Based on Hunterbrook Media’s reporting, Hunterbrook Capital is short $UWMC and long $RKT at the time of publication. Positions may change at any time after publication. This is not investment advice. See full disclaimer below.

Editorial Position:

Hunterbrook Media believes change starts with awareness, but doesn’t end there. Accountability requires action. Hunterbrook Media and its affiliates have taken several actions:

- Submitted data analysis and research — as well as the planned date of publication — to a national litigation firm. Hunterbrook’s nonprofit affiliate has entered an agreement with the law firm in exploration of a class action lawsuit against UWM seeking restitution for homebuyers. If you think you are paying too much on your mortgage, visit WasIRippedOff.com to learn if you might have used an independent broker who doesn’t shop.

- Shared key findings with federal regulatory agencies with direct responsibility for the mortgage sector and non-bank lenders including UWM.

- Sent letters detailing the data analysis to Attorneys General in states where brokers have a legal duty to borrowers — as well as state regulatory agencies with direct responsibility for the mortgage sector and non-bank lenders including UWM.

- Two of the authors of this article filed a whistleblower report to the S.E.C. represented by a former S.E.C. Commissioner. One, Matthew Termine, is also a party to the Hunterbrook nonprofit affiliate’s agreement with the national law firm.

Upon publication, Hunterbrook Media plans to share this article and the data with:

- Civic advocates who focus on fairness and reform in housing and mortgages;

- Shareholder litigation firms whose clients own $UWMC shares and may have claims due to UWM’s governance and performance, including paying the CEO and his family over $600 million in annual dividends despite reporting a $70 million loss in 2023 by consistently missing SPAC revenue projections; and

- The consortium of brokers already suing UWM for antitrust violations.

Hunterbrook Media is continuing to report on UWM, including the critical audit matter of UWM’s Mortgage-Servicing Rights (MSRs) and UWM’s overall Non-GAAP Adjusted EBITDA. If you have relevant publicly-available information, please email ideas@hntrbrk.com and one of our legal colleagues will review your message before potentially sharing it with our reporters.

Hunterbrook Media’s Editorial Board believes that UWM has potentially committed fraud, would likely lose business and gain-on-sale margin if brokers fulfilled their fiduciary duties, and could face material legal and regulatory consequences — from civil, state, and federal accountability. UWM’s contracts with its credit lenders; contracts with its mortgage purchasers like Fannie and Freddie; and the CEO’s ownership of an NBA team — which was reportedly collateralized by billions of dollars in $UWMC shares — may also be at risk, Hunterbrook Media believes.

Hunterbrook Media also does not view UWM’s large dividend as sustainable, particularly in light of the company’s net loss of $70 million last year, compared to the over $600 million in dividends paid to the CEO and his family each year.

Due to this editorial opinion and with compliance review, Hunterbrook Media provided the article to its investment affiliate, Hunterbrook Capital.

“We fucking took those cocksuckers down, fuck them, and we’re gonna keep fucking sticking it to them forever,” boasted Mat Ishbia, the chief executive of what had just become the largest mortgage lender in the United States, in a voicemail to Anthony Casa, a longtime ally in the industry. Casa has been known to use colorful language as well, according to court filings — claiming a rival’s wife had engaged in sexual acts with Ishbia. Casa later apologized.

“I fucking hate them with all my heart and we’re gonna keep kicking their ass every fucking day,” Ishbia continued, according to an audio file of the message that was leaked to a 5,000-member Facebook group earlier this year.

Around that time, in the winter of 2022, the National Basketball Association announced Ishbia had agreed to purchase the Phoenix Suns at a record valuation.

Twenty-nine of the league’s 30 owners voted to approve the United Wholesale Mortgage CEO’s bid. Just one abstained: Dan Gilbert of Rocket Mortgage, the company whose ass Ishbia allegedly had been celebrating kicking — according to members of the mortgage industry who confirmed the voicemail’s authenticity with Hunterbrook.

Hunterbrook also ran the voicemail through generative AI detection software, which appeared to confirm that it was not a deep fake.

The story of how UWM ascended is complicated, involving many chapters, from a housing bubble that popped the global economy to a regulatory regime that scared big banks out of the mortgage industry.

But it’s also simple. It’s the story of a lie: UWM telling homebuyers that its mortgages come from independent brokers — while turning those brokers into loyalists who send the company business regardless of price.

Hunterbrook repeatedly sought comment from UWM and senior officials over several days, including with a detailed list of questions on the findings in this report. UWM responded with a legal document known as a cease-and-desist letter, sent by an outside law firm.

Sign Up

Breaking News & Investigations.

Right to Your Inbox.

No Paywalls.

No Ads.

Beth Lundberg was stressed.

She was moving for the first time in 15 years. Her four kids were stuck at home amid pandemic shutdowns. The youngest was just 2 years old.

“I multitask a lot,” she explained, “and it goes down as one of my most overwhelming moments.”

So she did what millions of Americans do when they need help finding a mortgage: She hired an independent mortgage broker.

“I needed someone I could trust,” she said.

Lundberg said she felt she could trust Whitney Bulbrook, one of the most prolific brokers in North Carolina, whose website markets her as an “advocate” for homebuyers.

“Banks and big lenders can’t show you the big picture,” explains the narrator of a video on Bulbrook’s homepage, “but a broker compares deals from hundreds of banks and lenders of all sizes.”

It was a good pitch. But it wasn’t true.

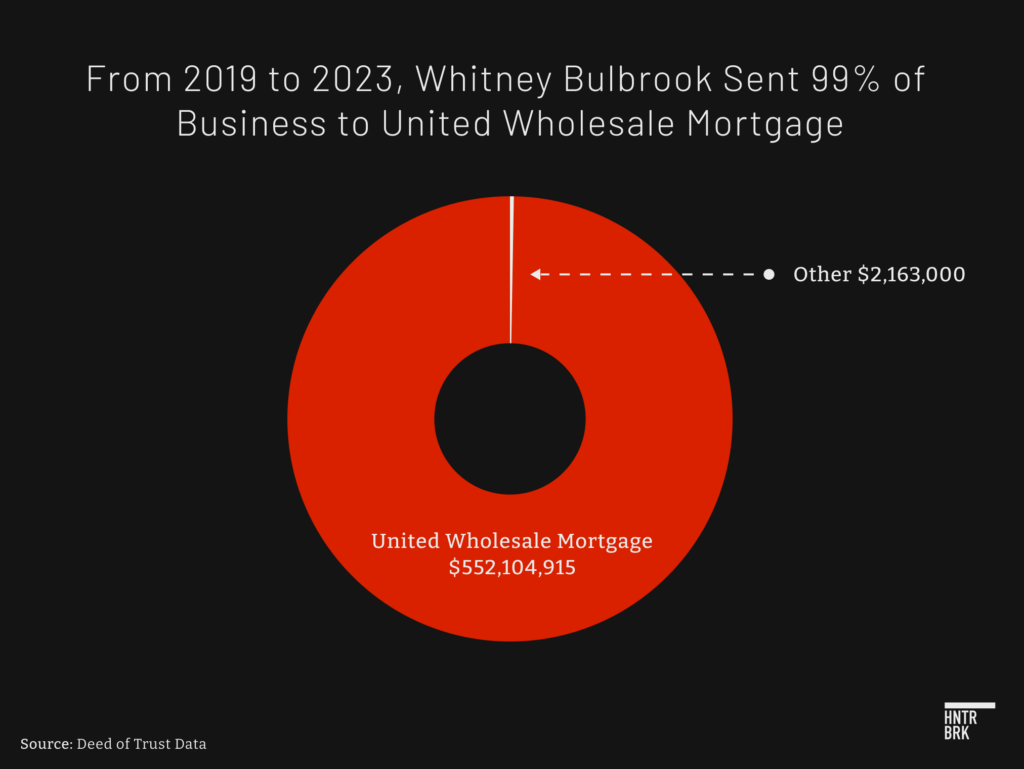

Bulbrook doesn’t appear to shop among hundreds of options to find the best deal for homebuyers. She has sent more than 99% of borrowers like Lundberg, with some $550 million in mortgages, to just one lender: UWM.

That’s not because UWM always offers the best deal. Hunterbrook estimates that on average, Bulbrook’s UWM loans charged customers more in closing costs compared to typical North Carolina loans from other independent brokers, controlling for interest rate, transaction type, loan size, and a wide variety of other factors.

See: Methodology Appendix, which reveals the process by which Hunterbrook arrived at its data analysis — and lays out potential shortcomings.

