Hunterbrook Media’s investment affiliate, Hunterbrook Capital, does not have any positions related to this article at the time of publication. Positions may change at any time.

Seven lawsuits. Five years. Millions of dollars.

After Liquidia overcame each tactic that its nemesis United Therapeutics deployed to delay FDA approval, Liquidia finally won FDA approval on Friday to bring its medicine Yutrepia to market.

That’s good news for patients suffering from pulmonary hypertension, a disease that interferes with blood circulation through the lungs and impacts an estimated 1% of the global population.

The FDA approved Yutrepia for both PAH (pulmonary arterial hypertension) and PH-ILD (pulmonary hypertension due to interstitial lung disease). In the U.S., about half of PAH patients and about one-third of PH-ILD patients die within five years.

Although Yutrepia’s launch is now likely imminent, a judge is still considering a potential legal action that would delay Liquidia in response to a last-minute lawsuit from earlier in May by United.

United’s strategy to thwart competition has demonstrated how powerful companies weaponize the legal and regulatory system to keep medicines from patients — according to doctors, attorneys, and other experts that Hunterbrook interviewed for this deep dive and our previous investigation in the fall.

United did not respond to Hunterbrook’s repeated requests for comment. Liquidia also did not respond to Hunterbrook’s request for comment on Yutrepia’s approval by the time of publication.

Liquidia CEO Roger Jeffs cheered the long-awaited approval in a press release.

“Today, we celebrate for the patients and physicians who will now have access to a potential best-in-class dry-powder form of treprostinil with exceptional portability, tolerability, titratability and durability,” Jeffs said.

“With today’s milestone, our commercial team is prepared to launch YUTREPIA and bring meaningful change to the lives of patients in need, and we look forward to speaking with physicians and patients about the unique benefits of YUTREPIA in the days and weeks ahead.”

