Hunterbrook Media’s investment affiliate, Hunterbrook Capital, does not have any positions related to this article at the time of publication. Positions may change at any time. Hunterbrook Media is working with litigators on potential lawsuits based on our investigation. If you are a victim, we invite you to share your story by emailing ideas@hntrbrk.com — where we source information for ongoing reporting.

You’re in what you thought would be your dream house — until it wasn’t.

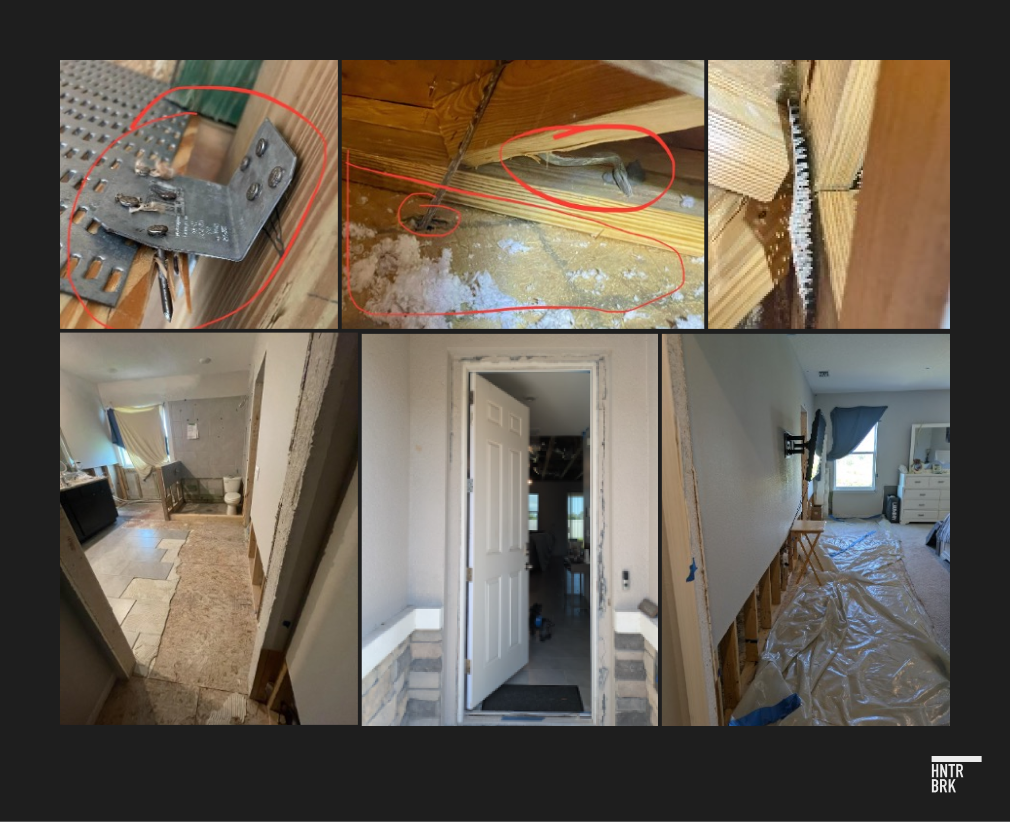

The living room ceiling has been ripped out after sewage water backed up and flooded the upstairs bathroom. With the drywall gone, you can spot loose nails and concerning gaps between the floor joists. Rainwater seeps through the cracks around the front door.

Insects crawl through the window frames — even though the windows were reinstalled because they weren’t installed properly in the first place. And most of your bathrooms are unusable, awaiting repairs the builder promised more than a year ago.

It feels like a nightmare — but it’s reality, according to Danielle Antonucci, who invited a Hunterbrook Media reporter to the home she and her husband bought just four years ago in Sarasota, Florida, built by the nation’s largest homebuilder, D.R. Horton ($DHI). In an email provided to Hunterbrook, Antonucci desperately pleaded with D.R. Horton to address the numerous defects rendering their home nearly uninhabitable: “I keep getting the response that this matter has been escalated to the Sarasota office,” she wrote. “It has been 21 months!”

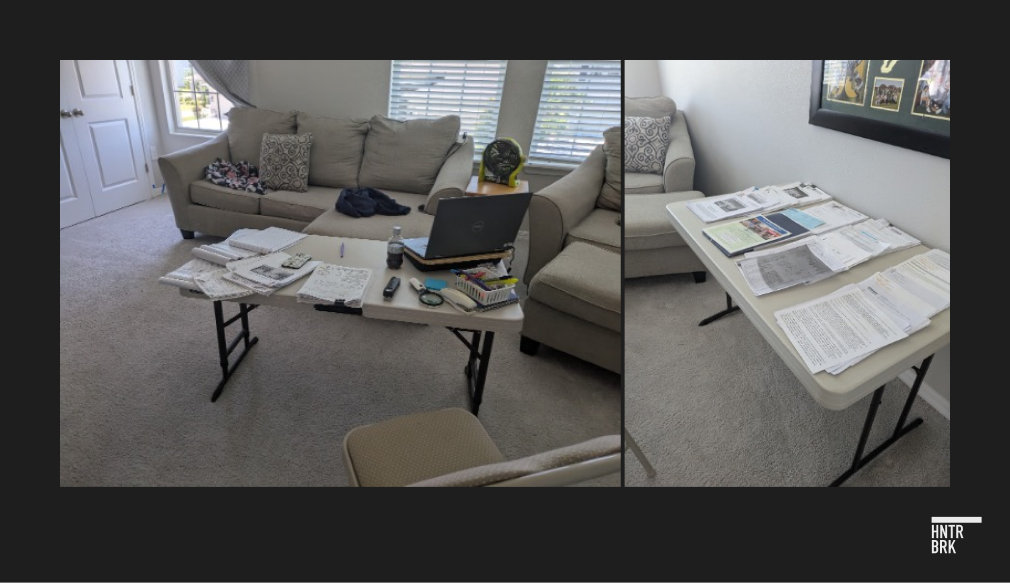

“Physically, mentally, emotionally, financially, it’s been the biggest nightmare of my life,” Antonucci said, adding, “This is my full-time job now, dealing with this home.”

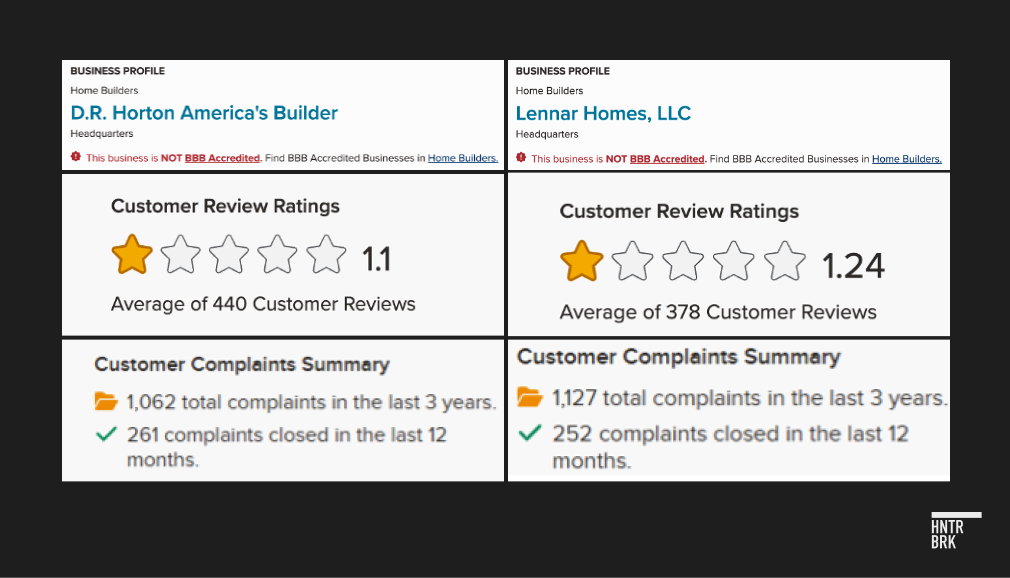

More than 60 homeowners across 16 states who purchased their dream home from one of the nation’s two largest residential homebuilders, D.R. Horton and Lennar ($LEN), shared similar accounts with Hunterbrook. They described extensive construction defects stemming from substandard workmanship, inferior materials, and blatant building code violations that sometimes make their homes unsafe and unlivable.

These homeowners also expressed profound frustration with the builders’ complex tactics to evade responsibility for these defects, leaving families out in the cold — sometimes literally.

“It’s been the biggest nightmare of my life.”

Danielle Antonucci

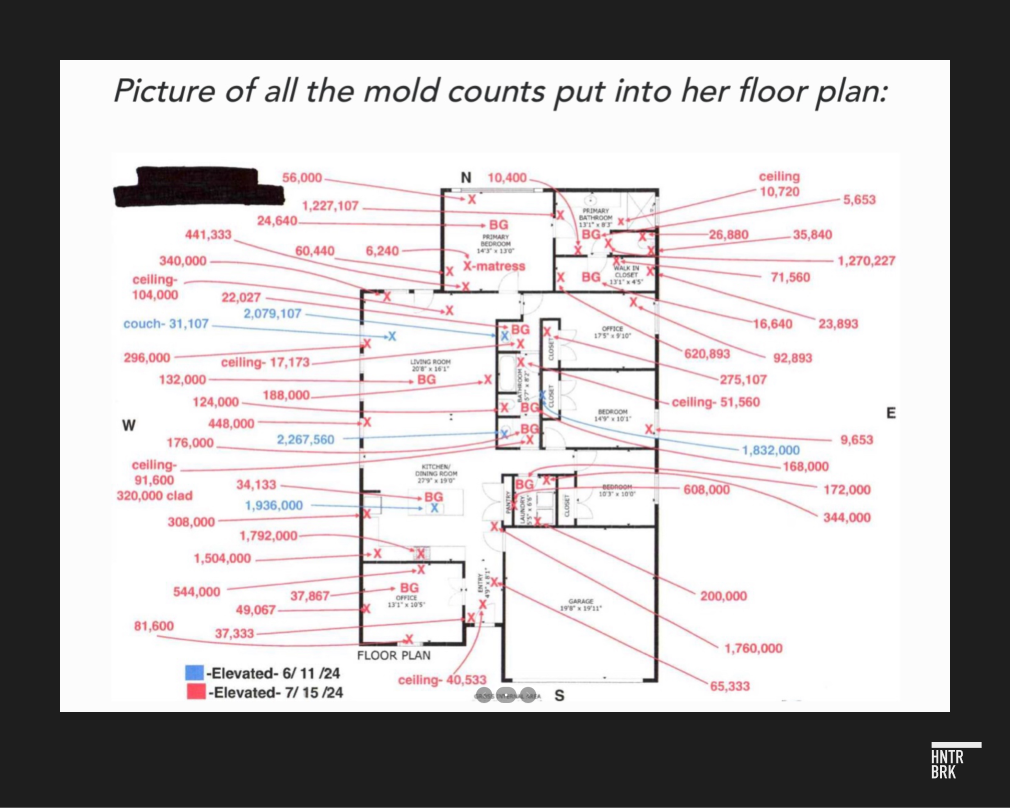

Take Leslie Montgomery, who said her family has had to live in hotels since county officials condemned her house after a mold infestation so severe that her previously healthy teenage son was unable to attend school.

Lennar offered to clean the ducts, according to Montgomery, downplaying the problem even after biochemical inspectors the company hired declared the home a total loss. The inspectors tried to reason with Lennar, saying there was “a sick kid involved,” according to Montgomery, but Lennar didn’t budge.

