Based on Hunterbrook Media’s reporting, Hunterbrook Capital is short $SYM at the time of publication. Positions may change at any time. See full disclosures below.

To save their controversial deal, Albertsons and Kroger needed a plan.

The Federal Trade Commission had challenged their $24.5 billion combination — “the largest supermarket merger in U.S. history” — as anticompetitive, so the grocery giants set out to create a new competitor.

They’d divest more than 500 of their stores and distribution centers to C&S Wholesale Grocers LLC, one of the largest grocery supply companies in the nation.

And to help fund the divestiture? SoftBank, the Japanese investment firm, would put $400 million into the deal.

Since the arrangement was proposed, however, the FTC — which has argued the merger would lead to higher grocery prices while harming workers — has identified some puzzling facts about C&S as a buyer. For instance, C&S had expressly stated its intention to steer clear of retail in the past. And in internal communications revealed by the FTC, C&S executives allegedly lamented that they had been given the “worst chains” as part of this deal.

The SoftBank investment also induced head-scratching. Why would a tech VC known for its investments in WeWork and Alibaba spend hundreds of millions buying grocery stores?

A Hunterbrook Media investigation — building on clues from a recent, 80-page anonymous short report posted to Dropbox — suggests the proposed divestiture may serve an ulterior motive for C&S and SoftBank: propping up Symbotic Inc. (NASDAQ: $SYM), a struggling warehouse automation company that C&S executives and SoftBank just so happen to own.

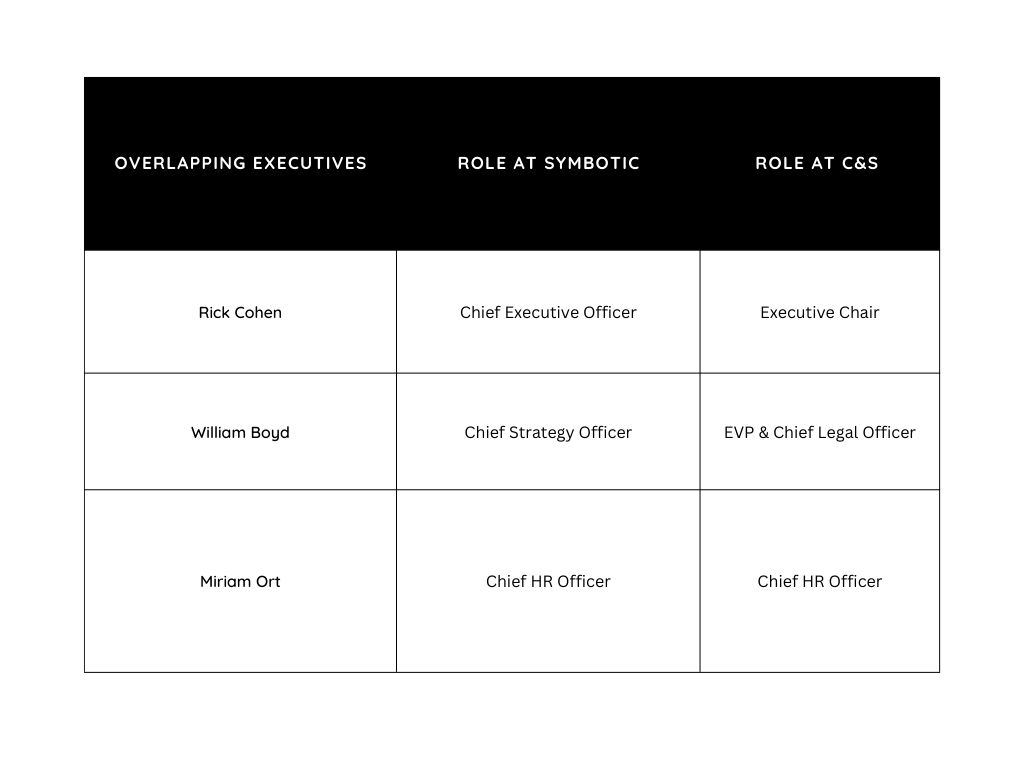

In SEC disclosures, Symbotic notes: Rick Cohen, the executive chair of C&S, is the CEO of Symbotic; William Boyd, the executive vice president and chief legal officer at C&S, is the chief strategy officer of Symbotic; and Miriam Ort, the chief human resource officer at C&S, serves the same role at Symbotic.