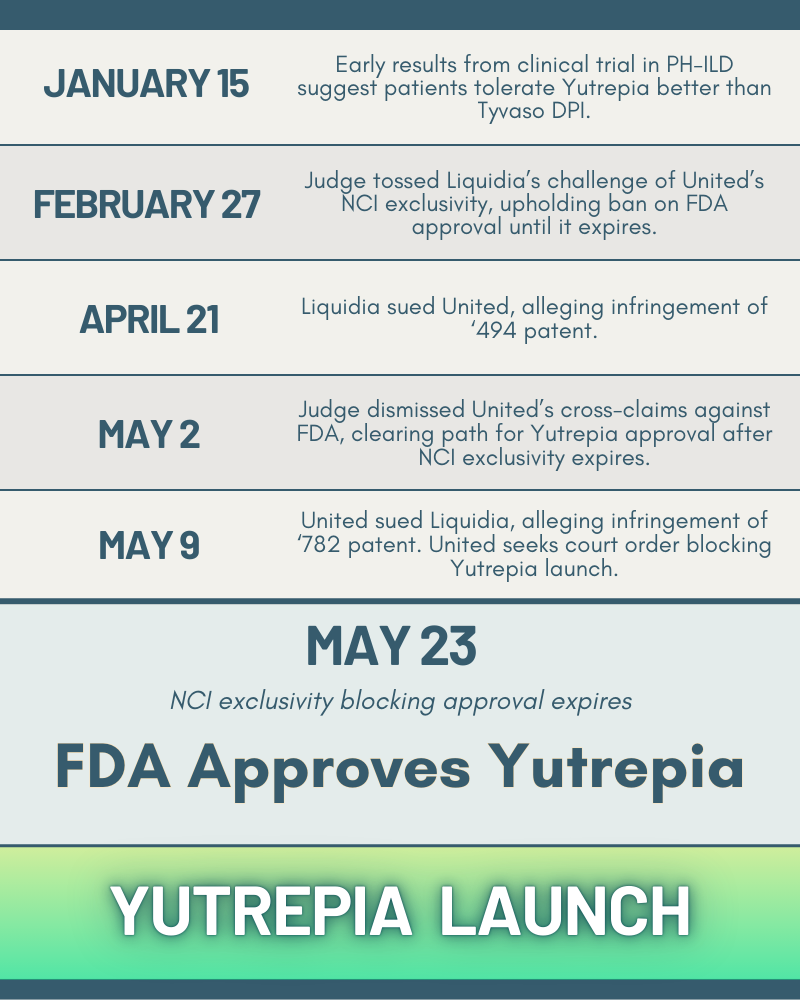

United has delayed Liquidia’s Yutrepia from threatening its blockbuster Tyvaso franchise for several years. See “Timeline of Liquidia’s Battle for Approval of Yutrepia” in Hunterbrook’s earlier reporting on the Liquidia/United rivalry for an overview.” On May 2, a federal judge in D.C. tossed out what appeared at the time to be United’s last attempt to stall approval of the competing inhaler.

But United had one more idea to stop the drug from hitting the market.

On May 9, United filed a new patent infringement lawsuit against Liquidia in federal court. On May 20, the court in North Carolina held a hearing on United’s motion for a Temporary Restraining Order (TRO) and/or preliminary injunction to block Yutrepia’s launch.

“Justice Scalia once said that he realized at oral argument that one side was trying to get him to do something that wasn’t quite right, and he just had to figure out which side it was,” stated Judge Thomas Schroeder.

Victory at Last?

As Hunterbrook detailed in December — during the earlier litigation — Liquidia tried to convince a judge that the exclusivity protection awarded to United should not have stopped the FDA from approving Yutrepia in August 2024. But in February, the judge upheld the exclusivity, keeping Liquidia on hold until the exclusivity expired on May 23, 2025 — today.

United had also set up another possible barrier: a legal challenge aimed at delaying Yutrepia’s approval for one of the two diseases, PH-ILD. United sued the FDA last spring with the same allegations but voluntarily dismissed the case after a judge said it was premature. They reasserted the claims in September 2024, in the suit Liquidia brought against the FDA.

United asked the court to restrict Yutrepia’s approval to PAH, which would have forced Liquidia to submit a separate application to the FDA for PH-ILD. The maneuver would extend United’s monopoly in PH-ILD for a few more months — worth a fortune to United, which earned more than $466 million in revenue from its inhaled treatments in the first quarter of 2025. As University of Alabama Law Professor Sean Tu estimated for Hunterbrook, the value of a single day without Yutrepia on the market is worth roughly $3 million to United.

But the judge saw through United’s gambit.

“United’s cross-claims, while nominally aimed at the FDA’s decision to allow Liquidia to amend Yutrepia’s NDA [New Drug Application], are in fact back-door ways to preemptively challenge the FDA’s approval of that NDA, at least for the PH-ILD indication,” Judge Timothy J. Kelly wrote in his opinion.

This removed the last roadblock to Yutrepia’s full approval.

“We are pleased with the court’s decision to dismiss this cross-claim, specifically holding that UTHR failed to establish standing,” Liquidia CEO Roger Jeffs said in a press release, also noting that Liquidia looked forward “to delivering what we believe will become the prostacyclin of first choice for patients with PAH and PH-ILD and the physicians who treat them.”

Liquidia’s stock jumped roughly 15% on May 2 when the judge dismissed the case.

United has twice failed to secure a preliminary injunction over the FDA expanding Yutrepia for PH-ILD: Last spring, Judge John D. Bates also denied United’s analogous request as premature.

Both Judge Kelly and Judge Bates stated United could not prove that letting Liquidia add the PH-ILD indication via amendment caused “competitive harm” to United, because the competitor product Yutrepia isn’t on the market yet. Now that the FDA has approved Yutrepia, that changes — so United could sue the FDA again to try and reverse the decision. In a hearing Tuesday in United’s ‘728 patent litigation, lawyers for Liquidia repeatedly stated that they expect United to file such an action soon. Yesterday, United submitted a brief denying that it will try to enjoin approval: “UTC confirms that it does not intend to file a motion seeking to enjoin FDA’s approval of Liquidia’s NDA.”

