Based on Hunterbrook Media’s reporting, Hunterbrook Capital is short $USAP at the time of publication. Positions may change at any time. See full disclosures below.

Ryan Smith hasn’t flown since leaving his job at Universal Stainless, the Pennsylvania-based speciality steelmaker whose product, as its former CEO once put it, is part of “every Boeing airplane.”

Over what Smith said were three stints at Universal Stainless starting around 2014 — in roles ranging from machine operator to maintenance supervisor — he encountered outdated equipment “from the ’50s,” a fire drill mentality when major customers visited, and quality control subject to “pressure from management.”

Now, Smith, who lives in western New York, said he would drive his kids to Disney World rather than fly. “The fact that their stuff was going on the plane” would “absolutely” be a concern, he said.

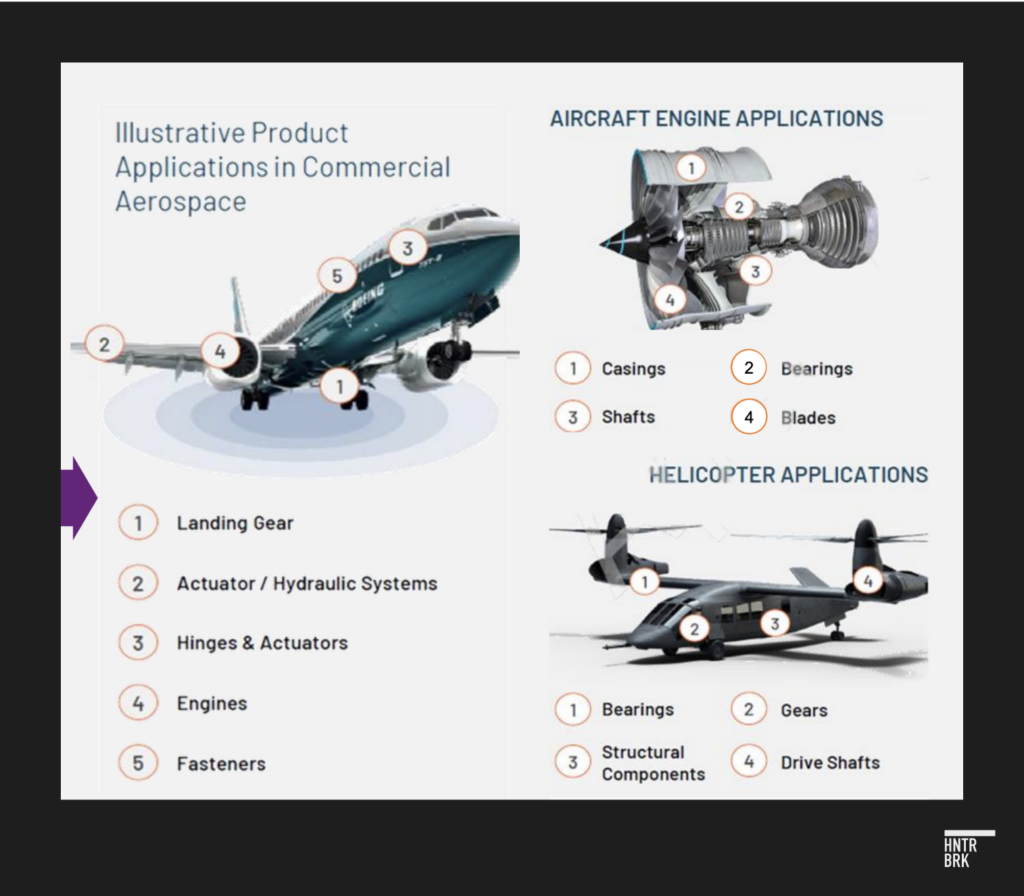

The specialty steel alloys produced by Universal Stainless are used in structural parts and engines in aircrafts by customers like Boeing and the U.S. military.

Another former Universal Stainless employee, a manager who spoke to Hunterbrook anonymously out of fear of retribution, also pointed to a noxious, high-stress corporate culture that prioritized production over quality and safety. He said he “saw two lab managers go out in ambulances because they thought they were having a heart attack.”

“My wife actually took out a life insurance policy on me while I worked there,” he said, describing a culture of “finger-pointing” and intense “pressure to get things done quickly.”

He also said Universal’s workers are told they “can lie to the customers” and deal with the “fallout later.”

A Hunterbrook review of open source intelligence and court records shows that the manager’s and Smith’s concerns about shoddy quality control and a misguided culture are widely shared. At least five lawsuits in the last four years by former employees describe discrimination, unsafe working conditions, and retaliatory practices. It also received far more violations from the Occupational Safety and Health Administration (OSHA) per employee compared to its competitors.

The allegations Hunterbrook found in the lawsuits and in interviews are echoed by numerous online reviews. Employees describe the company as “a sinking ship” where product quality and worker safety are routinely compromised. One recent review stated, “It’s a job where you may risk an injury or your life and the company wouldn’t bat an eye!”

And the consequences of this culture may now prove to have been deadly — according to a recently revealed internal U.S. Air Force Safety Investigation Board report.

The report — obtained and reported on by Military.com — places Universal Stainless at the center of persistent problems with the military’s V-22 Osprey, including a deadly Osprey aircraft crash off Japan last November that claimed the lives of eight U.S. airmen.