Cohen and his family own a stake in Symbotic worth billions. SoftBank also owns hundreds of millions of dollars in shares.

“The overlapping executives may have actual or apparent conflicts of interest with respect to matters involving or affecting each company,” Symbotic acknowledges in its SEC filings.

The two companies have ties going back to 2007 — when Symbotic was founded “in response to distribution challenges at the Cohen family-owned C&S Wholesale Grocers,” according to Symbotic’s website.

And Symbotic has said its growth strategy is to “increase existing customer penetration,” citing its relationships with “anchor customers” like C&S and Albertsons.

Hunterbrook’s comprehensive review of the 579 grocery stores and warehouses ultimately agreed upon between the parties as a part of the divestment package reveals a striking pattern of proximity to the 18 U.S. “site operations” listed on Symbotic’s website. Symbotic lists the names of the municipalities where its operations are located but does not disclose the exact addresses of their facilities — so Hunterbrook pinned the location to the approximate center of the listed municipality as shown on Google Maps. We also don’t know the exact nature of Symbotic’s operations in each of these places.

Seventy-four of the stores C&S would receive under the divestiture plan — including 20 Albertsons stores and 54 Safeway locations — are within the Phoenix metro area, adjacent to Symbotic’s facility in Tolleson, Arizona. C&S would also receive two Albertsons distribution centers in the region.

Within 30 miles of Melrose Park, Illinois, where Symbotic has a site, C&S would receive 32 stores — including 28 Marianos and 4 Jewel-Osco locations. Another 14 stores are within a 30-mile radius of Irvine, California, where Symbotic has operations, and an additional 49 stores are being divested across Southern California.

All told, about one-fifth of the divested stores are located near Symbotic sites — and that calculation doesn’t include states like Texas, where Symbotic has operations in Palestine, about 150 miles from 26 stores set to be divested in the Dallas-Fort Worth metropolitan area. (For context: “The average one-way travel distance” between Walmart and its distribution centers is 124 miles, according to supply chain consultant MWPVL International.)

Hunterbrook Media’s back-of-the-envelope math found that there is less than a 0.01% chance that this overlap was a mere coincidence. Using a universe of 233 Metropolitan Statistical Areas where there is either an Albertsons or a Kroger store (based on CSVs purchased and downloaded from Scrape Hero and the Census), and 18 relevant Symbotic locations in the U.S., Hunterbrook calculated the probability that any given store would be located near a Symbotic facility. We would expect approximately 45 stores to be near Symbotic locations by chance — 579 multiplied by (18/233). However, the actual number of stores near Symbotic facilities is 110, which is much higher. The standard deviation, which measures expected variability, was calculated to be approximately 6.42 stores via a binomial distribution (where n=579, p=.077, and 1-p = the probability of a store not being near a Symbotic facility). The z-score, calculated by subtracting the expected value (45 stores) from the observed value (110 stores) and dividing by the standard deviation, is 10.16. This z-score corresponds to a near-zero probability of such clustering occurring by chance. In percentage terms, this means the likelihood of this clustering happening randomly is less than 0.00000001%. There are many variables not considered here, including population size — although, when Hunterbrook redid the calculations assuming an average MSA population size for the MSAs where a Symbotic-Divestiture overlap wasn’t present, the result was still significantly lower than 0.01% (AKA a z-score of around 5.91). Regardless: Please let us know if you come up with a more precise analysis at ideas@hntrbrk.com.