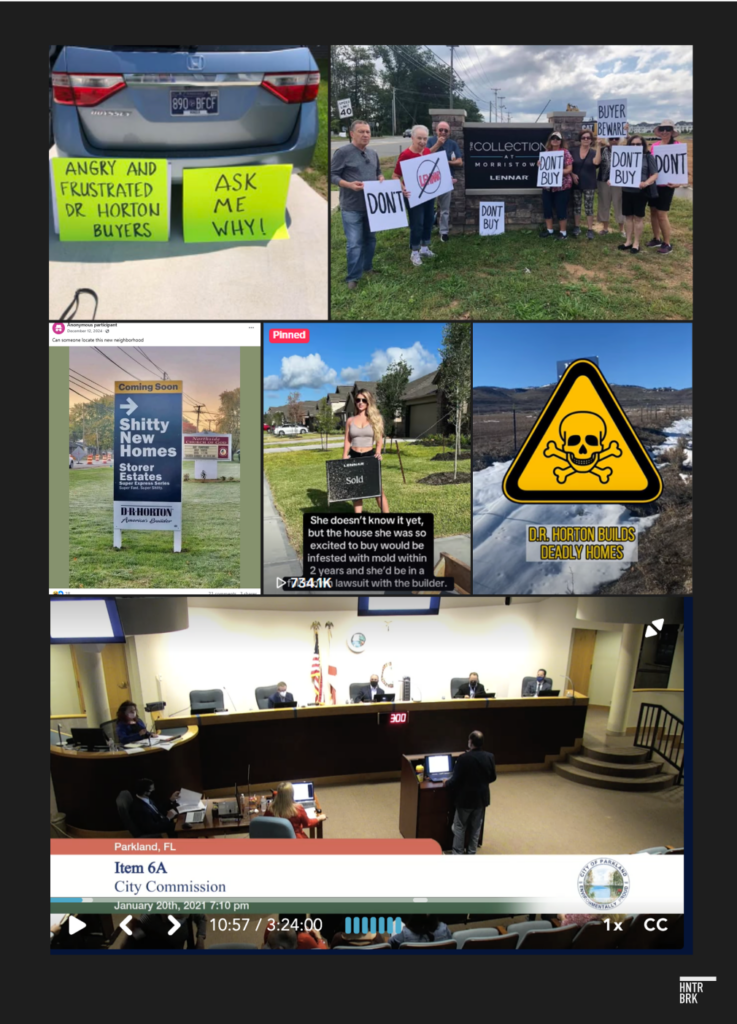

Their testimonies echo those of thousands of other homeowners who have desperately turned to social media platforms, official government channels, consumer review sites, and local news to demand answers on the construction defects that the companies refuse to acknowledge or address. Common complaints range from water intrusion, truss and joist deficiencies, ventilation problems, and missing or inadequate fireproofing or insulation, to foundation cracks, improper grading, and plumbing issues, many in violation of building codes.

Both D.R. Horton and Lennar promise that their mission to build affordable homes will not come at the cost of quality — even as they have told investors they would cut costs to offset diminishing margins amid a tightening housing market.

“You have to start value-engineering every component of the home, which means making compromises, not in quality, but in the way that you actually configure the homes,” Lennar CEO Stuart Miller said in an interview with Bloomberg Television last year.

D.R. Horton similarly promised its investors it would find ways to cut costs, like “replacing certain high quality fixtures and finishes with less expensive yet still high-quality fixtures and finishes.”

But many avoidable defects are caused by business practices that focus on building and selling quickly, with minimal concern for repeat business or quality control, according to Robert Knowles, president and founder of the National Association of Homeowners and a licensed professional engineer who said he has inspected thousands of new builds.

“There is no bonus for building the house to code, for quality,” Knowles said, to his knowledge. “There’s only bonuses for speed … and volume.” Knowles estimated 100% of all new builds probably have multiple code violations.

Knowles’ comments echo those of multiple other building experts and former employees interviewed by Hunterbrook, who accused the builders of cutting corners and neglecting safety measures. “I don’t know how they passed inspections, because there were so many violations,” one former D.R. Horton superintendent, who said they had left “because I do not want my name attached to that kind of work,” told Hunterbrook.

“They always used the cheapest subcontractor, and focused on speed rather than quality.”

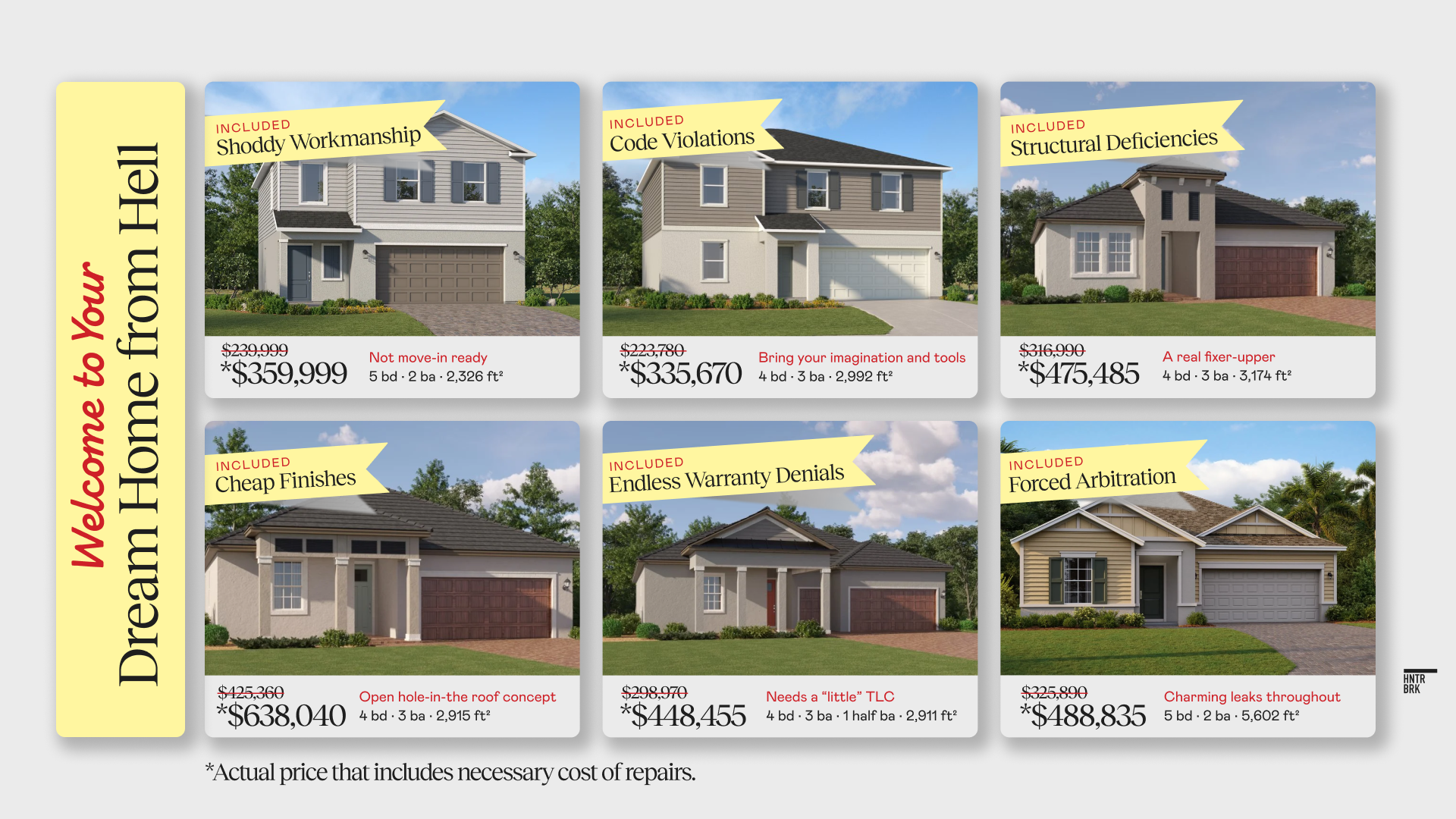

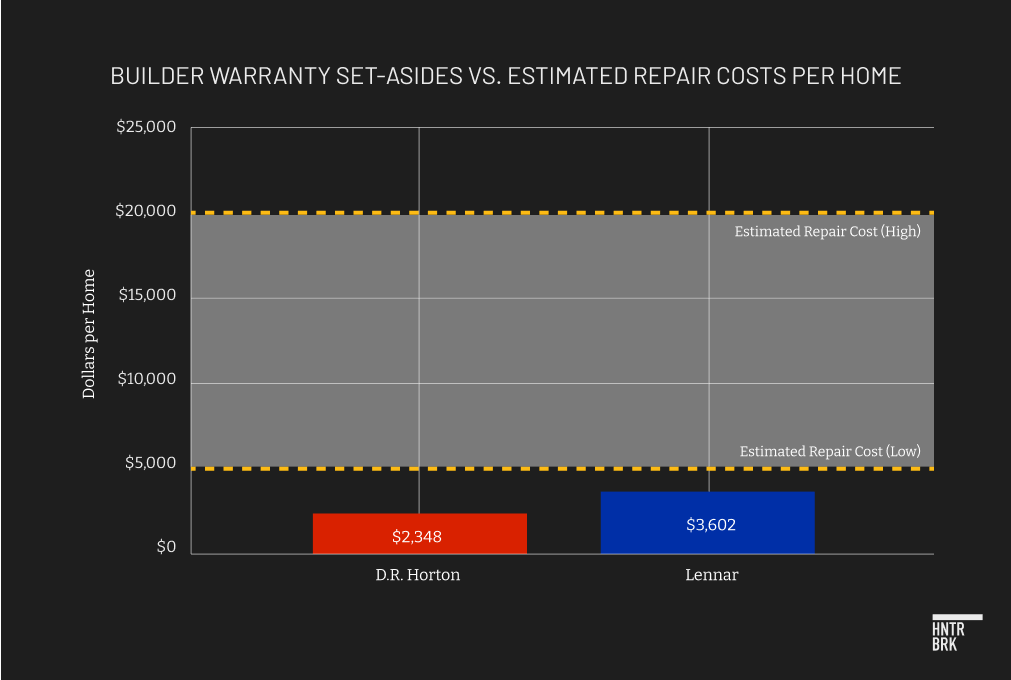

Knowles estimated repair costs to be about $5,000 to $20,000 for these defects in a typical new home by these builders — assuming there are no major issues like siding or roofing that need replacing.

That’s far more than the $2,348 on average per home that D.R. Horton set aside last year in expected warranty costs, or Lennar’s set-aside of about $3,602 per home, according to their SEC disclosures.

Hunterbrook’s investigation suggests a step-by-step corporate playbook designed to push the cost of the defects to buyers by exploiting the vast power imbalance between the billion-dollar companies and middle-class buyers. D.R. Horton and Lennar do this through one-sided contracts that lock in buyers and insulate the companies from liability for defects in the homes they sell, while minimizing the buyer’s ability to seek legal recourse.

Sign Up

Breaking News & Investigations.

Right to Your Inbox.

No Paywalls.

No Ads.

The playbook starts by rushing shoppers — lured by glossy brochures, upgraded model homes, unbeatable loan offers, and assurances of expansive warranty coverage — into signing away their rights in contracts that make it nearly impossible for buyers to back out, even if major defects are found, according to homeowners.

After closing, many homeowners who uncover defects are confronted with a byzantine warranty process seemingly designed to outlast the homeowners’ willpower — or the warranty clock. Homeowners called the warranty a “sham” and described having to “hound” the company, “fighting tooth and nail” to try and get their problems addressed. One compared the experience to “performing a root canal on yourself.”

Even if the buyers succeed in this process, the companies often make cheap band-aid fixes that don’t last, forcing homeowners to repeat the cycle all over again. As one Lennar homeowner put it, “If they do, quote, attempt to repair something, you’re left with at least three to five new issues. … It’s very depressing. It becomes your full-time job.”

Many end up paying for the repairs themselves. Others, worried about property value, opt not to pry deeply into the problems and keep quiet.

Still others face problems so severe and expensive that they can’t pay for repairs out of pocket, leaving them stuck in a nightmare home that they can’t even sell.

