Hunterbrook Media’s investment affiliate, Hunterbrook Capital, does not have any positions related to this article at the time of publication. Positions may change at any time. Full disclosures below.

It was like taking a victory lap at the starting line.

Ground broke. Cameras flashed. Politicians celebrated a purported economic victory: an upstart Vietnamese electric vehicle manufacturer, VinFast (NASDAQ: $VFS), was building a factory in North Carolina.

VinFast pledged to bring $4 billion in investment and 7,500 new jobs to Chatham County over the plant’s first five years. In return, local and state governments, as well as a nonprofit, agreed to provide incentives of $1.2 billion.

“This VinFast factory will create thousands of good-paying jobs in our state,” said Roy Cooper, North Carolina’s governor, at the groundbreaking last July. When VinFast first announced plans for the factory, back in March 2022, President Biden tweeted about it, calling the company’s decision to manufacture electric vehicles in North Carolina “the latest example of my economic strategy at work.”

More than two years later, little progress is visible at the roughly 1,800-acre site beyond partial foundation work. When a Hunterbrook Media reporter visited the site on two weekdays in February, no construction workers were present.

“We continue to make progress on our proposed North Carolina manufacturing site,” a VinFast spokesperson told Hunterbrook Media, saying the company’s plan “remains to complete principal construction on the site before the end of 2025.” When the project was first announced, it was slated to open this year.

In a statement to the Raleigh News & Observer published last week, a county spokesperson said that, at the moment, “no construction is being done.” Shortly after the News & Observer’s article was published, detailing the lack of progress at the site with the help of drone imagery, VinFast filed a new construction plan with Chatham County.

An EV plant 300 miles southwest tells a different story. A few months after VinFast’s North Carolina factory was announced, Hyundai began building a $7.6 billion facility in Ellabell, Georgia.

At that site, steel beams cover the 2,900 acres. Some structures “have roofs and floors, and exterior wall panels have begun to go up,” according to the AP. Both companies originally planned for their facilities to be up and running in 2025 — but Hyundai’s timeline has been accelerated. VinFast’s, meanwhile, has been pushed back.

Timelapse of satellite imagery: Hyundai facility on left; VinFast facility on right

Since entering the competitive global electric-vehicle market in early 2023, VinFast has issued a steady stream of ambitious announcements. Besides the North Carolina factory, it has announced a $2 billion plant in India and a $2.1 billion investment to establish a presence in Indonesia.

But after a months-long Hunterbrook Media investigation spanning satellite imagery, AIS data, trade records, and on-the-ground reporting in multiple U.S. states and multiple continents, it’s unclear who is going to buy the cars — and how VinFast is going to pay for these expansions.

VinFast’s central manufacturing facility in Hai Phong, which boasts annual production capacity of 300,000 cars, delivered fewer than 35,000 automobiles last year, just 12% of capacity and short of its target of 50,000.

More than 70% of those deliveries were to other companies owned by VinFast’s Chief Executive Pham Nhat Vuong, according to SEC filings that were reported on by Reuters earlier this month. They accounted for more than 90% of Vinfast’s total sales revenues. VinFast reported total revenues of $1.1 billion from vehicle sales in 2023. It said it received $839 million in revenues from sales of vehicles delivered to GSM, and approximately 14% of total revenues of EV sales (or $154 million) from sales to customers applying VinFast vouchers provided by Vinhomes.

The new plant in North Carolina would be able to produce an additional 150,000 vehicles. To date, VinFast has shipped 3,118 cars to the US. Hunterbrook Media was able to track the activity of VinFast’s dedicated roll-on roll-off (RO/RO) transport vessel, the Silver Queen, utilizing both AIS and overhead imagery. The Silver Queen made three voyages to North America, delivering 999 VF8s to the U.S. on its first voyage in December of 2022, 1098 VF8s to the U.S. and 781 to Canada in May of 2023, and a final delivery of 1021 VF8s to the U.S. in November 2023. After completing this final delivery, the Silver Queen resumed normal operations, plying the waters of the Western Pacific. Hunterbrook Media was able to confirm that since the November 2023 delivery, the Silver Queen did not make another port call in Vinfast’s export hub, Haiphong, nor did it return to a US port. Of those, only 265 had been sold as of December, according to EV registration data, leading VinFast to offer what Tom McParland, an auto blogger, called a “death spiral of discounts” in a column for Jalopnik, an industry publication.

