Based on Hunterbrook Media’s reporting, Hunterbrook Capital is short $RBLX at the time of publication. Positions may change at any time. See full disclosures below.

U.S. regulators have been investigating Roblox Corp. (NYSE: $RBLX), the gaming giant Hindenburg Research accused of inflating key metrics and failing to keep harmful content off its platform, according to documents obtained through Freedom of Information Act requests.

The SEC’s Division of Enforcement and the Federal Trade Commission have both opened probes into the $33 billion online gaming platform, the FOIA documents reveal.

SEC

The SEC’s probe into the company appears to have been launched recently.

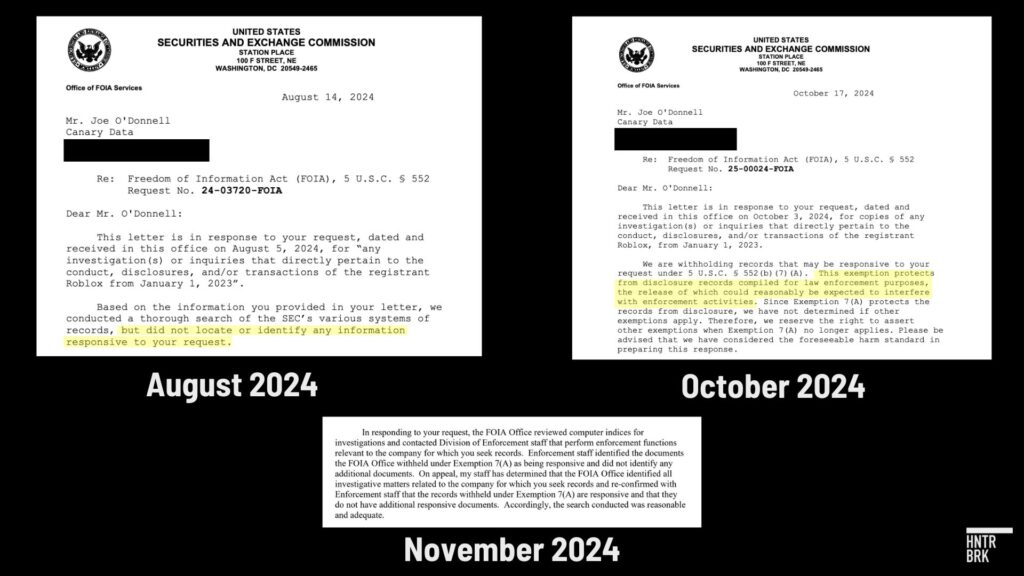

In an August response to a FOIA request for information related to investigations or inquiries into Roblox, the SEC wrote that it “did not locate or identify any information responsive to your request.”

But in response to a follow-up request, on October 17, the Commission changed its tune. “We are withholding records that may be responsive to your request,” the SEC wrote.

The Commission cited Exemption 7(A), which is intended to protect information “compiled for law enforcement purposes, the release of which could reasonably be expected to interfere with enforcement activities.”

The FOIA requests were made by Canary Data, a “database of investment risk,” which went on to appeal the October decision.

On November 20, in response to the appeal, the SEC’s FOIA office wrote to Canary that it had “contacted Division of Enforcement staff that perform functions relevant to the company for which you seek records.”

The Enforcement staff confirmed that records exist for “investigative matters related to the company” — in contrast to the August FOIA response — but maintained that these documents would be withheld from release under Exemption 7(A).

The SEC cautions that “the assertion of this exemption should not be construed as an indication by the Commission or its staff that any violations of law have occurred with respect to any person, entity, or security.” The scale and subject of the investigation are also unknown.

FTC

The Federal Trade Commission, whose mission is “protecting the public from deceptive or unfair business practices,” is also investigating Roblox.

In response to a separate FOIA request sent by Canary seeking information on investigations or inquiries that “directly pertain to the conduct, disclosures, and/or transactions of the registrant Roblox,” the FTC stated it had identified “9,237 pages of responsive records.”

The agency would not share them, however.

Like the SEC, the FTC cited an exemption — which, in this case, “provides that information obtained by the Commission in a law enforcement investigation, whether through compulsory process, or voluntarily in lieu of such process, is exempt from disclosure.”

In 2022, the watchdog group Truth in Advertising filed a complaint with the FTC alleging that Roblox allowed brands to create in-game advertisements that were not clearly disclosed as such, potentially misleading users, especially children.

“As of March 2024, the FTC had yet to publicly act on TINA.org’s April 2022 complaint,” the organization wrote on its website, which also links to 292 pages of consumer complaints.

It is unclear if the probe referred to in the FOIA response is related to those allegations.

[EMBED FTC DOCUMENT CLOUD]

Roblox does not appear to have disclosed either of these investigations — and did not respond to Hunterbrook Media’s repeated requests for comment on whether the company is cooperating with them.

It is possible the company had been unaware of the existence of these probes.

Probes come amid accusations that Roblox has presented misleading financials and created a petri dish for pedophilia

The news of these probes follows the resignation of Roblox’s chief financial officer, Michael Guthrie, on September 30. According to a company filing, Guthrie notified Roblox of his intent to resign on August 1, 2024, “to pursue personal interests.” Guthrie, who on Friday sold more than $2 million worth of Roblox shares, will continue in his role until a successor is appointed.

