Based on Hunterbrook Media’s reporting, Hunterbrook Capital is short $ALTM, long $SQM, and long $ALB. A member of the team submitted a whistleblower report regarding the company’s accounting to the SEC. Hunterbrook Media also shared key data with a shareholder litigation firm.

This is a forensic accounting report by Nick Gibbons, an advisor and reporter at Hunterbrook Media. His experience includes a blend of qualitative and quantitative investment roles at Two Sigma, Norges Bank Investment Management, and Citadel. He is also an Adjunct Assistant Professor of Accounting at NYU Stern School of Business, Certified Fraud Examiner (CFE), and Master Analyst in Financial Forensics (MAFF). He began his career in forensic accounting at independent equities research provider Gradient Analytics.

Hunterbrook Media simultaneously published an investigation into Arcadium’s water exploitation in Argentina. The reporting was led by Daniel Sherwood, Senior Investigator and Financial Editor, and Katie Ross, Contributing Reporter. The six-month investigation involved on-the-ground visits, a review of tens of thousands of pages of local permitting documents, mining technical reports, Argentinian court filings and security filings, and interviews with experts. The reporting found that Arcadium’s flagship operation has required significantly more water to make its product than the U.S.-based company has presented — and more water than key competitors. (Methodology linked here.) The company has denied wrongdoing.

On January 4, 2024, Livent and Allkem merged to form international lithium producer Arcadium Lithium PLC (NYSE: $ALTM). While the merger was expected to enhance market position and profitability, a closer look at Arcadium’s financial statements reveals several concerning irregularities that raise questions about the company’s long-term viability and the sustainability of its reported profitability.

It also raises questions about whether the company’s management is engaging in good faith accounting practices — or whether leadership is relying on misleading financials to cover up the truth about a bull market merger that has not gone according to plan, in part to hit compensation thresholds that it would otherwise have missed.

Asked for comment on findings related to the company’s accounting, Arcadium initially said the company planned to be in touch before the deadline provided. Ultimately, however, Arcadium declined to address any of the issues. “We are comfortable with our accounting treatment and would continue to refer you to our filings, which include the required disclosures on these matters,” the company said.

Key Findings

1) Spring-Loaded Acquisition Masking Livent’s Weakness

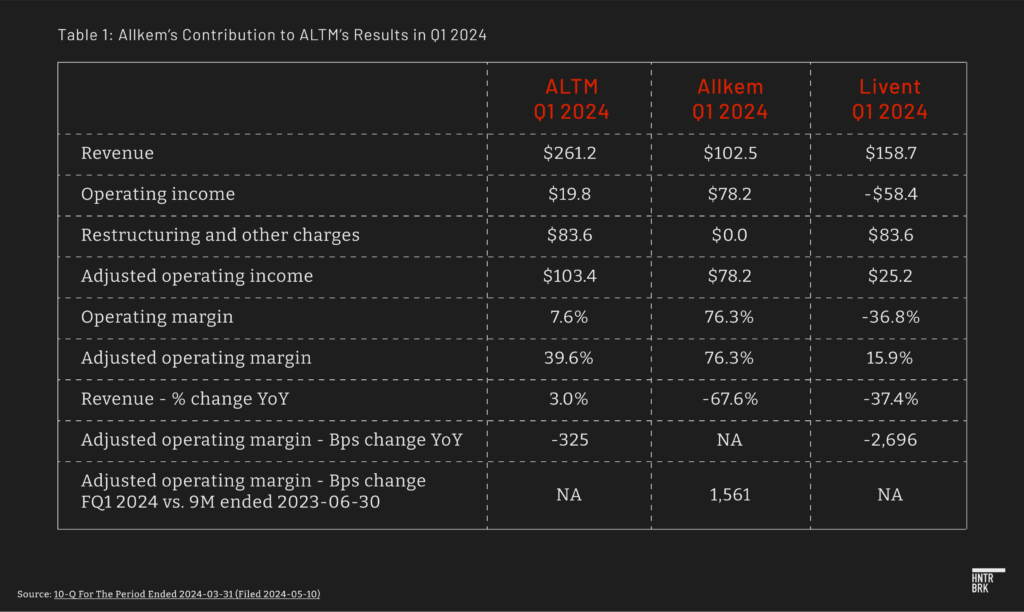

Arcadium’s financial reporting following the merger with Allkem appears to mask a significant decline in Livent’s profitability. While the combined company reported a 3% increase in revenue to $261.2 million and a seemingly modest 325 basis points (bps) decrease in operating margin to 39.6% compared to the same quarter in the previous year, a closer examination reveals a more troubling picture.

Our analysis shows that Livent’s standalone adjusted operating margin actually plummeted by a significant 2,696 bps year-over-year, to just 15.9%. This steep decline is concealed by Allkem’s abnormally high adjusted operating margin of 76.3%, which it claimed to achieve despite declining revenue. Such a high margin suggests that Arcadium may be engaging in aggressive M&A accounting practices, such as pre-booking future expenses, building reserves, and reversing reserve recognition. (More later on how, exactly, Arcadium does this spring-loading.)

By including Allkem’s seemingly unsustainable, merger-related benefits in its financial reporting, Arcadium is effectively overstating its true profitability. As these benefits are exhausted over time, Arcadium’s overall profitability is likely to decline toward Livent’s significantly reduced standalone profitability.

2) Excess Acquired Liabilities and Non-GAAP Adjustments

Arcadium’s first-quarter earnings may be significantly overstated due to potential accounting irregularities and the misclassification of regular expenses as “transaction-related.”

The company’s financial reporting raises several red flags:

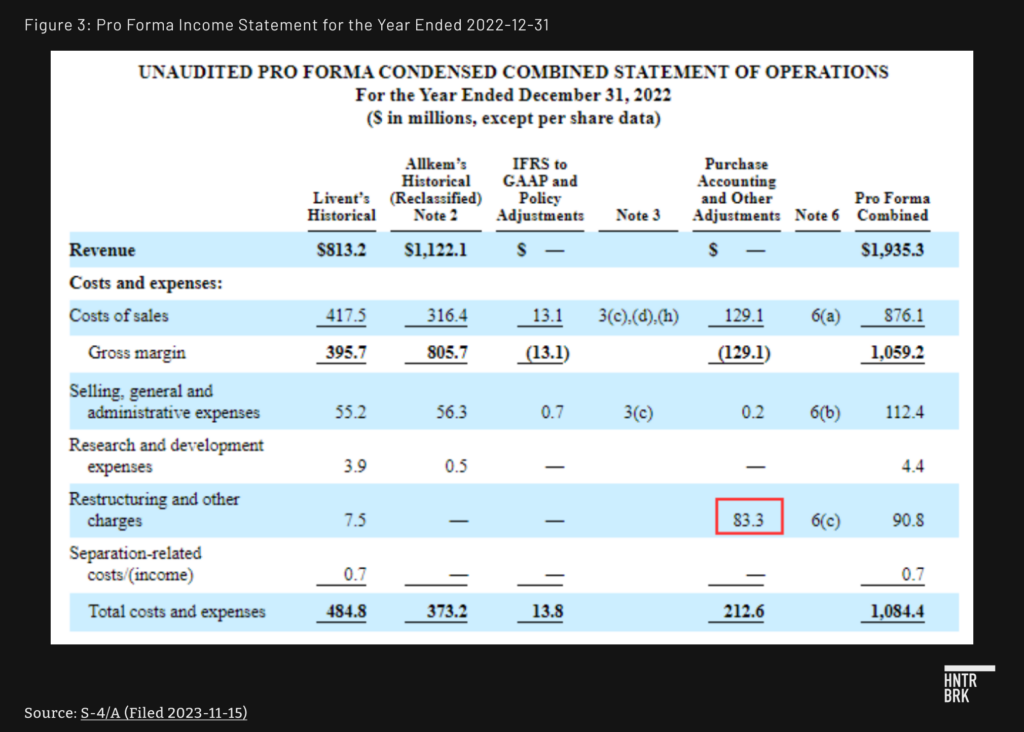

First, before the merger, Arcadium indicated that Livent and Allkem would recognize a total of $83.3 million in transaction-related expenses, with Allkem responsible for $45.2 million in its pre-combination income statement. However, in Q1 2024, after the merger, Arcadium recognized $67.0 million in costs related to the Allkem Livent Merger. In combination with $21.8 million of transaction-related expenses recognized by Livent standalone in Q4 2023, it appears that all expenses related to the acquisition were entirely borne by Livent, which is inconsistent with provided guidance.