Beyond clearing the path for today’s approval, the dismissal also bolstered Liquidia’s odds of accessing an additional $50 million of funding. In March, Liquidia updated a financing agreement with HealthCare Royalty Partners, unlocking $50 million upon Yutrepia’s first sale, “so long as no injunction has been issued prohibiting Liquidia from commercializing Yutrepia for either or both of PAH and PH-ILD.”

But Liquidia may not be fully in the clear just yet.

United Seeks To Delay Launch With New Litigation

With no remaining avenues to stop the drug approval, United has pursued another last-minute strategy to block Yutrepia from actually launching: suing Liquidia for patent infringement, again. The newest lawsuit is United Therapeutics Corporation v. Liquidia Technologies, Inc., 1:25-cv-00368, (M.D.N.C.). It was filed as a related case to Liquidia’s ‘494 patent lawsuit.

The latest patent United accuses Liquidia of infringing is similar to other United patents that Liquidia already overcame. United alleges infringement of U.S. Patent No. 11,357,782 (the ‘782 patent), which is a narrower, follow-on patent in the same “family” as U.S. Patent No. 10,716,793 (the ‘793 patent). Liquidia successfully invalidated the ‘793 patent through a PTAB challenge in 2022, which was upheld on appeal. “Patent family” refers to a collection of patents related to a single, original patent application. All patents in a given family cover the same “invention.”

“I am seeing all of the same games that they are playing to try to delay or deter market entry, so none of these tactics are very surprising or even new,” University of Alabama School of Law professor Sean Tu told Hunterbrook.

United is seeking an emergency order to keep Yutrepia off the market until the case is resolved.

The court held a hearing on United’s request for a Temporary Restraining Order on May 20. Judge Thomas D. Schroeder said he would do his best to issue his decision by today; as of 4 p.m. EST, no decision has been filed in PACER, the legal files tracker, and court representatives have not provided clarity in response to Hunterbrook’s request for comment.

“We are not surprised by UTHR’s repeated, last-minute attempts to deny PAH and PH-ILD patients access to an alternative therapy,” the Liquidia CEO said in a press release. Liquidia did not respond to a request for comment on this latest litigation.

“We have invalidated similar claims covering the treatment of pulmonary hypertension patients with inhaled treprostinil in the past and will continue to defend the rights of patients suffering with these critical illnesses to choose the therapy that works best for them.”

Liquidia asked the court to dismiss the case, on the basis that filing a separate patent lawsuit goes against federal court procedure for prior adjudication, given multiple prior opportunities to raise and resolve the newly alleged patent issue. These doctrines include “res judicata”, collateral estoppel and the patent-specific Kessler doctrine. Res Judicata Collateral Estoppel Kessler

“After an initial failed federal Hatch-Waxman litigation filed nearly five years ago in the District of Delaware, two failed Administrative Procedure Act litigations against the FDA in the District of Columbia, two pending North Carolina state-court actions, and on the eve of trial in a second Hatch-Waxman suit in Delaware, UTC now brings its seventh case—which is the third one to raise the same issues against the same defendant in connection with the same allegedly infringing product,” Liquidia’s memorandum states.

“You should only be allowed one bite at the apple, and what they’re trying to do is get multiple bites at the apple,” Tu told Hunterbrook.

But United argues it could not have raised this specific patent in earlier litigation because it covers a different United product than prior cases. According to United, because Tyvaso nebulizer is the reference-listed drug tied to Yutrepia’s application, the latest patent could not have been raised in the specific type of litigation (called Hatch-Waxman) United previously brought.

The current patent-in-suit only covers Tyvaso DPI (a dry powder inhaler), while earlier lawsuits involved patents on Tyvaso nebulizer — United’s older inhaled treatment.

United also contends that Yutrepia’s launch had to be “immediate” in order for them to raise this claim of alleged infringement.

Convincing a judge to prevent Yutrepia from launching until the case is resolved could be an uphill battle, based on similar requests in other lawsuits against Liquidia.

