Based on Hunterbrook Media’s reporting, Hunterbrook Capital is short $SOC at the time of publication. Positions may change at any time after publication. This is not investment advice. See full disclaimer below.

Editorial Position:

Hunterbrook Media’s Editorial Board believes that Sable Offshore will not restart production at Santa Ynez on time, if at all. Sable listed on NYSE via SPAC as $SOC earlier this year. The company’s auditors have since flagged Sable’s ability to continue as a “going concern.” Our Editorial Board agrees.

Exxon — a more well-capitalized and experienced company — spent seven years trying (and failing) to bring Santa Ynez back online. Sable’s only apparent novel approach seems to be an attempt to bypass Santa Barbara County, which will likely only bring more scrutiny in California, a state not known as fossil fuel friendly.

The CEO’s most recent prior company, Sable Permian Resources, went bankrupt. Before that, he flamed out from Freeport-McMoRan. Now, he and his repeat management team seem to be relying on a highly speculative gamble at the mercy of California regulators, litigators, and communities.

Due to this editorial opinion and with compliance review, Hunterbrook Media provided the article to its investment affiliate, Hunterbrook Capital.

Hunterbrook Media:

On May 19, 2015, oil flooded the Santa Barbara coast and spilled into the Pacific Ocean. An old pipeline carrying crude from the Santa Ynez platforms had ruptured, polluting 3,700 acres of beaches and fisheries. It was the largest oil spill in California since 1990. The largest spill by volume in gallons. In 1990, an oil tanker punctured its hull, spilling more than 400,000 gallons in the ocean. The Refugio Beach oil spill is the largest coastal spill since 1969, also in Santa Barbara County; CA Refugio Beach Oil Spill Final Damage Assessment; Orange County Coastkeeper Coastal Spill History; AP, Judge approves $230M Settlement; NBC LA, The Huntington Beach Spill Isn’t California’s First Oil Disaster

On February 14, Sable Offshore Corp. acquired the platforms and pipeline from ExxonMobil Corp. — after the oil giant’s failed seven-year effort to restart the project. SOC Feb 14, 2024 8k; US CDC Order re: XOM Emergency Permit; Offshore Mag, Exxon faces hurdles

Exxon abandoned its attempts to restart Santa Ynez earlier this year amid what it called “continuing challenges in the state regulatory environment,” leading the company to revise down the value of Santa Ynez by $2.1 billion. XOM Jan 1, 2024 Ex. 99.1 Earnings Considerations; XOM Feb 2, 2024 Earnings 8k Faced with the same roadblocks, Sable now aims to bring Santa Ynez online by October, just eight months after acquiring the assets.