This discrepancy, in combination with the acquisition of excessive liabilities, suggests that Allkem may have improperly classified regular expenses as transaction-related costs in the first quarter. In doing so, Allkem could have artificially inflated Arcadium’s post-merger earnings by making these expenses appear to be one-time, nonrecurring items.

This potential misclassification of expenses may have allowed Arcadium to report higher profitability in the first quarter of 2024 than it could have if these costs were correctly categorized as regular expenses. This potential manipulation of financial results calls into question the accuracy and transparency of Arcadium’s financial disclosures and raises concerns about the company’s true underlying profitability.

Second, Livent appears to have acquired approximately $52.9 million in additional liabilities compared to its historical balance sheet, with a 61.5% increase in accounts payable. This substantial increase aligns with concerns that Allkem may have pre-booked expenses in the second half of 2023 to artificially boost profitability when combined with Livent. By front-loading expenses, Allkem could have manipulated its financial performance to make the merged entity appear more profitable than it actually is.

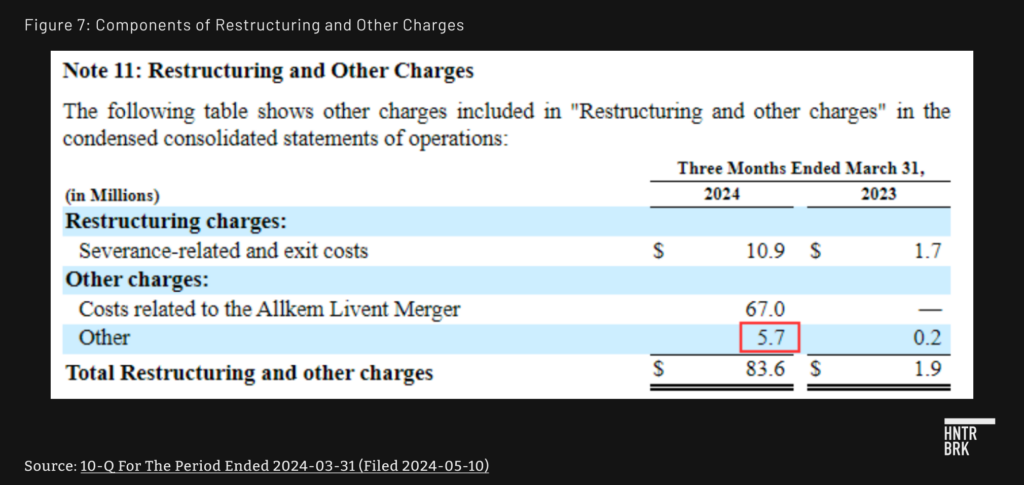

Third, Arcadium reported $83.6 million in restructuring and other charges in Q1 2024, including $67.0 million related to the merger. The lack of detailed explanations for the $5.7 million in “other” charges raises suspicions that regular SG&A expenses may have been misclassified as nonrecurring items. This potential reclassification of regularly occurring expenses as one-time charges further reinforces concerns about the company’s financial reporting practices.

The combination of these issues — the discrepancy in transaction-related expenses, the significant increase in Allkem’s liabilities, and the potential misclassification of regular expenses — suggests that Arcadium’s first-quarter earnings may be artificially inflated.