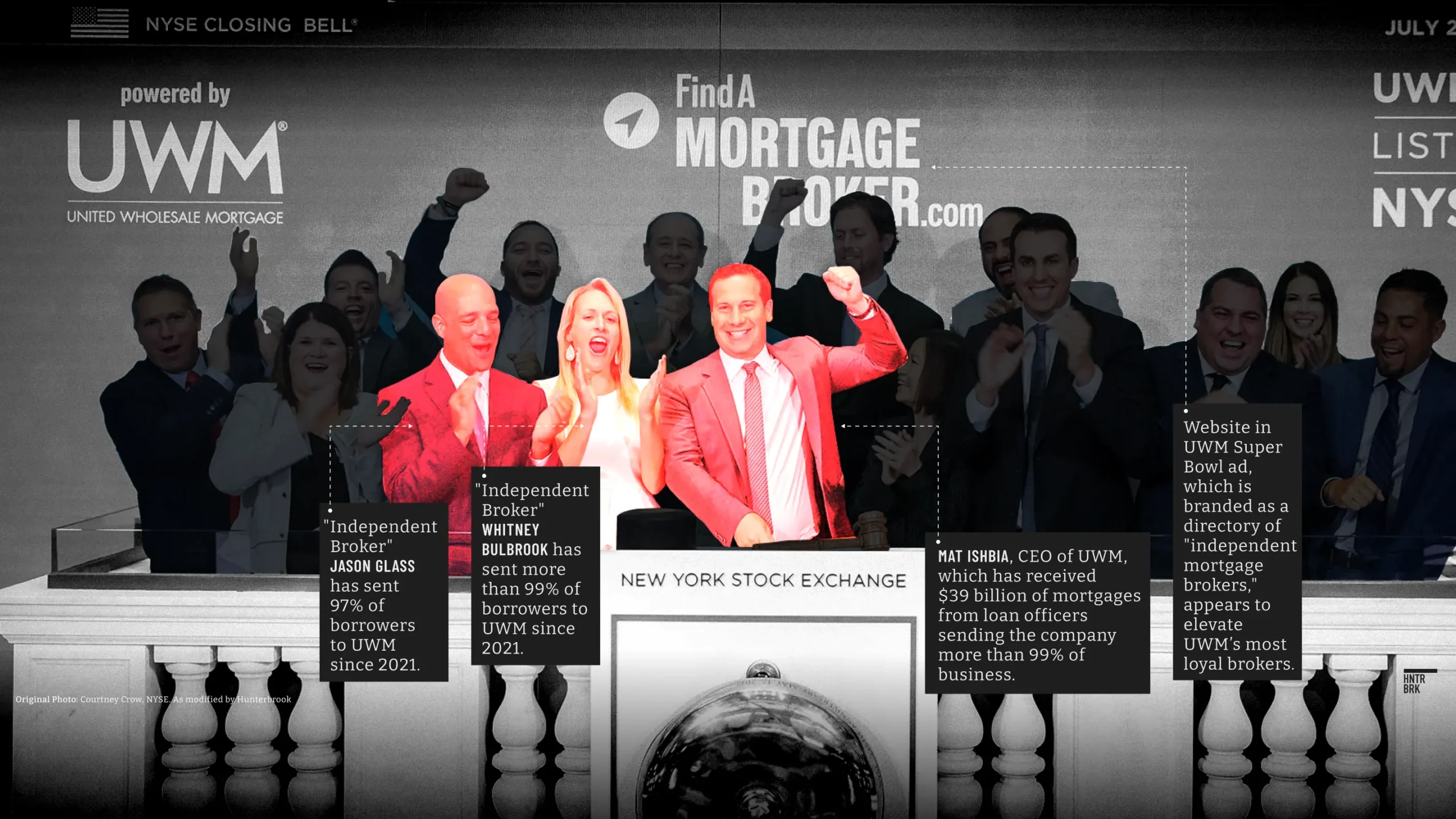

Several of Bulbrook’s clients, including a veteran who received multiple loans from her, said Bulbrook did not disclose that she sent UWM almost all her business. Nor did she disclose that UWM flew her to New York to ring the closing bell at the stock exchange with its CEO. Nor that the video on her website was originally an ad sponsored by UWM. The frame revealing UWM’s involvement in the video was omitted from the version posted to Bulbrook’s website.

Bulbrook did not respond to several emails and a phone call requesting comment.

“I was taken advantage of,” Lundberg said.

Even worse, she added, she recommended Bulbrook to friends — including Lara Moussa and Ibrahim Duqum. The couple told Hunterbrook they believed Bulbrook was “going to do the best job for us.” They ended up with a mortgage from UWM.

“Now I feel sick,” said Lundberg.

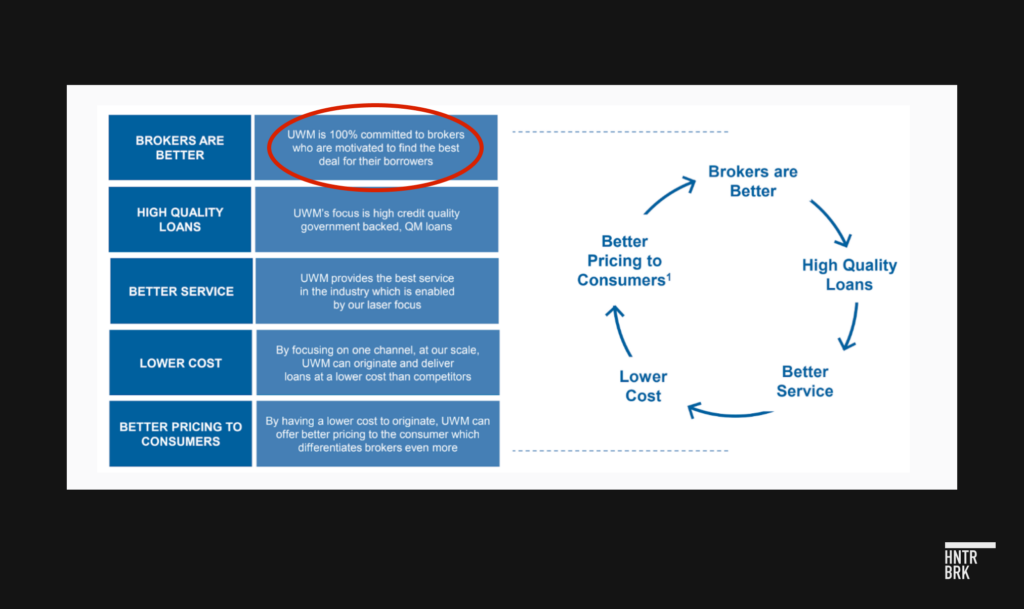

Bulbrook isn’t unique. She’s one of thousands of purportedly independent mortgage brokers who have sent virtually all their business to UWM in recent years. That has helped UWM overtake its largest competitor, Rocket, to become the largest mortgage lender in the United States.

In social media posts, SEC filings, and a Super Bowl ad, UWM tells prospective homebuyers its mortgages come from brokers who are “independent.” UWM has said these brokers have “your best interest in mind” and “shop dozens of lenders” to find “the best deal” for homebuyers. The “best deal” quote is from a Q4 2022 slide deck not posted to the “archived presentations” section of the company’s website, which was recently updated to only include a single presentation from 2024.