Last May, a Delaware District Court judge denied United’s request for a preliminary injunction in a separate ongoing patent lawsuit. United Therapeutics Corporation v. Liquidia Technologies, Inc., 1:23-cv-00975, (D. Del.). The case concerns U.S. patent no. 11,826,327 (‘327 patent) – which only relates to PH-ILD (not PAH). ,in part because, as he put it, he was “unpersuaded” that United’s products “meet the market need.”

Liquidia CEO Jeffs agrees. At the April 9 conference, he estimated that only about 6,000 of the possibly 60,000 patients in the U.S. with PH-ILD are currently being treated with United’s products.

At an investor dinner earlier in May, United executives said their penetration in the PH-ILD market is only in the “teens percentage” — and that “every 10,000 patients treated represents ~$1B in revenues for the company.”

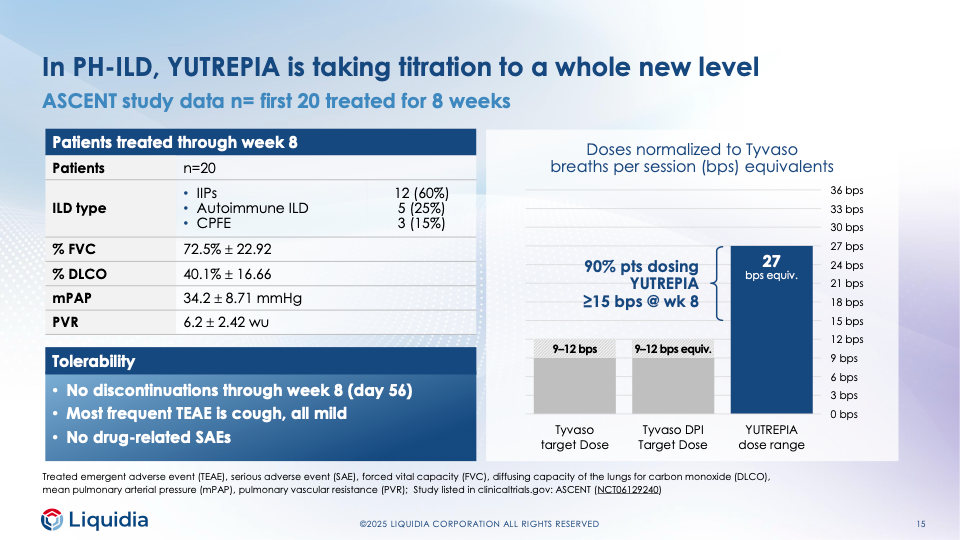

“We don’t really need to take the share from the competitive brand to do well. We just need to get our own share,” Jeffs said. “But certainly, as we’re seeing with our ASCENT data in PH-ILD, we do seem to offer a different and better value proposition, and we’ll continue to progress these types of studies in the future to show that,” referring to a clinical trial of Yutrepia called ASCENT.

Early Data Suggests Yutrepia Is Better, Especially In PH-ILD

Yutrepia isn’t just another option for patients; it’s a better option, according to Liquidia.

The company claims its proprietary formulation and low-resistance device work better than United’s products for patients whose lungs are impaired by pulmonary hypertension.

Now, early emerging data supports Liquidia’s position.

The company presented the first preliminary data from its ongoing clinical trial of Yutrepia in patients with PH-ILD, at the JPM Conference in January. None of the first 20 participants had dropped out by week eight.

That’s a stark contrast to the only clinical data for United’s competing Tyvaso DPI in PH-ILD patients. Most patients in an observational cohort study by National Jewish Health had to quit taking Tyvaso DPI, and some dropped out in the first two weeks.

Liquidia presented more promising data at a conference Tuesday: The first 20 patients in the trial were able to reach high doses of Yutrepia and saw improvements on a key efficacy endpoint called a six-minute walk distance.

After eight weeks on Yutrepia, the average distance patients were able to walk in six minutes increased by 26.4 meters (from 302.7 meters at baseline to 329.1 meters). In United’s clinical trial of Tyvaso nebulizer in PH-ILD patients, the mean improvement was 21.08 meters, and that was after twice as long on therapy.