3) Disproportionate Inventory Levels

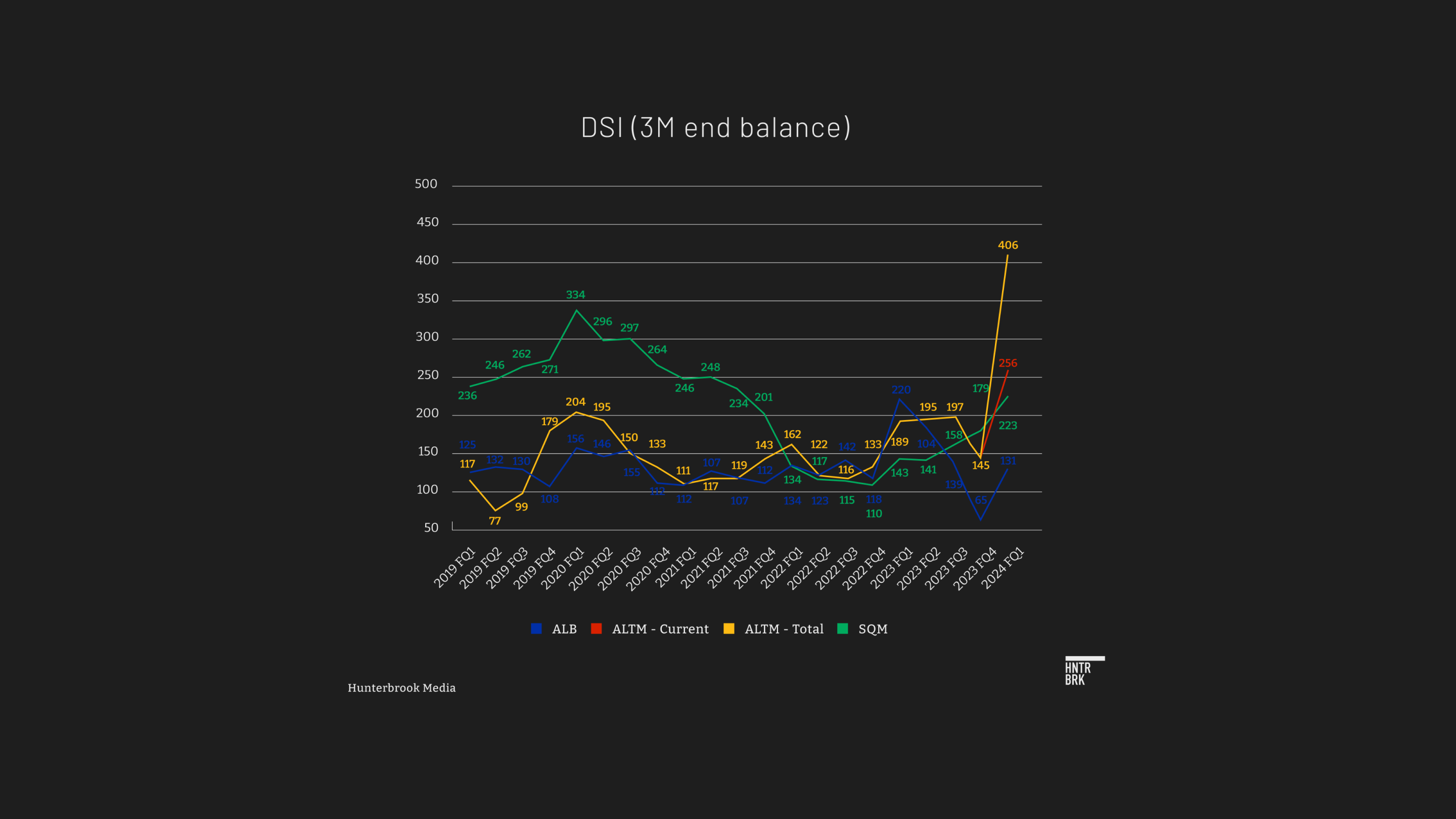

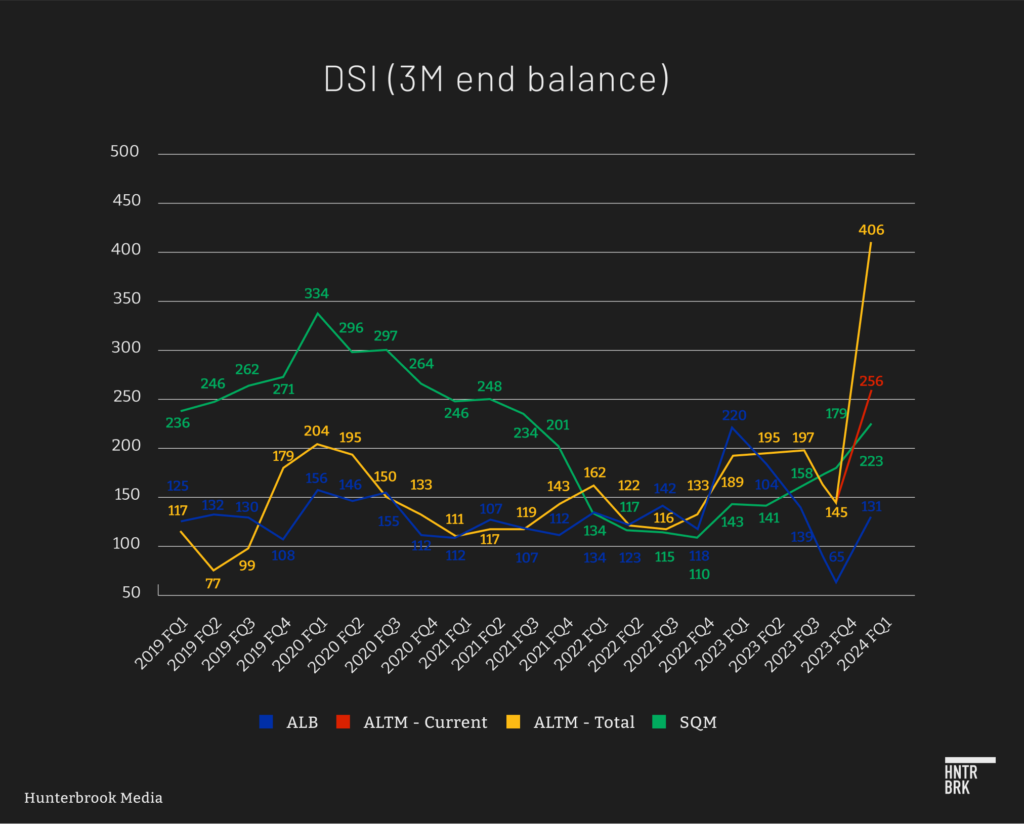

Arcadium’s days sales in inventory (DSI) jumped to 406 days, significantly higher than its peers SQM (223 days) and ALB (131 days) at the end of Q1 2024. But in what appears to be an attempt to play down this discrepancy, Arcadium reported its inventories to be 256 days, separating what it referred to as long-term “semi-finished goods” inventory into the “other assets” (long-term).

Competitors don’t appear to separately classify their long-term inventories. This indicates that Arcadium may have more than double as much total inventory as Albemarle and 82% more inventory than Sociedad Química y Minera.

Arcadium’s “semi-finished goods inventory” grew from $51.9 million as of 2022-06-30 to $192.2 million in Q1 2024. This adds accounting risks, with the potential for inflated current gross margins and future profitability compression due to lower market prices or cost adjustments.

Historical analyses of companies with high DSI levels show that this metric often leads to subsequent gross margin compression, highlighting the risks of current inflated inventory levels.

4) Misleading Financial Targets and Compensation Metrics

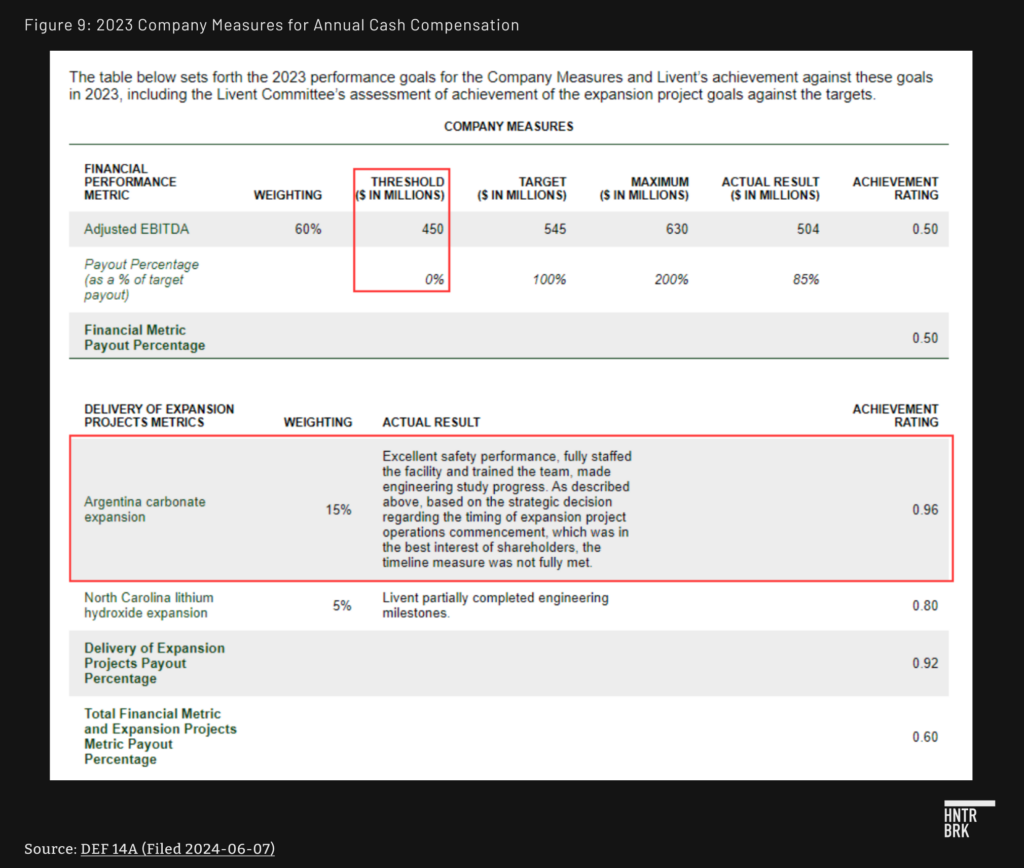

Arcadium appears to have inflated its adjusted EBITDA for compensation purposes by including $56.7 million in restructuring and other charges, $54.1 million of which were related to the merger.

Adjusted EBITDA is a non-GAAP financial measure that starts with EBITDA (earnings before interest, taxes, depreciation, and amortization) and then adds back certain expenses that the company considers nonrecurring or unrelated to its core operations.

By adding back the $56.7 million in restructuring and merger-related charges, Arcadium effectively increased its adjusted EBITDA. This is because adjusted EBITDA treats these expenses as if they didn’t occur, even though they represent real costs to the business. Without these adjustments, Arcadium’s adjusted EBITDA would have been $447.3 million, missing the $450 million target threshold that accounted for 60% of short-term compensation.

While adding back one-time expenses to EBITDA is a common practice, it can be misleading if those charges are actually recurring or represent real costs of doing business. In this case, the adjustments allowed Arcadium to meet a compensation target that it otherwise would have missed, raising questions about the appropriateness of the adjustments and the incentives they create for management.

Furthermore, during the merger process, Arcadium projected $1.1 billion in sales and $594 million in adjusted EBITDA, but set the compensation target at a lower $545 million in adjusted EBITDA.

This misalignment between management incentivization and projections for shareholders suggests that the company may be prioritizing short-term compensation over long-term value creation.