The FTC has sought information related to Symbotic’s relationship with C&S, requesting “communications about or relating to the Proposed Divestiture between the Company and SoftBank, Richard Cohen, Symbotic,” as well as “all Documents relating to any opportunities for Symbotic to provide services to assets that C&S acquires from Kroger and Albertsons in connection with the Divestiture Acquisition.”

Asked by the FTC whether C&S would work with SoftBank to use AI to automate jobs, presumably in reference to Symbotic, CEO Eric Winn purportedly said: “I don’t know. We haven’t done any plans. We haven’t made plans to automate any of these warehouses.”

He also said in court that Kroger chose which locations it would divest, according to the Los Angeles Times, but only after a “long negotiation.”

When Hunterbrook followed up with Symbotic and C&S — asking about the overlap between the divested locations and Symbotic’s operations — the companies did not respond. SoftBank, Kroger, and Albertsons also did not return Hunterbrook’s requests for comment.

The FTC declined to comment.

This proposed divestiture comes at a critical time for Symbotic. After the anonymous short report questioned the company’s deal with Walmart, Symbotic’s ability to grow its relationships with C&S and Albertsons has seemingly become all the more important.

Is Symbotic using C&S as a “cookie jar” after downfall from high-flying SPAC?

Building on its early promises to automate the supply chains of big box stores, Symbotic signed a large deal with Walmart in 2021 and went public in 2022 via a $5.5 billion special purpose acquisition company in partnership with SoftBank.

Symbotic and Walmart expanded their agreement that same year, which gave Walmart its majority stake in the company and cemented the retailer as Symbotic’s largest customer.

But since Symbotic’s share price hit its all-time peak in July 2023, it has been on the decline, and the company has been unable to attract much meaningful business outside of its principal customer, Walmart, which was responsible for more than 85% of Symbotic’s revenue in each of the last two years, according to its publicly filed financial statements.

The anonymous short report alleged Symbotic is “far more penetrated” in its Walmart rollout “than investors appreciate” — meaning Symbotic has already received more of the revenue from the contract than previously understood. The report also published drone and satellite imagery that it said indicated locations Symbotic had characterized as “sites in deployment” in reality had “zero activity.”

In security filings, Symbotic has highlighted its “strong blue chip customer base” — describing Walmart, C&S, and Albertsons as “anchor customers” that it is “dependent upon” for sales.

But in 2022 and 2023, neither C&S and Albertsons accounted for more than 10% of the company’s revenues, according to Hunterbrook’s review of Symbotic’s earnings from C&S and its anonymized list of “significant customers” in its public securities disclosures.

Brittain Ladd, a supply chain management consultant, told Hunterbrook in an interview, “Symbotic’s challenge is they have a complex system. They are struggling to get these systems running the way they’re designed, struggling to achieve the throughput, the savings, and to really reduce the high labor costs all these companies have.”

Ladd continued, “It’s the execution piece I think Symbotic’s severe trouble is at. I struggle to see how Symbotic will turn anything around any time soon.”

In recent quarters, Symbotic continued to rely on its contract with Walmart for the majority of its revenues. But it is also becoming more and more dependent on C&S, increasing its earnings from the grocery wholesaler threefold from the end of 2023 to mid-2024 compared to the same period the year prior, according to Hunterbrook’s review of Symbotic’s security filings.

That increase may be the result of a creative deal Symbotic cut with its related parties SoftBank and C&S.

In July 2023, Symbotic announced a joint venture with SoftBank, called GreenBox, whose first customer would be C&S.

Symbotic hyped $7.5 billion in sales from the seemingly matryoshka-doll deal, but whether its new venture turns into sustainable profits remains to be seen.

Herb Greenberg, the veteran financial reporter who now runs the blog Herb On The Street, wrote in May that “the whole thing is clever to the point of being brilliant.”