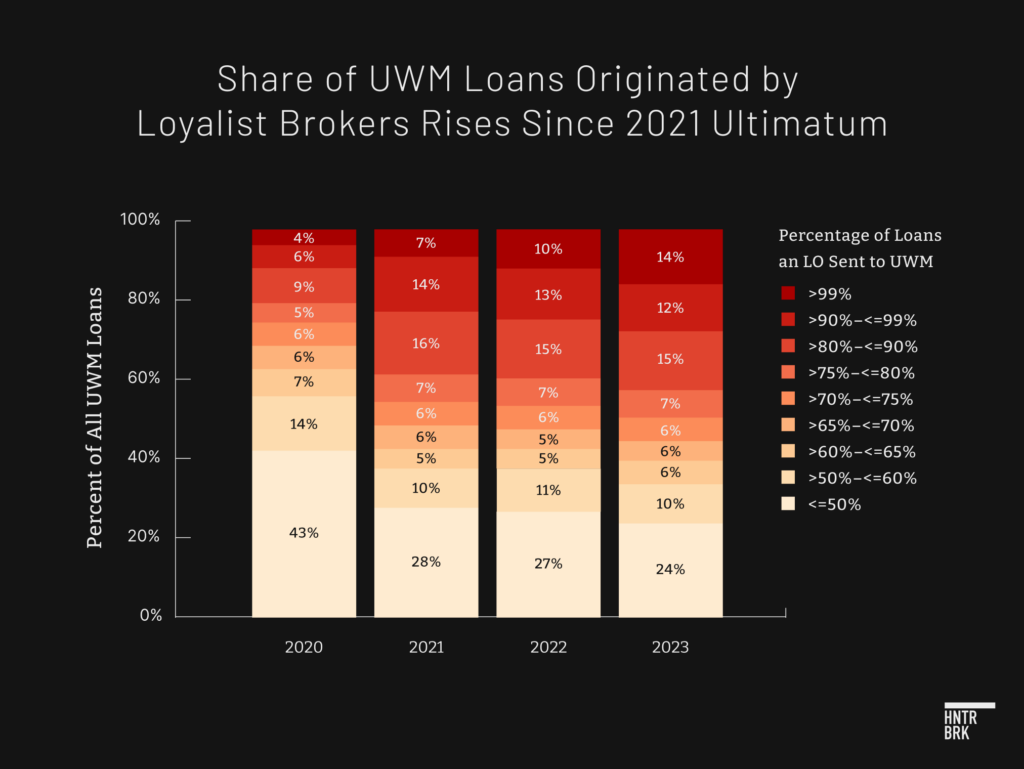

But UWM deploys an arsenal of carrots and sticks to “cultivate ‘loyalist’ brokers,” as the company put it in a presentation to investors. Their methods range from offering those who send UWM loans better placement in their Super Bowl-advertised directory to suing brokers who shop around for better deals from certain competitors.

In 2021, UWM shook up the industry by changing its contracts with brokers to explicitly bar them from doing business with what were then two of its biggest competitors, Rocket and Fairway Independent Mortgage Corporation.

Ishbia called it the “All-In” initiative. In the industry, it became known as “the ultimatum.”

Since UWM forced brokers to make that Sophie’s choice, its share of the independent mortgage broker market has jumped to 48% from 31%, according to an Inside Mortgage Finance report and a UWM security filing. UWM 2022 10-K, p. 7.

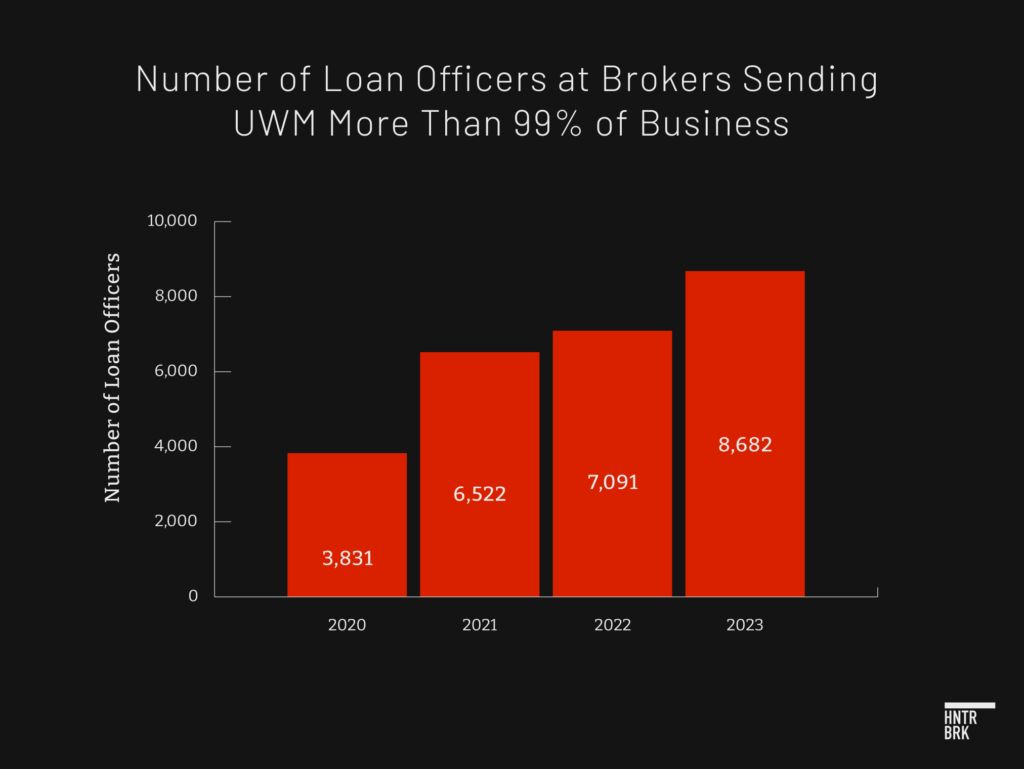

During that same time period, the number of loan officers sending 99% or more of their mortgages to UWM has doubled, according to Hunterbrook’s data analysis.

Last year, more than 8,000 loan officers at mortgage brokers — a primary local conduit for Americans seeking loans to buy houses — sent UWM more than 99% of their mortgages, worth at least $11.7 billion, according to millions of federal and state records.

Several of UWM’s biggest competitors, including LoanDepot and Stearns Lending, have closed their broker businesses in recent years, as high interest rates have lowered loan volume across the industry.

Homepoint, which had been the biggest lender using exclusively independent brokers outside of UWM and Rocket — and whose pricing typically was more affordable, according to Hunterbrook’s data analysis — shut down as well.

Fairway, one of the two targets of the ultimatum, stopped working with independent mortgage brokers entirely earlier this year. Fairway did not respond to Hunterbrook’s request for comment. Rocket declined.

UWM’s growing market share helped Ishbia, whose father founded the company in 1986, to buy the Phoenix Suns. Ishbia’s purchase was also reportedly aided by access to $4.6 billion in loans collateralized by UWM shares — which had been listed on the New York Stock Exchange in 2021 via a $16 billion Special Purpose Acquisition Company (SPAC), the largest ever SPAC listing. The Ishbia family holds 94% of the equity in $UWMC through an entity called SFS Holding Corp, according to SEC filings.

Ishbia has repeatedly defended the ultimatum, even as UWM has faced antitrust lawsuits from brokers. He has said that without Rocket or Fairway, brokers who signed the ultimatum still had over 70 other lenders from which they could choose.

Technically, that was true: Brokers were free to sign the ultimatum or not; and even if they did, they could still shop around on behalf of their clients.

But until Hunterbrook’s analysis, whether brokers who signed the ultimatum were, in fact, shopping as Ishbia indicated they could — or instead simply funneling loans to UWM — was unclear.

Sign Up

Breaking News & Investigations.

Right to Your Inbox.

No Paywalls.

No Ads.

Hunterbrook data scientists, financial reporters, and a certified fraud examiner, working with mortgage industry experts, analyzed publicly available data to determine the impact of UWM’s pressure campaign.

The analysis is based on two datasets: Home Mortgage Disclosure Act data (the “HMDA Data”), which is filed with the federal government by major mortgage lenders and includes information about the interest rates and closing costs of loans; and deed of trust data (the “Deed of Trust Data”), which is filed at the county level in connection with individual mortgage closings and includes information about what loan officers and brokers were involved.

By merging millions of loans between the two datasets based on overlapping fields, Hunterbrook was able to answer a question we had not seen tackled anywhere else: To what extent were independent mortgage brokers shopping for the best deal for borrowers?

The approach controls for interest rate, loan type (e.g., conventional vs. FHA vs. VA), occupancy type (e.g., primary residence vs. second home), and other factors to compare loans that have similar characteristics.

After all of the filters were applied, Hunterbrook was able to evaluate a universe of about 25% of UWM’s loans that met the strict requirements for having sufficient information to compare against similar loans.

Within this group, Hunterbook estimates that borrowers paid UWM $229 million more in closing costs over the past four years than those whose brokers provided them with an average priced loan. Assuming the loans evaluated by Hunterbrook Media are representative of the overall national population, as examined in the methodology, this indicates Americans have paid UWM an estimated $894 million more in total.

Because UWM has said its brokers will find homeowners “the best deal,” in addition to using the average, Hunterbrook also compared UWM’s loans to similar loans received by more affordably priced lenders in any given month. This comparison aims to approximate the results if a broker were actually shopping across a universe of five options — and chose the cheapest one, controlling for all of the same variables mentioned above. Hunterbrook did this by comparing UWM’s loans to the 20th percentile loans in any given bucket.

By that metric, UWM charged Americans an estimated $912 million in extra closing costs within the universe of loans observed by Hunterbrook — and an estimated $3.5 billion in all.

Please read Hunterbrook’s methodology linked here.

Ishbia has boasted to investors that he can “set the margins daily” for UWM loans and dictate the costs borrowers pay.