Additionally, Arcadium’s management awarded themselves a 96% achievement rating for the Argentina carbonate expansion, despite delays, calling it a “strategic decision.” The company further adjusted EBITDA higher for compensation purposes and increased its overall achievement measure by 5%. These actions further underscores the potential misalignment between management’s interests and those of shareholders.

Recap

While the merger with Livent and Allkem was expected to bolster Arcadium’s market position and profitability, our investigation reveals several red flags in the company’s financial statements. The aggressive M&A accounting practices, inflated inventory levels, and misleading financial targets and compensation metrics raise serious concerns about the sustainability of Arcadium’s reported profitability and the company’s overall financial viability.

They also raise questions regarding whether shareholders have been presented with the honest truth about the company’s financials — and the justifications for the merger.

Sign Up

Breaking News & Investigations.

Right to Your Inbox.

No Paywalls.

No Ads.

In the Weeds: A Forensic Look at the Numbers

Spring-Loaded Acquisition Masking Livent Weakness

- In Q1 2024, Arcadium’s revenue increased by 3.0% year-over-year (YoY) to $261.2 million. The company generated $103.4 million in operating income before taxes, excluding $83.6 million for restructuring and other charges. This resulted in a 39.6% operating margin, which was a decrease of 325 basis points (bps) compared to the same quarter in the previous year.

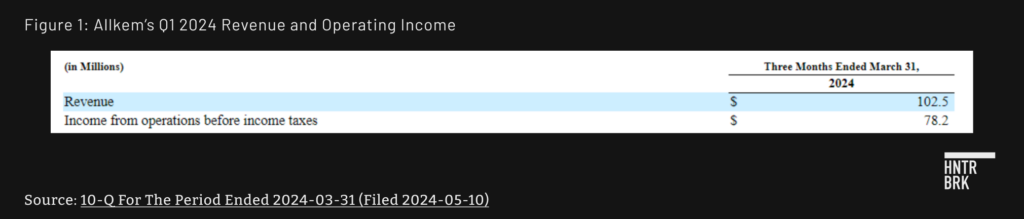

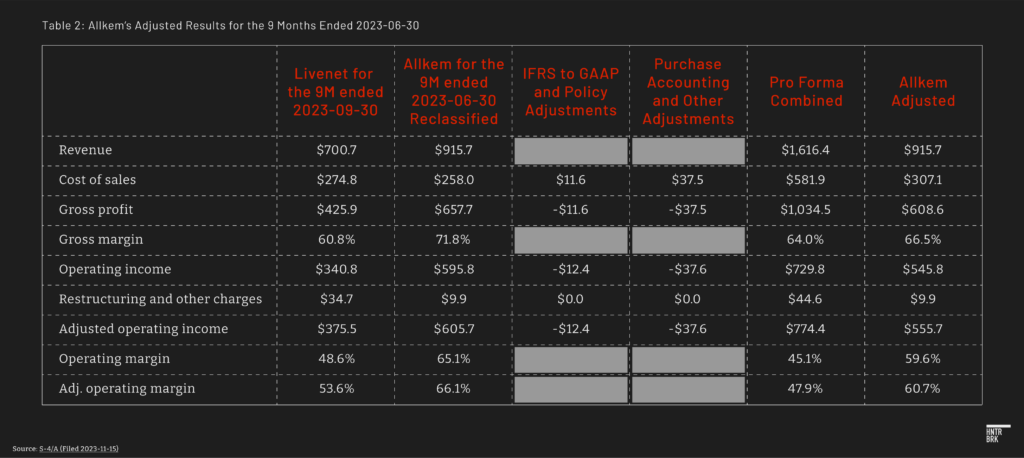

- Allkem, a subsidiary of Arcadium, contributed $102.5 million in revenue, which was a 67.6% decrease YoY. However, Allkem’s operating income before taxes was $78.2 million, resulting in an unusually high operating margin of 76.3%. An analysis of Allkem’s pro forma results for the 9-months ended 2023-06-30 showed that its adjusted operating margin improved by 1,561 bps relative to pro forma results. This significant improvement in operating margin, despite the decline in revenues, suggests that Allkem may have employed aggressive mergers and acquisitions (M&A) accounting practices.

- Excluding Allkem’s contribution, Livent’s revenue declined by 37.4% YoY to $158.7 million. Livent generated only $25.2 million in operating income before taxes, resulting in a 15.9% adjusted operating margin, which was a decrease of 2,696 bps YoY. This indicates that without Allkem’s significant operating income contribution, Livent would have experienced a substantial decrease in profitability.

- In the future, Allkem’s profitability may return to its previous levels and/or Arcadium’s overall profitability may decrease toward Livent’s standalone profitability as demonstrated in Q1 2024.

Adjusted operating income = Operating income + addback of Restructuring and other charges.

Operating margin = Operating income / Revenue

Adjusted operating margin = Adjusted operating income / Revenue

Adjusted operating income = Operating income + addback of Restructuring and other charges.

Operating margin = Operating income / Revenue

Adjusted operating margin = Adjusted operating income / Revenue

Excess Acquired Liabilities Support Spring-Loading Concerns

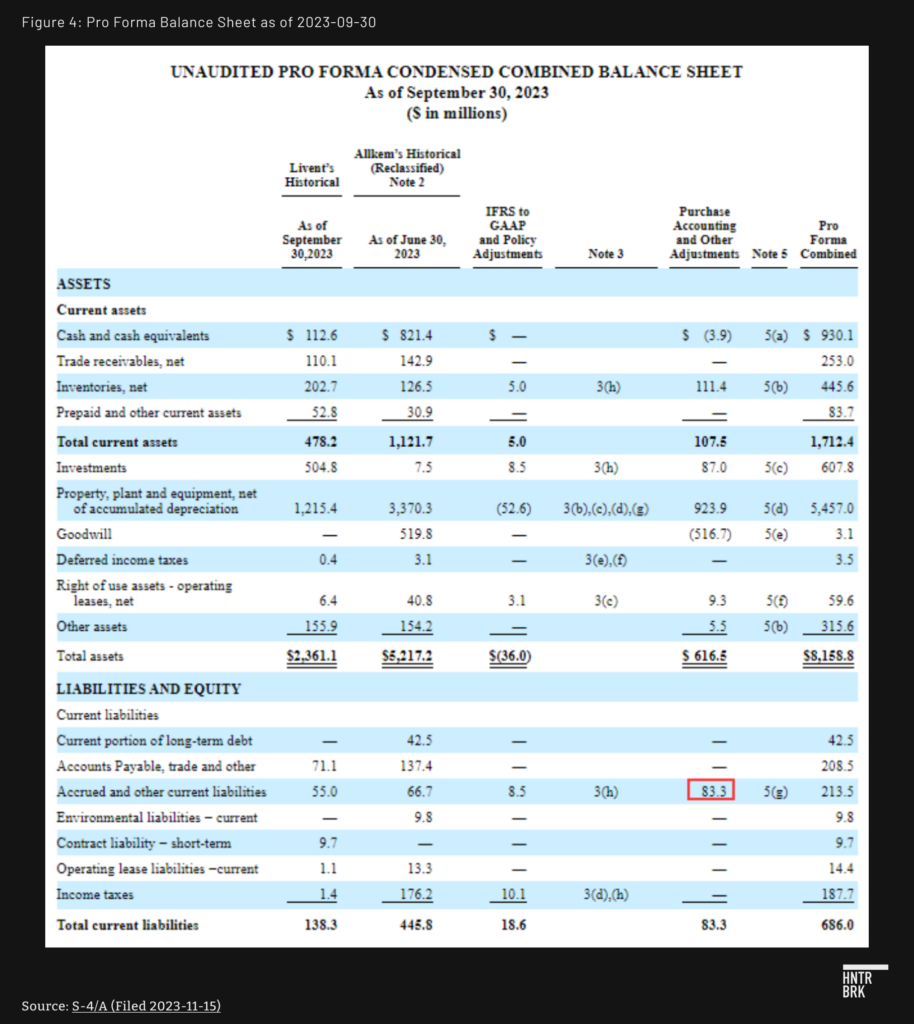

- To find potential explanations for the outsized operating margin contribution from Allkem we further reviewed the company’s purchase price allocation and pro forma financials as indicated in ALTM’s S-4/A (filed 2023-11-15).