“I’ve lived in the house almost four years. I’ve had no peace,” Kim Cardillo, a realtor who purchased a D.R. Horton home in a 55+ community in Port St. Lucie, Florida, in 2021 told Hunterbrook. “My credit’s wrecked because of this whole situation. So it’s like, where do I go?” She added, “I’m ready to just walk away, honestly. A couple weeks ago, in tears because it’s so stressful, I was just like, you know what, I’m just going to foreclose on the house.”

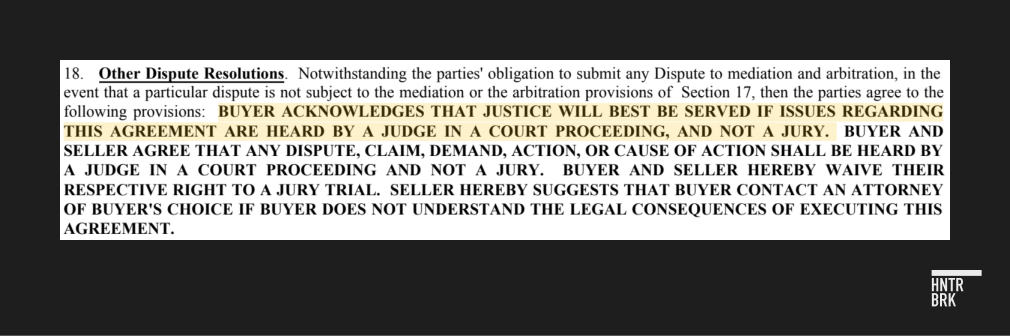

Many turn to legal action as a last resort, only to find they’ve waived their right to go to court by signing the purchase agreement. Instead, they are forced into a private arbitration system that critics say is rigged in favor of the builders.

“This concept of forced arbitration, it abuses the very sense of justice,” said Martha Perez-Pedemonti, a civil justice and consumer rights attorney with advocacy organization Public Citizen, who has spent years fighting against forced arbitration.

“You’re talking about someone’s housing, someone’s survival,” she told Hunterbrook, adding, “I think there’s very little else that’s more important to anyone.”

For the builders, the system seems to be working.

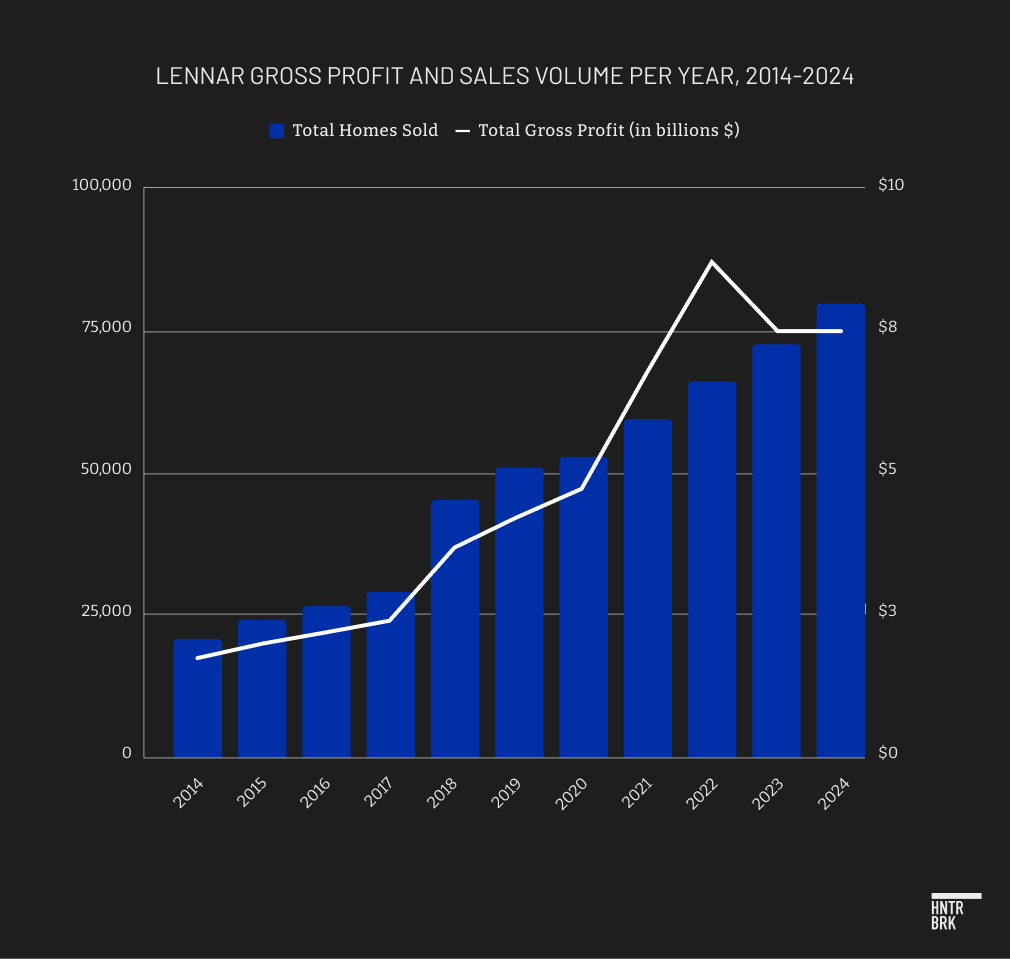

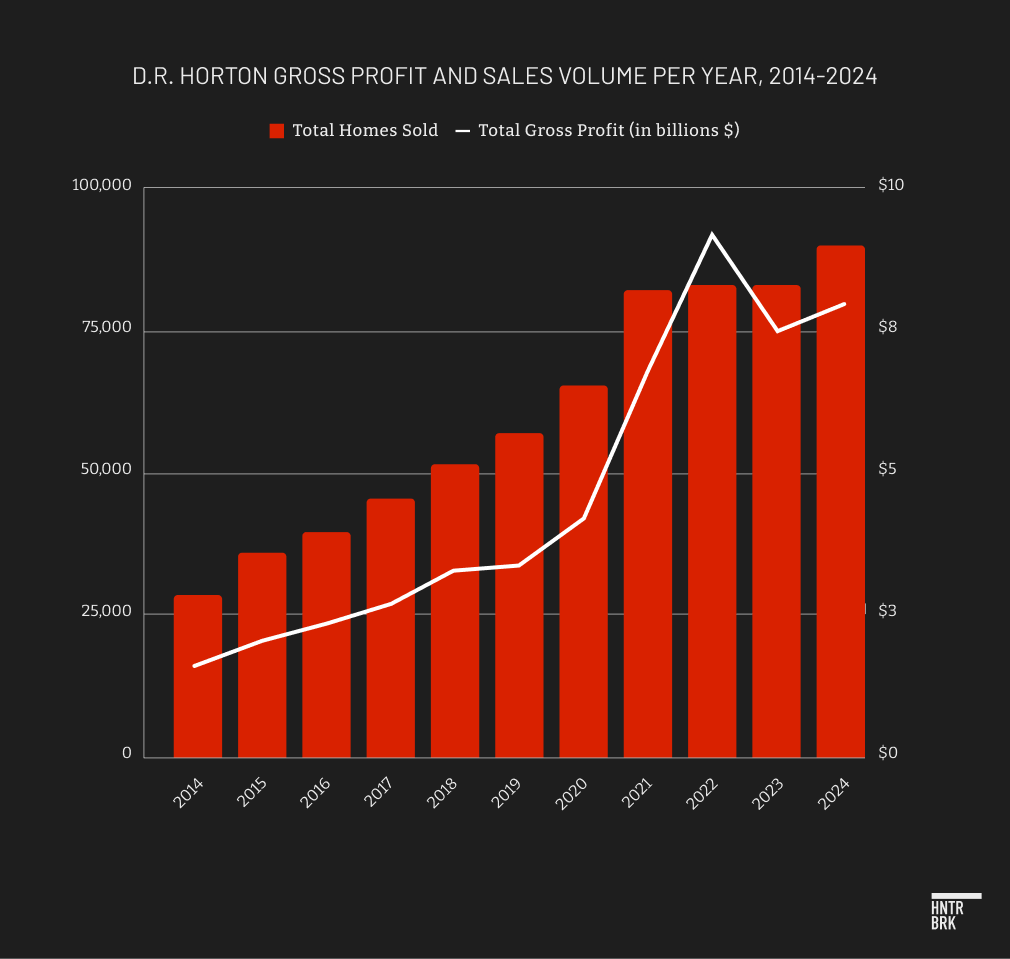

The two companies have remained hugely profitable even as their stock prices have tumbled more than 30% in the last year amid cooling demand and rising costs. In 2024, each company netted around $8 billion in gross profit from home sales — or $88,661 gross profit per home sold for D.R. Horton, and about $95,609 for Lennar. The figures are based on Hunterbrook’s calculation of the estimated cost per homes, subtracted from the average selling price per home, based on D.R. Horton’s and Lennar’s annual statements to the SEC.

In response to Hunterbrook’s request for comment, a D.R. Horton spokesperson said in an email, “D.R. Horton is proud to consistently deliver top-quality new homes across the United States, enabling more than 1,100,000 individuals and families to achieve the dream of homeownership since our founding in 1978.” They said the company provides “a robust new home warranty to our homebuyers” and the staff is “fully committed to customer satisfaction and respond to any warranty needs and concerns of our homeowners.”

Lennar did not respond to our request for comment.

Meanwhile, the lives of many homeowners across the country have been ruined.

Desperate, some of these victims have become citizen journalists themselves, filing public records requests; clandestinely recording conversations with the companies; becoming amateur construction experts; and poring over manufacturer’s inspection manuals and local building codes. They’re also speaking at city council meetings to advocate for stronger policies against the builders, engaging audiences on TikTok, Instagram, and even Discord, and picketing and putting up flyers along roadways to warn other shoppers.

“It’s really hard to find the words that describe the nightmare of a situation that this has been,“ said Antonucci.

“This is the house from hell.”

Step 1: Rush to Close

As homeowners uncover defect after defect in their newly purchased homes, many make a second disturbing discovery: Long before closing day, they had already been ensnared in a system designed to prevent them from detecting these problems until it was too late to walk away.

Hunterbrook spoke with D.R. Horton and Lennar buyers who recalled being pressured to sign a deal and even feeling trapped in it by the threat of losing a substantial deposit.

Lennar sales reps seemed particularly prone to rushing people, according to Hunterbrook’s interviews.

Chris Holdridge closed on a Lennar home in 2023 in Riverview, Florida. He said he was told the house he wanted was the last one, and in order to get the discount offered on closing costs, he had to “sign right here, right now.”

“And I work in real estate. I don’t generally work with that type of pressure.”

Another Lennar homeowner, who wished to be anonymous out of fear of retribution from Lennar, told Hunterbrook a similar story. “I had to lock in. And they really pushed it. … They really make it out like they’re giving you an opportunity but you have to do it really fast.”

One possible explanation for these high-pressure tactics may be Lennar’s unique “production-first” business strategy, which aims to maintain production volume regardless of market conditions, relying on quick sales to clear all that inventory. Hunterbrook interviewed more than 20 Lennar homeowners, and most said they’d felt rushed by aggressive and sometimes misleading sales tactics.

Trap Buyers in Draconian Contract Terms

After signing the purchase agreement, Lennar and D.R. Horton buyers also said they were unable to back away without losing their deposit even after finding major defects.

Nesha Gee, who signed a purchase agreement in 2023 with Lennar on a home in Athens, Alabama, told Hunterbrook she backed out of the deal after a third-party inspector found significant defects in her house — but not without losing her $7,500 deposit.

Julie Biondolillo and her husband were also told they could not back out of their contract on a D.R. Horton home without losing their $25,000 down payment, after they found mold in the floor and walls. They only got the money back after they agreed to transfer the money toward another D.R. Horton home.