“It’s not market-driven,” Ishbia said on an earnings call last year. “Every day, I look at the pricing, I set it with our capital markets team. Personally, I do it.”

As with any synthesis of millions of data points, “there can always be unobserved stuff,” said Greg Buchak, an associate professor of finance at Stanford with experience studying the residential real estate market, whose feedback informed Hunterbrook’s data analysis. No two homebuyers are exactly alike, which makes comparisons difficult — particularly because certain variables, like credit scores, are not disclosed in publicly available data for privacy reasons.

UWM has also, during certain periods, lowered the rates it charges — for example, as part of its “pricing initiative … aimed at long-term growth of the wholesale channel and our market share,” as described in UWM’s annual shareholder filings.

But even with these initiatives, the data shows that UWM is rarely the cheapest option for borrowers and certainly not the best deal anywhere close to 99% of the time. In addition to having generally higher closing costs when controlling for interest rate, UWM also does not have lower interest rates when controlling for closing costs. In 2023, its rates were right around the average.

“I have been tracking rate sheets on wholesale lenders for 17 years, and I can tell you there’s not one time in history, not one time close in history, when I can see consistently sending more than 40% of loans — and that’s generous, usually it’s closer to 20% or 30% — to any one lender,” said Andy Harris, a former board member of the National Association of Mortgage Brokers who stopped working with UWM after the ultimatum.

“Right now,” he added, “is way worse than before the financial crisis on ethics.”

Experts say UWM and its brokers may be committing fraud and violating mortgage industry regulations

Litigators, professors, and brokers interviewed by Hunterbrook say the pressure UWM uses to win the loyalty of brokers may violate a number of laws — including regulations passed in the aftermath of the 2008 financial crisis to protect homebuyers.

In the housing bubble leading up to the Great Recession, many brokers fraudulently completed loan applications on behalf of borrowers and pushed many homebuyers toward risky loans. (See: This classic scene from The Big Short). It was one of the factors that led to a wave of foreclosures, bank failures, and ultimately a worldwide financial crisis.

In the fallout, state and federal legislators aimed to enhance mortgage-related regulations, among others. The most notable was the Dodd-Frank Wall Street Reform and Consumer Protection Act, which created the Consumer Financial Protection Bureau. The CFPB is an independent bureau within the Federal Reserve charged with monitoring and tightening consumer protections on financial markets.

New regulations aimed to prevent lenders from deceiving homebuyers. These included guidelines under the Truth in Lending Act that barred lenders and brokers from steering borrowers into higher-cost loans when they qualified for more affordable options.

The CFPB was also given authority to implement the Real Estate Settlement Procedures Act and block lenders from providing “a thing of value” to brokers in exchange for business. In other words, RESPA was supposed to put an end to incentives and kickbacks.

Many states, which are the main regulators of mortgage brokers, strengthened regulations as well. The common stated aim was to ensure that lenders and independent mortgage brokers primarily served the interests of homebuyers, instead of only trying to close the greatest number of loans possible at the highest cost possible. In California — where 16.2% of all loan volume was originated in 2022, From HMDA Data Browser. California had 9.5% of originated loans by volume in 2022, a total of 8,394,278 originated loans in the U.S. and 798,735 in California. California loans constituted 16.2% of dollars loaned ($460,321,305,000 in California of $2,839,569,670,000 nationwide in originated loans). including more than $34 billion from UWM — a law enacted in 2009 states:

“A mortgage broker providing mortgage brokerage services to a borrower is the fiduciary of the borrower, and any violation of the broker’s fiduciary duties shall be a violation of the mortgage broker’s license law. This fiduciary duty includes a requirement that the mortgage broker place the economic interest of the borrower ahead of his or her own economic interest.”

In more than a dozen states, brokers have a form of duty to homebuyers via statute or judicial precedent, according to a report printed by the Mortgage Bankers Association after the initial spate of post-crisis regulation.

These regulations are a central reason many banks retreated from the mortgage industry in the wake of the financial crisis. Big lenders also tightened standards on loan approvals, credit checks, and down payments, chilling the market. That created an opening for nonbank lenders like UWM, which have greater operational latitude and less regulatory scrutiny because they don’t manage deposits. The share of the mortgage origination market from these lenders rose to a high of over 60% in 2021 from under 10% in 2009.

But nonbank lenders face many of the same mortgage-specific regulations as banks. And legal experts interviewed by Hunterbrook said UWM could be risking enforcement actions from agencies like the CFPB and Federal Trade Commission, as well as lawsuits from homeowners under both state and federal laws.

The company is “skirting rules that are intended to provide price competition and transparency for the consumer,” said Deepak Gupta, a former senior counsel for enforcement strategy at the CFPB and a lecturer at Harvard Law School.

“UWM seems to have a captive stable of brokers who are incentivized to bring their business to UWM, not to look out for their customers,” he said, adding that “this is in tension with the purpose” of laws like the Real Estate Settlement Procedures Act and the Truth in Lending Act.

If UWM is encouraging mortgage brokers to mislead their customers, Gupta said, then the company faces a “very high risk” of enforcement: “Since the Great Recession, there is simply no question that large mortgage lending businesses cannot lawfully mislead their customers.”

The CFPB did not respond to a request for comment.

“It’s easy to envision a judge or jury calling that fraud.”

Deepak Gupta, former senior counsel for enforcement strategy, CFPB

Mark Calabria, the director of the Federal Housing Finance Agency under former President Trump and President Biden, said that if lenders are in violation of RESPA or TILA, “it’s not just a regulatory risk, it’s a massive amount of litigation risk,” though he cautioned that it has historically been “really hard for plaintiffs to demonstrate harm.”

“I do think that there’s potentially an exposure there,” he said, citing a suspicion that lawyers for nonbank mortgage lenders are asked, “Can you paint a legal picture saying I can do this?” rather than a more earnest question like: “Can I do this?”

He said, generally, nonbank lenders operate under a “short-term time horizon,” in part because even if a company goes under, “everybody lands on their feet and reorganizes under a different name.”

Brokers face their own set of liabilities. In North Carolina, for instance, the Secure and Fair Enforcement Mortgage Licensing Act says it is unlawful to “misrepresent or conceal the material facts or make false promises likely to influence, persuade, or induce an applicant for a mortgage loan.” Many states have similar laws that brokers funneling to a single lender could be violating.

“Brokers that claim to help consumers shop for the best deal but deliver virtually all their business to one wholesale lender in exchange for a kickback would appear to be deceiving their customers,” Gupta said. “It’s easy to envision a judge or jury calling that fraud.”

In its security filings, UWM discloses that it can be on the hook for the actions of its brokers: “Whether a misrepresentation is made by the borrower, the loan officer or one of our team members,” the company writes in its 2022 and 2023 10-K filings, “we generally bear the risk of loss associated with the misrepresentation.”

UWM is also responsible for upholding representations made to its most important counterparties: credit providers and mortgage buyers.

Like most nonbank lenders, UWM keeps little cash on its books, using “warehouse facility” lines of credit from Wall Street banks, such as Goldman Sachs, to fund its mortgages. The banks generally put up 97% to 98% of the cash, with UWM having to front just 2% to 3%.

UWM then sells the vast majority of those mortgages to one of two government-sponsored enterprises (GSEs), Fannie Mae and Freddie Mac, enabling it to pay back the banks.

In turn, the banks and GSEs require covenants from UWM that it is in compliance with consumer protection laws.

“If there’s fraud in the origination, then Fannie and Freddie have a right to force the lender to repurchase the loans from them,” said Buchak. A large quantity of forced repurchases would be “the nightmare scenario” for a nonbank lender like UWM with limited cash, he said.

“They totally rely on the GSEs,” he added. “I don’t think they can function without it.”

Calabria, the former FHFA head, told Hunterbrook Media that Fannie and Freddie, which his agency oversaw, do not “have a strong set of incentives” to hold lenders accountable for violations of covenants. But he said he thinks it’s “a real risk” that the warehouse facilities that nonbanks rely on could pull out in the event that a lender faces regulatory scrutiny.

Like the GSEs, these financing partners require UWM to agree to strict covenants regarding adherence to regulations. Violations could lead to the warehouse facilities being pulled immediately, though banks have intervened in such a way only rarely. The risk is that if one cancels its agreement with UWM, the rest could follow, leading to what the company calls in its security filings a “cross default.”

“The odds are, if one warehouse line is being pulled back, it’s probably something a little more systemic,” said Calabria.

It’s the dependence on these credit lines that led Treasury Secretary Janet Yellen to say in February that she is “very focused” on “non-bank mortgage companies”— citing their reliance “on short-term financing that may be a lot less stable than deposits,” such as warehouse facilities.