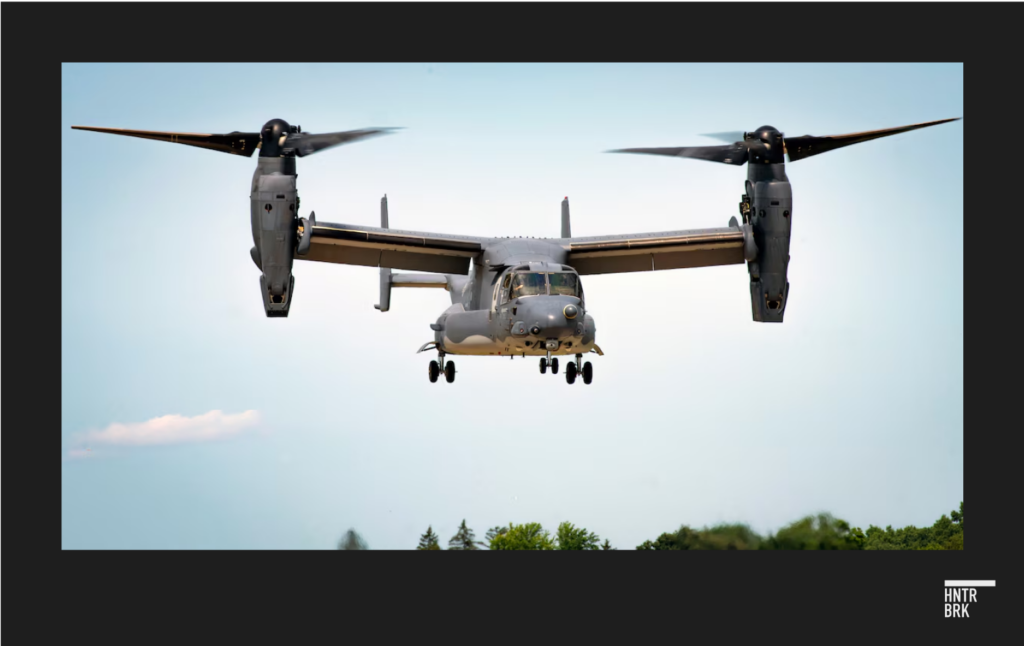

The V-22 Osprey is a tilt-rotor aircraft — designed to take off and land like a helicopter but fly as fast as an airplane — developed by Bell Textron Inc., a subsidiary of Textron Inc. (NYSE: $TXT), and The Boeing Co. (NYSE: $BA). Variants of the aircraft serve in the U.S. Navy, Marine Corps, and Air Force. They’re used primarily for special operations, but specially outfitted ones are also used for carrying high-profile government officials. In August, Vice President Kamala Harris arrived at the Democratic National Convention aboard an Osprey.

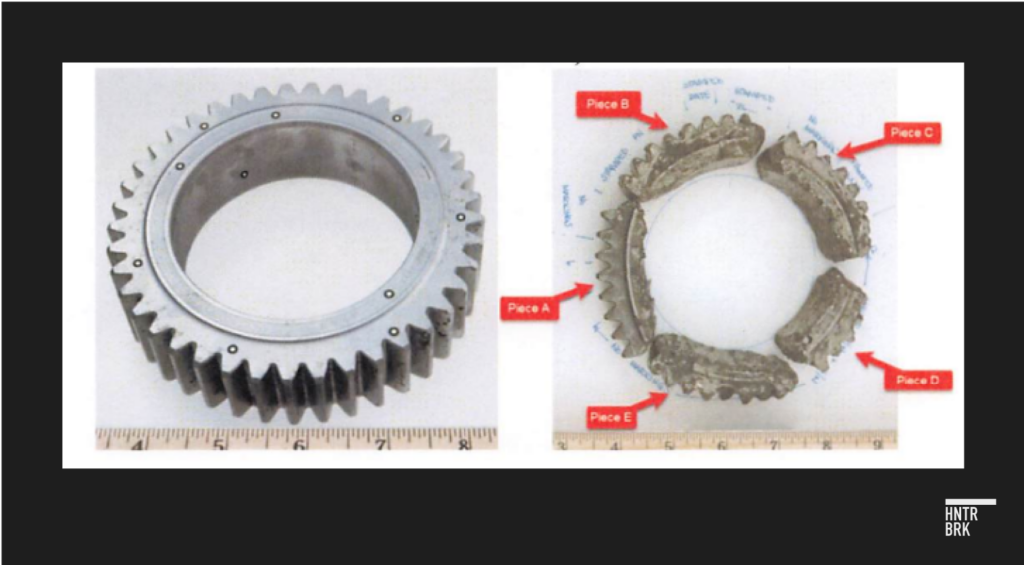

A public Air Force report released in early August and widely reported in major news outlets had identified the root causes of the November crash as a catastrophic failure in the aircraft’s gearbox, as well as the crew’s decision not to land sooner after warnings of initial failure. This conclusion has sparked criticism from pilots, family members, and legal representatives of the deceased, who argue that it unfairly shifts focus away from the underlying technical problems plaguing the Osprey fleet, which has had a controversial past.

Over 50 U.S. service members have died in Osprey crashes throughout the program’s lifespan, with 20 fatalities occurring in just four crashes over a 20-month period — earning the Osprey the nickname “the widow-maker.”

After the crash in Japan, in December 2023, the U.S. House of Representatives Committee on Oversight and Accountability launched a bipartisan inquiry, requesting extensive documentation on the Osprey’s safety history. Just three months later, the Air Force lifted the ban on Ospreys that it had placed after the Japan crash, after revising training manuals and maintenance procedures, according to DefenseNews. Members of Congress in July accused the Department of Defense of hindering their investigation and threatened to subpoena the DOD over a failure to provide additional information in a timely manner.

The internal report — which the Air Force did not release to the public but was leaked in August — links the gear failure to a defect in the alloy supplied by Universal Stainless.

It also identified a pattern of failures in Ospreys dating back to 2013, with at least seven previous incidents involving similar gearboxes, according to military.com, and “‘a significant proportion of the alloys used’” in the gearboxes were made by Universal Stainless. Five of these failures were attributed to “‘non-metallic inclusions,’” which are impurities in the alloy that weaken the metal. Luckily, in all prior instances, the aircraft landed before the gear failed completely.

The internal report said that, after receiving a risk assessment in 2014 from Bell and Boeing that flagged the impurities in the gear metal, the Naval Air Systems Command “implemented contractual financial withholds’” so that Universal Stainless would “‘correct deficiencies’” in the alloy, according to military.com. But failures continued, “‘suggesting contractual financial withholds did not prompt corrective actions’” from Universal Stainless.