According to multiple Lennar and D.R. Horton contracts Hunterbrook reviewed, if the buyer delays or backs out of the deal for any reason — even for known construction defects like foundation cracks, grading problems, or “biological contaminants” like mold — they trigger an automatic default, giving the seller the right to claim the deposit money as liquidated damages in amounts up to 15% of the value of the home. Lennar’s contracts even state that the builder’s failure to obtain a certificate of occupancy in time cannot be grounds for delaying closing.

“You go in with this dream, the American dream, to acquire a house,” Gee, a disabled Air Force veteran “bamboozled and fined” by Lennar, told Hunterbrook. “Either you receive the crappy home or you lose a substantial amount of money like I did.”

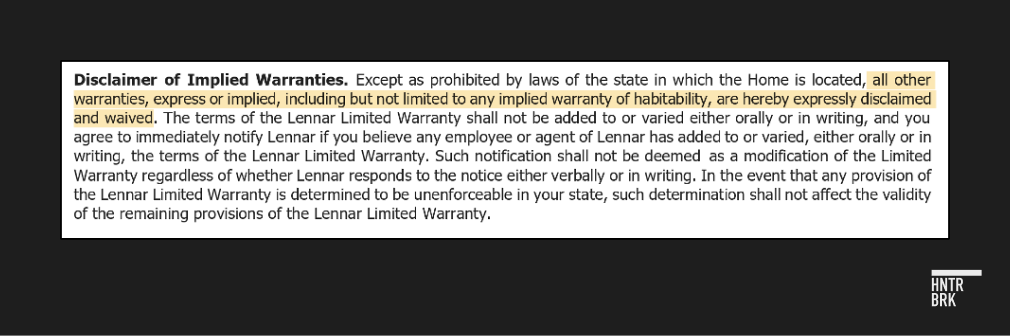

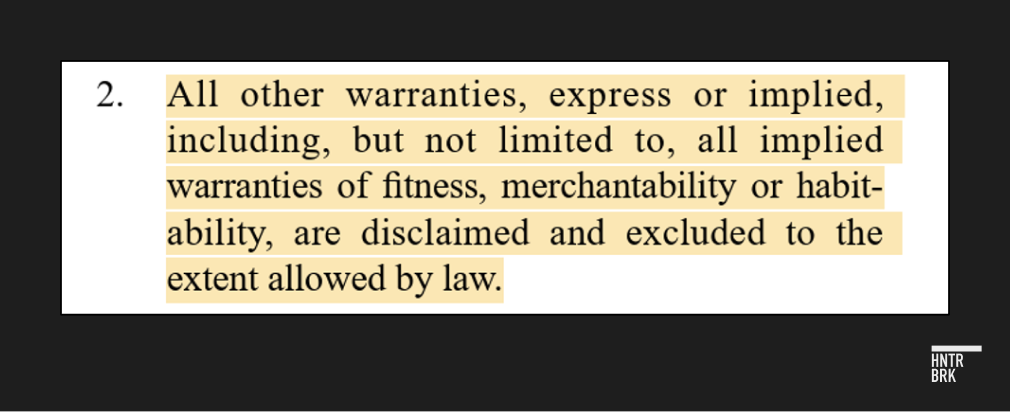

Worse, the builders’ take-it-or-leave-it contracts often leave buyers with fewer rights than if they had just closed the deal with a handshake. In many states, Laws in some states, such as Maryland, Connecticut, Massachusetts, and New Jersey, require homebuilders to provide an implied warranty of habitability and construction quality for new homes, which cannot be waived by the buyer except in very limited circumstances. the builders require buyers to waive pre-existing legal rights such as implied warranties An implied warranty is a legal principle, established by courts through judicial decisions, under which courts infer, even absent express language in a contract, that a newly constructed home will be built in a workmanlike manner and be fit for habitation. Most U.S. states recognize common-law implied warranties as inherent in residential construction contracts unless explicitly disclaimed in a written contract. Judicial enforcement of implied warranties varies by jurisdiction. Link in favor of the company’s “limited warranty.”

And the builders’ limited warranties often explicitly lack basic guarantees otherwise available to purchasers under the law — like that the home will be “habitable.” Nor do the builders’ warranties usually cover issues related to drainage, grading, erosion, and soil, or the presence of biological contaminants like mold — even though these are common defects caused by workmanship deficiencies that sometimes make homes uninhabitable.

For many buyers, spotting all of these legal traps before it’s too late may be difficult — especially because homebuilders sometimes discourage buyers from hiring realtors familiar with the system.

Lennar, for instance, only compensates buyers’ agents in certain communities, and even then, only those who were present at the buyer’s first visit to the model home, according to legal disclaimers.

“The way they write their purchase agreement is — and I found this out after the fact… — Lennar can do anything they want,” Michael Stark, who said he didn’t have realtor representation when he purchased a Lennar home in Fort Myers, Florida, told Hunterbrook. “If we had a realtor, the realtor would have been told that there was no commission,” Stark said.

“I think if an attorney had gone through the documentation they may have said to us, yeah, this isn’t a good thing for you,” Stark added.

“It’s great for them, but it’s not good for you.”

Discourage Third-Party Inspections, Brush off Building Codes, Rush Walk-Throughs

Multiple homeowners Hunterbrook spoke with also said the builders discouraged third-party inspections, with lines like “there isn’t enough time.”

When a Hunterbook reporter visited Lennar and D.R. Horton model homes, sales representatives called third-party inspections a “waste of money” because the new construction homes had to pass local government inspection at every step to ensure building code compliance.

But code inspection isn’t a guarantee against violations, construction experts Hunterbrook spoke with suggested. According to Knowles, county or municipal inspectors often have an overwhelming number of houses to inspect, sometimes up to 80 a day, and may prioritize quick “pass” inspections over thorough checks, as flagging failures requires significantly more time and paperwork. “They miss dozens and dozens of code violations on all the homes I look at,” Knowles told Hunterbrook.

One Arizona-based third-party inspector who asked to be anonymous because he sometimes works for national builders said he’d seen county inspectors who “didn’t even get out of the car” before signing off on a job.

A legal loophole in states like Florida and Texas — states where D.R. Horton and Lennar sold most of their homes in recent years — even allows builders to hire their own inspection companies to sign off on building code compliance. Under a Florida statute called the Private Provider law, builders can hire private firms like GFA to conduct inspections required for construction approvals in lieu of municipal government inspections. Proponents of the Private Provider law praise it as allowing faster building progress and saving time and money for municipalities. Link

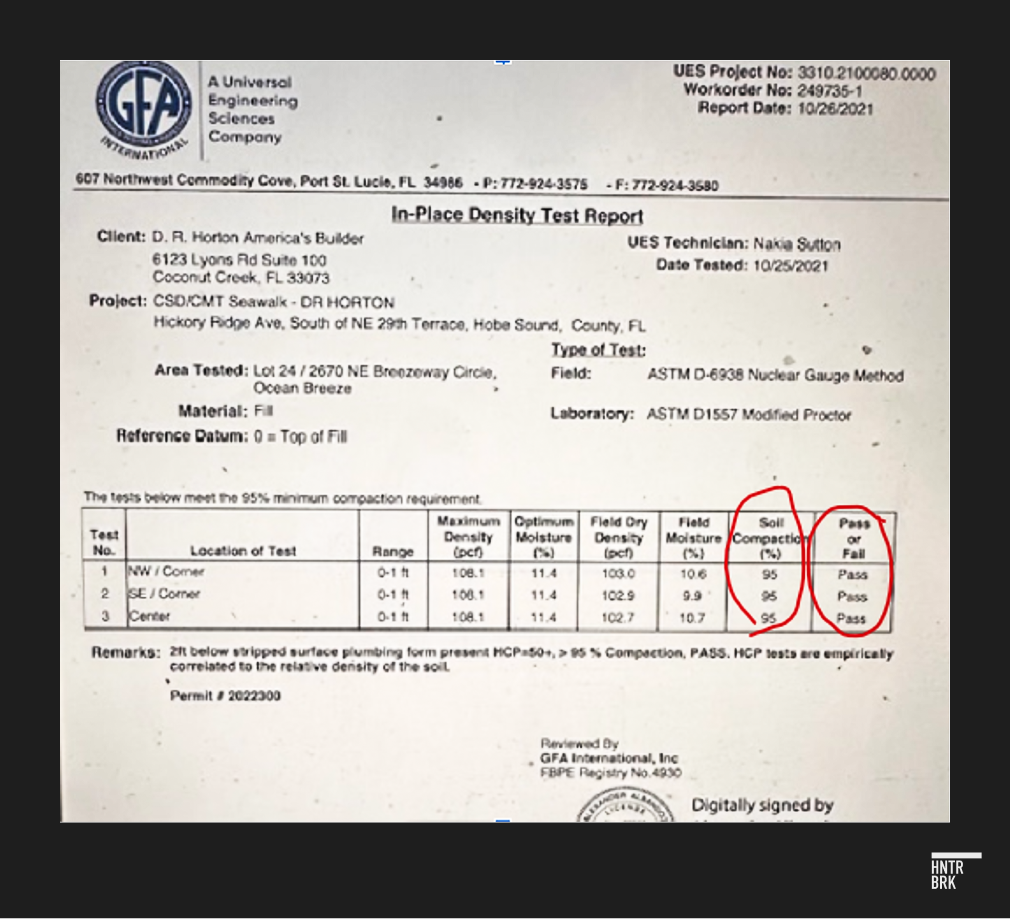

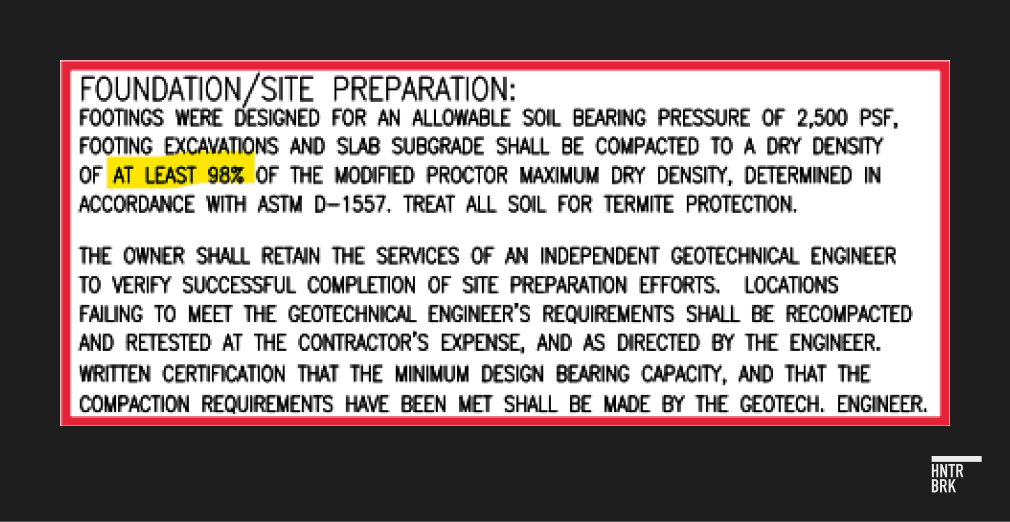

Biondolillo discovered through public records requests that a private inspection company called GFA International had signed off on the soil compaction test for her new D.R. Horton house in Ocean Breeze, Florida. Soil compaction is an important part of site preparation, where the ground is mechanically compacted into a stable mass that can safely hold up a house.

D.R. Horton’s own architectural plans, which were on file with the county, required a 98% compaction rate. But GFA attested to a 95% soil compaction rate, suggesting the land under Biondolillo’s house was too loose by the builder’s own design standards — an apparent code violation. The Florida Building Code (§107.4) mandates that construction adhere strictly to the approved plans and specifications. Any deviation requires a formal revision approved by the building official. This would presumably cover a failure to meet the specified compaction level. Link

In fact, of the 143 homes in her subdivision, only 14 actually passed all the tests at the required 98% soil compaction rate, according to the documents Biondolillo obtained and shared with Hunterbrook. And this soil compaction issue is not trivial. It can lead to serious foundation damage, symptoms of which include cracks in walls and sticky doors — all of which Biondolillo has experienced in her home.