“The competitor is struggling with an absolute issue of intolerance to the formulation. And they’re having — by using that high-resistance, low-flow device — it’s, in our view, sticking in the upper airway and causing discomfort. What we’ve seen in ASCENT is a complete 180 to that,” Jeffs said in April.

“We’ve seen patients all tolerate the drug. There is mild cough, but it’s not dose limiting. We’re able to titrate the dose to levels above the therapeutic target that they suggest, and we’re able to do that quickly.”

And Jeffs is determined to prove it. He said Liquidia is initiating a clinical study that will take PH-ILD patients using Tyvaso or Tyvaso DPI and transition them to Yutrepia.

But United CEO Martine Rothblatt reassured investors that United’s entrenched dominance will survive the threat from Liquidia.

“I have not seen anything in, since the company has begun developing products, where some new one comes in and kind of steals the market. It actually has never happened,” Rothblatt said during United’s Q1 earnings call on April 30.

“And the reason why is that when a patient who has a life threatening illness is well managed on the medicine, as the patients are well managed on United Therapeutics medicines in overwhelming numbers, it is a very fraught and cautious and slow process to move those patients to some, like, newbie on the block that has not really been well proven in the clinic.”

Rothblatt and another executive reportedly told investors during a recent dinner hosted by TD Cowen that Yutrepia won’t dent United’s bottom line: “LQDA is not a commercial threat due to undifferentiation across the board and UTHR believes they will only take 5% share.”

But in court, United has told a different story: Yutrepia’s launch would force United to lower its prices, steal United’s sales and market share, and push “UTC out of major segments of the market” — causing United “irreparable harm.”

Liquidia Gears Up for Anticipated Launch

“We are preparing to vigorously enter the market at full speed,” Jeffs said at the April 9 conference. “We have 50 reps in the field,” along with “a full suite of patient support services.”

Yutrepia should be available within a couple weeks of approval, according to Liquidia.

But getting Yutrepia on the market is only the beginning.

As Liquidia takes on its big, well-resourced adversary, it also needs to secure adequate insurance coverage and reimbursement for Yutrepia.

Liquidia and United have spoken publicly about negotiating with insurance companies in anticipation of Yutrepia’s launch. United said it has secured “very favorable” terms with insurers, including rebates and assurances that health plans will not give preference to competitors.

Liquidia CFO Michael Kaseta recently countered that the company has been “engaging” with payors for years (formal negotiations can’t start until Yutrepia is approved), and doesn’t expect to be disadvantaged.

“A stalwart of ours is we want to make sure that patients have an opportunity to choose,” Kaseta said in April.

“In order for patients to have an opportunity to choose, we need to have access. And we feel extremely confident, based on those conversations across all, all of those segments, that we will be able to achieve access at or near launch.”

Liquidia Switches to Offense with Patent Suit Against United

After years of fending off United’s patent infringement claims (one of which is headed to trial in June) United’s lawsuit against Liquidia for alleged infringement of its ’327 patent is scheduled to begin June 23. United Therapeutics Corporation v. Liquidia Technologies, Inc., 1:23-cv-00975, (D. Del.). Liquidia executives have told investors they expect to prevail in the suit. Liquidia turned the tables last month by suing United.

This case — an incumbent sued by a smaller company trying to enter the market — is unusual for pharmaceutical patent litigation.

“I’ve never seen this before, and I’ve looked at a lot of this stuff, so to me, this is fairly rare,” Tu said.

Liquidia alleges infringement of U.S. Patent No. 10,898,494 (‘494 patent), which covers a dosing regimen of 100 mcg to 300 mcg of treprostinil per inhalation session, four times a day.

According to the complaint, selling Tyvaso DPI “kits” in the infringing dose range and instructing prescribers and patients to use 100 mcg or more of treprostinil per session infringes Liquidia’s patent.

United has not yet filed a response in court.

“We believe that Liquidia’s lawsuit lacks merit and intend to vigorously defend ourselves, including asserting invalidity of their patent among other defenses,” a United spokesperson told Bloomberg Law.

If Liquidia prevails, United may have to pay damages.