There appear to be some varying views on whether the defects were unique to Universal’s products. Senior editors of Aviation Week Network, who also received the internal Air Force investigation report, said in a podcast that “the raw material supplier for the pinion gear that ultimately shattered and failed in this case used a process that creates a higher incidence of this nonmetallic inclusions.”

By contrast, they claimed, “other suppliers that supply the same type of material use a totally different process where the rate of that incidence of this inclusion — nonmetallic inclusion — is much less.”

However, The Air Current — another news outlet that extensively reported on the causes of the Osprey crash — called inclusions an “insidious problem that has not been fully solved in either military or civil aviation,” adding that Bell has tapped several alloy producers over the years, but inclusions were found in products from multiple manufacturers.

But that may be little consolation to those who lost their loved ones to the crash caused by flaws in Universal’s products. “Certainly, the aircraft was in a defective condition,” Tim Loranger, an attorney for two of the families of airmen lost in the Japan crash, told Hunterbrook Media. “It was not manufactured, I think, the way that even the military could legally accept it because those parts were supposed to be made to, like I said, certain specifications with certain alloys that can withstand the kind of use and pressure and all of that, and not fall apart.”

Loranger said his firm is contemplating a lawsuit against the Osprey manufacturers, adding that there are “difficulties with a case like this because the aircraft crashed into the ocean,” which could introduce more complex legal issues regarding jurisdiction and who has standing to file a lawsuit, as well as what types of damages can be claimed.

But if there is a lawsuit, Universal Stainless could be named, he said. “Whether they start out in the lawsuit at the beginning or come in later on, that’s yet to be determined.”

The revelations of its role in the deadly crash come as Aperam (AS:APAM), a European steel company with close ties to global giant ArcelorMittal (NYSE:$MT), is set to acquire Universal Stainless for $45 per share in cash — a 19% premium to the average stock price in the last three months. Universal’s share price is at its highest since 2012, having more than doubled this year amid unprecedented growth in margins since 2023, which the company has credited to the expansion of its aerospace business.

On a conference call explaining the acquisition, an Aperam executive justified buying Universal at peak share price by highlighting Universal’s aerospace business, saying that business is “very healthy in terms of growth.”

“We are convinced this is a solid business so the results are there to stay.”

Competitors have performed well, too, in recent years, buoyed by a strong recovery in demand from the aerospace sector following the COVID-19 pandemic. But none has reported margin growth like those at Universal, even as it cycled through three auditors in the last year and disclosed material weaknesses in internal controls.

Universal reported in February it expects continued robust demand from aerospace, including from Boeing and the U.S. defense sector.

But the company may be hard-pressed to keep these relationships, especially in light of a beleaguered Boeing’s promises to recommit to safety after the January incident in which a door plug on a 737-9 Max blew out in midair.

In a statement to Hunterbrook Media, a spokesperson from Air Force Special Operations Command (AFSOC) confirmed that AFSOC was “not able to make any comments about the Safety Investigation Board” due to the nonpublic nature of the report, but that “AFSOC conducted a comprehensive review of the CV-22 enterprise” and that they are working closely with various stakeholders to “ensure AFSOC is properly organized, trained and equipped to conduct safe and affordable CV-22 operations.”

Customers and Employees Describe Major Project Defects and Poor Quality Control

Quality control issues at Universal Stainless did not start with fatally flawed Osprey parts.

In 2001, Teledyne Technologies Inc. (NYSE: $TDY) sued Universal Stainless, accusing the company of producing defective steel that caused multiple crankshaft failures in general aviation aircraft engines.

The failures had already led the Federal Aviation Administration in April and November 2000 to issue emergency airworthiness directives ordering owners of affected engines to remove a sample of the crankshaft and send it to Teledyne for analysis.

In the lawsuit, Teledyne alleged that over 90% of the crankshafts made from this steel were found to be defective. “Universal knew that this steel was to be used for aircraft engines and other aircraft parts,” the company wrote. Teledyne accused Universal Stainless of not having in place “quality assurance practices and procedures described in its manual” and of “not conducting internal audits.”

Asked about the case, Walter DeForest, the attorney that represented Teledyne, said over email, “The matter was amicably resolved during the trial” — likely an indication that Universal Stainless was forced to settle.

In 2014, Rolls-Royce Holdings PLC (LON:RR), a major customer, and one of the world’s largest aerospace and defense companies, discovered in 2014 a large air pocket in the center of a steel bar that Universal Stainless had produced, according to Ryan Smith, the former employee who says he no longer flies on planes.

“We got this bar back and the ends were great, but the middle of the bar had this massive air pocket in it,” Smith recalls. “I don’t understand how you miss that.” He added that somehow the bar had been passed through about “10 departments.”

Smith said that during his time at Universal Stainless, meetings about defects typically occurred only after a customer discovered a problem, rather than through internal quality control processes.

One reason for the quality issues, Smith said, was outmoded equipment. While the company’s North Jackson, Ohio, plant is “state-of-the-art” and “sophisticated,” as he put it, the steel made there is ultimately “refined by an outdated facility” in Dunkirk, New York.

There, he said, some equipment dates back to the 1950s or even earlier: “Some of these machines were present during the World War era,” he said. “You can’t even get parts for this stuff. It’s so old.”

This antiquated infrastructure created significant challenges for maintenance and quality control, he said.

On a recent visit to the Universal Stainless mill in Bridgeville, PA, a Hunterbrook reporter found a rundown collection of structures, rusting in a valley just south of the nation’s steel capital, Pittsburgh. The mill was a hive of activity on a Sunday afternoon.

Outside of Universal’s newer North Jackson, Ohio mill, a lonely “Now Hiring” banner flapped in the wind adjacent to the main entrance. The mill was also clearly operating on a Sunday, with employees present and heavy machinery active.

Another reason for Universal’s quality issues may be what employees describe as a culture that emphasizes production numbers at all costs. “That’s the worst corporate culture I’ve ever worked in in my life,” said the former manager Hunterbrook spoke with who wished to remain anonymous. “It was straight down from the CEO and chief commercial officer, who is now the CEO.”