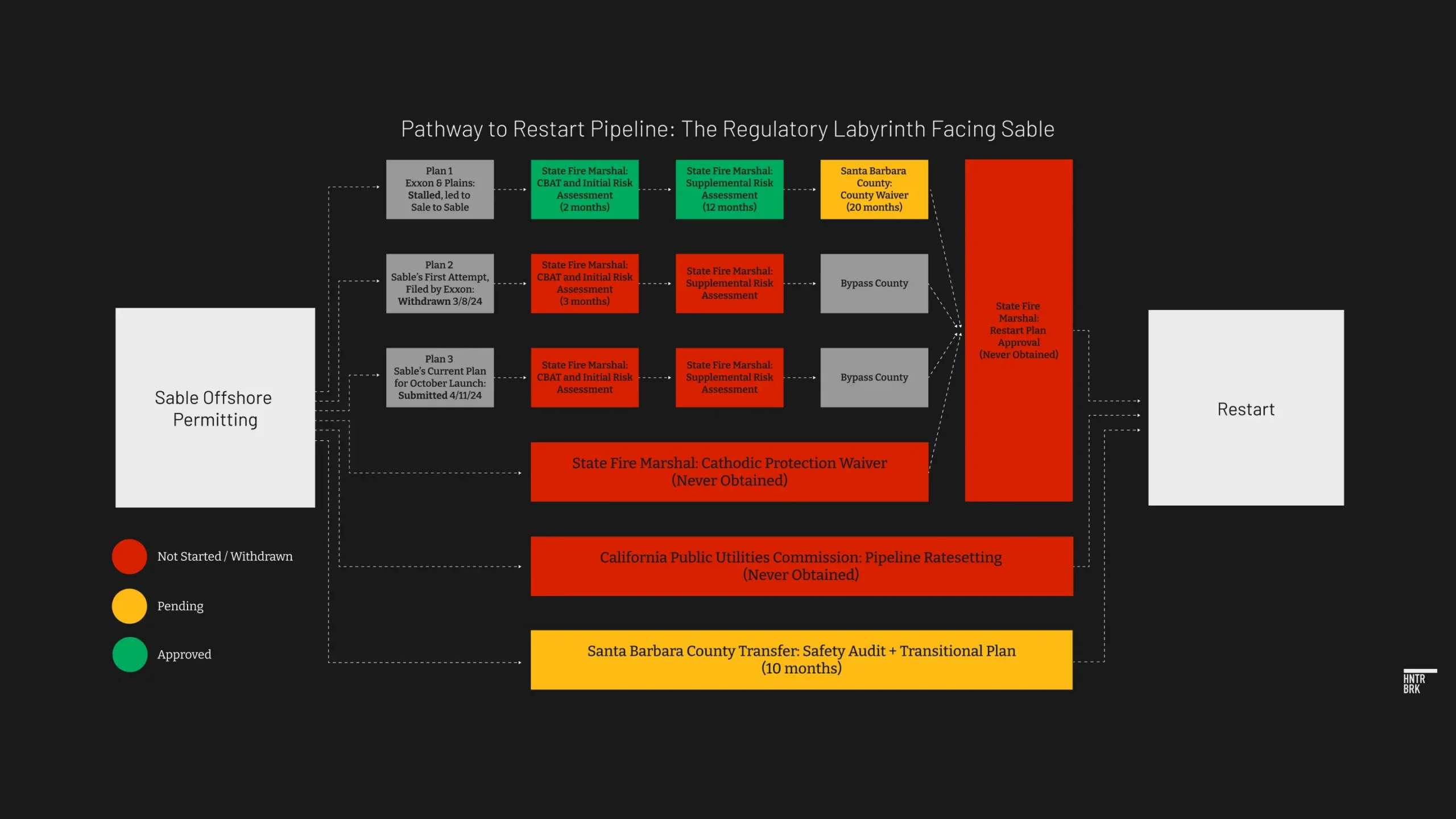

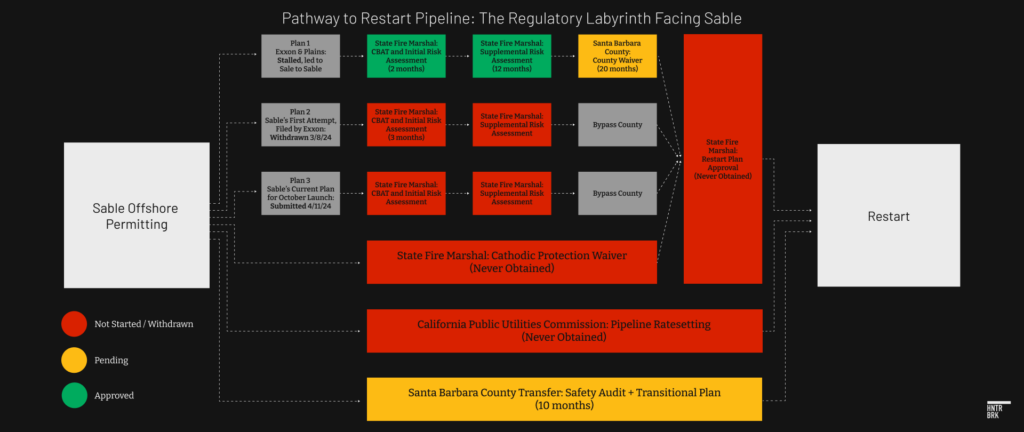

The approval process involves multiple government bodies that all have to sign off on different steps of the restart plan. Exxon failed in part because, although it successfully obtained approval for the main safety design from the California Fire Marshal, Santa Barbara County denied related permits to carry out that design.

Sable’s strategy is to sidestep the county approval process by submitting a new design to the California Fire Marshal (Cal Fire) that Sable argues won’t require the County’s approval, according to the company’s security filings.

The County was not “made aware” of the company’s plan, the County said in response to Hunterbrook Media’s questions, adding that Cal Fire would need to approve any new filing from Sable “before seeking permits from the County.”

