Based on Hunterbrook Media’s reporting, Hunterbrook Capital is short $YY at the time of publication. Positions may change at any time. See full disclosures below.

The video app Bigo Live was 89% of third-quarter revenue at Joyy (NASDAQ: $YY). It was also the focus of a recent investigation by The New York Times, “On These Apps, the Dark Promise of Mothers Sexually Abusing Children.” The article documented how users pay via the app for livestreamers to commit sex crimes against kids, but did not mention Bigo Live’s owner Joyy.

According to the NYT investigation: “The Times learned of the streaming on Bigo Live from a 39-year-old man in Utah who had visited the woman’s profile page on his iPhone in what he described as a period of suicidal depression. The man, who spoke on the condition of anonymity, paid $550 for the mother and another woman to sexually abuse their daughters, including the 8-year-old girl and another believed to be 3 or 4.”

In response to the reporting, Apple and Google cut Bigo from app stores, although apps already installed on devices may be still functioning.

Joyy reported $559 million in third-quarter revenue, down from the prior year. $496 million came from Bigo, which already faced declining usage before the ban. Joyy’s other video apps, including Likee and Hago, totaled only $21.7 million. Its cash position may also be much weaker than it appears, as Joyy may be forced to return $1.9 billion it received from the terminated sale of its China-focused streaming platform YY Live to Baidu. Baidu ended that agreement in early 2024, claiming that Joyy failed to satisfy certain conditions of the deal. Joyy has recorded a $1.9 billion liability attributable to “Consideration received related to disposal of YY Live,” effectively acknowledging on its balance sheet that the funds may have to be returned. Joyy reported $396 million in restricted cash, much of which is tied to transaction-related escrow accounts from the YY Live deal. Even if the entire restricted cash balance is attributed to this transaction, YY would still face a $1.5 billion liability to Baidu. The company most recently reported $482 million in cash on hand. If this amount were fully used to meet obligations to Baidu, Joyy still has a $1 billion shortfall. To bridge this gap, Joyy would likely need to draw from its $1.8 billion in short-term deposits and $460 million in long-term deposits. This carries risks: such deposits may not be immediately liquid or could incur penalties for early withdrawal, further compounding financial pressures.

Joyy discloses the risk of sanctions from Apple or Google in its SEC filings — writing that its “business depends upon services provided by, and relationships with… the iOS App Store and the Google Play Store.” It added that if these “distribution channels voluntarily or involuntarily suspend their services to us,” Joyy could “lose users temporarily or permanently.”

Neither Apple nor Google responded to a request for comment on if the app could be reinstated, and if so, on what timeline.

A Google spokesperson told The Times that in response to its reporting, it had suspended a range of apps “out of an abundance of caution.”

Apple, meanwhile, told The Times it had taken down apps as well — and remains “constantly on guard for these kinds of violations which carry severe penalties including removal from the store and termination from our developer program.”

In a statement to Hunterbrook, Joyy appeared to confirm being taken off the app stores.

“We have a zero-tolerance policy against any malicious use of our platform,” the company claimed in a statement signed by the Bigo Live Team, saying it had implemented rules to “further protect users from harmful content.”

The company also claimed to be “actively collaborating with relevant authorities to rigorously and effectively combat violations.”

“We aim to restore our product availability as quickly as possible,” the Bigo Live Team stated.