The Ocean Breeze permit office told Hunterbrook that the “town does not independently verify” the accuracy of the soil compaction certifications submitted by private firms because “the certificates are signed and sealed by a professional engineer who attests that it meets the requirement of the approved plan.”

Homeowners also said they were prohibited from inspecting the attic, roof, and crawl spaces during pre-closing inspections, ostensibly for safety reasons. D.R. Horton’s purchase agreement includes burdensome requirements for inspection access, like requiring a week’s notice and proof of over $1,000,000 in insurance by the inspector. Lennar’s agreement limits buyers’ access to the home prior to closing, allowing access only when accompanied by a Lennar representative and only at times designated by the seller.

While Hunterbrook visited a Lennar sales office, a new homeowner walked in and asked to see the home for which he’d just signed a purchase agreement. But a sales representative said no, not until the closing. “I put down $10,000 and I can’t see my house?” the homeowner demanded angrily and stormed off.

Homeowners also frequently reported the builders dismissing or downplaying defects; refusing to write them down on the punch list A punch list identifies tasks, from touching up surface finishes to making repairs, the builder agrees to carry out for the project to be considered completed, at which point the final payment may be made. Link during the final walk-through; and rushing them to close with the promise that problems would be fixed after the move-in — only to find they weren’t.

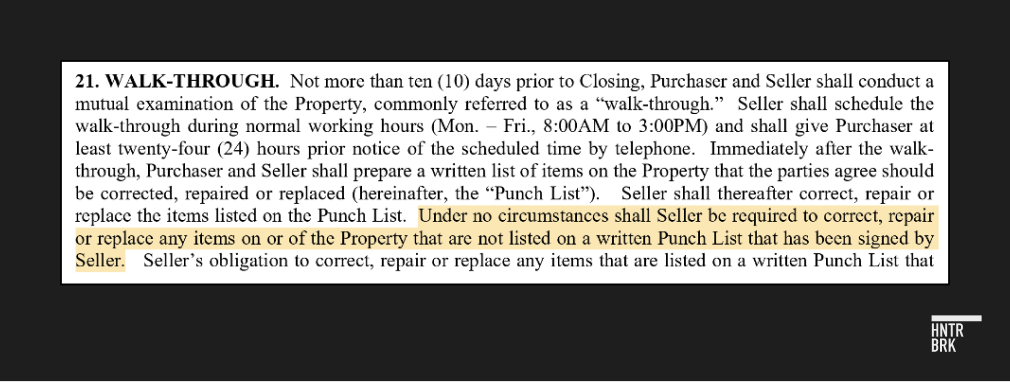

This is particularly troubling in the event that a company explicitly disclaims any liability for defects not identified on a punch list during the pre-closing walk-through. A sample D.R. Horton purchase agreement obtained by Hunterbrook states that “under no circumstances shall D.R. Horton be required to repair or replace items not on the punch list.”

One Lennar homeowner said, after they pointed out a brown smudge on the wall and a weird smell during a walk-through, Lennar painted over the smudge, brushing it off as “just a spot where they missed paint.” Within days of moving in, however, they saw the brown stain had reappeared and spread. The homeowner pushed Lennar to investigate, and after denying there was an issue, Lennar opened up the wall and found the main water line was leaking.

Legally, there may be little incentive or obligation for the builders to address defects identified during a third-party inspection or walk-through. A Lennar salesperson at a Florida development told a Hunterbrook reporter asking about a home that Lennar is under no obligation to agree with the findings of a third-party inspector.

Their statement is reflected in a Lennar contract, which says it will be obligated to fix problems “if any items noted are actually defective … in seller’s opinion.” A D.R. Horton purchase agreement explicitly states that “no funds may be escrowed” to guarantee completion of those tasks, meaning buyers have no financial leverage if the builders refuse to address those items.

And the builders’ tactics for evading necessary fixes can get creative. A D.R. Horton homeowner in Florida described a superintendent telling him that he didn’t need to write down problems identified during a final walk-through because the super could “grab his toolbox from his car” to fix the issues while the homeowner was signing the closing papers. The homeowner, who wished to be anonymous to avoid jeopardizing his chances of resolving his dispute with the builder, later found not only that the problems hadn’t been fixed, but that some of his neighbors had been deceived by the same toolbox-in-my-car story.

Step 2: Filibuster Warranty Requests

The day Madelyn Awalt moved into her brand-new D.R. Horton home in Princeton, Texas, the main circuit breaker in the house tripped as soon as the movers plugged in her new refrigerator, she told Hunterbrook. D.R. Horton sent out a technician who reset the breaker. He said new houses sometimes had “some loose wiring,” Awalt recalled. He assured her it should be just fine.

But the breaker kept tripping, and each time she reported the problem, the builder just told her to reset it. Finally, Awalt said, she hired a private electrician who discovered the breaker panel, made by Schneider Electric, had been recalled due to “thermal burn and fire hazard” in 2022 — well within the first-year warranty period. But D.R. Horton denied the claim, telling her she should have reported the problem before the warranty expired.

“I was like, this is completely D.R. Horton’s responsibility,” Awalt recalled. “And he’s like, you know, we’re America’s builder … We closed on 65,000 homes last year. And I said, all that means is that you got 65,000 sufferers like me.”

He’s like, “We’re America’s builder. We closed 65,000 homes last year. And I said, all that means is you got 65,000 sufferers like me.”

Madelyn AwaLt, D.R. Horton Homeowner

D.R. Horton’s standard warranty states that the homes “shall be free of defects for a period of one year, from the date of closing.” It offers a one-year warranty on workmanship, as well as a two-year warranty on mechanical systems, and a 10-year warranty against structural issues. Lennar promises buyers “peace of mind in your new home” with a similar “1-2-10” year warranty. Multiple interviewees told Hunterbrook that D.R. Horton and Lennar sales staff touted the warranty as the buyer’s safety net against defects, even using it to discourage buyers from doing a pre-closing third-party inspection.

In reality, as Awalt found out, the builders appear to do everything possible to avoid meaningful repairs, including by systematically denying problems, deflecting blame to homeowners and others, and delaying service until the warranty clock runs out. Homeowners reported submitting warranty requests online and never hearing back, and having to make repeated calls to schedule a repair — only for those efforts to end in a no-show.

“You submit a request online, they say someone will call you in three to five days, but no one ever does,” Sandy Nguyen, a D.R. Horton homeowner in Mobile, Alabama, told Hunterbrook.

Other homeowners Hunterbrook interviewed and across online platforms said the builders would constantly “gaslight” homeowners, claiming the problems were within “tolerance” or “standards.”

Such tactics became so well-known that residents of one Lennar community coined the term “being Lennared” according to Nathaniel Klitsberg, a homeowner in Parkland, Florida, speaking to city commissioners at a 2021 meeting.

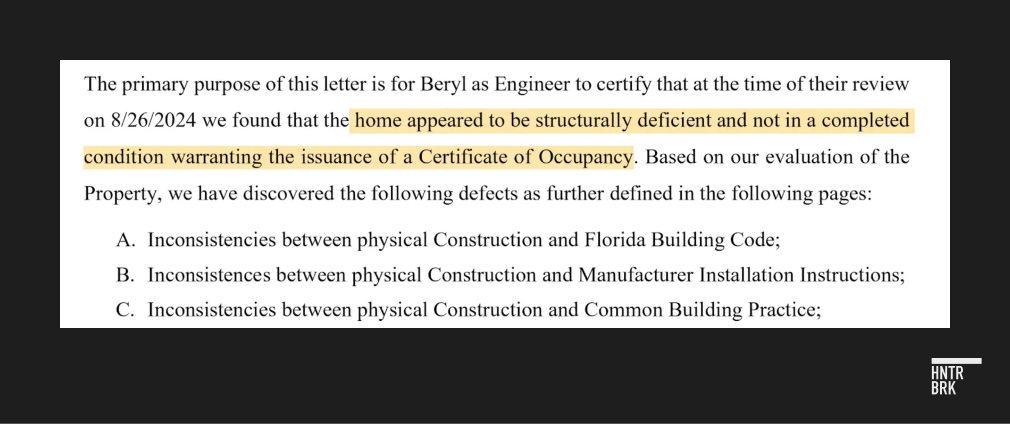

Florida homeowner Matthew French said D.R. Horton kept denying the seriousness of the problems in his home, calling some of the issues an “illusion,” even after he submitted a report from a third-party engineering company confirming severe structural defects and indicating the home should not have received a certificate of occupancy.

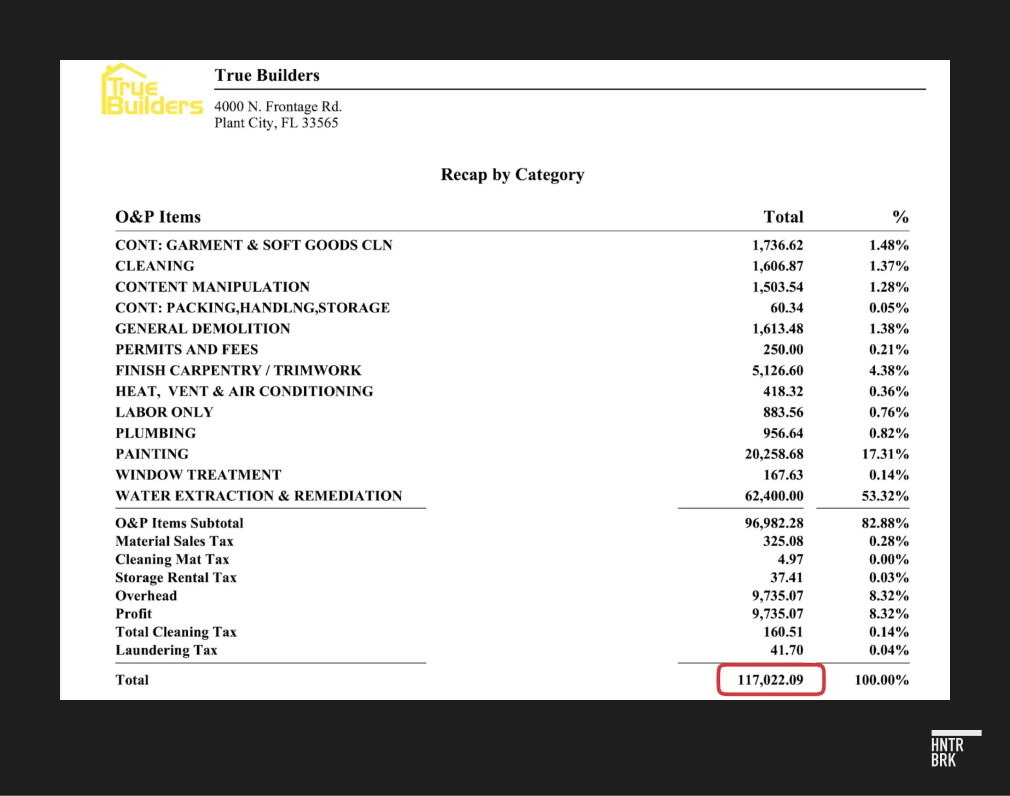

The engineering company quoted him $117,000 in repair costs. And to top it all off, on learning the extent of the defects through French’s insurance claim, the county appraiser apparently devalued his home by $162,942.