“In stressful times,” she said — like a financial crisis — “their credit lines can be pulled.”

Because nonbank lenders like UWM don’t also provide bank accounts to millions of Americans, however, Buchak said he believes the consequences of one of these actors losing its funding would not lead to systemic risk across the economy.

“They’re not really too big to fail,” he said.

How UWM turned some “independent mortgage brokers” into “loyalist brokers”

Part I: The Ultimatum

Both companies are based in Michigan, about 30 miles apart. Both Ishbia and Gilbert own basketball teams. And in recent years, the two have fought for the crown of biggest mortgage lender in the country, competing for market share in an industry with shrinking margins.

For years, UWM’s closest competitor has been Rocket Mortgage.

They also have one more thing in common, according to Ishbia. “He doesn’t like me and I don’t like him,” he told sports podcaster Bill Simmons last year.

Like UWM, Rocket sells mortgages to millions of Americans through independent mortgage brokers, a business it calls Rocket Pro TPO. Unlike UWM, Rocket also has a direct-to-consumer business, which lends money directly to homebuyers, more like a bank.

Before UWM’s ultimatum, when a homebuyer hired an independent broker, UWM and Rocket theoretically could compete to win each customer. Their scale and rivalry made them formidable rivals, with each ribbing the other in public.

“Playing with rockets is great when you’re a kid, but when it’s time to get a mortgage, you quickly realize that a rocket is complicated and expensive,” said the narrator of a UWM Super Bowl ad that aired about a month before the ultimatum.

“It’s best,” he added, “to work with an independent mortgage broker instead.”

[After publication of Hunterbrook Media’s investigation, this ad disappeared from UWM’s YouTube channel. Linked here, and posted below, is a version posted by another account.]

Rocket Pro TPO is very similar to UWM’s core business. It provides similar technology enabling independent mortgage brokers to efficiently originate loans. Rocket also offers loans to lower credit score borrowers, according to SEC filings. It does not, however, include a version of the ultimatum in its contracts with independent brokers.

Through 2020, UWM maintained a larger share of the independent broker market, but Rocket was a strong second. Many brokers worked with both lenders. Rocket reported a 22% share of the independent mortgage broker business that year, compared to UWM’s 34%. About 70 additional lenders competed for the remaining 44%.

Eddy Perez, the CEO of Equity Prime Mortgage, a lender that financed over $2.6 billion in loans in 2023, said he doesn’t think brokers need to be working with “200 wholesale lenders.” He said he does think brokers should generally be working with “seven to ten,” unless they are receiving incentives for doing particularly high volume, in which case he said they should rotate between at least “three to five.”

“To be independent,” he said, “you have to be independent.”

In reality, many brokers don’t routinely shop the entire universe of available options. But the fierce competition between UWM and Rocket often ensured that brokers had easy access to at least two national providers with advanced technology and relatively widespread name recognition, whom brokers could pit against each other to find the best deal for homeowners.

That ended with the ultimatum. Ishbia unveiled it weeks after UWM listed on the New York Stock Exchange, before the company’s first earnings call.

Ishbia said his hand had been forced because competitors were trying “to put brokers out of business” by favoring their parallel direct-to-consumer channel. It was a reference to Rocket, which steadfastly maintained that it had placed a “firewall” between the two operations.

To many in the industry, the ultimatum appeared to contradict UWM’s marketing highlighting a key advantage of engaging a broker: “choices” and “competition” between lenders.

“We’re not sure this is even legal. It certainly isn’t ethical,” said Kimber White, then president of the National Association of Mortgage Brokers, at the time: “And it doesn’t represent the American way of free enterprise. This is counter to the spirit of freedom and independence that is the very foundation of our broker businesses.”

Austin Niemiec, a Rocket Pro TPO executive, said in an interview with National Mortgage Professional, an industry publication: “Mat Ishbia is deliberately and systematically destroying [the broker] model to enrich himself. And he isn’t shy to admit it.” (Brackets included in original NMP article).

According to Ishbia, more than 19 in 20 of the brokers who worked with UWM before the ultimatum accepted the terms. Ishbia argued that didn’t stop them from working with the several dozen other lenders in the market. But Hunterbrook’s data analysis shows that brokers did not generally widen their lender relationships. They just sent more borrowers to UWM.

Before the ultimatum, in 2020, more than 3,800 loan officers sent 99% or more of their business to UWM, Hunterbrook found. By 2023, this number had more than doubled, to over 8,600.

Hunterbrook also found that the lender specific closing costs of a mortgage in the broker channel more than doubled to 1.223% of loan amount in 2023, from 0.549% in 2021, the year of the ultimatum, amid an inflationary environment. Closing costs here refer to “normalized blended origination charges,” as defined in the methodology appendix.

Christopher Griffith, a broker who signed the deal with UWM, told Hunterbrook that while the ultimatum was a “nonfactor” for him — because he was already partial to the company — he is not a fan of “constraints” and continues to “shop” on behalf of clients.

“I think choice is always a good thing,” said Griffith, owner of Be My Neighbor Mortgage in Texas. Griffith specializes in VA loans and says he has sent mortgages to 18 to 20 lenders in the last year, in addition to UWM. “I served in the Marine Corps. I believe in freedom.”

Taylor Gardner, co-owner of Loan Lab Lending in Texas, also sided with UWM after the ultimatum. At one point, he was sending UWM 95% of his business. “A year or two ago,” he said, UWM had “really good pricing,” but he claimed it’s no longer as competitive.

Earlier this year, he said, he finally decided to stop working with UWM, after every member of his team voted to switch to Rocket. “Ideally, I would love to use them both,” he said, but UWM left him no choice.

Chad Atkins is another broker who said he recently switched over to Rocket. “You can’t listen to everyone,” he said in a video he posted to the same Facebook group of mortgage originators where the voicemail had leaked, explaining that he had “avoided Rocket like the plague” for half a decade due to “lies” he had been told by “UWM,” among others, about the lender. He said in the video that his “experience with [Rocket] has been nothing short of amazing,” citing fast turn times, easy-to-reach underwriters, and “way better” rates.

Asked for further comment, Atkins declined. “I would not be comfortable with that interview,” he wrote in a Facebook message, citing lawsuits UWM has filed against brokers doing business with Rocket. “I FEAR UWM.”

Others said they don’t like working with either lender. “I’m not a fan of Michigan in the mortgage business at all, to be honest,” said Harris, the Oregon broker who previously served on the board of NAMB and had been a longtime UWM supporter. But he said he was especially concerned by the ultimatum and by brokers funneling business to any one lender.

In 2021, after expressing his disapproval of the ultimatum on social media, Harris said, he received a call from Ishbia.

Harris said he gave Ishbia suggestions on how to make the ultimatum more broker-friendly, some of which Ishbia implemented. He said he told Ishbia he was particularly concerned about UWM taking legal action against brokers who wanted to shop the entire universe of lenders.

Ishbia told him, “I want teeth in the agreement but I’m never going to sue anyone,” according to Harris.

“Once they started suing people,” Harris said, “that’s when I terminated them.”

UWM has sued several brokers, alleging they violated the terms of the ultimatum by shopping for homebuyers with both Rocket and UWM. This prompted countersuits on antitrust grounds, which are moving through the legal system but have yet to find success, at least partially because judges have ruled that the plaintiffs didn’t sufficiently support claims about the detrimental effects of the ultimatum with data.

Atlantic Trust Mortgage, one of the broker companies sued by UWM, said it never signed the ultimatum, according to an interview with the National Real Estate Post and Hunterbrook’s review of court filings. But UWM is seeking at least $355,000 in damages for 71 loans that Atlantic Trust allegedly sent to Rocket and Fairway.

Asked by the National Real Estate Post what he would say to UWM, Atlantic President Scott Goldstein said: “As soon as we decided that there was another lender that was a better fit for our company, you decide to sue us.”

“We’re a small company. We’ve got families. We’ve got people that we need to provide employment for. And they’re trying to take that away from us,” he said. “It should be consumer first. And it’s not. It seems like it’s UWM first.”

Sign Up

Breaking News & Investigations.

Right to Your Inbox.

No Paywalls.

No Ads.

Part II: Quid Pro Loan — How UWM Rewards Brokers for Sending Them Business

While suing brokers who allegedly violated the ultimatum, UWM wooed others with perks.