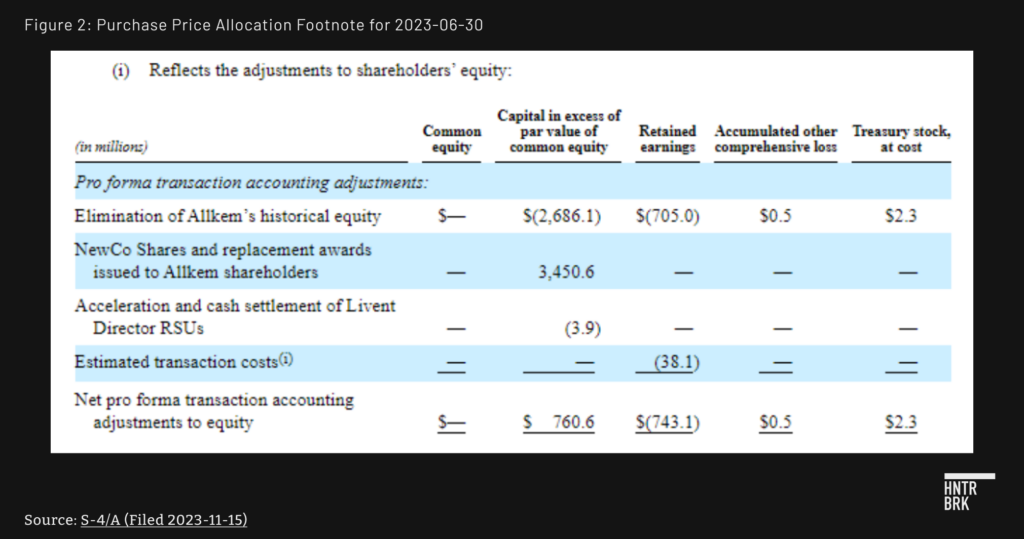

- Included within the purchase price allocation footnotes, ALTM indicated that Livent would recognize $38.1 million of estimated transaction costs after 2023-09-30, and that Allkem would recognize $45.2 million of estimated transaction costs “in Allkem’s pre-combination income statement” and this would be “reflected as a liability assumed by Livent, and do not impact the statement of operations of the combined entity.” This is $83.3 million in total transaction-related expenses for the combined entity.

- For perspective, Allkem incurred $9.9 million in transaction costs for the 12-months ended 2023-06-30, implying that the estimated transaction costs would be 456% of amounts already incurred. Additionally, Allkem’s Corporate and administrative expenses totalled $66.5 million for the 12-months ended 2023-06-30, implying that the estimated transaction expenses represented 68.0% of annual corporate expenses.

- On a standalone basis, certain regular SG&A expenses could be recharacterized as transaction-related expenses. This risk would manifest in the form of higher levels of SG&A post-combination after no longer making these adjustments.

- In Q4 2023, Livent recognized $21.8 million of cost related to the Allkem Livent Merger, which would imply Livent had $16.3 million of remaining estimated transaction costs and in combination there were $61.5 million of costs remaining to be recognized across Allkem and Livent.

- In Q1 2024, post-acquisition, Arcadium recognized $67.0 million of cost related to the Allkem Livent Merger. This amount plus the remaining estimated costs to be incurred by Livent works out to $83.3 million, suggesting that Allkem did not recognize transaction costs during H2 2023, which contradicts the guidance provided in the S-4/A.

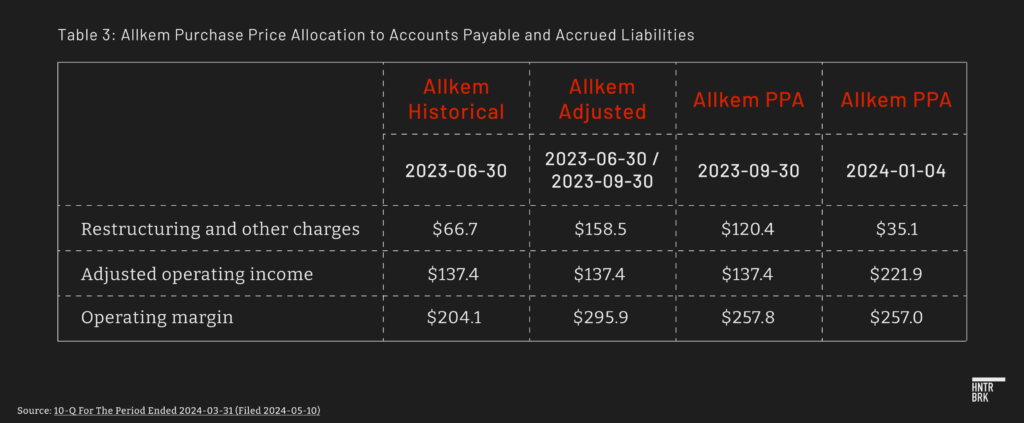

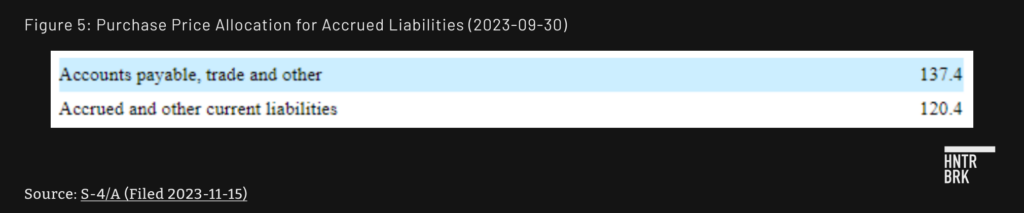

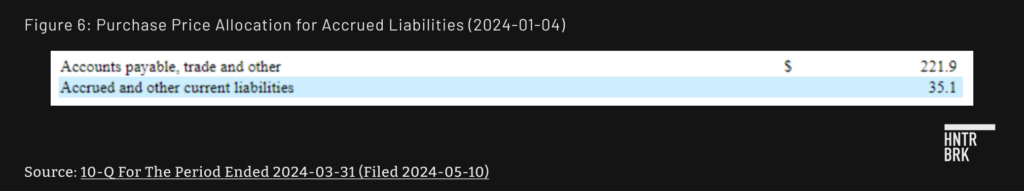

- Digging further, we compared the presentation of the pro forma balance sheet as well as purchase price allocations assigned as of 2023-09-30 and 2024-01-01 for accounts payable, trade and other (“accounts payable”), as well as accrued and other current liabilities (“accrued liabilities”).

- As part of the presentation of the pro forma balance sheet, no adjustments were made to the $137.4 million of accounts payable, and accrued liabilities were increased $91.8 million consisting of $8.5 million for IFRS to GAAP and Policy Adjustments and $83.3 million of Purchase Accounting and Other Adjustments to reflect the estimated transaction costs to be incurred by the combined entity to a revised balance of $158.5 million. The separate purchase price allocation as of 2023-09-30 reflected the same balance of accounts payable, but accrued liabilities were assumed to be $120.4 million, or $38.1 million lower than the pro forma presentation, which aligns with the estimated transaction costs to be incurred by Livent. Accounts payable and accrued liabilities totalled to $257.8 million as of 2023-09-30.

- In the Q1 2024 10-Q, the purchase price allocation for Allkem as of 2024-01-04 showed that only $35.1 million of accrued liabilities were acquired. This amount was $85.3 million lower than the accrued liabilities balance in the purchase price allocation as of 2023-09-30.

- At first glance, this might seem like a positive sign, suggesting that the company was more conservative in its valuation of accrued liabilities.