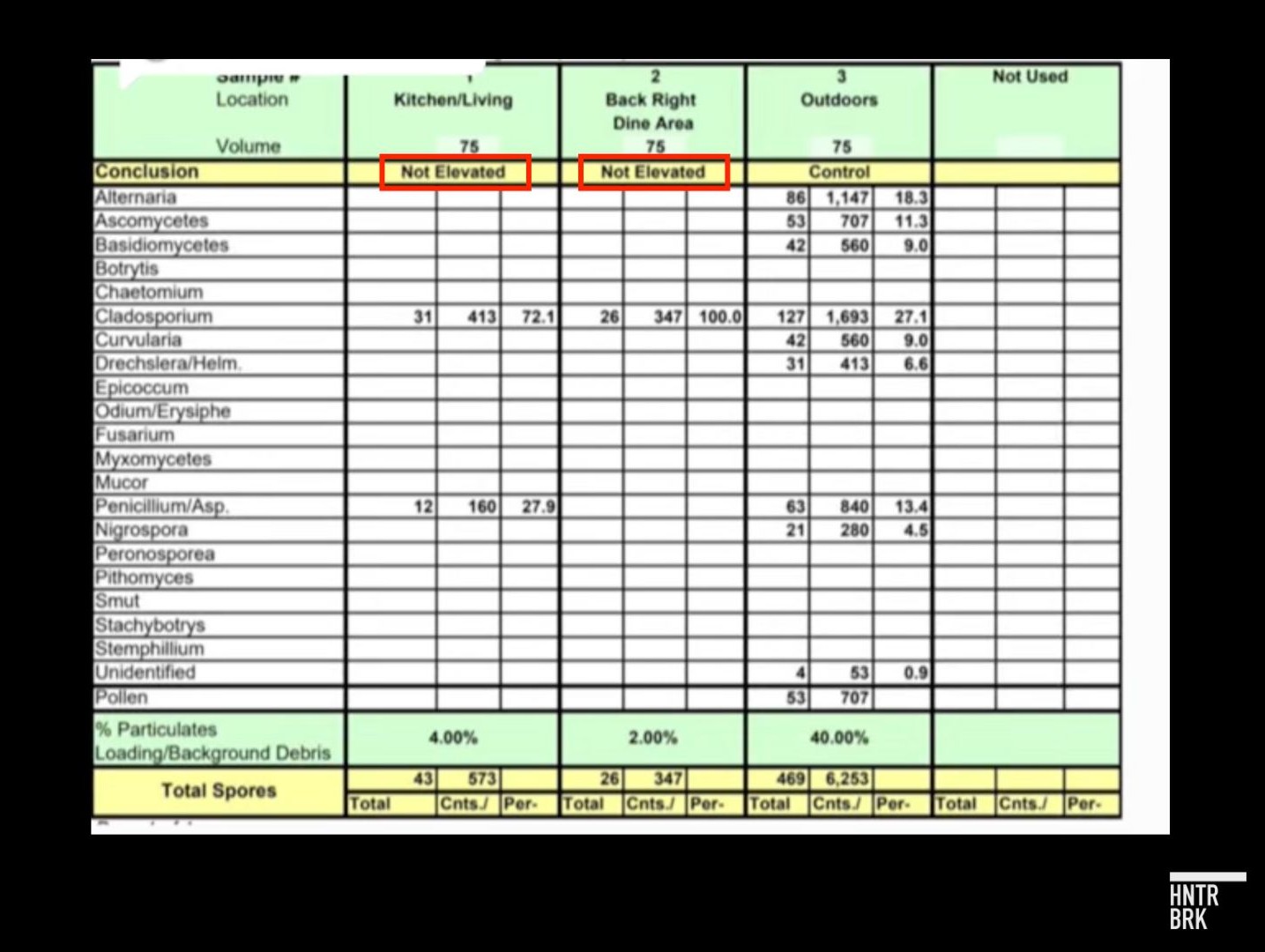

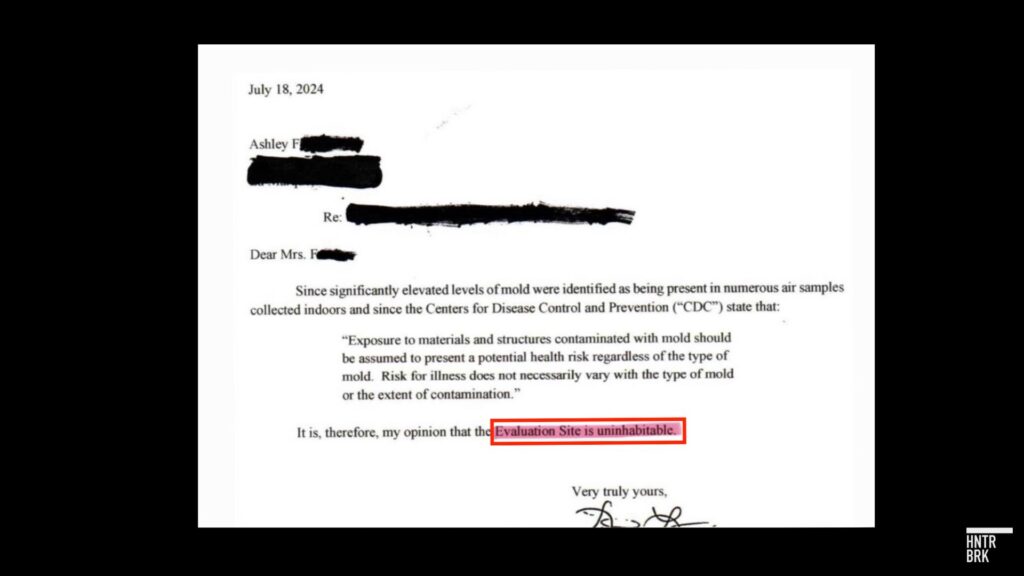

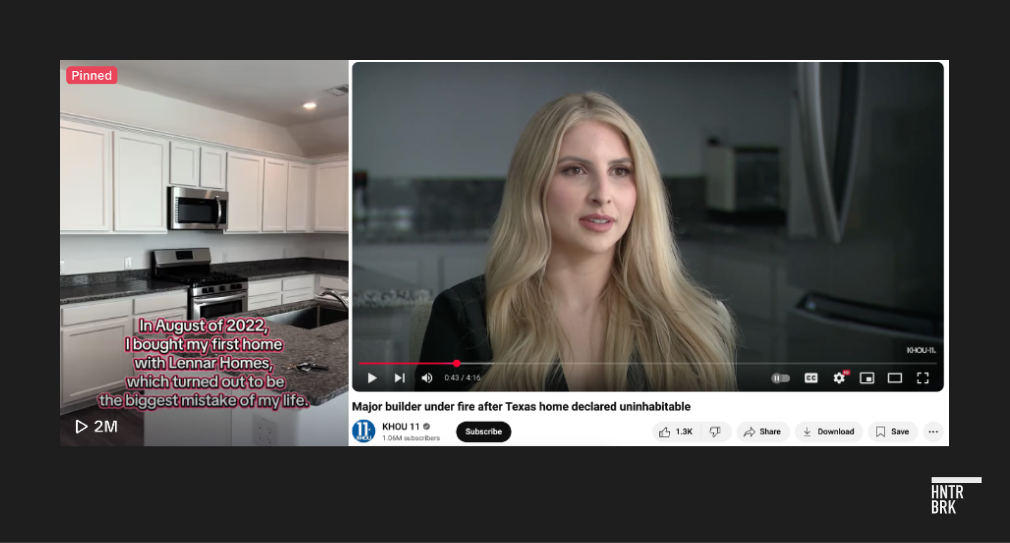

Lennar homeowner Ashley Frazier discovered a severe mold infestation in her new home, which was so full of moisture that the ceilings and walls were literally dripping water. But she said Lennar told her the mold levels were “not elevated” and offered to repair one square foot of drywall and a few base cabinets. She said a repair cost analysis arranged by her lawyers came out to $467,200.48.

“You know, I got a letter in the mail not too long ago about a recall on my car that’s 10 years old. They want me to bring it in so they can change out the part,” Antonucci told Hunterbrook.

“Why is that better than my home warranty?”

Even when they finally got a repair crew to show up, homeowners said, it often didn’t help.

They described some crews as comically unprepared and unqualified to do the work. Some crews didn’t even know what they were there to fix or arrived without the replacement item or necessary tools. And the repair was often just a cheap bandaid job that either failed to fix the underlying issue or made it worse.

One issue may be that the repairs often fall to the subcontractors who performed the actual construction. The subcontractors provide warranties to the builder and “are expected to respond to us and the homeowner in a timely manner,” according to D.R. Horton’s most recent SEC Form 10-K. Lennar’s 10-K similarly says that “we are primarily responsible to the homebuyers for the correction of any deficiencies,” while pointing out that subcontractors are contractually required to “repair or replace any deficient items related to their trade.”

But these subcontractors may be less than eager to come back at their own expense to fix work the builder has already paid them for. “‘I’m tired of working for free,’” one Lennar homeowner recalled a repair crew who came to fix the issues at her Lennar house as saying. “I went through that with four different subcontractors within the first month.” She added, “So, they have no incentive when they send people out to inspect a problem.”

Moreover, despite Lennar’s claims of “primary” responsibility, that hasn’t been the experience for some buyers. The same Lennar homeowner, for example, recalled a Lennar warranty representative saying “‘it’s up to the subcontractor to hold up their end of the warranty.”

The warranty policies Hunterbrook reviewed also explicitly disclaim any standard for repair work, however shoddy or inadequate. Lennar’s 2024 Homebuyers’ Warranty Guide, for example, states the company has the “sole right to determine the repairs or replacements necessary” based on “Workmanship Standards” it defines. It also explicitly states that any repairs it performs cannot extend the warranty’s original expiration date.

Frustrated homeowners described “begging” or having to “fight tooth and nail” to get the company to address their problems. Other approaches include posting on Facebook; filing a complaint with the Better Business Bureau, the county, or the state attorney general’s office; taking the story to a local news station; or even threatening to sue.

“I honestly didn’t want this. I don’t want to be on the news. I don’t want to be in a lawsuit,” Frazier, whose TikTok and Instagram videos about her Lennar home have reached as many as 2 million viewers, told Hunterbrook. She has also appeared in multiple local news reports.

“I’m in school trying to finish a dual doctorate and now living with my parents again.”

“I’m in school trying to finish a dual doctorate and now living with my parents again.”

Ashley Frazier, Lennar Homeowner

“I hounded them. I hounded them so much. In fact, they called and begged and pleaded to my husband to have me stop bitching about them on Facebook,” Bridget Smith, another Lennar homeowner in Aurora, Colorado, told Hunterbrook. She said her tactics helped get the builder to cover most of the issues covered by the warranty — except the estimated $42,500 in repair costs for water damage caused by a construction defect she discovered after the warranty period.

Others haven’t been quite as lucky. Multiple homeowners said that when they tried to escalate their cases after receiving inadequate responses from the warranty departments, they were redirected to company attorneys or legal departments — an action they said they believed was intended to intimidate them.

Some claimed the builders tried to rein in employees who went out of the way to help homeowners.

Steve Schoelman, who purchased a D.R. Horton home near San Antonio, Texas, in 2022, described how the superintendent in charge of his home was initially responsive after his roof was badly damaged by recent winds — even calling personally to apologize. But soon after, Schoelman said, the superintendent confessed he’d been told “basically not to say anything else,” that his “boss would handle this.” After that, Schoelman said, his calls and email went unanswered.

Another D.R. Horton homeowner in Lakewood Ranch, Florida, who has been dealing with defective roof shingles as well since moving in last year and chose to remain anonymous, said the company has likely spent more time and energy denying his persistent requests for warranty coverage than if they had just fixed the problem. He surmised the company might not want to set a precedent for making repairs: After going door to door to talk with his neighbors, he said he estimated nine out of ten of his neighbors had complaints about D.R. Horton.

Montgomery, who hadn’t been able to live in her mold-infested home since city officials condemned it last year, eventually sold it at a loss. She told Hunterbrook she had tried to appeal to Lennar’s ethical standards. “I want you guys to do the right thing. I want you to treat my house as if it’s your house. I want you to treat this as if your kids live here. I want you to make it safe and livable. I want you to do the right thing.”