“10 months after GreenBox and Symbotic announced they had contracted a bunch of business, they announced that their first location is a single location run by C&S,” Greenberg noted, adding, “If you didn’t know better, you might think there was an effort to inflate backlog so the company looks less reliant on Walmart than it really is.”

In an interview with Hunterbrook, Greenberg elaborated on this point in the context of the proposed Albertsons-Kroger merger, but stressed he was just asking questions: “How much of this has to do with what appears to be a poorly conceived public company that has been struggling because it has one big customer?”

“And now its business with that customer may be slowing, and much slower than people think,” he continued. “And C&S itself might be struggling. And then this out-of-left-field proposal to buy the grocery stores becomes some sort of an — I don’t want to call it an exit plan — but a way to divert attention from what’s going on.”

This sentiment is reflected in the anonymous short report: “We think GreenBox is a complicated, round-trip, related-party transaction whereby ‘billions’ of System revenue dollars are being added to Symbotic’s backlog at de minimis economic profit,” the author wrote. “We think that C&S has and continues to face substantial financial headwinds, and that because Symbotic is now far more important to Rick’s net worth than C&S is, he is using C&S as a ‘cookie jar’ to prop up SYM’s results.”

Even with the help of this “cookie jar,” Symbotic is starting to show signs of financial stress in its SEC filings, including a massive unbilled receivables balance and aging inventory.

The company has also seen significant turnover in its leadership — with its chief executive officer, chief human resources officer, chief technology officer, head of machine learning, and chief accounting officer all reportedly departing in recent years.

“C&S is absolutely hiding the ball”

The FTC has raised significant doubt over alternative explanations for C&S’ interest in the deal.

C&S — whose retail operation consists of about 160 Piggly Wiggly and Grand Union supermarkets and one pharmacy — has “spent most of the last decade seeking to avoid being a supermarket operator,” wrote the FTC.

In 2021, the FTC notes, C&S explicitly stated: “We do not intend to grow our grocery retailing operations or to operate the retail grocery stores in the long term. We expect to divest our retail grocery stores as opportunities arise.” And in testimony, a C&S executive referred to some of the stores included in the divestment package as Kroger’s “worst chains.”.

“My high level take on the divestiture generally from a big picture level is that it may not be designed to fail, but it’s designed with kind of a reckless indifference to whether the retail stores succeed and actually become a real competitor to a combined Kroger and Albertsons,” said Laurel Kilgour, a lawyer who has been covering the trial for the American Economic Liberties Project, in an interview with Hunterbrook. The AELP is a nonprofit focused on corporate accountability and antitrust.

The FTC also cited a history of C&S reportedly selling hundreds of retail locations after challenges due to “complicated integration of multiple banners, store sizes and formats and expansion into retail geographies.” This raises questions as to whether they could be the kind of formidable competitor to Albertsons and Kroger that is necessary for an antitrust divestiture.

Another question raised in an article by The Capitol Forum: Is C&S really going to compete hard with Walmart, Symbotic’s biggest source of revenue?

“Under the law, for the Albertson’s deal to go through, they are acknowledging by putting together this divestiture package that there will be some harm to competition by combining these two giants,” said Kilgour. “The function of the divestiture package is to create competition, have competitors in areas where it would be the most damaging to lose that competition. It seems clear on a number of levels that that is not what this package is actually designed to do.”

“C&S is absolutely hiding the ball,” Ladd told Hunterbrook. “They’re doing this to leverage technology, they are clearly interested in automation.”

Kilgour had a similar take — noting there has been “testimony saying … that C&S likes the divestiture package because it will expand their distribution center footprint.”

She specifically cited a hearing in which FTC expert Edward Fox said that “almost half of the stores” being divested to C&S “will not have their primary distribution center to date so will have to switch to another primary distribution center.”

Conveniently, there’s a good chance Symbotic has operations nearby.