“They would come up with shipping reports or shipping estimates at the beginning of the month. And there’d be a lot of pressure on operations … to hit these numbers. And then at the end of the month, it’s like, all hell breaks loose when you’re not hitting them,” he said, adding that managers would often cite a fear of missing an “earnings report” in order to convince them to move faster.

“I have no evidence for this,” he said, “but it would not surprise me if corners are cut at the end of the month and quarter because the last step before shipping is lab approval.”

That sentiment — the company’s emphasis on production over quality — is also reflected in employee reviews on job-hunting sites Indeed and Glassdoor. An employee at North Jackson — which appears to house Universal’s advanced equipment used for making aerospace-grade steel, including for the Osprey gearbox — wrote, “Your [sic] constantly being watched on camera. All the company cares about is producing numbers.”

“STOP focusing on numbers and take care of your employees and put money back into the equipment,” he offered as advice to management.

Other comments included: “The environment is very pass the buck and no accountability”; “The company is not serious about quality. There was no quality department”; and “Upper management only cares about 1 thing and that’s production numbers.”

Several reviews also mention the obsolete equipment being used at the facilities.

Former and current employees described the equipment as “raggedy,” “very very outdated,” “in considerable disrepair,” and “very old.”

One former quality inspector at the North Jackson facility said, “Almost everything in this place is falling apart” — in contrast to Smith’s description of the plant as “state of the art.” A former maintenance technician, meanwhile, claimed: “Nothing is repaired correctly because they just want to keep everything running, therefore most repairs are ‘band-aided.’”

The overall rating of 2.3 stars by 66 reviewers on Glassdoor puts Universal Stainless 32% below average for employers in the manufacturing industry. Its rating was also significantly lower than other comparable publicly-listed companies that produce aerospace metals, none of which had a score below 3.4 on Glassdoor.

On Indeed, Universal Stainless facilities received a similar overall score of 2.2 stars from 100 reviewers, but its facility in North Jackson had the lowest rating, at just 1.3.

Even then, the company management might be inflating the ratings, accused one employee at North Jackson:

“Looks like management has been on here putting up 5 star reviews to offset all the true reviews!!”

Court records reveal a culture of negligence and discrimination

“‘Lazy stupid bitch.’”

“‘Incompetent dumb bitch.’”

These were insults hurled by colleagues at Melissa Sparks, an electrician who worked at Universal Stainless, according to her Title VII case filed in 2020 against Universal Stainless. She alleged that she was subjected to a barrage of verbal abuse, regularly called derogatory names, and “told that ‘a woman’s place is in the home’ instead of working as an electrician.”

She also claimed retaliation, alleging that when she reported these issues to managers and the human resources department, she was told to ““keep your head down and your mouth shut.’” This advice allegedly came from an HR representative who told Sparks not to use the word “hostile” when describing her work environment.

A string of lawsuits filed against the company from 2018 to 2024 by former employees paint a similar picture: a workplace culture of discrimination, poor safety standards, and harassment.

Russell Lynch filed an Age Discrimination in Employment Act lawsuit against Universal Stainless, alleging he was denied promotion due to his age.

Erwin Ward, who worked as a head shearman at the Bridgeville plant, filed a lawsuit earlier this year alleging racial discrimination, retaliation, and multiple violations of state and federal workplace safety laws . Ward alleged that African American employees were routinely forced to perform dangerous tasks alone that typically required two or more people to complete safely. His repeated requests for assistance were ignored by supervisors.

After he filed a complaint with OSHA in August 2022, Ward said the company retaliated, harassing him even more while piling on work and requiring overtime. This retaliation culminated in his termination, allegedly for insubordination, though Ward maintained it resulted from his safety and discrimination complaints.

Stefan Cooper, another African American employee who worked as a millwright and welder, told a similar story of discrimination and retaliation. Cooper alleged he was subjected to “hyper scrutiny” and treated differently than his white colleagues, given less favorable work schedules than they were, and harassed by a supervisor. When Cooper complained to HR and the union about this treatment and filed a discrimination charge, he claimed he faced further retaliation, including being written up for false infractions and denied opportunities for advancement.

Employee reviews online similarly depict a work culture at Universal Stainless of discrimination, harassment, and disregard for safety. One review said the most stressful part of the job was “putting up with racism from the co workers.” Another wrote, “I’ve never worked in such a run down, degrading to women, terrible managed place in my life and I’m a male.” “Very hostile working environment if you are not a white male!” wrote a third.

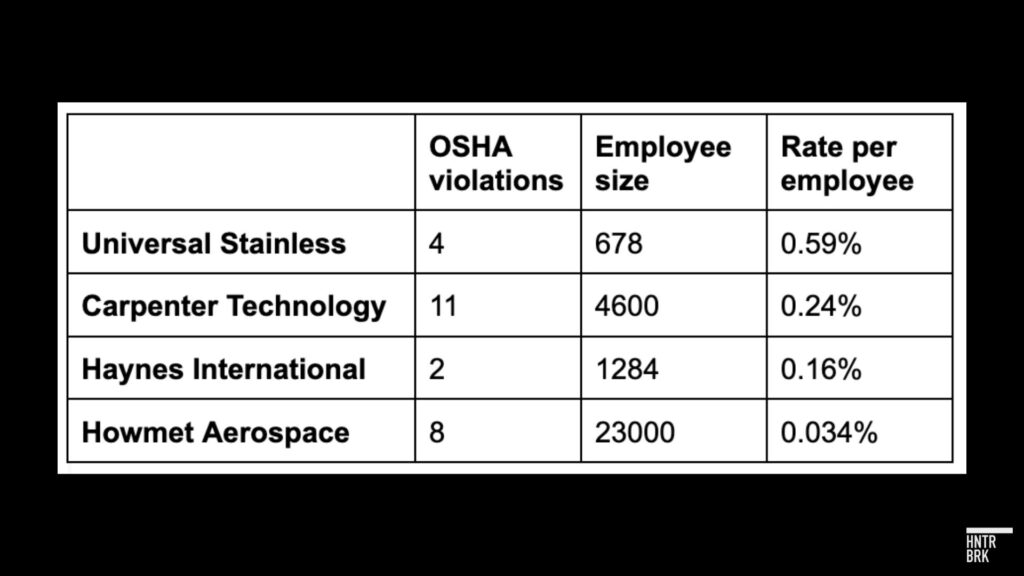

In the last ten years, Universal Stainless has received more OSHA violations per employee than its top three competitors combined, according to data compiled by Hunterbrook from a database maintained by Good Jobs First, a national policy resource center that promotes corporate and government accountability in economic development.