“I’ve said that repeatedly to them, but they don’t treat you that way.”

Step 3: Keep Cases Out of Court

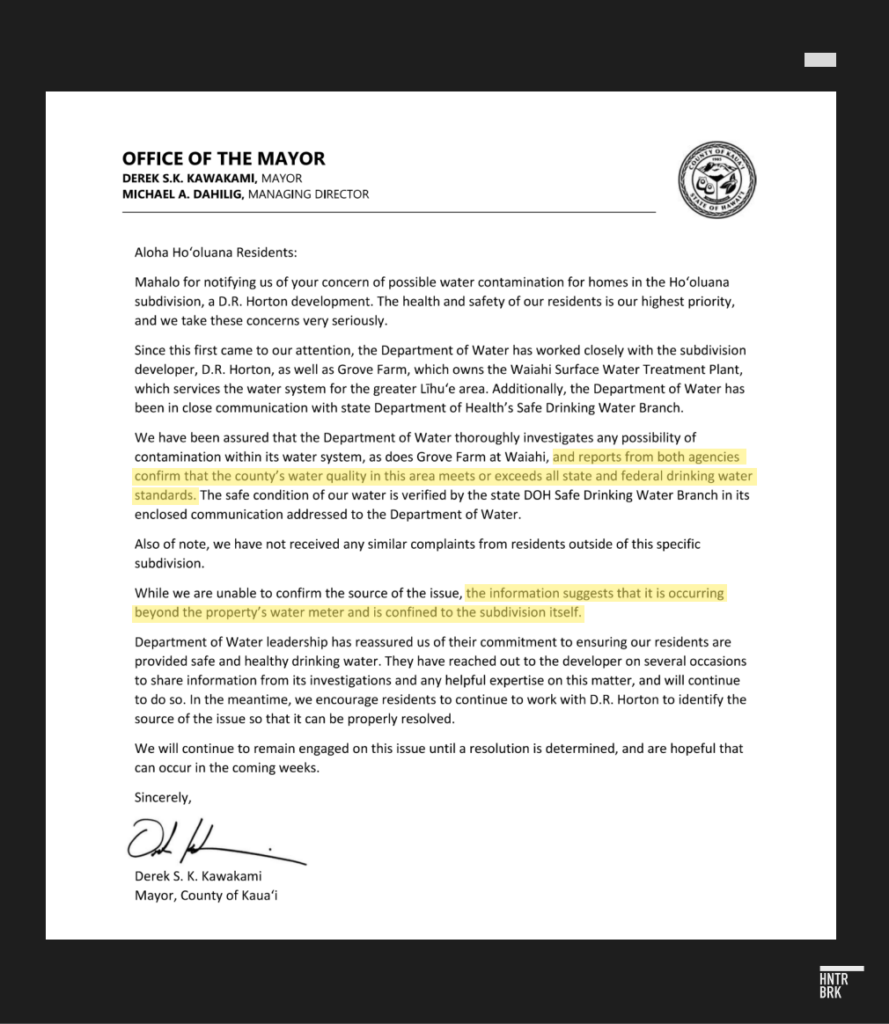

Christie Volkmer and her family have been drinking bottled water and showering in a makeshift camper shower for years, since watching black slime coming out of the kitchen sink, showers, and toilet in the D.R. Horton home they had bought new in Kauai, Hawaii, in 2018. Volkmer said about half of her neighbors in the 144-home community of Ho’oluana have the same problem.

Volkmer and other families have opted to take legal action against D.R. Horton, Volkmer said. She said the company denied responsibility, even after being presented with extensive tests run by the county showing the problem wasn’t the water source — D.R. Horton’s initial defense. Volkmer said she’d taken out a loan to pay for “devastating” legal and other fees, although “the financial burden pales in comparison to the emotional toll it has taken on us.”

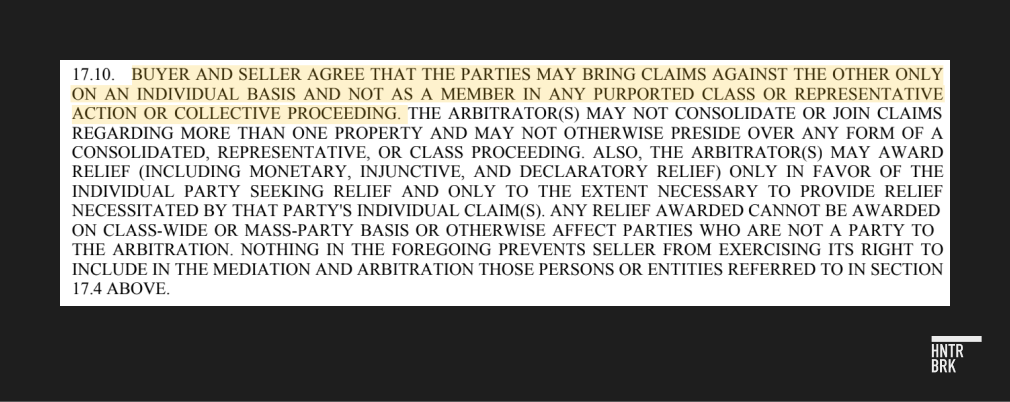

Instead of filing their complaints in a public court, the Volkmers are arbitrating privately with D.R. Horton. That’s not unusual. The D.R. Horton and Lennar contracts Hunterbrook reviewed include a mandatory arbitration clause that requires buyers to waive their right to go to court and instead requires that any disputes be resolved through a private arbitration system that consumer advocates say systematically favors the builder. Arbitration has its roots in the Federal Arbitration Act of 1925, which was originally intended to help resolve disputes between commercial entities of equal bargaining power; but over time, corporations across a wide range of industries — including housing, credit cards, employment, and health care — began embedding arbitration clauses into consumer contracts. Link

These agreements also require the buyers to waive their right to a class action lawsuit — “realistically the only tool citizens have to fight illegal or deceitful business practices,” as The New York Times put it.

Lobbying group the National Association of Home Builders claims that “in many cases ADR is often the most rapid, fair and cost-effective means to resolving disputes—for both the builder and the buyer,” referring to alternate dispute resolution, or arbitration.

But consumer advocates argue that arbitration firms have an incentive to deliver outcomes favorable to their most important repeat customers — the builders.

They “rely on happy customer return service,” Perez-Pedemonti said. “There’s no way they can be impartial because of the way their business model is made.”

And as Stanford Business put it, in arbitration, “companies have a big information advantage in fishing for arbitrators who are likely to rule in their favor.”

In an email response to Hunterbrook, a spokesperson for the American Arbitration Association — which both D.R. Horton and Lennar use as an arbitration service — said “fewer than one-third proceeded to an award. In those cases, when the arbitrator specified a prevailing party, the homeowner prevailed more frequently than the homebuilder.” It’s unclear if the two-thirds of cases that did not proceed to an award were dismissed or settled.

But last month, a group of Arizona residents filed a class action lawsuit against the AAA for systematically favoring corporations, alleging consumers lose 76% of the time in arbitrations they initiate. The plaintiffs cited AAA’s quarterly disclosures once readily found on their website but no longer available as of the date of the filing of the complaint.

A 2017 fact sheet by the Economic Policy Institute suggested a similar pattern. It found that “consumers obtain relief regarding their claims in only 9 percent of disputes.” Other studies paint an even bleaker picture, with an American Association for Justice report claiming consumers are more likely to get struck by lightning than win in a forced arbitration.

The awards from arbitration also tend to be smaller than in courts. The Institute’s 2015 report showed plaintiffs’ overall economic outcomes in state court were on average 13.9 times better than in mandatory arbitration.

A spokesperson told Hunterbrook that the AAA is “firmly committed to upholding the highest ethical standards across all facets of alternative dispute resolution” and that the arbitrators are “bound by the Code of Ethics” in commercial disputes. AAA’s roster of arbitrators “includes experienced, independent professionals with deep subject matter expertise,” they said, including construction.

Moreover, compared to public court cases, arbitration typically offers very limited rights to discovery and appeal and is conducted confidentially, with no public record of proceedings or outcomes. This secrecy benefits builders by preventing legal precedent from accumulating and by shielding systemic issues — like construction defects or warranty evasions — from public scrutiny or class-wide accountability.

“Lawyers are increasingly less open to taking these cases,” said Perez-Pedemonti. “The minute you see an arbitration clause, you’re like, ‘Oh my gosh, okay, well, this is going to be a dead end.’”

“Forced arbitration is unfair and un-American,” said U.S. Sen. Richard Blumenthal, who co-sponsored the Forced Arbitration Repeal Act of 2023, prohibiting forced arbitration in consumer contracts. “One of the fundamental principles of our American democracy is that everyone gets their day in court. Forced arbitration deprives Americans of that basic right.”

That bill has been killed each time it was introduced in Congress since 2017.

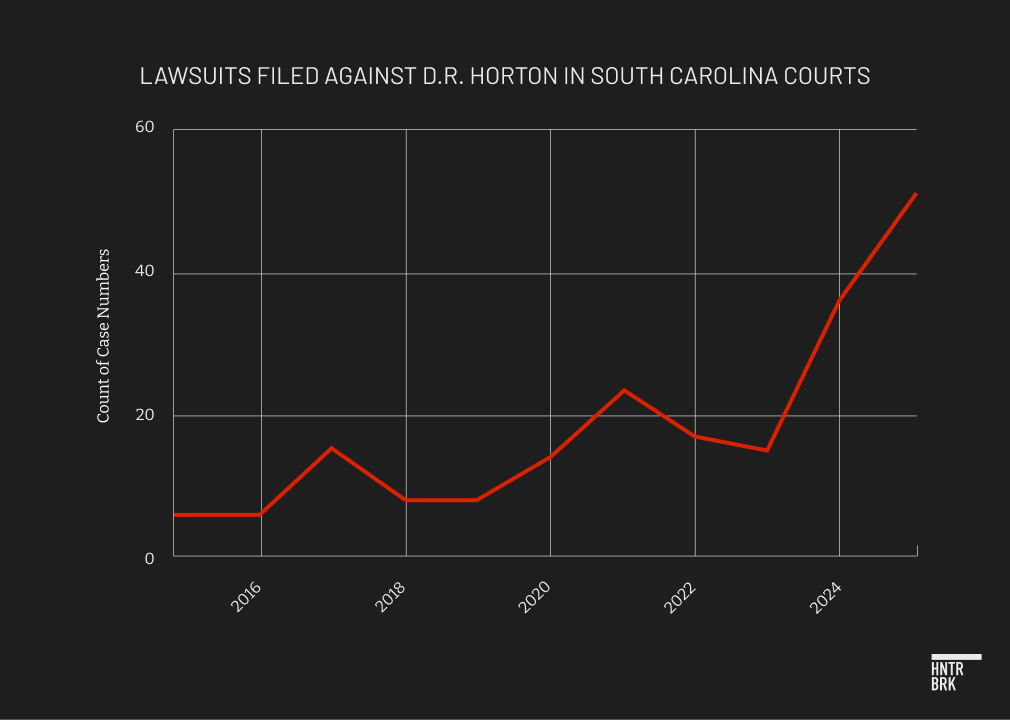

But some homeowners may be seeing a ray of light, at least in some states. In a landmark 2016 case, the South Carolina Supreme Court ruled that D.R. Horton’s arbitration clause was “unconscionable” and “unenforceable,” pointing out that most homebuyers were in a significantly weaker bargaining position and that the clause was a take-it-or-leave-it agreement drafted by one party that lacked a meaningful choice. In 2022, the same court reached the same conclusion with respect to Lennar when it ruled against the enforceability of Lennar’s arbitration clause in a construction defect case brought by a group of homeowners.

The rulings might have opened the floodgate to lawsuits in the state: Homeowners in a Myrtle Beach community said a local law firm estimated it had an eight-month waitlist for new clients. The firm won a $16.1 million settlement for over 200 homebuyers in a class-action lawsuit against D.R. Horton for construction defects, including issues with roofs, joists, and water intrusion.