Earlier this year, VinFast revealed global reservations of its two signature vehicles — which are non-binding for the customer and can be refunded — had been scaled down to about 14,700 from about 65,000.

VinFast’s struggles have come as its vehicles have received abysmal reviews from international press. A VinFast critic in Vietnam, meanwhile, has been arrested — and negative posts about the company seem to have disappeared from the internet entirely, including a YouTube video featuring a field full of vehicles gathering dirt that VinFast had sold to a related party.

Hunterbrook Media’s review of satellite imagery showed that many of these vehicles had been stored in the field for months.

The company is also up against a difficult environment for the entire electric vehicle sector. Demand in the U.S. slowed substantially, while globally China has been aggressively exporting EVs at low prices.

Industry leader Tesla (NASDAQ: $TSLA) reported disappointing earnings and has seen its stock drop about 40% since the start of the year. Legacy automakers like Ford (NYSE: $F) have slowed down their transition away from internal combustion engines. Many new entrants are struggling, such as once-hyped Fisker Inc. (formerly NYSE: $FSR, delisted in March), which is reportedly flirting with bankruptcy, and Rivian (NASDAQ: $RIVN), which is pausing the construction of a new facility.

VinFast has also seen its share price plummet. “The EV market has absolutely taken a dive,” says McParland, who in addition to writing for Jalopnik runs an auto consulting business highlighted by the New York Times. “If Ford is struggling to sell EVs, and everybody knows Ford, what chance does this Vietnamese automaker have?”

In the weeks following the North Carolina groundbreaking, VinFast used a Special Purpose Acquisition Company (SPAC) to list on Nasdaq with a $23 billion valuation. Its stock initially soared, with the company at one point reaching a $200 billion market capitalization, larger than Boeing. But its value has since declined by over 95%.

Instead of slowing down and reassessing its plans like its peers, VinFast has promised to double down.

The company has said it will deliver 100,000 vehicles worldwide in 2024, more than double its 2023 sales, while expanding to 50 countries. VinFast has said it expects to sell 750,000 cars annually by 2026, with the help of its North Carolina factory.

Most VinFast cars sold to taxi and real estate companies owned by its parent company Vingroup or CEO

VinFast founder Pham Nhat Vuong, 55, became Vietnam’s first billionaire in 2013 as a successful real estate developer. Vuong’s conglomerate, Vingroup, has since expanded across sectors, from education to healthcare, becoming a household name in Vietnam.

In 2017, Vingroup entered the auto industry — and in the years since, the company and its CEO have reportedly dedicated more than $11 billion to building VinFast. After going through several chief executives, Vuong named himself VinFast’s fourth CEO in three years in January.

Two of VinFast’s largest customers are owned by Vuong or Vingroup: electric taxi company Green and Smart Mobility (GSM) and real estate company Vinhomes.

GSM, which is 95% owned by Vuong, was responsible for the majority of VinFast’s sales last year, an arrangement that has received scrutiny. Until the recent investigation by Reuters, however, VinFast’s relationship with Vinhomes had received almost no attention — despite EV sales to VinHome customers accounting for approximately 14% of 2023 EV revenue, according to a March SEC filing.

Vinhomes said on its website that it had given away 1,000 VinFast cars for free to new homeowners. Vinhomes also offered its customers five years of free taxi service through GSM.

In a press release, VinFast said it saw “strong revenue growth” last year, with a 374% increase in total EV sales from 2022. But the sales increase to buyers other than companies owned by Vuong is only around 33% — off a small base, according to Hunterbrook Media’s calculations based on security disclosures. VinFast said total sales in 2023 of 34,855 were a 374% increase from 2022, which means about 7,353 EVs were delivered in 2022. In 2023, about 9,759 cars were delivered to unrelated third parties, based on its claim that 72% of total car sales were to related parties.