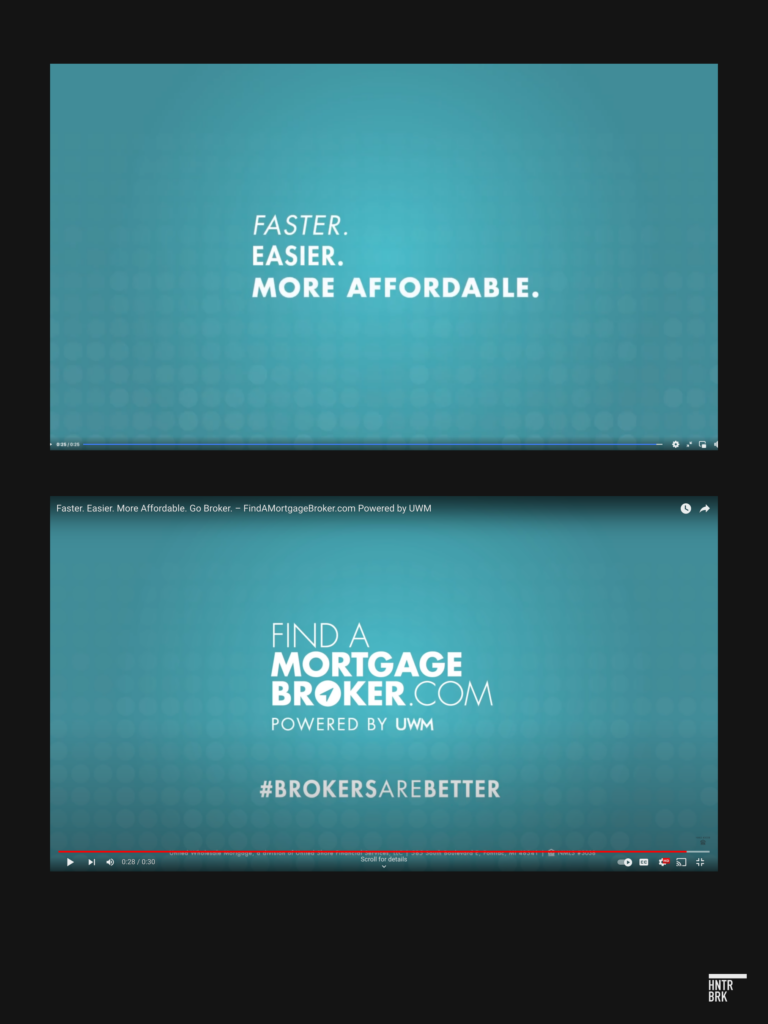

If you were among the more than 91 million viewers who watched Tom Brady win the Super Bowl at 43 years old, you might have seen this mortgage ad purchased by UWM for an estimated $5.5 million.

“The only way to get a mortgage that’s cheaper, faster, and easier is to find a local mortgage broker first,” the ad said, directing viewers to FindAMortgageBroker.com, “powered by UWM.”

Another video advertising the UWM-owned site (now called Mortgage Matchup) asserts that the brokers listed on it are independent and will “shop dozens of lenders to find the right home loan for your needs.” A blurb on the homepage has a similar message: “That’s why Mortgage Matchup helps you partner with a local mortgage broker — an independent, licensed professional in your area who can shop on your behalf and give you access to more home loan options than a bank or an online lender.”

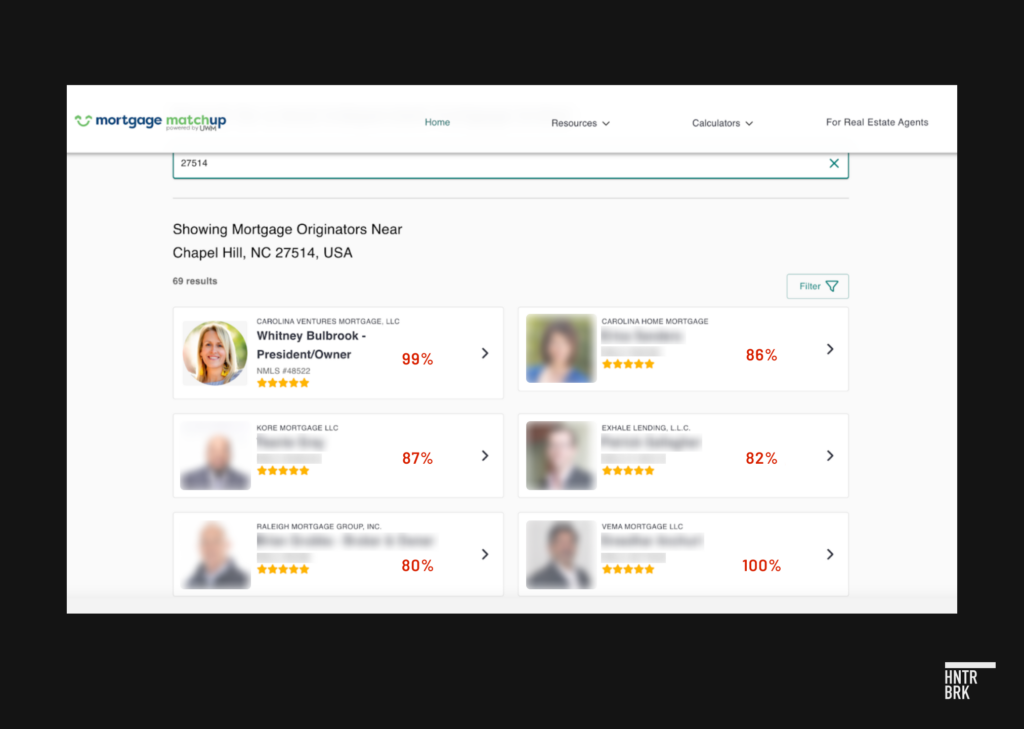

But when Hunterbrook searched a zip code in Chapel Hill, North Carolina, on MortgageMatchup.com, Bulbrook, who sends nearly 100% of her business to UWM, appeared as the first search result.

She was joined by other UWM brokers who send from 80% to 100% of their business to UWM.

Later searches showed Bulbrook as the second-highest result.

Visibility on MortgageMatchup.com is dictated, in part, by UWM’s “PRO rankings” system, a scale the company uses to rate brokers and dole out a wide variety of benefits, as described on their website.

Those include quicker turn times — reducing the number of days it takes UWM to complete an underwriting review of a loan file. The higher a broker’s PRO ranking, the more deals they can close.

Brokers also can receive points toward their “PRO score” when they close loans with UWM. Additionally, UWM awards points for talking to account executives at UWM or buying one of UWM’s paid service options that offer “additional loan processing support.” Many of these sources of points are steps brokers can take in the process of bringing UWM business.

Another way brokers can receive a boost to their PRO score is by visiting the company’s headquarters in Pontiac, Michigan.

Mortgage Matchup also promises to save “homebuyers, like you, $9,407 on average.” In smaller font, a UWM footnote clarifies this isn’t always true. The number is from a study conducted by a UWM-funded industry group, the Association of Independent Mortgage Experts (AIME), which only looked at conventional loans that closed in 2021 with debt-to-income ratios of between 41% and 45%.

That year, this group of loans represented just a narrow band of the total originations and excluded all government loans, including FHA loans typically for lower-income borrowers. Graph of DTI across all mortgages in 2021 (page 24 here) + data on conventional vs. government loans: AIME Study Calculations.

Still, Mortgage Matchup, which only includes UWM affiliated brokers, cites that number from the AIME study: $9,407. And as recently as February 28th, Ishbia claimed on an earnings call with shareholders and bank analysts that “you go to mortgagematchup.com, and it saves consumers thousands and thousands and thousands of dollars, like it’s crazy.”

To get a sense of the broker process, Hunterbrook financial editor Daniel Sherwood applied for a mortgage in Detroit through Jason Glass, the founder of an independent mortgage broker called One Stop Financial Group.

About a week after submitting a request on One Stop’s website, Glass sent Sherwood a preapproval for a $550,000 mortgage with 20% down.

In response, on February 2, Sherwood asked what rate, cost, and lender he could expect. After a back and forth that didn’t answer the question, Sherwood asked again on February 5: “Following up on the above re: costs, lender, and rate.”

On February 8, Glass sent Sherwood a document with an estimate of the terms he expected to provide. “Who is the lender?” Sherwood responded. Glass didn’t reply for a week. “Still wondering about the lender,” Sherwood wrote on February 15.

That day, Glass told Sherwood he would “most likely send the loan to UWM” but promised he would “research a ton.”

“Because of my volume I get monthly incentives at various outlets,” Glass said. “Once we’re ready to rock and roll I will look at who is giving what and who will be a good fit.”

According to Hunterbrook’s data, Glass has sent 97% of borrowers to UWM since 2021.

