferring and training surplus laborers to “promote social stability and economic development” in the region. Huocheng County’s five-year plan is rife with key words identified by Zenz and other scholars as terms that may be indicative of a forced labor policy, including “employment transfer (转移就业),” “labor relocation ( 劳动力转移),” “rural surplus labor (农村富余劳动力),” “return to poverty monitoring (返贫监测),” and “vocational skills training (就业技能培训).”

That strategy, which was adopted in 2021, specifically discussed Yihai Kerry as a potential investor in a planned Economic Development Zone, which it considered an important step in implementing Huocheng’s “industrial transfer” policy. Industrial transfers through the creation of industrial parks are a key tool for implementing the government’s repressive and assimilative policies against ethnic minorities, according to the Center for Advanced Defense Studies.

Nell Minow told Hunterbrook that expanding operations in Xinjiang poses a material governance risk that shareholders and customers should take seriously.

“You can’t just say, ‘It’s a subsidiary. It’s not my problem,’” she said. “You can’t just offload that obligation.”

ADM and Wilmar risk losing access to billions in ESG capital and contracts from U.S. government and other key customers

Even as ADM and Wilmar have expanded operations in Xinjiang, the companies have garnered institutional acclaim for their ESG commitments, helping them access significant capital through sustainability-linked bonds and ESG funding, or investments intended for companies that meet certain ESG standards. While many companies with links to Xinjiang have been subjected to scrutiny by human rights advocates and think tanks since 2017, ADM and Wilmar seem to have largely escaped such scrutiny. The only exception Hunterbrook found was the inclusion of ADM on a 2018 list of companies doing business in Xinjiang published by ChinaFile, a project hosted by the Asia Society.

Both companies profess a commitment to eliminating indentured labor, slavery, or human trafficking in their supply chains to comply with international standards. ADM says it prohibits “all forms of forced labor, including bonded labor, indentured labor, and child labor in our operations and our supply chains.” The company promises to audit its supply chains and investigate allegations of human rights violations. Like Wilmar, ADM does not refer to Xinjiang in the company’s annual Corporate Sustainability Report. Wilmar states it is committed to the “elimination of forced, bonded (including debt bondage) or indentured labour, slavery and trafficking of persons, and restrictions on workers’ freedom of movement. Wilmar is committed to upholding the rights to freedom of movement and the right to resign from employment.” As recently as 2022, the company’s annual report promoted what it said were measures to prevent human trafficking in Malaysia, Indonesia, Ghana, and Nigeria — it did not mention Xinjiang.

However, neither ADM nor Wilmar currently mentions the Xinjiang facilities in its disclosures, such as annual or sustainability reports. After 2020, Wilmar stopped including a detailed map that showed its Xinjiang locations in its annual reports.

ADM has more explicitly denied any ties to Xinjiang. Its 2021 Statement on the California Transparency in Supply Chains Act and UK Modern Slavery Act reads, “ADM, its subsidiaries and its joint ventures strongly support human rights, and we expect our business partners to treat their employees with dignity and respect. We will never knowingly use suppliers who employ or exploit legally underage workers or forced labor, and will not condone such practices.”

The statement also said, “In 2020, there were several allegations of human rights violations in our supply chains. Each was investigated and addressed in accordance with our protocol, and the outcomes were published in our log.” In the log, regarding “Reports of Human Rights Violations in the Xinjiang Uygur Autonomous Region,” the company stated, “ADM investigated any possible links to sourcing from the region in question. There are no direct links, and no identifiable indirect links.”

The log was updated as recently as February of this year.

ABF, meanwhile, listed the Cocodala facility and its address in its 2023 annual report as one of its joint ventures but provided no additional detail. A spokesperson for the company confirmed that, “Since 2015, the [Cocodala facility] has been included in every report to investors.”

ADM is included on the “World’s Most Ethical Companies” list by Ethisphere, a for-profit company that ranks companies based on ethics criteria and charges fees for their participation, according to the LA Times. Both ADM and Wilmar are S&P Global’s Sustainability Yearbook members — a distinction that S&P awards annually to companies with the highest Corporate Sustainability Assessment scores, which measure ESG performance.

In 2022, ADM issued almost $750 million in sustainable bonds to provide financing for its ESG projects.

Wilmar in 2021 announced it had been included in the London Stock Exchange Group’s FTSE4Good Index Series, which, according to Wilmar, is “designed to reflect strong ESG risk management practices.” It has also secured over $2 billion in sustainability-linked loans Wilmar reported $2.20 billion in its 2022 Annual Sustainability Report but has since added more. — loans with terms that incentivize achieving sustainability goals — including from major Singapore-based banks like DBS Bank Ltd. and United Overseas Bank Ltd. Wilmar said that its sustainability track record has enhanced its ability to secure funding.

“I would absolutely presume ADM knows what’s going on. … It would be negligent to own 20% of the company and not know what they’re doing,” said Kent Greenfield, a Boston College Law School professor and an expert on constitutional law and corporate governance.

If in fact ADM were involved in forced labor, the company could be “wiped out” of the ESG lists that “investors and public actors are using” to make decisions, said Greenfield. This, he added, could have a material impact on the business.

Ethisphere and S&P Global did not respond to Hunterbrook’s request for comment.

Minow described doing business in Xinjiang as a regulatory risk, not just for ADM and Wilmar but for companies that buy their products.

ADM and Wilmar’s buyers include household names, such as Cargill, Johnson & Johnson, Unilever, and Procter & Gamble, according to Sayari trade data. All have published codes of conduct specifically disavowing forced labor by their suppliers, although several have had controversies of their own.