Another possible outcome could be a licensing agreement, where United pays royalties to Liquidia in exchange for the rights to sell Tyvaso DPI at the patented higher dosages.

Because most pharma patent infringement lawsuits involve an incumbent branded drugmaker suing a generic seeking to enter the market, licensing deals in this space can raise anticompetitive concerns.

Liquidia’s case is the opposite.

“There’s probably some opportunity,” patent attorney Matthew Zapadka told Hunterbrook.

Zapadka is a partner at Arnall Golden Gregory and leader of the firm’s patent prosecution team.

“I don’t know enough about the background facts and some of the other issues to say that definitively, one way or another, but it sounds like there’s probably some availability for licensing here,” he said.

The ‘494 Patent Was Issued in 2021: Why Is Liquidia Suing Now?

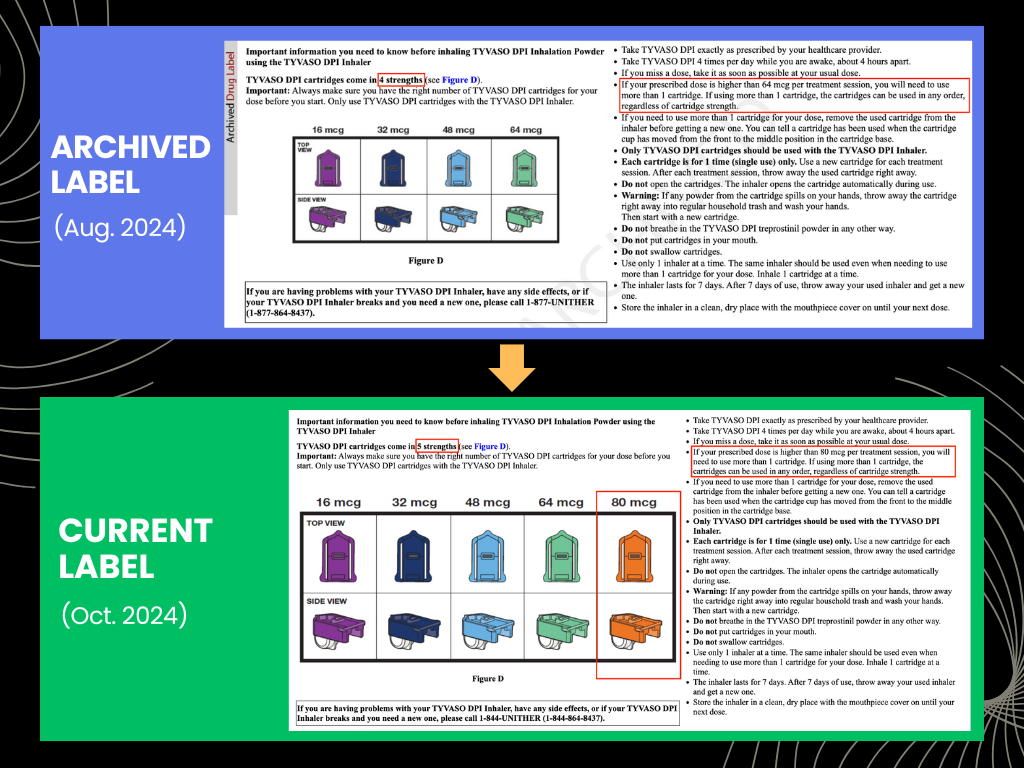

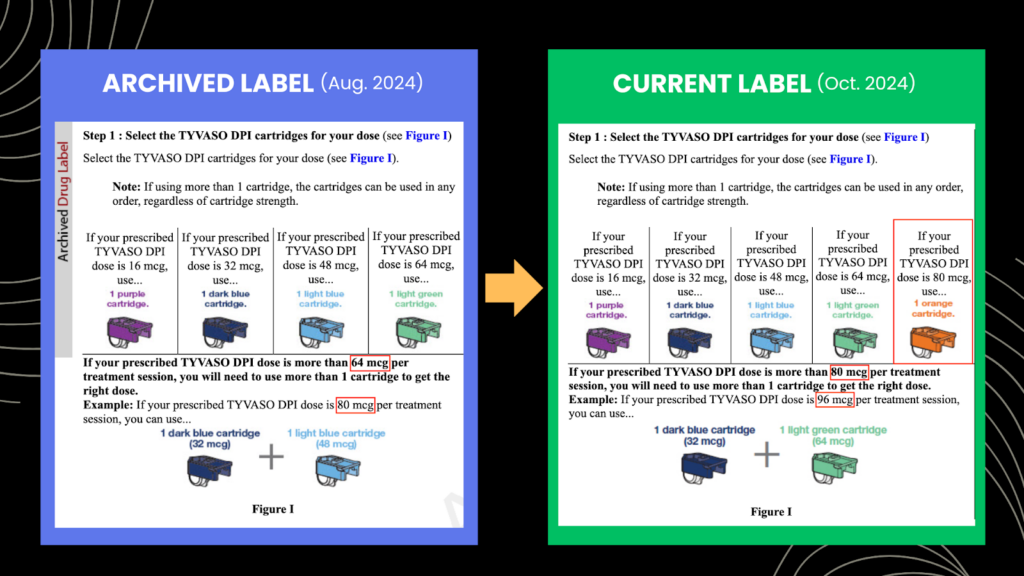

A variety of factors shape companies’ patent strategy, Zapadka said, but one detail in Liquidia’s evidence stuck out: United’s labeling materials for Tyvaso DPI were “Revised 10/2024.”

“I don’t know what those documents may have looked like before then, or in what form they existed. But it could be that something changed in the instructions for use that they then think they’ve got a better position to now litigate on,” Zapadka said.

So Hunterbrook dug into the archive of United’s “Prescribing Information” and “Instructions for Use.” On October 24, 2024, the FDA approved a new 80 mcg cartridge for Tyvaso DPI. Previously, the highest strength cartridge United offered was 64 mcg. So the company had to update its labeling materials:

United began marketing the 80mcg cartridge for Tyvaso DPI in October. Patients who need doses higher than the maximum strength cartridge use multiple cartridges when they take the medication, as explained in Tyvaso DPI’s label and instructions for use. When United updated the inhaler’s label to add the new 80 mcg cartridge, they also revised the instructions for using multiple cartridges.