Financial Red Flags: Unprecedented Margins Amid Auditor Turnover and Material Weaknesses

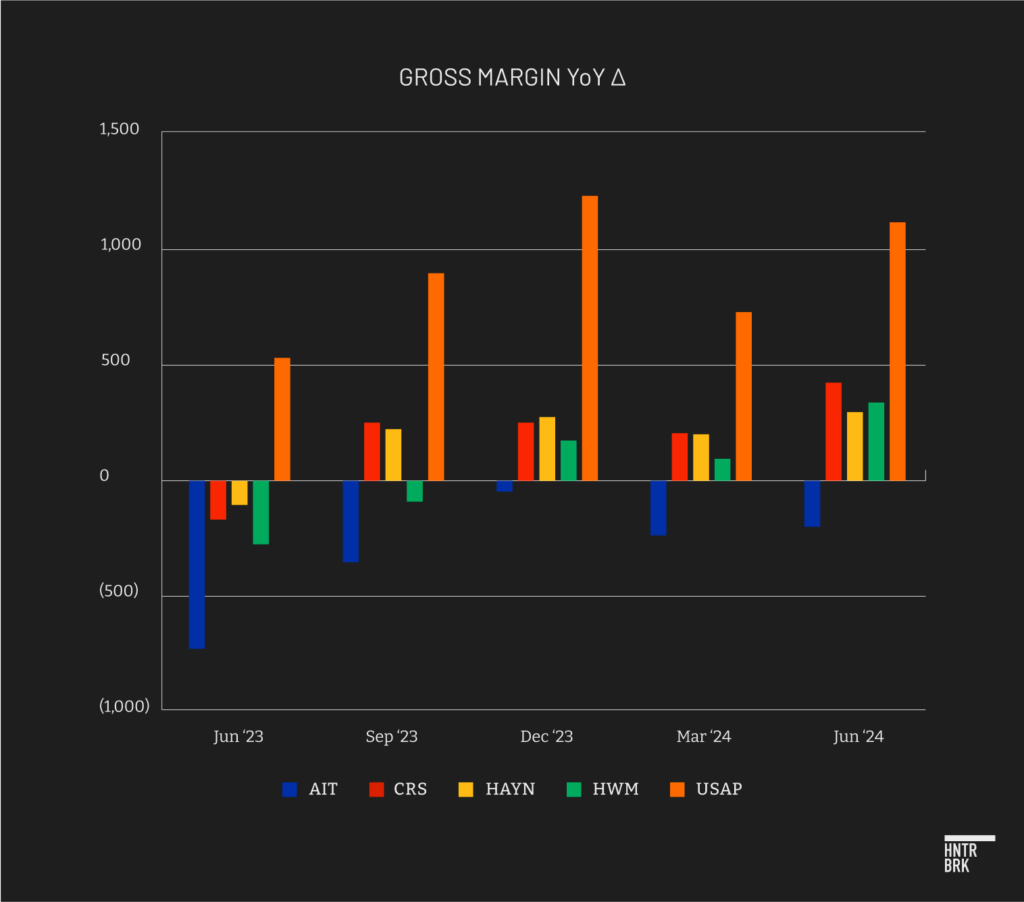

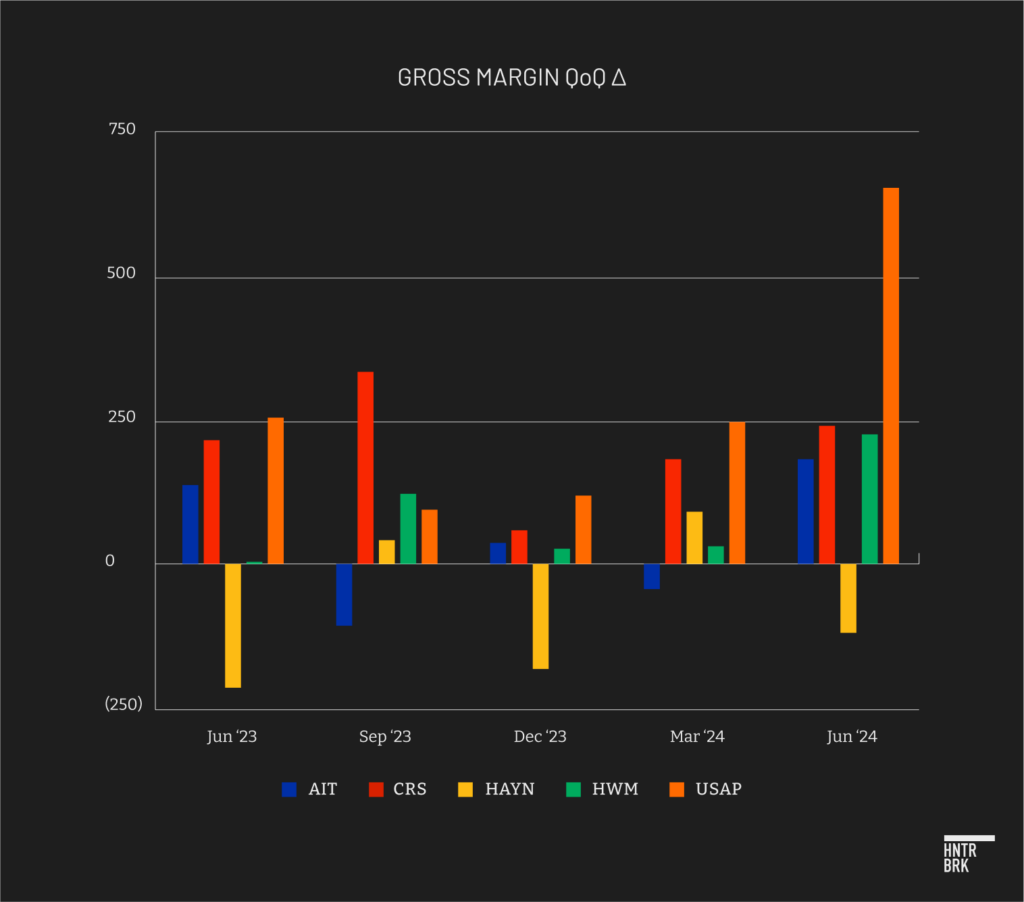

On the surface, 2023 was a banner year for Universal Stainless, which logged an unprecedented 41% increase in revenue and gross margin of 14.5% of net sales — more than doubling from 7% in 2022. The company has since continued to claim record-breaking results, with second quarter 2024 revenue increasing 19.9% year-over-year, and gross margin increasing to 25.4%.

The explosive margin growth reported by Universal Stainless stands out among its peers in the aerospace metals industry.

Universal’s revenues, as with others in the industry, have been growing along with the recovery in the demand from aerospace since COVID-19, but an unusually high percentage — about 74% — of its new sales were turned into profit on a year-over-year basis. On a quarter-on-quarter basis, the increase in gross profit was at about 124% of the revenue increase, meaning that profit grew in excess of additional sales.

Universal attributed the gross margin improvement to “cost improvement initiatives, higher base prices, and higher mix of aerospace market sales.” It described its premium products — alloys for aerospace applications — as having “higher margins than our other products,” and attributed cost reduction to recent capital investments to expand premium alloy production capacity.

But a closer look at Universal’s financial statement casts doubt on at least one piece of that explanation, showing premium products were in fact responsible for only 25% of revenue growth; the rest of the growth came from the non-premium “specialty products.” The company did not offer any details about cost improvements to speciality steel production lines.

The company’s recent financial reporting history also raises questions about the glossy numbers Universal has been putting up lately.

In 2023, Universal Stainless cycled through three different auditors — an exceptionally rare event for a publicly traded company. Russell 3000 members — including Universal Stainless — have a median audit tenure of 12 years. This puts the probability of two turnovers in one year at 0.69%. Auditor tenure for SEC registrants was generally 7 to 9 years as of 2013, according to a 2018 study. At an average of seven years, the likelihood of three turnover in one year is (1/7)(1/7) = 2.04% ((1/7)(1/7) and nine years puts the figure at 1.23%. So, less than 97% likelihood of this occurring is a safe assumption. Another study linked higher likelihood of finding fraud with new/fresh-look auditors.

The auditor carousel began when Schneider Downs resigned after the filing of the company’s SEC form 10-Q for the second quarter of 2023. Universal stated in an SEC disclosure that “The resignation was solely due to a practice management decision made by SD and was through no fault of the Company.”

Baker Tilly filled in, only to resign four months later, just one day after Universal Stainless filed its third-quarter 10-Q with the SEC. Neither Universal nor Baker Tilly disclosed any reason for its resignation.