A Recent Visit to Bigo Shows a Largely Deserted App

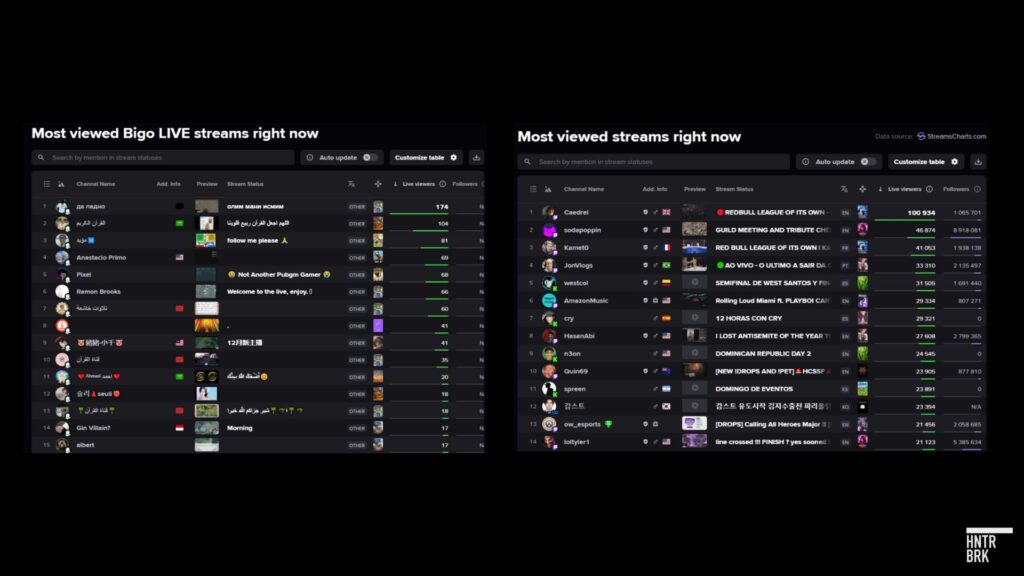

Bigo is still available on its less-used bigo.tv site, where the “Top Streams” on Sunday evening appeared to have extremely limited engagement. A streamer with more than 20 concurrent viewers ranks among the top 10 most watched. By contrast, the top 10 streamers across major platforms like Twitch consistently draw audiences exceeding 20,000 concurrent viewers.

In one featured livestream, a girl with braces sang along to music. In another, a woman ate chips. For this supposedly “Top Streamer,” Bigo reported 930 viewers — but there were very few chat messages and hardly any responses to the audience. A simultaneous Twitch stream of a man Christmas shopping, with a similar viewer count, had dozens of comments within a minute.

Another Bigo streamer, reportedly with over 2,000 concurrent viewers, spent most of the time silently listening to music, occasionally interacting with the few chat messages that came through.

Apple and Google Removals Cap a Year of Challenges for Baidu

On January 1, the Chinese conglomerate Baidu terminated its plan to acquire Joyy’s China-focused livestreaming platform YY Live. As a result, Joyy may have to return $1.9 billion to Baidu, which said that Joyy had failed to satisfy certain conditions of the deal.

In the year since, sales have been declining. Monthly average users for each of its apps are down significantly from a year earlier. Bigo had fallen to 36.5 million MAUs from 40.3 million in the third quarter of 2023.

And even before the Apple and Google ban, Joyy’s fourth-quarter revenue was already expected to shrink due to a decline in Bigo.

“We estimate BIGO to decline by about 3% QoQ,” wrote a Jefferies analyst in a November 27 research note. “We expect Bigo Live to remain a major revenue driver, with increasing contribution from short-form video platform Likee.”

Joyy’s new CEO put a positive spin on the path ahead in the most recent earnings call.

“We believe that both Bigo and Joyy are poised for a fresh start for the year ‘25,” the CEO stated, days before the Times investigation.

The now-terminated Baidu acquisition was first announced in 2020, a couple of days before the short activist Muddy Waters Research published a 71-page report criticizing Joyy: “We conclude that YY Live is ~90% fraudulent. YY’s international livestreaming business, Bigo, seems barely more real,” read the report. “Our base case estimate is that ~80% of Bigo’s revenue is fake, roughly on par with YY Live.”

Four years later, Joyy’s stock is down over 50%, though up since third-quarter earnings amid significant share buybacks. Only about 3% of its shares appear held short.

Despite Joyy having around a $2 billion market cap, the removal of its key app seems to have received almost no coverage — and extremely few user complaints. Searching for “Bigo Live” on X, Reddit, and YouTube surfaces an occasional post, almost always lewd, almost always with minimal engagement. On Google News as of Sunday night, there are only three results from the past seven days, including a Salt Lake Tribune syndication of the NYT investigation, an essay on a digital news site called Techweez, and an article by a marketing outlet that does not mention the investigation, instead focusing on apps similar to TikTok.