Authors

Daniel Sherwood joined Hunterbrook from The Capitol Forum, a premium subscription financial publication, where he was an Editor & Senior Correspondent, writing and managing market-moving investigative reports and building the Upstream database. Prior to The Capitol Forum, Daniel has experience conducting undercover investigations into fossil fuel companies and other research. He also served as an Honors Law Clerk in the Criminal Enforcement Division of the EPA. He has a JD from Michigan State University. Daniel is based in Michigan.

Sam Koppelman is a New York Times best-selling author who has written books with former United States Attorney General Eric Holder and former United States Acting Solicitor General Neal Katyal. He helped build Fenway Strategies into one of the preeminent strategic communications firms in the country—with side quests speechwriting for Michael Bloomberg, running the surrogate remarks operation on the Biden-Harris campaign, and co-founding Mayday, which is now one of the leading information providers on how to access reproductive health care in states with bans. Sam has published in the New York Times, Washington Post, Boston Globe, Time Magazine, and other outlets — and occasionally volunteers on a fire speech for a good cause. He has a BA in Government from Harvard, where he was named a John Harvard Scholar and wrote op-eds like “Shut Down Harvard Football,” which he tells us were great for his social life. Sam is based in New York.

Editor

Jim Impoco is the award-winning former editor-in-chief of Newsweek who returned the publication to print in 2014. Before that, he was executive editor at Thomson Reuters Digital, Sunday Business Editor at The New York Times, and Assistant Managing Editor at Fortune. Jim, who started his journalism career as a Tokyo-based reporter for The Associated Press and U.S. News & World Report, has a Master’s in Chinese and Japanese History from the University of California at Berkeley.

Hunterbrook Media publishes investigative and global reporting — with no ads or paywalls. When articles do not include Material Non-Public Information (MNPI), or “insider info,” they may be provided to our affiliate Hunterbrook Capital, an investment firm which may take financial positions based on our reporting. Subscribe here. Learn more here.

Please contact ideas@hntrbrk.com to share ideas, talent@hntrbrk.com for work opportunities, and press@hntrbrk.com for media inquiries.

LEGAL DISCLAIMER

© 2026 by Hunterbrook Media LLC. When using this website, you acknowledge and accept that such usage is solely at your own discretion and risk. Hunterbrook Media LLC, along with any associated entities, shall not be held responsible for any direct or indirect damages resulting from the use of information provided in any Hunterbrook publications. It is crucial for you to conduct your own research and seek advice from qualified financial, legal, and tax professionals before making any investment decisions based on information obtained from Hunterbrook Media LLC. The content provided by Hunterbrook Media LLC does not constitute an offer to sell, nor a solicitation of an offer to purchase any securities. Furthermore, no securities shall be offered or sold in any jurisdiction where such activities would be contrary to the local securities laws.

Hunterbrook Media LLC is not a registered investment advisor in the United States or any other jurisdiction. We strive to ensure the accuracy and reliability of the information provided, drawing on sources believed to be trustworthy. Nevertheless, this information is provided "as is" without any guarantee of accuracy, timeliness, completeness, or usefulness for any particular purpose. Hunterbrook Media LLC does not guarantee the results obtained from the use of this information. All information presented are opinions based on our analyses and are subject to change without notice, and there is no commitment from Hunterbrook Media LLC to revise or update any information or opinions contained in any report or publication contained on this website. The above content, including all information and opinions presented, is intended solely for educational and information purposes only. Hunterbrook Media LLC authorizes the redistribution of these materials, in whole or in part, provided that such redistribution is for non-commercial, informational purposes only. Redistribution must include this notice and must not alter the materials. Any commercial use, alteration, or other forms of misuse of these materials are strictly prohibited without the express written approval of Hunterbrook Media LLC. Unauthorized use, alteration, or misuse of these materials may result in legal action to enforce our rights, including but not limited to seeking injunctive relief, damages, and any other remedies available under the law.