The probes also follow the release of a critical report by short seller Hindenburg Research, which raised concerns about both safety and accounting issues at Roblox.

The SEC and FTC’s actions mark the latest in a series of wins for Hindenburg.

The subjects of its two most recent short reports prior to Roblox — Super Micro Computer Inc. (NASDAQ: $SMCI) and iLearningEngines Inc. (NASDAQ: $AILE) — have both since seen their share prices collapse, amid auditor resignations, earnings restatements, and federal investigations. Yesterday, the United States Department of Justice indicted billionaire Gautam Adani and several affiliates of his Adani Group, accused of fraud by Hindenburg in 2023. Each company, like Roblox, initially denied Hindenburg’s reporting.

The Hindenburg report on Roblox, published in October, came after critical a series of articles by Edwin Dorsey of The Bear Cave, who had repeatedly flagged issues with child predators on the platform. A more recent article by Dorsey also highlighted “school shooting games” on Roblox.

The Hindenburg report includes claims that Roblox is potentially overstating the number of people on its platform, as well as engagement hours. The report also noted that Roblox has had “net losses every quarter since becoming a public company” and that “the company’s response to the SEC appears to be a flat out lie” regarding its accounting of user metrics.

The report highlights concerns about child safety on Roblox, with allegations of insufficient measures to protect minors from inappropriate content and potential predators. “Our in-game research revealed an X-rated pedophile hellscape, exposing children to grooming, pornography, violent content and extremely abusive speech,” reported Hindenburg.

Roblox has challenged these claims, stating that the Hindenburg report is “misleading” and that the authors “have an agenda irrespective of the substance of Roblox’s business model and results.”

To disclose or not to disclose?

The undisclosed SEC and FTC scrutiny of Roblox contribute to an ongoing debate over the responsibility of companies to disclose federal probes — especially given that companies may not be aware of the investigations until later in the process; and that investigations can ultimately resolve and prove immaterial.

Hunterbrook Media previously revealed an undisclosed SEC investigation into NuScale Power (NYSE: $SMR).

After initially criticizing Hunterbrook, the company soon filed an 8-K disclosing that it had, in fact, received requests from the SEC. The general counsel left NuScale one week later, and Law.com proposed that the situation was “likely to spur a new round of litigation” against NuScale and could impact the broader paradigm for company requirements to disclose SEC investigations.

Author

Sam Koppelman is a New York Times best-selling author who has written books with former United States Attorney General Eric Holder and former United States Acting Solicitor General Neal Katyal. Sam has published in the New York Times, Washington Post, Boston Globe, Time Magazine, and other outlets — and occasionally volunteers on a fire speech for a good cause. He has a BA in Government from Harvard, where he was named a John Harvard Scholar and wrote op-eds like “Shut Down Harvard Football,” which he tells us were great for his social life. Sam is based in New York.

Editor

Jim Impoco is the award-winning former editor-in-chief of Newsweek who returned the publication to print in 2014. Before that, he was executive editor at Thomson Reuters Digital, Sunday Business Editor at The New York Times, and Assistant Managing Editor at Fortune. Jim, who started his journalism career as a Tokyo-based reporter for The Associated Press and U.S. News & World Report, has a Master’s in Chinese and Japanese History from the University of California at Berkeley.

LEGAL DISCLAIMER

© 2026 by Hunterbrook Media LLC. When using this website, you acknowledge and accept that such usage is solely at your own discretion and risk. Hunterbrook Media LLC, along with any associated entities, shall not be held responsible for any direct or indirect damages resulting from the use of information provided in any Hunterbrook publications. It is crucial for you to conduct your own research and seek advice from qualified financial, legal, and tax professionals before making any investment decisions based on information obtained from Hunterbrook Media LLC. The content provided by Hunterbrook Media LLC does not constitute an offer to sell, nor a solicitation of an offer to purchase any securities. Furthermore, no securities shall be offered or sold in any jurisdiction where such activities would be contrary to the local securities laws.

Hunterbrook Media LLC is not a registered investment advisor in the United States or any other jurisdiction. We strive to ensure the accuracy and reliability of the information provided, drawing on sources believed to be trustworthy. Nevertheless, this information is provided "as is" without any guarantee of accuracy, timeliness, completeness, or usefulness for any particular purpose. Hunterbrook Media LLC does not guarantee the results obtained from the use of this information. All information presented are opinions based on our analyses and are subject to change without notice, and there is no commitment from Hunterbrook Media LLC to revise or update any information or opinions contained in any report or publication contained on this website. The above content, including all information and opinions presented, is intended solely for educational and information purposes only. Hunterbrook Media LLC authorizes the redistribution of these materials, in whole or in part, provided that such redistribution is for non-commercial, informational purposes only. Redistribution must include this notice and must not alter the materials. Any commercial use, alteration, or other forms of misuse of these materials are strictly prohibited without the express written approval of Hunterbrook Media LLC. Unauthorized use, alteration, or misuse of these materials may result in legal action to enforce our rights, including but not limited to seeking injunctive relief, damages, and any other remedies available under the law.