- However, upon further examination, it was observed that accounts payable had significantly increased to $221.9 million. This amount was $84.5 million higher than the accounts payable balance in the previous purchase price allocation. Interestingly, the increase in accounts payable nearly matched the decrease in accrued liabilities.

- This indicates that Livent did acquire approximately $52.9 million in incremental liabilities across accounts payable and accrued liabilities relative to the company’s historical presentation of its balance sheet. In other words, despite the apparent decrease in accrued liabilities, the overall liabilities assumed by Livent in the acquisition increased by $52.9 million when compared to the company’s previous balance sheet.

- Furthermore, the substantial 61.5% increase in accounts payable raises concerns that Allkem may have pre-booked expenses in the second half of 2023. This is consistent with the suspicion that expenses were recognized in a manner that would boost the profitability of Allkem when combined with Livent.

- To summarize, while the accrued liabilities decreased by $85.3 million, the accounts payable increased by a similar amount of $84.5 million. This suggests that the company might have reclassified certain accrued liabilities as accounts payable, rather than actually reducing the overall liabilities assumed in the acquisition. Additionally, the significant increase in accounts payable, along with the $52.9 million in incremental liabilities acquired by Livent, raises concerns about potential expense manipulation by Allkem to enhance its profitability prior to the merger with Livent.

- These observations point to a number of interrelated risks:

- If expenses were booked in H2 2023 for the benefit of future results, risk exists that expenses will be higher / profitability will be lower than demonstrated in Q1 2024 as Allkem’s results annualize.

- If Livent acquired excess liabilities, these liabilities could potentially serve as cookie jar reserves, which can be reversed (and recognized at a 100% operating margin contribution) to offset the recognition of current expenses and provide an unsustainable benefit to profitability. Once these unsustainable benefits are exhausted, the company’s profitability may appear weaker than presented in Q1 2024 as well as any periods that reflect these unsustainable benefits.

Represents estimated transaction-related costs that are not currently reflected in the historical consolidated financial statements of Livent; these estimated transaction costs consist primarily of advisor fees, legal fees, accounting fees, and certain deal related bonuses. It is assumed that these costs will not affect the condensed combined statements of operations beyond twelve months after the closing date of the transaction. The balance excludes $45.2 million of estimated transaction costs to be incurred by Allkem as a result of the transaction, which were not reflected in the Allkem 2023 Annual Report. These costs will be recognized as an expense in Allkem’s pre-combination income statement and therefore they are reflected as a liability assumed by Livent, and do not impact the statement of operations of the combined entity.”

Source: S-4/A (filed 2023-11-15)

Represents $83.3 million of transaction-related costs for the year ended December 31, 2022 that are not currently reflected in the historical consolidated financial statements of Livent or Allkem. Livent recognized transaction related costs of $2.9 million and $25.0 million in the Pro Forma Annual Period and Pro Forma Interim Period, respectively. Allkem recognized transaction related costs of $9.9 million in the Pro Forma Interim Period. It is assumed that these costs will not affect the condensed combined statements of operations beyond twelve months after the closing date of the transaction.”

The pro forma adjustment for accrued and other current liabilities represents: (i) $38.1 million of estimated transaction-related costs to be incurred by Livent which have not yet been reflected in the historical consolidated financial statements of Livent and (ii) $45.2 million of estimated transaction-related costs to be incurred by Allkem which have not yet been reflected in the historical consolidated financial statements of Allkem.”

Non-GAAP Adjustment for Charges Further Flatter Results

- In Q1 2024, Arcadium recorded $83.6 million for restructuring and other charges that were adjusted from the presentation of non-GAAP results, consisting of $10.9 million of restructuring charges for severance-related and exit costs (up from $1.7 million recorded in Q1 2023 and $2.4 million recorded in full year 2023 results).

- While severance charges generally would be fair to characterize as nonrecurring, the company has indicated that exit costs include demolition costs and write-downs of long-lived assets. Certain regularly occurring expenses could be characterized as restructuring activities, thereby causing non-GAAP profitability to be overstated.

- Other charges consisted of the aforementioned $67.0 million of costs related to the Allkem Livent Merger. As previously stated, risk exists that certain regularly occurring SG&A costs are being allocated to this cost line.

- Additional charges included $5.7 million attributed to “other” (versus $0.2 million recognized in Q1 2023 and negative $0.6 million recorded in full year 2023 results). Prior to Q1 2024, the company would also break out environmental remediation charges, however these appear now to be consolidated within “other.” Given the nature of Arcadium’s business, it is reasonable to assume the company will regularly incur environmental remediation-related expenses, and therefore, it does not seem appropriate to characterize these charges as nonrecurring for the purposes of the presentation of non-GAAP results.

- In addition to flattering the presentation of non-GAAP results, the lack of explanation regarding what is included in the $5.7 million of other other charges further supports our concerns that certain regularly occurring expenses may be getting reclassified for the benefit of flattering non-GAAP results.