In the first quarter of 2024, the company reported a total of 9,689 EV deliveries — a decrease of 28% from the previous quarter. More than half those deliveries were to other Vingroup companies.

Hunterbrook Media research suggests VinFast has significantly underperformed sales estimates in the United States and Europe

VinFast has had a harder time selling cars outside of Vietnam.

Out of the 3,118 EVs the company shipped to the U.S. last year, only 265 VinFast vehicle registrations — a common proxy for estimating car sales — were recorded across the U.S. in 2023, according to an S&P report. The state of California’s database reports 445 VinFast vehicle registrations — but clarifies their database does not “identify a vehicle registration as a ‘new vehicle sold,’” suggesting they may also include leased vehicles.

In February 2024, Hunterbrook Media visited the California port terminal where VinFast’s cars have been offloaded in the United States. Hundreds of vehicles remained parked there, months after the last shipment arrived. Long-term storage by the ocean risks corrosion and paint wear. There have been no new shipments since, according to AIS data.

VinFast appears to be behind its schedule outside the U.S. as well.

In 2023, Canada was the only country outside of Vietnam and the U.S. where VinFast reported sales, with a total of $24.2 million in revenue. The company has delayed its expansion to Europe — where it made its first shipment earlier this year, despite having announced plans to deliver 3,000 vehicles to the continent in 2023. VinFast appears to be well short of its target number of showrooms as well. The company said it would have 30 showrooms in California alone by the end of 2022; only 17 are open across the United States as of April. In Europe, VinFast said it planned to establish 50 retail outlets across Germany, France, and the Netherlands, but has so far only opened 13.

Auto trade reviewers pan VinFast and expert says the rollout was rushed — as the company offered the “cheapest lease in America” to boost demand

VinFast has received disastrous reviews of its EVs from the American automotive media.

Motortrend titled their review “2023 VinFast VF8 First Drive: Return to Sender,” Road & Track, “First Drive: The 2023 VinFast VF8 Is Unacceptable,” and Inside EVs, “2023 VinFast VF8 City Edition First Drive Review: Yikes.” Reported problems ranged from “flaky turn signals” to “suspension that induces nausea,” according to a Jalopnik round up.

Vinfast had taken unorthodox steps to win favor from the auto press. Before its initial wave of bad reviews, VinFast offered $100 in prepaid debit cards to journalists in the United States testing out the vehicles. Matt Farah, an auto podcaster, says he was offered an expenses-paid trip to Vietnam to visit the company’s headquarters, plus $10,000 for his time.

Farah’s response? “Of course not, that sounds fucking shady,” he said.

Tu Le, Founder and Managing Director of the consultancy firm Sino Auto Insights, told Hunterbrook Media that delivering vehicles to the United States before they had been tested more comprehensively was part of a chain of critical errors VinFast made in its expansion to the United States.

“Trying to sell the first set of EVs they’d ever built from the Hai Phong factory before they could dial in the quality and reliability was a major mistake,” he said in an email. “They’d invited a gaggle of journos to Vietnam to visit and test drive their vehicles. Most journos were not impressed. That should’ve been an indication that they should slow down and get things right.”

“Most people spending $50K on something want to trust the brand, especially when families and children are involved,” he added.

Since the initial criticism, VinFast has said it has made several improvements to its vehicles, earning the company marginally better reviews.

“Additionally, VinFast has also swiftly and proactively refined its manufacturing processes to prevent the recurrence of similar issues in the future,” the company said in a statement to Hunterbrook Media. “As a relatively new brand, we highly value market feedback and suggestions, and we are fully committed to delivering exceptional products and services.”

VinFast also cited its first quarter increase in sales in the U.S. — but did not mention that in January, the company began offering steep discounts.