One law firm told Hunterbrook that in South Carolina alone, they’ve been contacted by around 500 homeowners with complaints — and they’re actively investigating 125 of those cases for potential legal action. According to Hunterbrook’s review of complaints filed in the state’s county courts, almost half of the 198 complaints filed against D.R. Horton in the last 10 years were filed in just the last two years.

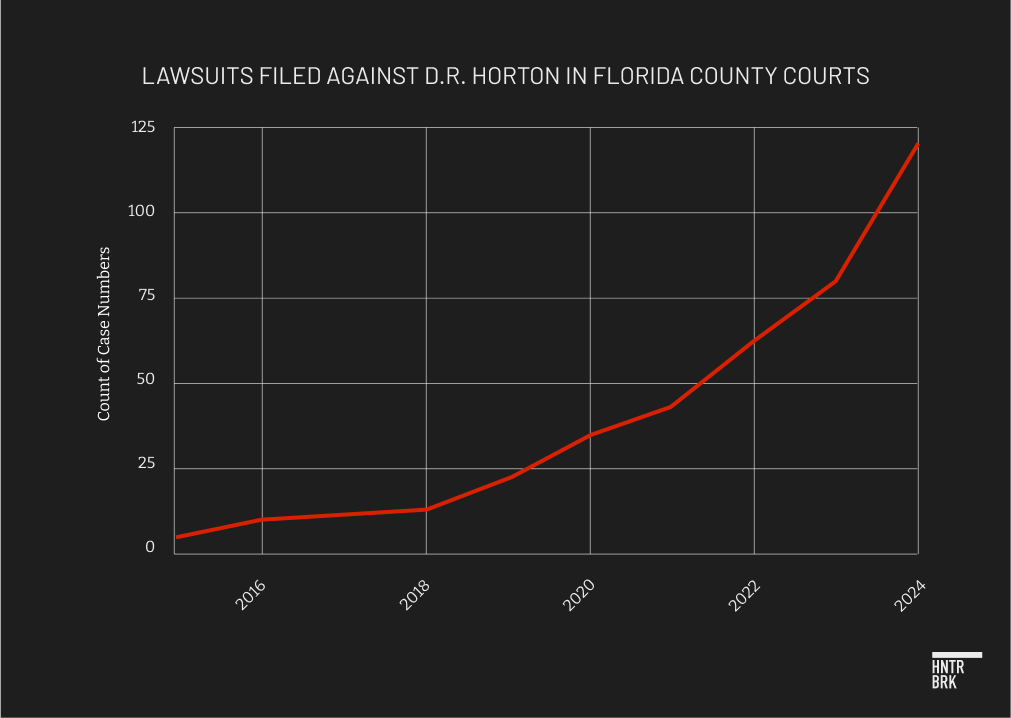

Other states, however, including Texas and Florida, continue to enforce arbitration clauses, routinely returning cases submitted to the state’s justice system back to the private arbitration system, according to Hunterbrook’s review of court cases filed in those states. Texas seems to be doubling down, including with a 2023 reversal in court ruling that other family members or subsequent owners were also bound by the arbitration clause.

Still, homeowners are undeterred, with court records showing an exponential rise in legal complaints filed against D.R. Horton in select Florida courts in recent years.

French filed a lawsuit against D.R. Horton in Florida over the severe construction defects in his home. He said he believes he can get a jury trial because the contract was forced on him without his full awareness of the arbitration clause.

“If I’m able to go through trial, I that think peers would definitely see my point.”

Volkmer, who is in arbitration, says D.R. Horton has continued to launch endless legal maneuvers for years to hold up her case — all in an effort to avoid accountability.

“We are stuck with no end in sight,” Volkmer said. “We can’t sell our home — not even at a loss — because it is trapped in legal limbo.”

“I am exhausted. I am heartbroken. I am angry. But I will not give up because we deserve what we were promised in our D.R. Horton contract.”

“I am exhausted. I am heartbroken. I am angry. But I will not give up because we deserve what we were promised.”

Christie Volkmer

For homeowners unable to afford legal recourse, though, the future could be bleaker.

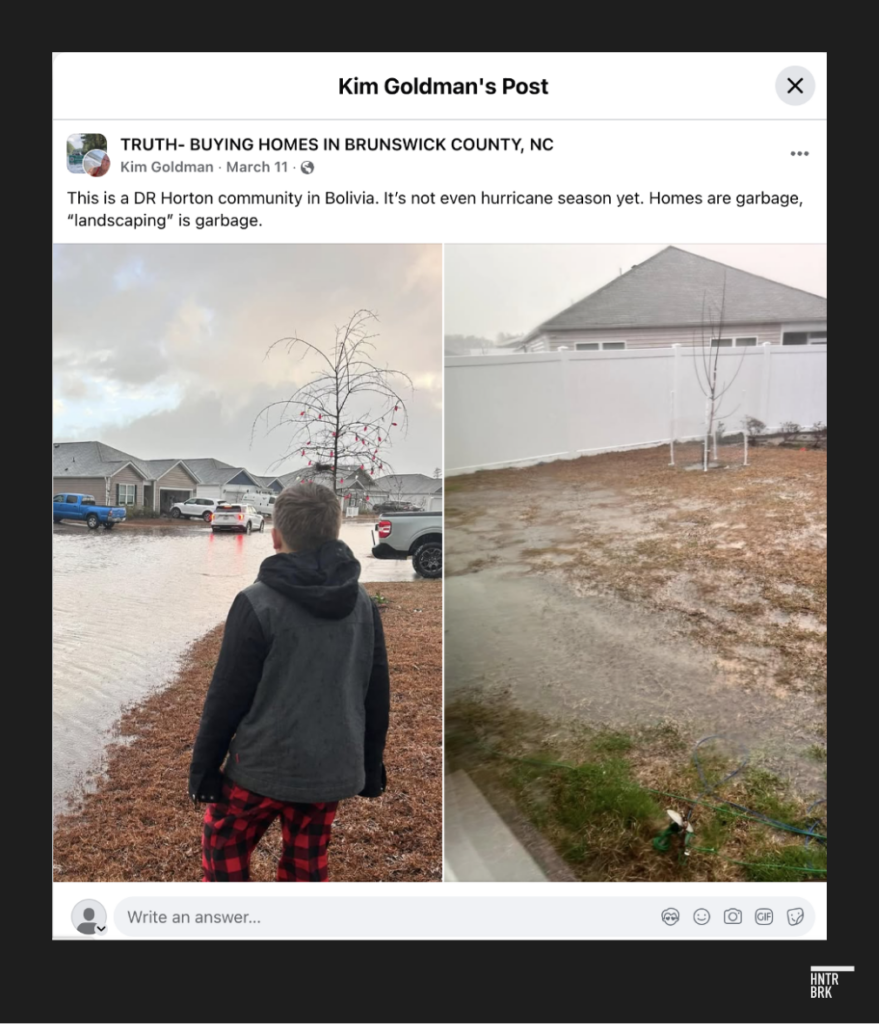

“Our whole life is tied up into this house. With us just moving here, I mean, we’re still trying to recoup from the move,” said Kim Goldman, who told Hunterbrook her brand-new D.R. Horton community floods when they “get a heavy rain — which is frequent.” She’s worried her house will be next.

“Every time it rains heavy, I’m like holding my breath,” she said.

Authors

Jenny Ahn joined Hunterbrook after serving many years as a senior analyst in the US government. She is a seasoned geopolitical expert with a particular focus on the Asia-Pacific and has diverse overseas experience. She has an M.A. in International Affairs from Yale and a B.S. in International Relations from Stanford. Jenny is based in Virginia.

Michelle Cera is a sociologist specializing in digital ethnography and pedagogy. She received her Ph.D. in Sociology from New York University, building on her Bachelor of Arts degree with Highest Honors from the University of California, Berkeley. Currently serving as a Workshop Coordinator at NYU’s Anthropology and Sociology Departments, Michelle fosters interdisciplinary collaboration and advances innovative research methodologies.

Matthew Termine is a lawyer with nearly five years of experience leading the legal team at a mortgage technology company. In 2017, Matt was credited by the Wall Street Journal, among others, for identifying suspicious mortgage loan transactions that led to several successful criminal prosecutions, including that of a prominent political operative and the chief executive officer of a federally chartered bank. He is a graduate of Trinity College and Fordham University School of Law. He grew up in Old Saybrook, Connecticut and now lives in Brooklyn with his wife and three children.

Editors

Wendy Nardi joined Hunterbrook after working as a developmental and copy editor for academic publishers, government agencies, Fortune 500 companies, and international scholars. She has been a researcher and writer for documentary series and a regular contributor to The Boston Globe. Her other publications range from magazine features to fiction in literary journals. She has an MA in Philosophy from Columbia University and a BA in English from the University of Virginia.

Jim Impoco is the award-winning former editor-in-chief of Newsweek who returned the publication to print in 2014. Before that, he was executive editor at Thomson Reuters Digital, Sunday Business Editor at The New York Times, and Assistant Managing Editor at Fortune. Jim, who started his journalism career as a Tokyo-based reporter for The Associated Press and U.S. News & World Report, has a Master’s in Chinese and Japanese History from the University of California at Berkeley.

Sam Koppelman is a New York Times best-selling author who has written books with former United States Attorney General Eric Holder and former United States Acting Solicitor General Neal Katyal. Sam has published in the New York Times, Washington Post, Boston Globe, Time Magazine, and other outlets — and occasionally volunteers on a fire speech for a good cause. He has a BA in Government from Harvard, where he was named a John Harvard Scholar and wrote op-eds like “Shut Down Harvard Football,” which he tells us were great for his social life. Sam is based in New York.

Hunterbrook Media publishes investigative and global reporting — with no ads or paywalls. When articles do not include Material Non-Public Information (MNPI), or “insider info,” they may be provided to our affiliate Hunterbrook Capital, an investment firm which may take financial positions based on our reporting. Subscribe here. Learn more here.

Please contact ideas@hntrbrk.com to share ideas, talent@hntrbrk.com for work opportunities, and press@hntrbrk.com for media inquiries.

LEGAL DISCLAIMER

© 2026 by Hunterbrook Media LLC. When using this website, you acknowledge and accept that such usage is solely at your own discretion and risk. Hunterbrook Media LLC, along with any associated entities, shall not be held responsible for any direct or indirect damages resulting from the use of information provided in any Hunterbrook publications. It is crucial for you to conduct your own research and seek advice from qualified financial, legal, and tax professionals before making any investment decisions based on information obtained from Hunterbrook Media LLC. The content provided by Hunterbrook Media LLC does not constitute an offer to sell, nor a solicitation of an offer to purchase any securities. Furthermore, no securities shall be offered or sold in any jurisdiction where such activities would be contrary to the local securities laws.

Hunterbrook Media LLC is not a registered investment advisor in the United States or any other jurisdiction. We strive to ensure the accuracy and reliability of the information provided, drawing on sources believed to be trustworthy. Nevertheless, this information is provided "as is" without any guarantee of accuracy, timeliness, completeness, or usefulness for any particular purpose. Hunterbrook Media LLC does not guarantee the results obtained from the use of this information. All information presented are opinions based on our analyses and are subject to change without notice, and there is no commitment from Hunterbrook Media LLC to revise or update any information or opinions contained in any report or publication contained on this website. The above content, including all information and opinions presented, is intended solely for educational and information purposes only. Hunterbrook Media LLC authorizes the redistribution of these materials, in whole or in part, provided that such redistribution is for non-commercial, informational purposes only. Redistribution must include this notice and must not alter the materials. Any commercial use, alteration, or other forms of misuse of these materials are strictly prohibited without the express written approval of Hunterbrook Media LLC. Unauthorized use, alteration, or misuse of these materials may result in legal action to enforce our rights, including but not limited to seeking injunctive relief, damages, and any other remedies available under the law.