“Bigo Live Removed from App Store and Google Play,” posted a user named Florence on an app download site called Pyger APK Hub, who claimed that Bigo had previously been banned from Indonesia for hosting pornographic content and India due to national security concerns.

“$YY – The Chinese Social Media App That’s Already Banned,” posted Vineet Mudupalli, a software engineer who also reached out to Hunterbrook.

A thread on Apple Discussions included a couple dozen posts asking and answering why Bigo could no longer be downloaded, starting on December 5, which is also when data from app tracker SensorTower data shows downloads plummeting.

Google and Apple have banned apps from their platforms plenty of times for violating their terms on harmful or illegal content, but many have been allowed to come back after addressing the violations. Parler, a social media app that was removed from the app stores after the January 6 riot at the Capitol for posts encouraging violence and crime, was reinstated about a year later.

Other apps to return after temporary bans — ranging from one month to over a year — include Chatroulette, Chamet, and Tumblr.

The latter continues to present public safety risks: Hunterbrook identified a Tumblr account that appeared to belong to the school shooter in Madison, Wis., and listed school shootings among its interests.

And the streams on Bigo Live, themselves, appear to be slumping.

According to the streaming analytics company Streams Charts, Bigo Live regularly pulled in more than 100,000 viewers during 2022 and 2023, but after a brief removal from Apple’s App Store in 2023 related to advertising issues, viewership cratered.

Whether this latest removal from Apple and Google Play will have a similarly negative impact — or last even longer — remains to be seen.

Author

Blake Spendley joined Hunterbrook from the Center for Naval Analyses (CNA), where he led investigations as a Research Specialist for the Marine Corps and US Navy. He built and owns the leading open-source intelligence (OSINT) account on X/Twitter, called @OSINTTechnical (>925K followers), which now distributes Hunterbrook Media content. His OSINT research has been published in Bloomberg, the Wall Street Journal, and The Economist, among other top business outlets. He has a BA in Political Science from USC.

editor

Sam Koppelman is a New York Times best-selling author who has written books with former United States Attorney General Eric Holder and former United States Acting Solicitor General Neal Katyal. Sam has published in the New York Times, Washington Post, Boston Globe, Time Magazine, and other outlets — and occasionally volunteers on a fire speech for a good cause. He has a BA in Government from Harvard, where he was named a John Harvard Scholar and wrote op-eds like “Shut Down Harvard Football,” which he tells us were great for his social life. Sam is based in New York.

LEGAL DISCLAIMER

© 2026 by Hunterbrook Media LLC. When using this website, you acknowledge and accept that such usage is solely at your own discretion and risk. Hunterbrook Media LLC, along with any associated entities, shall not be held responsible for any direct or indirect damages resulting from the use of information provided in any Hunterbrook publications. It is crucial for you to conduct your own research and seek advice from qualified financial, legal, and tax professionals before making any investment decisions based on information obtained from Hunterbrook Media LLC. The content provided by Hunterbrook Media LLC does not constitute an offer to sell, nor a solicitation of an offer to purchase any securities. Furthermore, no securities shall be offered or sold in any jurisdiction where such activities would be contrary to the local securities laws.

Hunterbrook Media LLC is not a registered investment advisor in the United States or any other jurisdiction. We strive to ensure the accuracy and reliability of the information provided, drawing on sources believed to be trustworthy. Nevertheless, this information is provided "as is" without any guarantee of accuracy, timeliness, completeness, or usefulness for any particular purpose. Hunterbrook Media LLC does not guarantee the results obtained from the use of this information. All information presented are opinions based on our analyses and are subject to change without notice, and there is no commitment from Hunterbrook Media LLC to revise or update any information or opinions contained in any report or publication contained on this website. The above content, including all information and opinions presented, is intended solely for educational and information purposes only. Hunterbrook Media LLC authorizes the redistribution of these materials, in whole or in part, provided that such redistribution is for non-commercial, informational purposes only. Redistribution must include this notice and must not alter the materials. Any commercial use, alteration, or other forms of misuse of these materials are strictly prohibited without the express written approval of Hunterbrook Media LLC. Unauthorized use, alteration, or misuse of these materials may result in legal action to enforce our rights, including but not limited to seeking injunctive relief, damages, and any other remedies available under the law.