According to a lease offer received by a Hunterbrook Media reporter during a visit to VinFast’s recently opened dealership in Apex, N.C., the discounts amounted to more than $20,000 off list prices, including a $7,500 rebate to compensate for the fact that VinFast cars don’t qualify for federal EV tax incentives. The VF8, VinFast’s electric SUV-crossover, was being leased for $249 per month. The VF8 also comes in a Plus model, which was being leased for $299 per month, according to the lease offers obtained by Hunterbook Media. The lease deal, which was originally intended to last until Feb. 29, 2024, was extended in North Carolina until all 2023 models are sold from the dealership. The dealership officially sold out of its 2023 models — around 50 vehicles — in early April, according to a salesman. The new lease offer for the VF8 is $429 per month for the Eco and $579 per month for the Plus model, according to the dealership’s website. According to a lease offer given to Hunterbrook Media, a VF8 Eco would cost about $2,200 down for a 36-month lease at 10,000 miles per year. That means the lease offer includes a $15,488 discount being swallowed by VinFast, plus a $7,500 rebate to make up for the fact that VinFast doesn’t qualify for EV tax incentives. The implied value of the vehicle after the car is leased is listed at $19,352. The North Carolina dealership, which opened Dec. 28, 2023, says it has leased at least 38 cars via the discount.

Based on a review of 500 lease deals, this made the VF8 the “cheapest lease in America,” according to a Jalopnik write-up of the automotive research company CarsDirect’s report.

Sign Up

Breaking News & Investigations.

Right to Your Inbox.

No Paywalls.

No Ads.

Criticism of VinFast appears to be monitored and suppressed in Vietnam amid alleged arrests, a burning car, and lots filled with VinFast vehicles collecting dust

In 2021, VinFast reported a customer to the police for making what it said were “untrue” comments on YouTube. That video was later deleted.

In December 2023, Sonnie Tran, a blogger in Vietnam who had been critical of VinFast, was detained and allegedly interrogated for 35 hours by law enforcement. His phone and computer were reportedly seized before his release.

In January, numerous local outlets in Vietnam reported on a VinFast internal combustion vehicle on fire outside a courthouse in Hanoi. Within hours, these articles appear to have been pulled from the Vietnamese websites — although footage of the vehicle fire has survived on other social media sites. Hunterbrook Media had seen these articles when they were live — then the links stopped working.

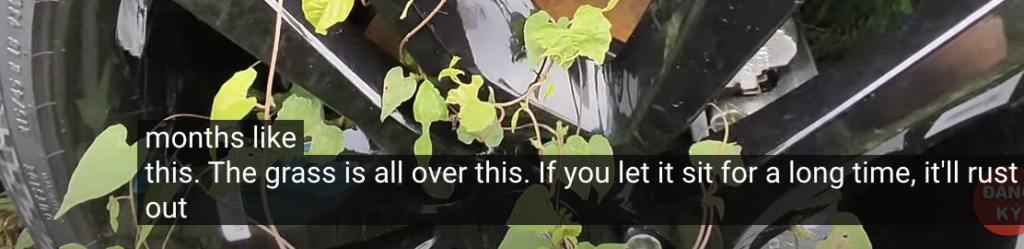

That same month, a Vietnamese blogger posted a video on YouTube of a giant field in Thái Nguyên, a small city near Hanoi, filled with hundreds of blue VinFast vehicles that appeared to belong to GSM. Weeds lined the wheels, as the cars collected dust.

Within days of the video being posted to YouTube, it was taken offline — and no longer accessible to the public.

But Hunterbrook Media — with help from the Bellingcat geolocation community — tracked down the location featured in the missing video. Hunterbrook Media’s research found that this was one of multiple sites where vehicles sold to GSM appear to have been parked for months at a time.

As of Feb. 11, 2023, 210 GSM taxis were parked in the complex. They had been in the area since at least December, satellite imagery showed.

Hunterbrook Media also found the location of another GSM lot along the Hồ Chí Minh – Long Thành – Dầu Giây Expressway, based on comments in a VinFast subreddit. Satellite imagery of the location shows a lot filled with upwards of 480 GSM-owned VinFast vehicles as of December 2023.