Sable told investors the Cal Fire review of the new design had been underway since December 2023 and slated for approval by April. Sable SEC Dec Prelim Proxy materials; Sable Dec 2023 Slide Deck But on March 8, the company withdrew the alternate plan, according to an email Cal Fire sent to Hunterbrook Media. On April 12, Sable told shareholders that it filed a new plan with the agency that still aims to avoid County review.

Sable did not respond to Hunterbrook Media’s inquiry on how it intends to comply with state law without receiving the County approval that prior operators sought.

Even if Sable wins Cal Fire’s approval of its new permit, it still needs regulatory sign-off on at least four other authorizations before it can restart its operations. That includes a separate approval from Santa Barbara County of the transfer of ownership from Exxon to Sable.

This figure represents the different permits necessary to restart the pipeline. The bubbles in the center represent individual permits and authorizations. The parenthetical text reflects the length of time it took for Exxon to obtain the respective permit. Figure made using Canva.

If Sable doesn’t restart production by January 1, 2026, the Santa Ynez assets will revert back to Exxon “without any compensation to [Sable],” according to the terms of the deal.

Sable is led by Chief Executive James Flores, an oil and gas veteran who has had some struggles in the oil patch over the last decade.

In 2021, Flores formed a Special Purpose Acquisition Vehicle (SPAC) in pursuit of his next venture and quickly zeroed in on Exxon’s Santa Ynez operations. When the deal closed with Exxon earlier this year, Sable Offshore debuted on the New York Stock Exchange. The Santa Ynez complex is its only asset.

Sable did not acknowledge receipt of Hunterbrook Media’s requests for comment. Flores could not be reached for comment. Exxon declined to comment.

The pipeline that covered Refugio State Beach with oil

The ruptured pipeline spilled more than 120,000 gallons of oil. The largest spill by volume in gallons. In 1990, an oil tanker punctured its hull, spilling more than 400,000 gallons in the ocean. The Refugio Beach oil spill is the largest coastal spill since 1969, also in Santa Barbara County. See footnote 1 for references.

Federal investigators found that the owner and operator of the pipeline at the time of the spill, Plains All American Pipeline LP, failed to prevent and detect corrosion that led to the rupture. PHMSA May 2016 Failure Investigation Report The investigation also found that Plains’ monitoring systems, alarms, and response were inadequate and worsened the damage from the spill. PHMSA May 2016 Failure Investigation Report; 2020 Federal and State Consent Decree

In 2018, a jury found Plains guilty of nine criminal counts for spilling oil into state waters, killing wildlife, and failing to alert authorities. CA OAG Sep 7, 2018 Announce Guilty Verdicts PR; SBC DA Apr 25, 2019 Sentencing on Felony Conviction PR; Accessed Superior Court of Santa Barbara Clerk 2/20/24. Case No. 1495091. The felony count of causing the discharge is a reasonableness standard — based on a person or corporation knowingly engaging in or causing the conduct “or a person who reasonably should have known that the person was engaging in or causing” the conduct. See Cal Gov Code § 8670.64 Plains paid a $3.3 million fine, the maximum the law allowed. SBC DA Apr 25, 2019 Sentencing on Felony Conviction PR; Noozhawk, Plains Ordered to Pay $3.3 Million The company later paid $61 million in civil penalties to the state and federal governments and settled a lawsuit with coastal landowners and fishers for $230 million. CLC Mar 18, 2020 Oil Pipeline Company to Pay more than $60 Million PR ($61.325 million precisely, according to 2020 Federal and State Consent Decree); AP, Judge approves $230M Settlement

Legal and regulatory fallout casts a shadow over Sable plans

In the aftermath, California tightened regulations on fossil fuel operators — passing a law in 2015 requiring extensive upgrades to coastal pipelines. California Assembly Bill 864; OSFM Pipeline Safety & CUPA CBAT webpage Plains also agreed to an additional layer of oversight after its 2020 settlement with the state and federal governments. DOJ March 2020 PR Plains Settlement; 2020 Federal and State Consent Decree

As the enhanced safety provisions came into effect, Plains tried to restart the pipelines and Exxon tried to restart the Santa Ynez platforms. SM Sun, ExxonMobil withdraws pipeline replacement; SBC Interim Trucking Planning & Development In October 2022, Exxon bought the pipeline infrastructure from Plains.