Currently, EisnerAmper is the company’s auditor. It assumed the role on December 14, 2023, but the transition has not been smooth. Universal Stainless filed its annual report to the SEC late, and revealed a series of material weaknesses, including “ineffective internal controls over certain business process cycles,” inadequate documentation of management review controls, insufficient monitoring of internal controls, and ineffective “information technology general controls.”

Despite these issues, the auditor affirmed in the late report that “the financial statements present fairly, in all material respects, the consolidated financial position of the Company as of December 31, 2023.”

Universal’s proxy statement — filed in connection with its annual shareholder meeting less than two weeks after the late annual report — revealed it paid its auditors nearly $1.2 million in 2023, or 2.4 times more than the previous year.

None of the auditing firms answered Hunterbrook’s questions, citing company policies not to comment on their clients.

Universal reported in the second-quarter filing this year that it was taking steps laid out in its 2023 annual statement to remedy the internal control deficiencies. However, “material weaknesses are not considered remediated until the new controls have been operational for a period of time, are tested, and management concludes that these controls are operating effectively,” the company added.

Another oddity about the company’s public financial statements is the unusually low cash balance — $1,000 or less — as of the end of July. Only about five out of more than 1,400 companies on the Nasdaq have cash levels this low, according to an analysis of screening data from FactSet, a financial data compiler.

At first glance, the low cash balance might seem like a smart way to handle cash and debt, as the company did use some funds to pay off part of its credit line. But it still has $36.9 million in unpaid bills and $47.5 million in total short-term debts.

Taken together, this unusual combination of events — the unprecedented gross margin growth, ongoing material weakness in internal controls, multiple auditor turnover, and minimal cash balance — suggest the company may face difficulty sustaining its claimed recent success, according to Nick Gibbons, a Hunterbrook Media advisor, who is a certified fraud examiner and teaches accounting at NYU.

The company’s recent history also suggests it may do whatever it takes to hoist its numbers. In 2020, the company received $10 million in a Paycheck Protection Program loan from the U.S. government intended to help small businesses struggling to survive during the coronavirus crisis. After receiving full forgiveness for the loan, Universal Stainless recorded $7.9 million in net income in the third quarter of 2021, compared to a net loss of $2.5 million in the previous quarter, and a net loss of $7 million in the third quarter of the prior year.

Congress’ Select Subcommittee on the Coronavirus Crisis tried to reason with Universal Stainless to return the money. In a May 2022 letter to the CEO, the members of the subcommittee wrote: “Returning these funds will allow truly small businesses — which do not have access to alternative sources of capital— to obtain the emergency loans they need to avoid layoffs, stay in business, and weather the economic disruption caused by the coronavirus crisis.”

Congressional pressure and a public outcry led other large companies to eventually return the PPP money, but Universal Stainless — along with just three other large corporations shamed by Congress — did not.