In a response to Hunterbrook’s email request for comments, Cargill said it confirmed the company does not purchase from the ADM or Wilmar facilities in Xinjiang. Cargill also reconfirmed that it does not “have any of our own facilities in Xinjiang, China.” Johnson & Johnson, Unilever, and Procter & Gamble did not respond.

ADM also received a total of $700 million from U.S. government contracts from 2017 to 2024, according to USASpending.gov, a website that provides information on federal spending.

Even if ADM and Wilmar’s customers aren’t buying products specifically made in Xinjiang, some might still worry about being seen as “guilty by association,” said Greenfield.

This also doesn’t mitigate potential misrepresentations the two companies may have made to their customers regarding their ESG practices, according to Minow.

“If ADM is … soulless enough that they have separate contracts for people who care about this and people who don’t care about this, that’s pretty bad,” she said.

Minow also said Gregory Morris should step down from Wilmar’s board as ADM’s representative. “That is literally his job … to oversee risks like that,” she said.

Gregory Morris also serves on the board of the Chicago Council of Global Affairs and is a member of the Illinois State University Finance Advisory Board. Neither the Chicago Council of Global Affairs nor Illinois State University responded to a request for comment regarding the ties between Morris and Xinjiang.

Given its history of scandals, ADM may need an even bigger restart. “I’m thinking about other companies that have been in this kind of a dark situation,” said Minow. She added, “That just had to clean everybody out and start over again with a new board and a new CEO.”

Whether that will happen is another question — the answer to which, Posner said, could come down to how much pressure ADM is under. “If there’s enough public attention, consumer attention, media attention … at some point, it becomes enough of a risk that the company is forced to act.”

Hunterbrook published a separate investigation into ADM’s operations in Russia, where it is partnered with a company suspected of selling stolen Ukranian grain.

Authors

Jenny Ahn joined Hunterbrook Media after serving many years as a senior analyst in the U.S. government. She is a seasoned geopolitical expert with a particular focus on the Asia-Pacific region and has diverse overseas experience. She has an M.A. in International Affairs from Yale and a B.S. in International Relations from Stanford. Jenny is based in Virginia.

Christopher Giles is a reporter who utilizes open-source investigative approaches to cover international stories. His work has been featured by CNN, Bellingcat, and the BBC.

Grant Parks is a China analyst for Hunterbrook Media. He was previously at the Center for Advanced Defense Studies, where he researched the Chinese government’s networks and influence operations on the State-Sponsored Threats cell. Before joining C4ADS, Grant served for 10 years in the U.S. Navy as a carrier-based EA-18G pilot and tactics instructor, and completed a deployment to the western Pacific and Middle East. He continues to serve as a pilot in the reserves.

Editor

Sam Koppelman is a New York Times best-selling author who has written books with former United States Attorney General Eric Holder and former United States Acting Solicitor General Neal Katyal. Sam has published in the New York Times, Washington Post, Boston Globe, Time Magazine, and other outlets — and occasionally volunteers on a fire speech for a good cause. He has a BA in Government from Harvard, where he was named a John Harvard Scholar and wrote op-eds like “Shut Down Harvard Football,” which he tells us were great for his social life. Sam is based in New York.

Hunterbrook Media publishes investigative and global reporting — with no ads or paywalls. When articles do not include Material Non-Public Information (MNPI), or “insider info,” they may be provided to our affiliate Hunterbrook Capital, an investment firm which may take financial positions based on our reporting. Subscribe here. Learn more here.

Please contact ideas@hntrbrk.com to share ideas, talent@hntrbrk.com for work opportunities, and press@hntrbrk.com for media inquiries.

LEGAL DISCLAIMER

© 2026 by Hunterbrook Media LLC. When using this website, you acknowledge and accept that such usage is solely at your own discretion and risk. Hunterbrook Media LLC, along with any associated entities, shall not be held responsible for any direct or indirect damages resulting from the use of information provided in any Hunterbrook publications. It is crucial for you to conduct your own research and seek advice from qualified financial, legal, and tax professionals before making any investment decisions based on information obtained from Hunterbrook Media LLC. The content provided by Hunterbrook Media LLC does not constitute an offer to sell, nor a solicitation of an offer to purchase any securities. Furthermore, no securities shall be offered or sold in any jurisdiction where such activities would be contrary to the local securities laws.

Hunterbrook Media LLC is not a registered investment advisor in the United States or any other jurisdiction. We strive to ensure the accuracy and reliability of the information provided, drawing on sources believed to be trustworthy. Nevertheless, this information is provided "as is" without any guarantee of accuracy, timeliness, completeness, or usefulness for any particular purpose. Hunterbrook Media LLC does not guarantee the results obtained from the use of this information. All information presented are opinions based on our analyses and are subject to change without notice, and there is no commitment from Hunterbrook Media LLC to revise or update any information or opinions contained in any report or publication contained on this website. The above content, including all information and opinions presented, is intended solely for educational and information purposes only. Hunterbrook Media LLC authorizes the redistribution of these materials, in whole or in part, provided that such redistribution is for non-commercial, informational purposes only. Redistribution must include this notice and must not alter the materials. Any commercial use, alteration, or other forms of misuse of these materials are strictly prohibited without the express written approval of Hunterbrook Media LLC. Unauthorized use, alteration, or misuse of these materials may result in legal action to enforce our rights, including but not limited to seeking injunctive relief, damages, and any other remedies available under the law.