Hunterbrook Media confirmed the lot was filled with GSM vehicles three times in the past six months.

VinFast’s parent company, Vingroup, struggles to raise capital as Vietnamese government tightens scrutiny of conglomerates

Despite VinFast’s poor sales, the company has been described as having “nearly unlimited resources” due to its backing from Pham and Vingroup Joint Stock Co., one of the largest conglomerates in Vietnam.

VinFast also has repeatedly assured its investors of Vingroup’s financial commitments to the company, amid VinFast’s losses and difficulties in raising significant capital from third-party investors. Even the initial public offering – VinFast’s debut to public markets – barely raised the minimum $30 million that VinFast’s SPAC partner Black Spade had agreed to, because the vast majority of investors cashed out ahead of the merger, according to Bloomberg. In 2023, VinFast announced a subscription agreement of up to $1 billion with an investor named Yorkville Advisors, but only drew $30 million from the facility, according the VinFast’s Q4 2023 earnings call. (See: Link to document in Hunterbrook Media’s public share drive.) But Vingroup’s finances might be finite.

In 2023, amid negative cash flows and stagnating profits, Vingroup took on an additional $1.6 billion in borrowings. Vingroup reported a total of $4.74 billion (115,658,072 million VND) in drawdown of loans from credit facilities, of which $3.18 billion (77,620,096 million VND) was used to repay existing loans, resulting in a $1.6 billion net increase in loan balance. These figures were converted from the Vietnamese dong (VND) to U.S. dollars using the December 31, 2023, exchange rate of 0.000041 USD/VND. At the same time, profit from property sales — by far Vingroup’s largest revenue-generating segment — flatlined, despite a 44% jump in revenues last year that dominated headlines.

In August 2023, Vingroup’s bond offering to the Vietnamese public, aimed at raising funds for VinFast — at a record-high coupon rate of 14.5% to 15% — only managed to raise 35% of its subscription target, $28 million. The coupon rate exceeds the rates on all other bonds issued by VinFast or Vingroup on VinFast’s behalf that were disclosed by VinFast in SEC filings, which range from 4% to 14.5%. As of the end of 2023, Vingroup’s average borrowing cost was 10.6%.

At the same time, the Vietnamese government is tightening regulations on corporate bonds and tasking banks with resolving bad debts, potentially adding further strains on Vingroup’s efforts to raise capital for Vingroup for its carmaking subsidiary.

The Vietnamese government, meanwhile, is also doubling down on a corruption crackdown that has been dubbed the “blazing furnace.” Over the last two years, the government has made numerous high-profile arrests of the country’s wealthiest individuals — some of whom headed major companies, especially in real estate.

In early April, Trinh Van Quyet, a real estate tycoon who often vied with Vuong for the title of the richest man in Vietnam, was indicted on stock manipulation charges.

After Trinh’s initial arrest two years earlier, his FLC Group was forced to restructure and refocus on its core business in real estate, giving up its shares in an airline business — a pet project of Trinh’s that remained unprofitable and has cut most of its flight routes amid bankruptcy concerns — to recover funds for its debtors.

Le Hong Hiep, a senior fellow at the Vietnam Studies Program of the ISEAS-Yusof Ishak Institute, told Hunterbrook Media he believes Vuong is safe from this campaign.

The Vietnamese government’s backing of VinFast — at least initially — suggests its interest in seeing the company succeed. And it’s widely known that Vinhomes has received preferential treatment from the government over the years.

“I don’t think it will be targeted because … they are the darling of Vietnam,” he said. “The government provides support for them and if they wanted to target Vingroup, they would have done so earlier.”

Hiep, however, is skeptical that the Vietnamese government would ever step in to support VinFast financially.

“There has been no case in which the government has bailed out a private company,” said Hiep. “They have bailed out state-owned companies, but no private company.”