Exxon’s efforts to bring Santa Ynez online stalled last year when the company was unable to win approval for any of its three restart plans, which ranged from retrofitting the old pipes to receiving and shipping the oil onshore via truck. Pacific Pipeline Oct 24, 2023 Withdrawal; SBC Valve Upgrade Energy Minerals and Compliance; US Central District of California Sep 27, 2023 Court Order; SBC KEYT-TV, ExxonMobil drops lawsuit

In February, Sable bought the three offshore platforms, the processing facility, and offshore and onshore pipelines from Exxon for $988 million, supported by a $625 million loan from Exxon. SOC Pro Forma Combined Financials; HBEG, Sable Offshore completes deal

While Sable’s “management believes the Company has sufficient capital to maintain operations and complete the repairs necessary to restart production,” it also concedes in a security filing that due to the regulatory hurdles, “substantial doubt exists about the Company’s ability to continue as a going concern.”

Regulatory maneuver to clear hurdles

Cal Fire is the agency responsible for implementing the state law following the 2015 rupture. Cal Fire also has the final sign-off for approving the pipeline restart pursuant to the conditions the government imposed on the pipeline in 2020.

Before granting its final approval for a restart, Cal Fire is to consider a number of permits including a “Risk Assessment and Implementation Plan.” For the risk assessment, Cal Fire’s task is to assess whether the best spill-prevention technology for the pipeline has been identified by the operator.

In 2022, Cal Fire approved Plains’ Risk Assessment, requiring the pipeline operator to add 16 safety valves to reduce the volume of a “worst case” scenario spill by 48%, according to security filings and the Risk Assessment document Hunterbrook Media obtained. SOC Mar 28, 24 10K; 2021 Plains CBAT Implementation Plan

To move forward, however, the project also needed permission from Santa Barbara County to access the planned construction sites for the additional valves. The County denied Exxon on the grounds that the risk of another oil spill was too high even with the additional measures, citing the age and condition of the pipeline as a primary concern.

After an appeal, the County board last August deadlocked with a 2-2 vote on a motion to decide if it should revisit its denial. The Board has not considered the issue since, and “Sable has taken no action” to reinitiate its consideration, according to the County’s email to Hunterbrook Media.

While Sable says it may resume those efforts, the company is betting it can avoid the County altogether, seeking Cal Fire’s approval for a different Risk Assessment plan that Sable says “will not require Santa Barbara County zoning approval,” according to security filings.

Cal Fire would not provide a copy of the company’s filing, reasoning that the information was exempt from an open-record request submitted by Hunterbrook Media.

Novel attempt hits a snag

Sable had said it was expecting Cal Fire to promptly approve its pending permit. But on March 8, Sable withdrew the application, which was originally filed by Exxon, according to the agency’s response to Hunterbook Media. Cal Fire said the law requires a new risk analysis be submitted when a company is sold.

Sable refiled its alternative plan on April 11 and maintains that the plan is still designed to avoid county-level zoning review.

It took Cal Fire 14 months to consider and approve the previous Risk Assessment plan for the project. Cal Fire Acceptance of Initial CBAT Plan; 2021 Plains CBAT Implementation Plan; SOC Mar 28, 24 10K pg. 5 (OSFM July 13, 2022).

Sign Up

Breaking News & Investigations.

Right to Your Inbox.

No Paywalls.

No Ads.

Sable’s ambitious timeline

Even if it bypasses the County’s zoning board, Sable still needs Santa Barbara County to approve Exxon’s transfer of ownership of the facilities to Sable. Cal Fire Acceptance of Initial CBAT Plan; 2021 Plains CBAT Implementation Plan; SOC Mar 28, 24 10K pg. 5 (OSFM July 13, 2022).

Sable anticipated that its transfer conditions would “be fulfilled in whole or in large part by the same audit information provided” during Exxon’s purchase of the assets, according to security filings. FAC Feb 9, 2024 Schedule 14A, pg. 257

Hunterbrook Media asked the County if its review of Sable will differ from its review of Exxon. In an email, the County said, “The County Board of Supervisors will review Sable’s current Change of Owner/Operator applications on their merit, independent from its previous review of Exxon’s applications.”

Santa Barbara County received Sable’s filings related to the transfer of ownership on March 25, according to the County’s response to Hunterbrook Media.