Sustained Growth Hinges on Aerospace Sales as Boeing’s Safety Record Receives Scrutiny

Despite its role in the fatal Osprey accident, Universal Stainless appears optimistic about its relationship with the aircraft’s manufacturer, Boeing.

“Boeing’s message to the supply chain: keep your foot on the gas and keep to the master schedule production plan,” a Universal Stainless executive said in an earnings call in May. He added reassuringly that Boeing is intent on ensuring supplier stability in preparation for planned increases in build rates for 2025 and 2026.

Universal Stainless has long been a key supplier for Boeing. Then-CEO Dennis Oates stated in 2022, “Every Boeing airplane has some Universal material on it.”

The importance of the partnership for Universal Stainless was made clear in 2008 when a Boeing machinist strike sent the steelmaker’s stock price to a two-year low.

And Universal’s relationship with Boeing has been crucial for its recent growth.

The aerospace industry accounted for more than 75% of revenue in 2023, up from 68% the previous year. Nearly a third of net sales were from its largest customer, possibly Boeing, up from 21% in 2022 and 19% in 2021.

Boeing employees have been on strike again since mid-September, plunging the company’s credit rating “close to junk status” and leading its “defense arm” to lose money, according to a report by Reuters. And Boeing’s ability to support its suppliers is fading, the report said, citing multiple suppliers that recently had to trim payroll.

In the aftermath of the door-plug incident, Boeing has also been forced to prioritize safety over production. Regulators capped Boeing’s production after the incident, upending the company’s plans to ramp up capacity. Boeing announced in May it had developed plans to reduce “incoming defects from suppliers,” including through “measures ranging from increased monitoring to canceling work.”

Now, it plans to cut 17,000 jobs as the strike continues, according to another Reuters report this month.

Boeing is not unfamiliar with the dangers of nonmetallic inclusions — the defects identified in alloys made by Universal Stainless for the Ospreys. In 2016, American Airlines Flight 383, a Boeing 767, experienced a catastrophic disk failure in its engine during takeoff, attributed to a “dirty white spot” inclusion in the metal alloy. In that case, the failed disk was not produced by Universal Stainless.

In response to a question during a recent conference call on whether Asperam saw any risk to Universal’s heavy reliance on aerospace sales and the “poor news flow of late,” an Apseram executive explained that Universal is an upstream producer in a long supply chain and that Universal is actually “very diversified in aerospace.”

Hunterbrook reached out to Boeing to ask whether its relationship with Universal Stainless — with its history of product defects, including the Osprey crash — was conducive to its recent emphasis on safety. The company declined to comment, referring all questions to the DOD.

Neither the DOD’s joint program office that oversees the Osprey program, nor the Defense Contract Management Agency, which oversees all contracts and subcontracts for the Pentagon, replied to Hunterbrook’s requests. (The DOD did, however, tell Military.com in August that “safety investigations are highly effective because of their inward-facing, limited-use analysis and follow-up action.”)

But a defense aerospace expert who asked to be unnamed because he is still in the industry told Hunterbrook that program issues may lead to trouble with future government contracts. “One thing I think about consistently is the V-280,” the expert said, referring to the potentially $70 billion U.S. military program to develop future helicopters using Bell’s Osprey technology.

“That’s something I think about,” the expert said. “The longer these issues play out … how that might impact the DOD’s willingness or the services’ willingness to purchase these aircraft moving forward.”

Former Universal employee Ryan Smith, for one, says if he were Boeing, he would “definitely look for another steel provider for these alloys.” And until then, he claims, “the only way I’m getting on a plane is if I had no other choice. I’d prefer a boat.”

But asked whether he would overcome the aerophobia his experience at the company left him with if he were assured a plane had no parts with material from Universal Stainless, he said “absolutely.”

“If I genuinely knew there was no product that was coming from Universal Stainless, then it wouldn’t worry me as much.”

Aperam, Targeting Close of Acquisition Early Next Year, Will Need CFIUS Review

Claudio Ochoa, managing partner at Donovan Capital Group, a private credit firm that invests in aerospace and defense services businesses, told Hunterbrook the Osprey incident by itself may not be a disqualifier for an acquirer. He said the acquiring firm, after quantifying the legal and technological risks, may still go through with the investment if the other aspects of the company’s business are strong.

Other factors, however, may impact the timing of when the deal can be completed.

Aperam will likely need to navigate a review by the Committee on Foreign Investment in the United States, or CFIUS — the same process that has held up plans by Nippon Steel Corp., Japan’s largest steelmaker, to acquire U.S. Steel for $14.9 billion. The CFIUS is an interagency committee tasked with assessing the national security implications of foreign investments in U.S. companies. Congressional members from both sides of the aisle have raised concerns about foreign ownership of strategic national assets like U.S. Steel.

While Aperam’s deal is much smaller — Universal Stainless is less than 10% the size of U.S. Steel — Aperam has close ties with Luxembourg-based steel giant ArcelorMittal. In addition to the Mittal family owning a significant percentage of Aperam, Aperam also shares two board members with ArcelorMittal’s leadership team: ArcelorMittal’s CEO and executive chairman.

Possibly further complicating any review of Aperam’s takeover is ArcelorMittal’s joint venture with Nippon with operations in the U.S. and India. Nippon has agreed to sell its share in its U.S. joint venture to ArcelorMittal if Nippon’s deal with U.S. Steel is cleared, which would increase ArcelorMittal’s control over critical U.S. assets and thereby potentially raise additional concerns about Aperam’s acquisition of Universal. Aditya Mittal, who is the chairman of the board of ArcelorMittal Nippon Steel India, has been a director on Aperam’s board since the company was incorporated in 2010.

“I’m sure the parties are undertaking a CFIUS review,” wrote Sarah Bauerle Danzman, a nonresident senior fellow at the Atlantic Council and international studies professor, in an email to Hunterbrook, adding that a review would “not be complete until after the November election.”