And last year, One Stop’s loans were on average more expensive than typical brokered loans in Michigan when controlling for rate, month of closing, and the other factors described above.

Many homebuyers don’t know to ask what deals are on the table — with the majority relying on the information “people with something to sell,” like lenders and brokers, tell them, according to CFPB research.

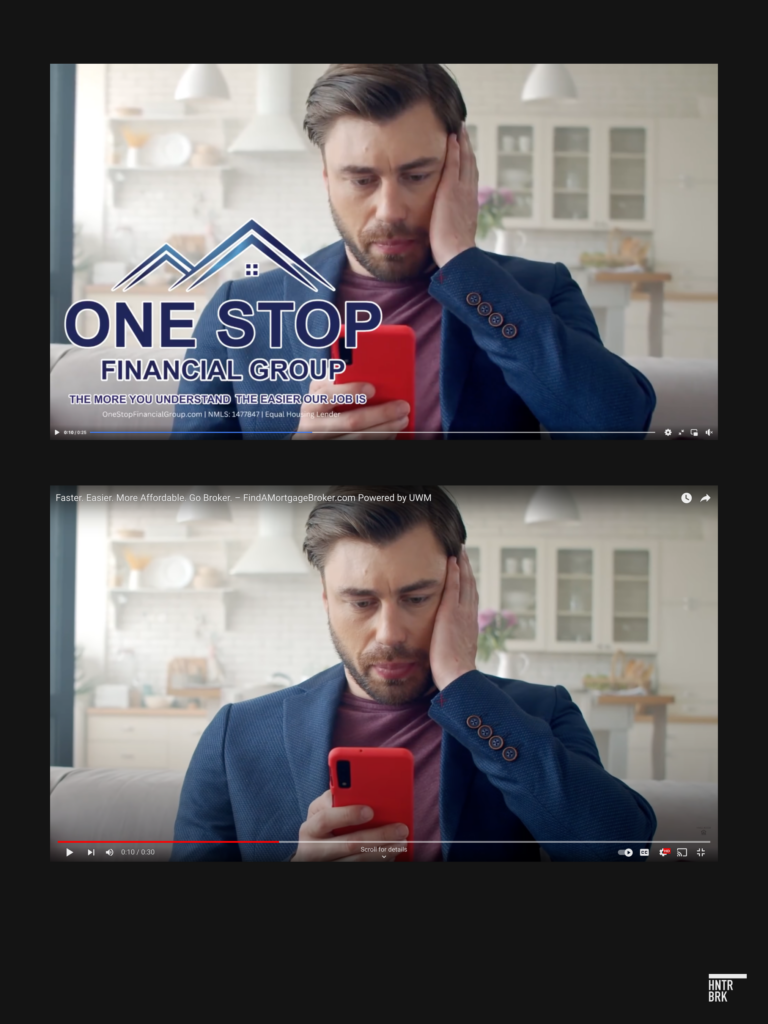

One Stop promises on Facebook that it has “strong relationships with a wide network of lenders.” A key focus of theirs is veterans, who the company says “deserve the best rates available.”

The page also features a video with One Stop’s logo in the bottom left-hand corner making the case that hiring an independent broker leads to a “faster,” “easier,” and “more affordable” process. One Stop doesn’t disclose that the video was originally made by UWM. (UWM has told investors that it shares “customizable” content and “facilitates brokers’ social media posts” such that it “enables the brokers to appear as large and credible institutions.”)

In fact, One Stop’s version cuts out the last frame of the ad, which discloses that the video was the same Super Bowl ad that UWM made for FindAMortgageBroker.com (now MortgageMatchup.com).

Like Bulbrook, Glass was flown to New York by UWM to ring the bell at the New York Stock Exchange — calling the experience “surreal.”

“You can’t really put it in words,” he said in a video posted to social media by UWM.

When Hunterbrook Media asked Glass to comment on its reporting, he said: “You must have the wrong person, I am not UWM.”

Harris, the former NAMB board member, said that even beyond the benefits UWM provides, some brokers send a single lender the bulk of their business because they are “captive and controlled and lazy and ignorant and not trained well,” despite the fact that becoming a mortgage broker requires a license.

Harris said many brokers don’t look through all the deals on offer and instead rely on a single company’s technology stack.

“You’ve got to have a universal pricing engine and independence from any lender,” he said. “If you don’t, it’s like having a car without gas and driving a consumer off a cliff in neutral.”

When asked whether there is more to how UWM wins the allegiance of brokers, Harris said: “That I won’t get into on a recorded call.”

Across SEC filings and investor presentations, UWM appears to have been quietly walking back its promises

In recent months, UWM has changed some of its disclosures and other statements.

In its 2022 SEC filing, UWM included sections entitled: “Benefits to Borrower” and “Benefits to Independent Mortgage Broker.”

The “Benefits to Borrower” section stated that “Independent Mortgage Brokers are able to provide borrowers with multiple options on product structure and pricing rather than being rooted in a single platform offering.” It also stated that “the interests of the Independent Mortgage Broker and the borrower are aligned to achieve the best outcome for the borrower.”

The “Benefits to Independent Mortgage Broker” section included the following: “We believe that Independent Mortgage Brokers and their loan officers are better served by the wholesale channel as it provides them the flexibility of matching their borrowers’ needs with the most applicable lender and lender program.”

Both sections were deleted in the company’s 2023 security filing, released in March, in what is otherwise a largely similar document, including standard updates to the annual financials.

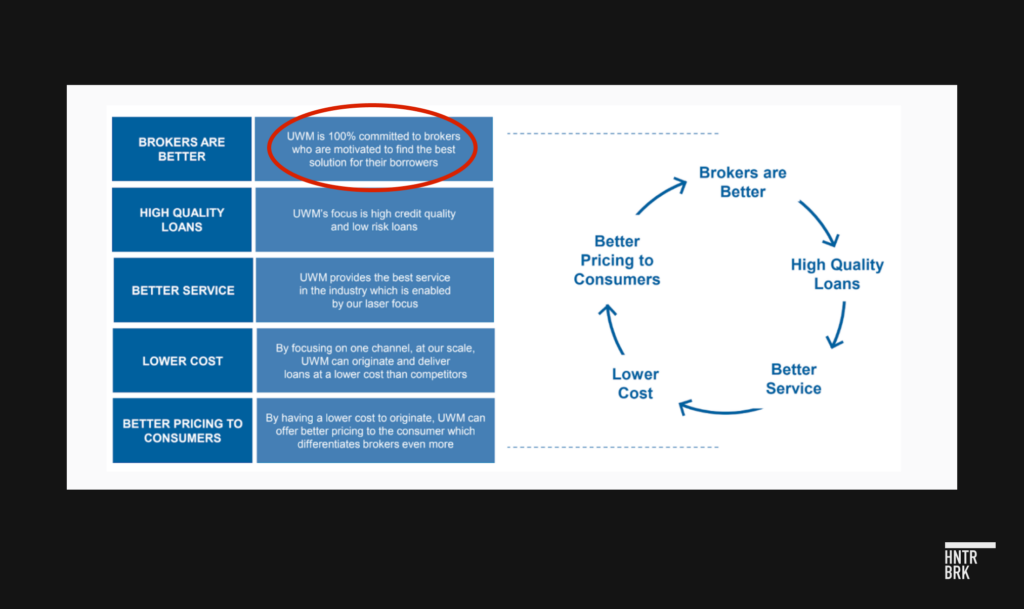

In addition, UWM made a key change to a slide between its 2022 and 2023 investor presentations.

In the earlier version, UWM said its brokers “find the best deal for their borrowers.” That was changed the next year to say that its brokers “find the best solution for their borrowers.”

UWM no longer includes either investor presentation on its website — which now only includes a single presentation from 2024.

In its cease and desist, UWM’s lawyer told Hunterbrook Media that answering questions about the accuracy of these prior public statements — and whether the company plans to file an 8-K — would “require the disclosure of non-public information,” which Hunterbrook Media had requested UWM not provide.

“A petri dish for potential problems”

UWM is valued at over $10 billion. It is a public company, but operates like a family business. Its 10-member board, chaired by Ishbia, also includes his father, Jeff Ishbia, the company’s founder, and his brother, Justin Ishbia, a private equity executive.

Other directors include mortgage industry executives and Michigan basketball legend Isiah Thomas, whose most prominent management experience is his four-year tenure as director of basketball operations of the New York Knicks. Thomas was fired and a jury in a civil case found he sexually harassed a colleague. He denied the allegations.

UWM’s chief legal officer, Adam Wolfe, is also close to Ishbia. The two played together on Michigan State’s men’s basketball team, while UWM board member Kelly Czubak played on the women’s team.