Source: National Library of Medicine DailyMed Archived Labels Repository

Liquidia points to these new instructions for dosing above 80 mcg as evidence that United is “inducing” patients and healthcare providers to infringe their patented dosing regimen.

United has actually been selling kits of Tyvaso DPI in strengths up to 128 mcg since May 2023. Those higher strength kits include 64 mcg cartridges — not 80 mcg cartridges, which were just approved in October — so United didn’t edit these sections of Tyvaso DPI’s label until last fall.

The change in marketing materials likely played a part in spurring Liquidia to take United to court over the ‘494 patent.

‘494 Patent Highlights Decades-Long Rivalry Between United and Liquidia

The ‘494 patent brings up an interesting chapter in the rivalry between United and Liquidia: Overlapping executives.

Liquidia CEO Jeffs spent 18 years at United, even serving as president and co-CEO with United founder Rothblatt for a year before departing in 2016.

Robert Roscigno is one of the inventors behind the ‘494 patent. But first, he worked for United and its subsidiaries from 1997 to 2007 — playing a “central” role in developing the Tyvaso nebulizer.

Roscigno is credited on several of United’s patents — including the patent United just asserted as the basis for asking a judge to stop Liquidia’s launch. He went to another biotech firm before joining Liquidia as senior vice president of product development in 2015. He left Liquidia five years later. Currently, Roscigno works for Gossamer Bio — another company developing treatments for PAH and PH-ILD, where a third potential competitor called Insmed is also pursuing approval.

“I would say it’s not entirely uncommon that someone leaves one company, goes to another, and they happen to carry with them the knowledge and expertise they have around a particular technology, so they then become inventors on similarly situated subject matter,” Zapadka said.