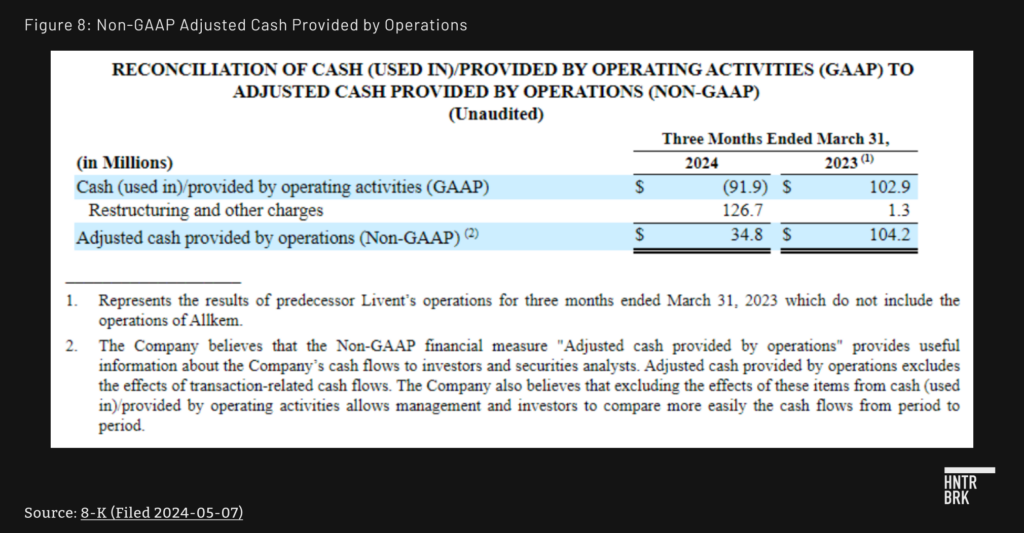

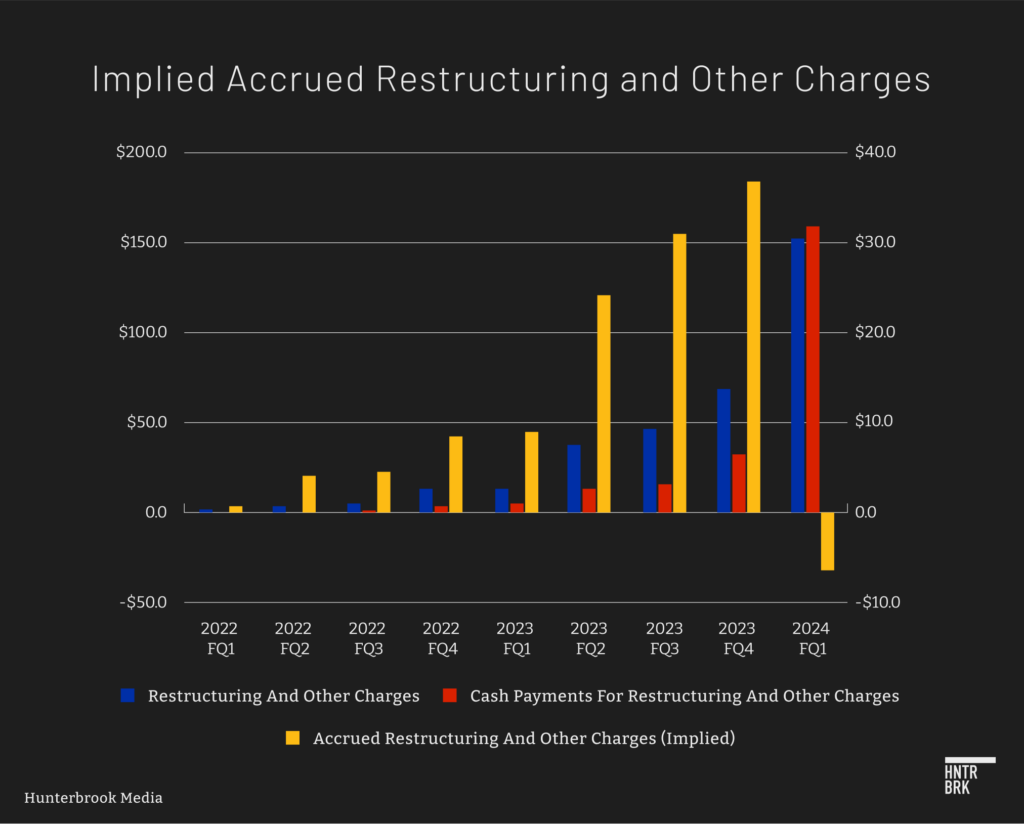

- In addition to concerns that these adjustments flatter earnings, ALTM also adds back cash outflows for restructuring and other charges to its presentation of non-GAAP adjusted cash from operations. The company made adjustments totaling $126.7 million for cash outflows associated with restructuring and other charges. The amount is higher than the expense recognized due to paying out previously recognized charges. Consistent with our concerns regarding these adjustments potentially containing regularly occurring SG&A costs, risk also exists that non-GAAP adjusted cash from operating activities overstates the company’s cash generation.

- Based on an analysis of cumulative charges recognized versus amounts paid from Q1 2019 through Q1 2024, the company paid out $6.4 million more than amounts recognized. Cumulative charges recognized totaled $152.4 million while amounts paid totaled $158.8 million. The payout of excess amounts relative to amounts charged is consistent with our concerns that the company acquired excess liabilities.

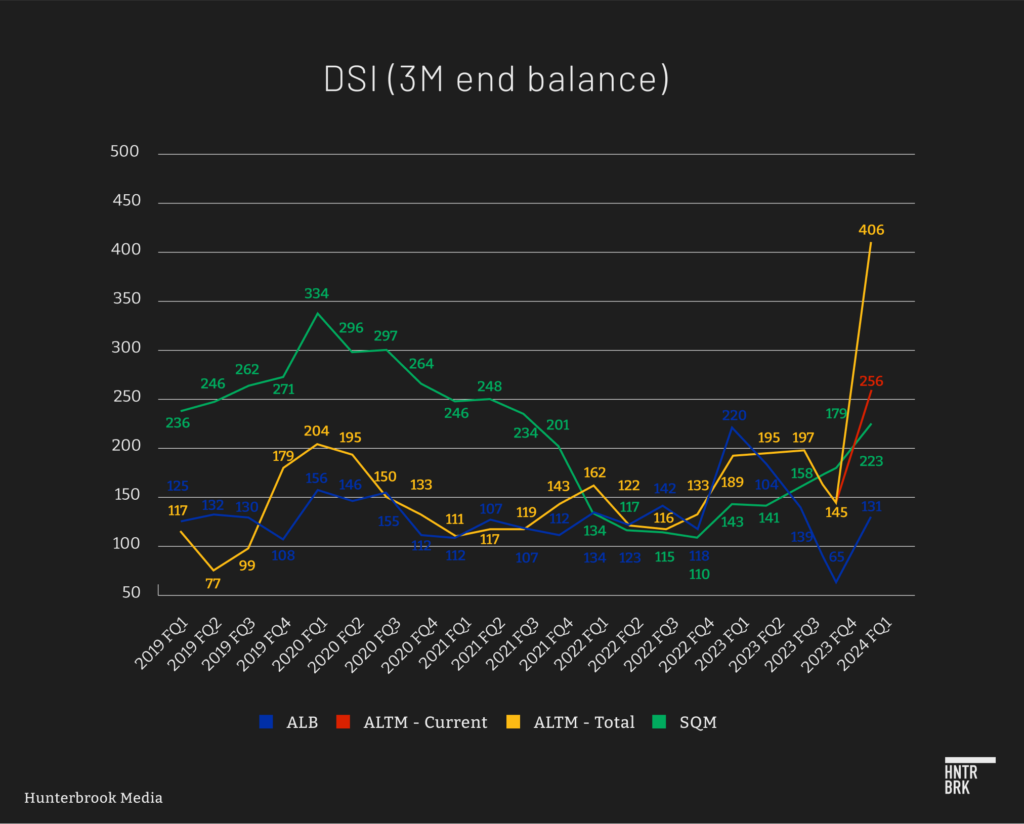

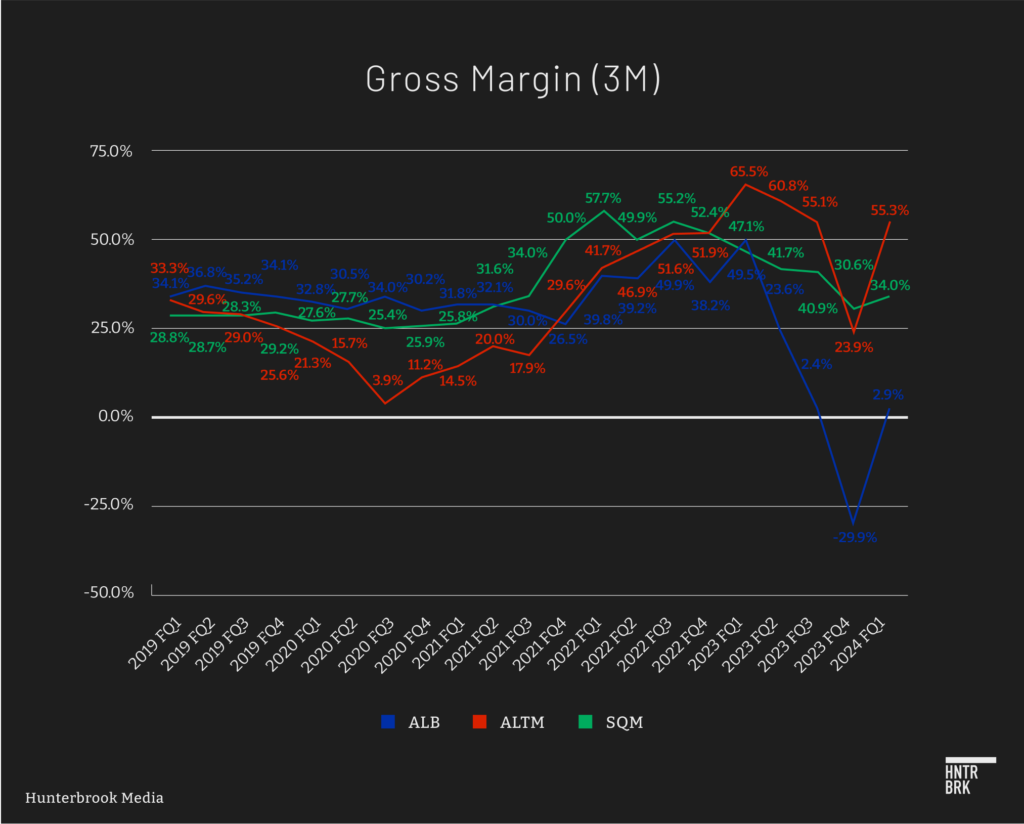

Inflated Inventory Levels

- Following the merger, ALTM’s days sales in inventory (DSI) jumped to 256 (406 including long-term inventory) days in Q1 2024, representing the highest level recorded from 2019 to current. This compares to peers SQM, which had 223 days, and ALB, which had 131 days at the end of Q1 2024. Of note, during Q4 2023, Arcadium recorded a $604.1 million charge to reduce the value of spodumene and finished goods to net realizable value due to the decrease in lithium prices. See Chart 1 (below) for a time series analysis of comparative DSI levels.