“This transfer from Exxon to Sable is different from the Plains to Exxon transfer,” Linda Krop, the chief counsel at local advocacy group the Environmental Defense Center, who has long opposed the restart of the pipeline and Santa Ynez platforms and was on the beach following the spill to monitor abatement efforts, told Hunterbrook Media.

“When Exxon filed the transfer of ownership we did raise concerns but the County approved the transfer based on Exxon’s financial resources, one of the components the County reviews,” Krop said. “But now that Exxon has sold to Sable, our concerns are much more serious and exacerbated by the fact that Sable wants to use the corroded, old pipeline.”

“A new company who received most of its money from Exxon through a loan — it raises concerns about safety and the company’s ability to respond to an incident,” Krop said. “We will definitely be engaged in the County’s consideration of the transfer. At a minimum, we will ask the County to thoroughly explore Sable’s financials and safety plans.”

Sable also needs approval from the California Public Utilities Commission’s (CPUC) rate-setting regime, where the agency determines what the company can charge its pipeline customers. Sable says in its security filings that the outcome of these proceedings will determine whether they can “earn an adequate rate of return in a timely manner or at all.”

There is no set timeline to a CPUC rate-setting proceeding, according to the agency’s website. Sable has yet to file an application or advice letter with the CPUC to initiate its deliberation process, according to the agency’s April 9 response to Hunterbrook Media.

CEO Flores gambles on the scraps

Flores became interested in Exxon’s operations when he was operating four offshore platforms at Point Pedernales and Point Arguello up the coast from Santa Ynez in the early 2000s, according to Sable’s security filings. FAC Feb 9, 2024 Schedule 14A, pg. 174.

At the time, he was running Plains Exploration & Production Co. and Plains Resources Inc., upstream affiliates of Plains All American, the company responsible for the 2015 pipeline spill. FAC Feb 9, 2024 Schedule 14A; PAA Pricing of Vulcan PO; NGI, Vulcan Energy Takeover of Plains Resources; Formation of PAA from Plains Resources 1998 AR; PAA Company History; 2021 PAA Proxy; NGI, Plains Resources Spin-off; PAA S-4

In 2013, mining giant Freeport bought Plains Exploration and McMoran Exploration.

Freeport retained Flores and appointed him co-chairman of the company’s new $9 billion oil and gas division, with Freeport’s president and CEO, Richard Adkerson, telling shareholders he knew “Jim for over 20 years and admired his track record as an entrepreneur in the oil and gas business.” Reuters, Freeport makes $9 billion energy bet; FCX 2012 Deal Announcement Transcript After that, the timeline on Sable’s investor presentations of the team’s “History of Value Creation” stops:

In 2016, Freeport shuffled its management and replaced Flores, amid billions of dollars in losses and write-downs and a protracted exit from its expensive diversification attempt. FCX Def14A 2016; HBJ, FCX Oil & Gas Cuts Jobs; Forbes, FCX Exits Disastrous Foray; BBG $6.5 Billion in Energy Writedowns

Flores’ next, much smaller act, Sable Permian Resources, suffered a similar fate.

At Sable Permian, Flores and two private equity firms targeted the debt-laden assets of the late Aubrey McClendon, the former CEO of Chesapeake Energy and American Energy Partners. Flores took the helm of Sable Permian as CEO with the hope of paring debt and reducing expenses. Permian Res 2017 Restructuring Transaction; HChron, The late Aubrey McClendon’s Permian business merges with parent to avoid bankruptcy After three years and a drop in oil prices, Sable Permian went bankrupt, laid off all its employees, and denied Flores’ attempt at a high payout. Bankruptcy Docket; WSJ, Sable Permian Heads off Fight Over Executive Bonuses; HBJ, Sable Permian to lay off all employees after bankruptcy; WSJ, Bondholders Seek Probe of Bankrupt Sable Permian

Tom Loughrey, who provides oil and gas data to institutional investors and worked on distressed credit analysis for the sector at Silverback Asset Management during Flores’ time at Sable Permian, questioned the company’s management in an interview with Hunterbrook Media.

“Sable Permian was poorly run. It was not a high-quality asset base to begin with and it was drilled horribly,” he said. “Flores and his team drilled the wells way too densely. It was basically destroying the company for near term quarterly results. And that was back in the day when everyone thought no one would look at the data. It was very scammy.”