But not all resumes feature such bitter rivals, as evidenced by the lawsuits United has brought against Liquidia and Roscigno. United has sued Liquidia and Roscigno twice for allegedly stealing trade secrets to facilitate Yutrepia’s development.

According to United, discovery in the litigation over United’s ‘793 patent revealed evidence that Roscigno shared “confidential FDA submissions and detailed financial forecasts relating to Tyvaso” with Liquidia in order to help them develop Yutrepia.

Roscigno did not respond to Hunterbrook’s request for comment via LinkedIn.

United tried to add the trade secret dispute to the ‘793 patent lawsuit, but after the judge declined, they filed a separate suit in the North Carolina state court. United Therapeutics Corp. v. Liquidia Techs., Inc., 2021CVS4094 (NCBC).

Last May, United sued Liquidia and Roscigno again, this time alleging Roscigno violated his employment agreement with United by taking ideas to Liquidia. United Therapeutics Corp. v. Roscigno, 2024CVS3755 (NCBC).

The North Carolina Business Court held hearings in both cases in December, and both lawsuits are ongoing.

Author

Laura Wadsten is a journalist based in Washington, D.C. She is also Executive Director of the nonprofit Moving to Value Alliance, where she produces and occasionally co-hosts the MTVA Unscripted Podcast. Previously, Laura wrote about antitrust and health care markets as a Correspondent for The Capitol Forum, a premium subscription financial publication. She was a Hodson Scholar at Johns Hopkins University, where she earned a B.A. in Medicine, Science & the Humanities.

Editor

Wendy Nardi joined Hunterbrook after working as a developmental and copy editor for academic publishers, government agencies, Fortune 500 companies, and international scholars. She has been a researcher and writer for documentary series and a regular contributor to The Boston Globe. Her other publications range from magazine features to fiction in literary journals. She has an MA in Philosophy from Columbia University and a BA in English from the University of Virginia.

Hunterbrook Media publishes investigative and global reporting — with no ads or paywalls. When articles do not include Material Non-Public Information (MNPI), or “insider info,” they may be provided to our affiliate Hunterbrook Capital, an investment firm which may take financial positions based on our reporting. Subscribe here. Learn more here.

Please contact ideas@hntrbrk.com to share ideas, talent@hntrbrk.com for work opportunities, and press@hntrbrk.com for media inquiries.

LEGAL DISCLAIMER

© 2026 by Hunterbrook Media LLC. When using this website, you acknowledge and accept that such usage is solely at your own discretion and risk. Hunterbrook Media LLC, along with any associated entities, shall not be held responsible for any direct or indirect damages resulting from the use of information provided in any Hunterbrook publications. It is crucial for you to conduct your own research and seek advice from qualified financial, legal, and tax professionals before making any investment decisions based on information obtained from Hunterbrook Media LLC. The content provided by Hunterbrook Media LLC does not constitute an offer to sell, nor a solicitation of an offer to purchase any securities. Furthermore, no securities shall be offered or sold in any jurisdiction where such activities would be contrary to the local securities laws.

Hunterbrook Media LLC is not a registered investment advisor in the United States or any other jurisdiction. We strive to ensure the accuracy and reliability of the information provided, drawing on sources believed to be trustworthy. Nevertheless, this information is provided "as is" without any guarantee of accuracy, timeliness, completeness, or usefulness for any particular purpose. Hunterbrook Media LLC does not guarantee the results obtained from the use of this information. All information presented are opinions based on our analyses and are subject to change without notice, and there is no commitment from Hunterbrook Media LLC to revise or update any information or opinions contained in any report or publication contained on this website. The above content, including all information and opinions presented, is intended solely for educational and information purposes only. Hunterbrook Media LLC authorizes the redistribution of these materials, in whole or in part, provided that such redistribution is for non-commercial, informational purposes only. Redistribution must include this notice and must not alter the materials. Any commercial use, alteration, or other forms of misuse of these materials are strictly prohibited without the express written approval of Hunterbrook Media LLC. Unauthorized use, alteration, or misuse of these materials may result in legal action to enforce our rights, including but not limited to seeking injunctive relief, damages, and any other remedies available under the law.