- On a standalone basis, outsized DSI levels both relative to peers and history may be indicative of excessive capitalization of costs in inventories and/or an overbuild of inventory relative to end market demand. In addition to potentially unsustainably benefiting reported gross margins, outsized DSI may weigh against future gross profitability due to lower realized prices relative to a higher cost basis and/or due to lower of cost or market adjustments.

- The fact that Arcadium is now recording long-term semi-finished goods inventory within other assets (long-term), as part of the acquisition of Allkem, heightens our concerns. Based on Allkem’s annual reports and the S-4/A regarding the acquisition, this represents brine that is not expected to be processed within the next 12 months.

- Allkem had reported $51.9 million and $86.7 million of these inventories as of 2022-06-30 and 2023-06-30, respectively. Livent indicated within the purchase price allocation for Allkem that as of 2023-09-30 they attributed $92.2 million to these inventories, which was included in the $159.7 million balance of other assets.

- However, as reflected in the 10-Q for Q1 2024, they now had a balance of $192.2 million recorded in long-term inventory. The purchase price allocation for Allkem as of 2024-01-04 indicated that total other assets acquired were $192.9 million, which would potentially suggest that the amount now reflected in ALTM’s long-term inventories was entirely acquired. However, the company’s cash flow statement reflected a negative cash utilization for change in prepaid and other current assets and other assets of $84.0 million, which may indicate that a portion of the $192.2 end balance may have been accrued during the periods.

- Semi-finished inventories carry incremental accounting related risks relative to other inventory types.

- For example, finished goods can be compared against market prices, and direct costs of raw materials are relatively easy to measure. However, in assessing the valuation of semi-finished inventories, an estimate of costs required to convert semi-finished inventories to finished goods must be made and then compared to market prices. As these specific semi-finished inventories are classified as long-term, assumptions regarding market pricing beyond 12 months must be made in order to assess valuation.

- Additionally, risk exists that excessive capitalization of costs are being recorded within long-term inventories, which would serve to benefit current gross margins at the expense of future gross margins.

- Further, the current balance of long-term inventories represents an incremental 150 days sales in inventory. When combined with current inventories, ALTM exited the quarter carrying 406 days sales in inventory. We noted that peers SQM and ALB do not report long-term inventories.

- As shown in Chart 2 (below), there have been multiple points from 2019 to current in which DSI reached individual company-level records and subsequently gross margins compressed significantly in later periods as DSI levels were reduced.

Misleading Financial Targets and Compensation Metrics

- Adjusted EBITDA Manipulation: According to the company’s 2024 Proxy Statement, ALTM’s key financial measure for compensation purposes was adjusted EBITDA, with a threshold of $450 million. For 2023, the company reported $502.5 million in adjusted EBITDA but rounded it up to $504 million when determining compensation. This adjusted EBITDA figure included $56.7 million in restructuring and other charges, of which $54.1 million were related to the merger. If these adjustments were excluded, the adjusted EBITDA would have been $447.3 million, falling short of the $450 million threshold. Meeting this threshold accounted for 60% of the company’s short-term compensation. The company further adjusted the achievement rating from 0.45 to 0.50, “In light of market pricing conditions, and the Board’s related strategic considerations surrounding the timing of expansion project operations commencement … to account for the decision that was in the best interest of shareholders but that nevertheless affected results.”

- Projection Misalignment: During the merger process, ALTM projected $1.1 billion in sales and $594 million in adjusted EBITDA. However, when setting the compensation target, the company lowered the adjusted EBITDA target to $545 million. This misalignment between the projections used for the merger and the compensation target raises questions about the company’s financial planning and incentive structures.

- Self-Assigned Achievement Ratings: ALTM awarded themselves a 96% achievement rating for the Argentina carbonate expansion project, despite experiencing delays in the project’s completion. The company justified this high rating by characterizing the delays as a “strategic decision.” This self-assigned rating, which appears to overlook the project’s actual performance, suggests a potential lack of objectivity in the company’s self-assessment process.

Author

Nick Gibbons is a seasoned forensic accounting expert and investment researcher. His experience includes a blend of qualitative and quantitative investment roles at Two Sigma, Norges Bank Investment Management, and Citadel. He began his career in forensic accounting at independent equities research provider Gradient Analytics. He additionally has a background in graduate level education having previously served as Adjunct Professor of Finance and Accounting at Thunderbird School of Global Management and currently as Adjunct Assistant Professor of Accounting at NYU Stern School of Business. He is a Certified Fraud Examiner (CFE) and Master Analyst in Financial Forensics (MAFF).

Editor

Sam Koppelman is a New York Times best-selling author who has written books with former United States Attorney General Eric Holder and former United States Acting Solicitor General Neal Katyal. Sam has published in the New York Times, Washington Post, Boston Globe, Time Magazine, and other outlets — and occasionally volunteers on a fire speech for a good cause. He has a BA in Government from Harvard, where he was named a John Harvard Scholar and wrote op-eds like “Shut Down Harvard Football,” which he tells us were great for his social life. Sam is based in New York.

Hunterbrook Media publishes investigative and global reporting — with no ads or paywalls. When articles do not include Material Non-Public Information (MNPI), or “insider info,” they may be provided to our affiliate Hunterbrook Capital, an investment firm which may take financial positions based on our reporting. Subscribe here. Learn more here.

Please contact ideas@hntrbrk.com to share ideas, talent@hntrbrk.com for work opportunities, and press@hntrbrk.com for media inquiries.

LEGAL DISCLAIMER

© 2026 by Hunterbrook Media LLC. When using this website, you acknowledge and accept that such usage is solely at your own discretion and risk. Hunterbrook Media LLC, along with any associated entities, shall not be held responsible for any direct or indirect damages resulting from the use of information provided in any Hunterbrook publications. It is crucial for you to conduct your own research and seek advice from qualified financial, legal, and tax professionals before making any investment decisions based on information obtained from Hunterbrook Media LLC. The content provided by Hunterbrook Media LLC does not constitute an offer to sell, nor a solicitation of an offer to purchase any securities. Furthermore, no securities shall be offered or sold in any jurisdiction where such activities would be contrary to the local securities laws.

Hunterbrook Media LLC is not a registered investment advisor in the United States or any other jurisdiction. We strive to ensure the accuracy and reliability of the information provided, drawing on sources believed to be trustworthy. Nevertheless, this information is provided "as is" without any guarantee of accuracy, timeliness, completeness, or usefulness for any particular purpose. Hunterbrook Media LLC does not guarantee the results obtained from the use of this information. All information presented are opinions based on our analyses and are subject to change without notice, and there is no commitment from Hunterbrook Media LLC to revise or update any information or opinions contained in any report or publication contained on this website. The above content, including all information and opinions presented, is intended solely for educational and information purposes only. Hunterbrook Media LLC authorizes the redistribution of these materials, in whole or in part, provided that such redistribution is for non-commercial, informational purposes only. Redistribution must include this notice and must not alter the materials. Any commercial use, alteration, or other forms of misuse of these materials are strictly prohibited without the express written approval of Hunterbrook Media LLC. Unauthorized use, alteration, or misuse of these materials may result in legal action to enforce our rights, including but not limited to seeking injunctive relief, damages, and any other remedies available under the law.