Because the Ishbias own the vast majority of the company’s shares, the family maintains the power “to determine all corporate actions requiring stockholder approval,” according to SEC filings.

Charles Elson, a prominent corporate governance expert at the University of Delaware, said there can be inherent conflict in boards when a single entity has dominant control. For instance, such entities at their worst can “take assets away from the business that belongs to all the holders and appropriate them for themselves.”

“You almost become a petri dish for potential problems,” he said.

Last year, UWM reported a net loss of $70 million amid an interest-rate-driven decline in the mortgage market. Nevertheless, the Ishbias received a dividend of more than $600 million. For context: That’s just 15% less than the dividend Mark Zuckerberg receives for a company over 100 times the size. Meta, a company more than 100 times larger in market cap, pays its founder/CEO Mark Zuckerberg $700 million a year in dividends.

UWM also paid the Ishbias an additional $21 million for such services as renting the family’s private jet for company travel and for renting the family’s land for the company’s headquarters in Pontiac, among other expenses. Page 86 of the 2023 10-K: “For the years ended December 31, 2023, 2022 and 2021, the Company made net payments of approximately $21.2 million, $26.4 million and $21.1 million, respectively, to various companies related through common ownership.”

The family received a similar amount of money from the company, including the $600 million dividend, in 2022. That year, UWM missed its $5.36 billion net revenue projection from its SPAC marketing by more than $2.9 billion.

Since UWM went public during the SPAC boom in 2021, its market cap has declined by more than $4 billion. At least one investor in the SPAC that acquired UWM has sued the SPAC sponsor in the Delaware Court of Chancery, claiming UWM’s aggressive projections did not ultimately come to fruition. During the same period, the Ishbias have taken home a total of at least $2 billion.

That money contributed to the down payment Ishbia made to become the majority owner of the Phoenix Suns.

He called it “the culmination of a lifelong dream.”

Authors

Matthew Termine is a lawyer with nearly five years of experience leading the legal team at a mortgage technology company, before he left the industry earlier this year. In 2017, Matt was credited by the Wall Street Journal, among others, for identifying suspicious mortgage loan transactions that led to several successful criminal prosecutions, including that of a prominent political operative and the chief executive officer of a federally-chartered bank. He is a graduate of Trinity College and Fordham University School of Law. He grew up in Old Saybrook, Connecticut and now lives in Brooklyn with his wife and two sons.

William D. Cohan, a former senior Wall Street M&A investment banker for 17 years at Lazard Frères & Co., Merrill Lynch, and JPMorganChase, is the New York Times bestselling author of five non-fiction narratives, three about Wall Street, including Money and Power: How Goldman Sachs Came to Rule the World; House of Cards: A Tale of Hubris and Wretched Excess on Wall Street; and The Last Tycoons: The Secret History of Lazard Frères & Co., the winner of the 2007 FT/Goldman Sachs Business Book of the Year Award. His book, The Price of Silence, about the Duke lacrosse scandal was published in April 2014 and was also a New York Times bestseller. His 2022 book Power Failure: The Rise and Fall of an American Icon, about the rise and fall of GE, once the world’s most powerful, valuable, and important company, was published in November 2022 by Penguin Random House. It was a New York Times bestseller and on the best book of the year lists published by The New Yorker, The Economist, The Financial Times, and the DealBook section of the New York Times. He is also a founding partner of Puck, the digital publication, and its Wall Street correspondent. For 13 years, he was a special correspondent at Vanity Fair. He is a former columnist for DealBook. He also writes for The Financial Times, The New York Times, Air Mail, Barron’s, Bloomberg Businessweek, The Atlantic, Town & Country, The Nation, Fortune, The Hollywood Reporter, and Politico, among other publications. He is a graduate of Phillips Academy, Duke University, Columbia University School of Journalism, and the Columbia University Graduate School of Business. He grew up in Worcester, Massachusetts and now lives in New York City and upstate New York with his wife and, on occasion these days, their two sons.

Sam Koppelman is a New York Times best-selling author who has written books with former United States Attorney General Eric Holder and former United States Acting Solicitor General Neal Katyal. He helped build Fenway Strategies into one of the preeminent strategic communications firms in the country — with side quests speechwriting for Michael Bloomberg, running the surrogate remarks operation on the Biden-Harris campaign, and co-founding Mayday, which is now one of the leading information providers on how to access reproductive health care in states with bans. Sam has published in the New York Times, Washington Post, Boston Globe, Time Magazine, and other outlets. He has a B.A. in Government from Harvard, where he was named a John Harvard Scholar and wrote op-eds like “Shut Down Harvard Football,” which he tells us were great for his social life. Sam is based in New York City.

Grace Scullion has reported for the Sacramento Bee, POLITICO, the Half Moon Bay Review, and Pacifica Tribune. She graduated from Stanford University with a degree in American Studies. Now based in New York, she’s dedicated to using data and storytelling to generate accountability.

Nick Gibbons, who contributed reporting and data analysis, is a seasoned forensic accounting expert and investment researcher. His experience includes a blend of qualitative and quantitative investment roles at Two Sigma, Norges Bank Investment Management, and Citadel. He began his career in forensic accounting at independent equities research provider Gradient Analytics. He has a background in graduate-level education, having previously served as Adjunct Professor of Finance and Accounting at Thunderbird School of Global Management and currently as Adjunct Assistant Professor of Accounting at NYU Stern School of Business. He is a Certified Fraud Examiner (CFE) and Master Analyst in Financial Forensics (MAFF).

Editor

Daniel Sherwood joined Hunterbrook from The Capitol Forum, a premium subscription financial publication, where he was an Editor & Senior Correspondent, writing and managing market-moving investigative reports and building the Upstream database. Prior to The Capitol Forum, Daniel has experience conducting undercover investigations into fossil fuel companies and other research. He also served as an Honors Law Clerk in the Criminal Enforcement Division of the EPA. He has a JD from Michigan State University. Daniel is based in Michigan.

Advisors

Hunterbrook Advisors Matt Murray, the former Editor-in-Chief of the Wall Street Journal, and Bethany McLean, the investigative reporter who exposed Enron and has written extensively about the mortgage sector, contributed editing. Hunterbrook also enlisted two external fact-checkers and a copy editor.

If you think you are paying too much on your mortgage, visit WasIRippedOff.com to learn if you might have used an independent broker who doesn’t shop

***

Hunterbrook Media publishes investigative and global reporting — with no ads or paywalls. When articles do not include Material Non-Public Information (MNPI), or “insider info,” they may be provided to our affiliate Hunterbrook Capital, an investment firm which may take financial positions based on our reporting. Subscribe here. Learn more here.

Please contact ideas@hntrbrk.com to share ideas, talent@hntrbrk.com for work opportunities, and press@hntrbrk.com for media inquiries.

LEGAL DISCLAIMER

© 2025 by Hunterbrook Media LLC. When using this website, you acknowledge and accept that such usage is solely at your own discretion and risk. Hunterbrook Media LLC, along with any associated entities, shall not be held responsible for any direct or indirect damages resulting from the use of information provided in any Hunterbrook publications. It is crucial for you to conduct your own research and seek advice from qualified financial, legal, and tax professionals before making any investment decisions based on information obtained from Hunterbrook Media LLC. The content provided by Hunterbrook Media LLC does not constitute an offer to sell, nor a solicitation of an offer to purchase any securities. Furthermore, no securities shall be offered or sold in any jurisdiction where such activities would be contrary to the local securities laws.

Hunterbrook Media LLC is not a registered investment advisor in the United States or any other jurisdiction. We strive to ensure the accuracy and reliability of the information provided, drawing on sources believed to be trustworthy. Nevertheless, this information is provided "as is" without any guarantee of accuracy, timeliness, completeness, or usefulness for any particular purpose. Hunterbrook Media LLC does not guarantee the results obtained from the use of this information. All information presented are opinions based on our analyses and are subject to change without notice, and there is no commitment from Hunterbrook Media LLC to revise or update any information or opinions contained in any report or publication contained on this website. The above content, including all information and opinions presented, is intended solely for educational and information purposes only. Hunterbrook Media LLC authorizes the redistribution of these materials, in whole or in part, provided that such redistribution is for non-commercial, informational purposes only. Redistribution must include this notice and must not alter the materials. Any commercial use, alteration, or other forms of misuse of these materials are strictly prohibited without the express written approval of Hunterbrook Media LLC. Unauthorized use, alteration, or misuse of these materials may result in legal action to enforce our rights, including but not limited to seeking injunctive relief, damages, and any other remedies available under the law.