Tu Le, the auto industry analyst, said he “can see VinFast raising some capital to keep going, but not enough to resolve all the issues they currently have.”

“One of Vinfast’s main challenges currently,” he added, “is that if people don’t think you’re going to be around, they will avoid your product.”

McParland compared VinFast to another auto company that has failed to meet expectations: Fisker, the EV upstart that at one point had a market cap of over $6 billion valuation but was delisted from the NYSE earlier this year.

“Yes, [Fisker] was a small niche brand, but amongst folks who were plugged into luxury EVs and wanted something a little different than a Tesla or whatever, it was an interesting alternative. People would at least consider Fisker,” McParland said. “Whereas I don’t know of anybody that would even remotely consider a VinFast.”

Blake Spendley joined Hunterbrook from the Center for Naval Analyses (CNA), where he led investigations as a Research Specialist for the Marine Corps and US Navy. He built and owns the leading open-source intelligence (OSINT) account on X/Twitter, called @OSINTTechnical (>925K followers), which now distributes Hunterbrook Media content. His OSINT research has been published in Bloomberg, the Wall Street Journal, and The Economist, among other top business outlets. He has a BA in Political Science from USC.

Jenny Ahn joined Hunterbrook after serving many years as a senior analyst in the US government. She is a seasoned geopolitical expert with a particular focus on the Asia-Pacific and has diverse overseas experience. She has an MA in International Affairs from Yale and a BS in International Relations from Stanford. Jenny is based in Virginia.

Ben Rappaport is a reporter based in North Carolina. He has previous experience at outlets across the state including the Chatham News + Record and the Border Belt Independent. A proud graduate of the Hussman School of Journalism & Media at the University of North Carolina at Chapel Hill, Ben’s previous coverage has focused on education, politics and rural communities.

***

Hunterbrook Media publishes investigative and global reporting — with no ads or paywalls. When articles do not include Material Non-Public Information (MNPI), or “insider info,” they may be provided to our affiliate Hunterbrook Capital, an investment firm which may take financial positions based on our reporting. Subscribe here. Learn more here.

Please contact ideas@hntrbrk.com to share ideas, talent@hntrbrk.com for work opportunities, and press@hntrbrk.com for media inquiries.

LEGAL DISCLAIMER

© 2026 by Hunterbrook Media LLC. When using this website, you acknowledge and accept that such usage is solely at your own discretion and risk. Hunterbrook Media LLC, along with any associated entities, shall not be held responsible for any direct or indirect damages resulting from the use of information provided in any Hunterbrook publications. It is crucial for you to conduct your own research and seek advice from qualified financial, legal, and tax professionals before making any investment decisions based on information obtained from Hunterbrook Media LLC. The content provided by Hunterbrook Media LLC does not constitute an offer to sell, nor a solicitation of an offer to purchase any securities. Furthermore, no securities shall be offered or sold in any jurisdiction where such activities would be contrary to the local securities laws.

Hunterbrook Media LLC is not a registered investment advisor in the United States or any other jurisdiction. We strive to ensure the accuracy and reliability of the information provided, drawing on sources believed to be trustworthy. Nevertheless, this information is provided "as is" without any guarantee of accuracy, timeliness, completeness, or usefulness for any particular purpose. Hunterbrook Media LLC does not guarantee the results obtained from the use of this information. All information presented are opinions based on our analyses and are subject to change without notice, and there is no commitment from Hunterbrook Media LLC to revise or update any information or opinions contained in any report or publication contained on this website. The above content, including all information and opinions presented, is intended solely for educational and information purposes only. Hunterbrook Media LLC authorizes the redistribution of these materials, in whole or in part, provided that such redistribution is for non-commercial, informational purposes only. Redistribution must include this notice and must not alter the materials. Any commercial use, alteration, or other forms of misuse of these materials are strictly prohibited without the express written approval of Hunterbrook Media LLC. Unauthorized use, alteration, or misuse of these materials may result in legal action to enforce our rights, including but not limited to seeking injunctive relief, damages, and any other remedies available under the law.