In an email response to Hunterbrook, an Aperam spokesperson said the company is unable to comment because it has signed a nondisclosure agreement with Universal Stainless — but stated “we do not expect Cifius [sic] to pose a significant hurdle for closing the transaction.” They also emphasized that ArcelorMittal and Aperam are “two separate and completely independent companies,” but acknowledged that the Mittal family is a major shareholder and that the members of the family serve on Aperam’s “leadership team and the supervisory board.”

An Aperam executive tried to play down concerns about the CFIUS review in a conference call with investors by saying that most of the aerospace end user application goes into commercial aerospace and that “Universal actually consciously does not determine into which channel and which end application it goes through.”

“These are regulatory filings which we need to do and we will look at it as and when the discussion happens. But we remain confident that compared to probably other items you’ve seen in newspapers that this should not be a big cause for concern,” the executive said.

This June, the CFIUS cleared Aperam competitor Acerinox S.A., based in Spain, to take over U.S.-based specialty alloy company Haynes International. Aperam and Acerinox were in merger talks in 2022 before they abandoned the discussions amid EU antitrust concerns.

Authors

Blake Spendley joined Hunterbrook from the Center for Naval Analyses (CNA), where he led investigations as a Research Specialist for the Marine Corps and US Navy. He built and owns the leading open-source intelligence (OSINT) account on X/Twitter, called @OSINTTechnical (>925K followers), which now distributes Hunterbrook Media content. His OSINT research has been published in Bloomberg, the Wall Street Journal, and The Economist, among other top business outlets. He has a BA in Political Science from USC.

Jenny Ahn joined Hunterbrook after serving many years as a senior analyst in the US government. She is a seasoned geopolitical expert with a particular focus on the Asia-Pacific and has diverse overseas experience. She has an MA in International Affairs from Yale and a BS in International Relations from Stanford. Jenny is based in Virginia.

Daniel Sherwood contributed reporting. Sherwood joined Hunterbrook from The Capitol Forum, a premium subscription financial publication, where he was an Editor & Senior Correspondent, writing and managing market-moving investigative reports and building the Upstream database. Prior to The Capitol Forum, Daniel has experience conducting undercover investigations into fossil fuel companies and other research. He also served as an Honors Law Clerk in the Criminal Enforcement Division of the EPA. He has a JD from Michigan State University. Daniel is based in Michigan.

Nick Gibbons, a Hunterbrook Media advisor, also contributed reporting. His experience includes a blend of qualitative and quantitative investment roles at Two Sigma, Norges Bank Investment Management, and Citadel. He began his career in forensic accounting at independent equities research provider Gradient Analytics. He is an Adjunct Assistant Professor of Accounting at NYU Stern School of Business, a Certified Fraud Examiner (CFE), and Master Analyst in Financial Forensics (MAFF).

Michelle Cera contributed reporting. Cera is a sociologist specializing in digital ethnography and pedagogy. She is a Ph.D. Candidate in Sociology from New York University, building on her Bachelor of Arts degree with Highest Honors from the University of California, Berkeley. Currently serving as a Workshop Coordinator at NYU’s Anthropology and Sociology Departments, Michelle fosters interdisciplinary collaboration and advances innovative research methodologies.

Wendy Nardi was the fact-checker on this article. She joined Hunterbrook after working as a developmental and copy editor for academic publishers, government agencies, Fortune 500 companies, and international scholars. She has been a researcher and writer for documentary series and a regular contributor to The Boston Globe. Her other publications range from magazine features to fiction in literary journals. She has an MA in Philosophy from Columbia University and a BA in English from the University of Virginia.

Editor

Jim Impoco is the award-winning former editor-in-chief of Newsweek who returned the publication to print in 2014. Before that, he was executive editor at Thomson Reuters Digital, Sunday Business Editor at The New York Times, and Assistant Managing Editor at Fortune. Jim, who started his journalism career as a Tokyo-based reporter for The Associated Press and U.S. News & World Report, has a Master’s in Chinese and Japanese History from the University of California at Berkeley.

Hunterbrook Media publishes investigative and global reporting — with no ads or paywalls. When articles do not include Material Non-Public Information (MNPI), or “insider info,” they may be provided to our affiliate Hunterbrook Capital, an investment firm which may take financial positions based on our reporting. Subscribe here. Learn more here.

Please contact ideas@hntrbrk.com to share ideas, talent@hntrbrk.com for work opportunities, and press@hntrbrk.com for media inquiries.

LEGAL DISCLAIMER

© 2025 by Hunterbrook Media LLC. When using this website, you acknowledge and accept that such usage is solely at your own discretion and risk. Hunterbrook Media LLC, along with any associated entities, shall not be held responsible for any direct or indirect damages resulting from the use of information provided in any Hunterbrook publications. It is crucial for you to conduct your own research and seek advice from qualified financial, legal, and tax professionals before making any investment decisions based on information obtained from Hunterbrook Media LLC. The content provided by Hunterbrook Media LLC does not constitute an offer to sell, nor a solicitation of an offer to purchase any securities. Furthermore, no securities shall be offered or sold in any jurisdiction where such activities would be contrary to the local securities laws.

Hunterbrook Media LLC is not a registered investment advisor in the United States or any other jurisdiction. We strive to ensure the accuracy and reliability of the information provided, drawing on sources believed to be trustworthy. Nevertheless, this information is provided "as is" without any guarantee of accuracy, timeliness, completeness, or usefulness for any particular purpose. Hunterbrook Media LLC does not guarantee the results obtained from the use of this information. All information presented are opinions based on our analyses and are subject to change without notice, and there is no commitment from Hunterbrook Media LLC to revise or update any information or opinions contained in any report or publication contained on this website. The above content, including all information and opinions presented, is intended solely for educational and information purposes only. Hunterbrook Media LLC authorizes the redistribution of these materials, in whole or in part, provided that such redistribution is for non-commercial, informational purposes only. Redistribution must include this notice and must not alter the materials. Any commercial use, alteration, or other forms of misuse of these materials are strictly prohibited without the express written approval of Hunterbrook Media LLC. Unauthorized use, alteration, or misuse of these materials may result in legal action to enforce our rights, including but not limited to seeking injunctive relief, damages, and any other remedies available under the law.