Flores has brought a loyal cadre of operational managers from venture to venture; three Sable executives worked with Flores at each of his last three companies, plus his son, whose first leadership experience was at the Texas company. Excluding board members. FAC Feb 9, 2024 Schedule 14A

Now, Sable’s small team — with less capital and less experience than Exxon and Flores’ earlier companies — is back in California to resuscitate an offshore platform just 35 miles away from the platforms Flores oversaw at Freeport.

A year before he left Freeport, Flores spoke to The Wall Street Journal about his philosophy in the oil patch during a low price environment. “It’s raining and it’s going to rain for a long time. We’re all going to get wet. A few people are going to drown. You just have to make it to the other side,” he said.

Daniel Sherwood joined Hunterbrook from The Capitol Forum, a premium subscription financial publication, where he was an Editor & Senior Correspondent, writing and managing market-moving investigative reports and building the Upstream database. Prior to The Capitol Forum, Daniel has experience conducting undercover investigations into fossil fuel companies and other research. He also served as an Honors Law Clerk in the Criminal Enforcement Division of the EPA. He has a JD from Michigan State University. Daniel is based in Michigan.

Author

Daniel Sherwood joined Hunterbrook from The Capitol Forum, a premium subscription financial publication, where he was an Editor & Senior Correspondent, writing and managing market-moving investigative reports and building the Upstream database. Prior to The Capitol Forum, Daniel has experience conducting undercover investigations into fossil fuel companies and other research. He also served as an Honors Law Clerk in the Criminal Enforcement Division of the EPA. He has a JD from Michigan State University. Daniel is based in Michigan.

Editor

Sam Koppelman is a New York Times best-selling author who has written books with former United States Attorney General Eric Holder and former United States Acting Solicitor General Neal Katyal. Sam has published in the New York Times, Washington Post, Boston Globe, Time Magazine, and other outlets — and occasionally volunteers on a fire speech for a good cause. He has a BA in Government from Harvard, where he was named a John Harvard Scholar and wrote op-eds like “Shut Down Harvard Football,” which he tells us were great for his social life. Sam is based in New York.

***

Hunterbrook Media publishes investigative and global reporting — with no ads or paywalls. When articles do not include Material Non-Public Information (MNPI), or “insider info,” they may be provided to our affiliate Hunterbrook Capital, an investment firm which may take financial positions based on our reporting. Subscribe here. Learn more here.

Please contact ideas@hntrbrk.com to share ideas, talent@hntrbrk.com for work opportunities, and press@hntrbrk.com for media inquiries.

LEGAL DISCLAIMER

© 2026 by Hunterbrook Media LLC. When using this website, you acknowledge and accept that such usage is solely at your own discretion and risk. Hunterbrook Media LLC, along with any associated entities, shall not be held responsible for any direct or indirect damages resulting from the use of information provided in any Hunterbrook publications. It is crucial for you to conduct your own research and seek advice from qualified financial, legal, and tax professionals before making any investment decisions based on information obtained from Hunterbrook Media LLC. The content provided by Hunterbrook Media LLC does not constitute an offer to sell, nor a solicitation of an offer to purchase any securities. Furthermore, no securities shall be offered or sold in any jurisdiction where such activities would be contrary to the local securities laws.

Hunterbrook Media LLC is not a registered investment advisor in the United States or any other jurisdiction. We strive to ensure the accuracy and reliability of the information provided, drawing on sources believed to be trustworthy. Nevertheless, this information is provided "as is" without any guarantee of accuracy, timeliness, completeness, or usefulness for any particular purpose. Hunterbrook Media LLC does not guarantee the results obtained from the use of this information. All information presented are opinions based on our analyses and are subject to change without notice, and there is no commitment from Hunterbrook Media LLC to revise or update any information or opinions contained in any report or publication contained on this website. The above content, including all information and opinions presented, is intended solely for educational and information purposes only. Hunterbrook Media LLC authorizes the redistribution of these materials, in whole or in part, provided that such redistribution is for non-commercial, informational purposes only. Redistribution must include this notice and must not alter the materials. Any commercial use, alteration, or other forms of misuse of these materials are strictly prohibited without the express written approval of Hunterbrook Media LLC. Unauthorized use, alteration, or misuse of these materials may result in legal action to enforce our rights, including but not limited to seeking injunctive relief, damages, and any other remedies available under the law.